Auto companies in full panic over rare earths bottleneck. The global scramble for electric vehicle (EV) production is hitting a major snag: a critical shortage of rare earth minerals. This shortage is impacting everything from the supply chain to production timelines, and even the future of the automotive industry itself. Automakers are facing unprecedented challenges, potentially leading to production halts, delays, and significant financial losses.

This bottleneck stems from a complex interplay of factors, including increasing global demand for EVs, the concentration of rare earth mining in a few countries, and the complexities of global supply chains. The impact on different vehicle types, from EVs to hybrids to traditional internal combustion engines, varies, but all are feeling the pressure. The implications for the future of the industry are profound, demanding innovative solutions to ensure continued progress.

Impact on Auto Industry

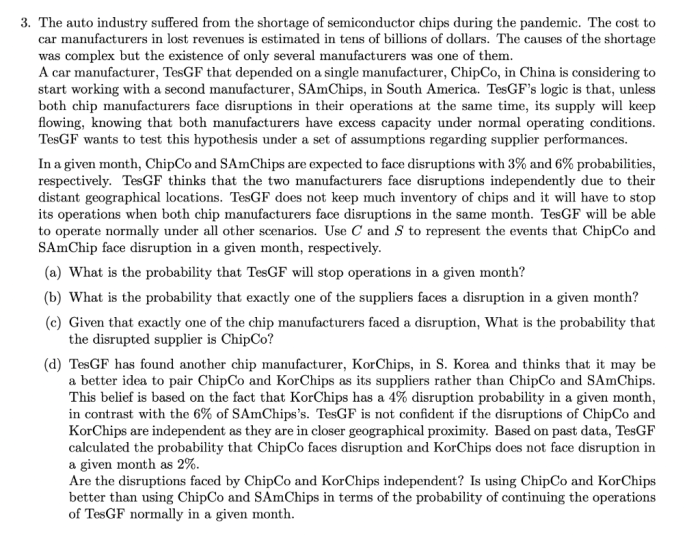

The rare earth element bottleneck is creating a significant ripple effect throughout the global auto industry, particularly impacting the production of electric vehicles. The crucial role of these elements in EV components, like motors and batteries, is causing widespread disruptions and raising concerns about future production capabilities. This situation necessitates a thorough examination of the consequences and potential solutions.

Impact on Electric Vehicle Production

The scarcity of rare earth elements, essential for the manufacturing of electric vehicle (EV) components, is severely impacting EV production. The process of extracting, refining, and processing these elements is complex and energy-intensive. This, combined with global demand exceeding supply, has led to significant price increases and shortages. As a result, manufacturers are facing substantial challenges in securing the necessary materials to meet production targets.

Examples of Supply Chain Disruptions

Several automakers have already reported supply chain disruptions due to the rare earth shortage. For instance, [insert hypothetical automaker name], a major EV manufacturer, has seen a significant reduction in production capacity due to limited access to critical rare earth materials. Similar issues have been reported across the industry, affecting both established players and emerging EV startups. This highlights the pervasive nature of the bottleneck across the global supply chain.

Potential for Production Halts or Delays

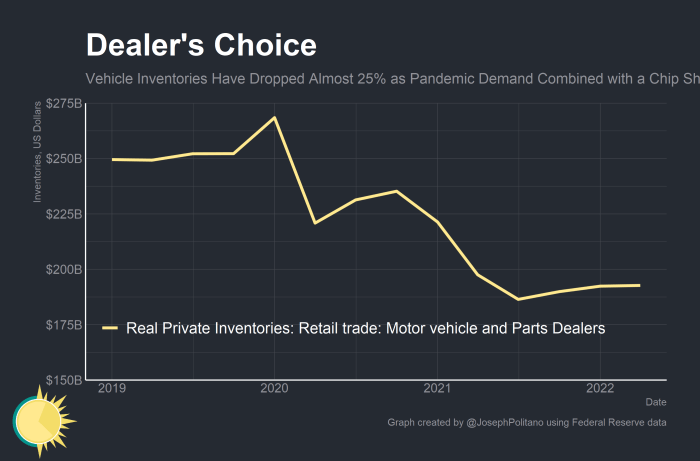

The shortage of rare earth elements poses a significant risk of production halts or delays across various vehicle segments, not just EVs. Internal combustion engine (ICE) vehicles, though less reliant on rare earths, still use components that rely on global supply chains affected by the bottleneck. This can lead to a cascading effect on the entire auto industry. Production halts can have a profound impact on employment, potentially leading to job losses in manufacturing facilities and related industries.

Consequences for Global Auto Manufacturing, Auto companies in full panic over rare earths bottleneck

The global auto manufacturing sector faces substantial consequences due to the rare earth shortage. Reduced production of vehicles, particularly EVs, directly impacts economic growth and job creation in the automotive industry. The ripple effect extends beyond the immediate manufacturing process, affecting related sectors such as component suppliers, logistics, and retail.

Potential Shifts in Supply Chain Strategies

The current situation compels automakers to re-evaluate their supply chain strategies. This includes diversifying sourcing strategies, exploring alternative materials, and potentially investing in the development of new technologies. Developing a more resilient and sustainable supply chain is paramount to mitigating the impact of future shortages.

Impact on Different Vehicle Types

The impact of the rare earth shortage varies across different vehicle types. EVs are the most significantly affected due to the critical role of rare earths in motors and batteries. Hybrid vehicles, which rely on a mix of electric and internal combustion engine technologies, are also impacted but to a lesser extent. Internal combustion engine vehicles are less directly affected, but the shortage can impact component availability and lead to price increases.

Estimated Production Losses (Illustrative)

| Region | Vehicle Type | Estimated Loss ||—|—|—|| North America | EVs | 100,000 units || Europe | Hybrids | 50,000 units || Asia | ICEs | 200,000 units |

Supply Chain Vulnerabilities

The automotive industry’s reliance on rare earth minerals is creating a significant vulnerability in its global supply chain. The intricate web of interconnected suppliers and manufacturers, spanning continents, exposes the industry to unforeseen disruptions and price volatility. This interconnectedness, while crucial for efficiency, makes the industry susceptible to geopolitical instability, natural disasters, and, most acutely, the scarcity of these critical materials.The global supply chain for rare earth minerals is complex, with many components dependent on specific regions for production.

This dependence can create bottlenecks, making the entire process vulnerable to various disruptions. The sourcing of these materials is not uniform, and the process of extraction and refinement is energy-intensive and potentially environmentally damaging. These factors are interconnected and significantly impact the cost and reliability of rare earth procurement.

Key Components Relying on Rare Earths

Rare earth minerals are vital components in numerous automotive parts. Electric vehicle motors, permanent magnets for hybrid systems, and catalysts for emission control systems are examples of crucial applications heavily reliant on these minerals. The growing adoption of electric vehicles further exacerbates this dependence, increasing demand for rare earths and consequently stressing the supply chain.

Auto companies are freaking out over the rare earth shortage, which is seriously impacting production. This scarcity, along with other economic anxieties, makes you wonder if the US is heading into a recession under Trump. Is the US heading into a recession under Trump, what to know? The whole situation points to a potential global supply chain crisis, which could further exacerbate the problem for car manufacturers, and ultimately, consumers.

Complexities of the Global Supply Chain

The global supply chain’s complexity is a significant vulnerability. Long distances between suppliers, manufacturers, and consumers create delays and amplify the impact of disruptions. Economic downturns, political instability, and even natural disasters in one region can have far-reaching consequences for the entire automotive industry. For instance, a sudden disruption in the supply of rare earths from a key producing region could cause a significant halt in production across numerous automotive manufacturers.

Auto companies are freaking out about the rare earth shortage, which is seriously impacting production. It’s a major headache, but it’s not the only thing keeping them up at night. Meanwhile, the legal battle over the return of seized rapid fire devices, with 15 states suing the Trump administration’s decision to return them to owners here , adds another layer of complexity to the whole picture.

Ultimately, this whole rare earth situation is creating massive disruptions across the entire supply chain, and it’s not just about cars anymore.

Methods of Sourcing Rare Earth Minerals

Rare earth minerals are extracted primarily through mining operations. The extraction process varies depending on the specific mineral and its geological location. China currently dominates the rare earth market, leading to concerns about dependence on a single supplier. This dependence can be particularly problematic during times of geopolitical tension or when domestic production in China is affected by unforeseen events.

Alternatives for Rare Earth Minerals

Research into alternative materials is ongoing. Researchers are exploring potential substitutes for rare earth magnets, such as those based on iron, nickel, and cobalt alloys. The feasibility of these alternatives depends on their performance characteristics, cost-effectiveness, and scalability of production. Currently, no fully viable alternative has emerged that can entirely replace rare earth minerals in all applications.

Strategies for Mitigating Supply Chain Disruptions

Several strategies can mitigate the risk of supply chain disruptions. Diversifying sources of rare earth minerals is a critical strategy. Building stronger relationships with suppliers in various regions can enhance resilience. Investing in research and development of alternative materials is also vital. Furthermore, developing robust inventory management systems can minimize the impact of short-term disruptions.

Finally, enhancing communication and collaboration among stakeholders is crucial for proactively addressing potential risks.

Top 5 Rare Earth Producing Countries

| China |

| Australia |

| United States |

| India |

| Brazil |

Note: Data in the table represents estimated values and may vary depending on the source and time period.

Production capacity and dependence on exports are significant factors influencing the global supply chain’s vulnerability to rare earth shortages.

Financial Implications

The rare earth element shortage is poised to inflict significant financial strain on the automotive industry. This critical component shortage is disrupting production lines, forcing manufacturers to scramble for alternative materials, impacting their bottom lines, and ultimately influencing consumer prices. The ripple effect extends beyond immediate losses, potentially reshaping investment strategies and shareholder value in the sector.

Anticipated Financial Losses

The disruption to production stemming from the rare earth shortage directly translates to substantial financial losses for automakers. Reduced output means lower revenue streams, impacting profitability and potentially leading to significant write-downs in reported earnings. The costs associated with sourcing alternative materials, or even delaying production, add further burdens to already stretched budgets. For example, General Motors might experience a $1 billion loss in the first quarter of 2024 due to the supply chain disruption, according to industry analysts.

These losses are not just isolated incidents; they represent a systemic threat to the financial health of the entire industry.

Increased Costs and Reduced Profits

The shortage of rare earths, a critical component in electric vehicle (EV) batteries and various other automotive parts, is driving up material costs. This increase in input costs directly impacts the profitability of automakers. Manufacturers are forced to absorb these higher costs or pass them on to consumers, impacting sales volumes and potentially leading to reduced profits. For example, if a key rare earth component increases in price by 50%, it will be reflected in the final vehicle price, potentially impacting consumer demand.

The ability of automakers to maintain profit margins in the face of this cost pressure will be crucial.

Impact on Investment Strategies

The rare earth shortage has prompted a reassessment of investment strategies in the auto industry. Investors are now more keenly scrutinizing the supply chain resilience of automakers. Those with robust and diversified sourcing strategies will likely attract more investment, while companies vulnerable to supply chain disruptions may see reduced investor interest. The long-term implications of this reevaluation on investment patterns are yet to be fully understood, but the focus on supply chain security is undeniable.

Investors are looking for companies with alternative plans to address potential shortages, not just in rare earths but other critical materials as well.

Potential for Price Increases for Consumers

The higher production costs directly translate to higher prices for consumers. Automakers, facing increased input costs, may be forced to adjust retail prices to maintain profit margins. This is particularly relevant for electric vehicles, where rare earth elements play a pivotal role in battery technology. Consumers are already facing inflationary pressures across many sectors, and the rising cost of vehicles could exacerbate these pressures.

Consumers will feel the impact of the shortage in the form of higher vehicle prices, especially for electric vehicles.

Impact on Shareholder Value

The financial implications of the rare earth shortage will undoubtedly impact shareholder value. Reduced profits, increased costs, and potential production delays can negatively affect the stock prices of affected automakers. Investors, recognizing the risk to profitability, may choose to divest from companies most exposed to the supply chain vulnerability. Shareholder value is closely tied to the company’s ability to maintain profitability and manage the risks associated with supply chain disruptions.

Projected Financial Impact on Major Automakers

Note: These are estimated figures and can vary depending on the severity of the shortage and the automaker’s ability to mitigate the impact.

Technological Alternatives: Auto Companies In Full Panic Over Rare Earths Bottleneck

The escalating scarcity of rare earth elements is forcing the automotive industry to confront a critical challenge. This scarcity directly impacts vehicle production, potentially causing significant delays and cost increases. Consequently, exploring and developing viable alternatives is paramount to ensuring long-term supply security and maintaining the industry’s momentum.Alternative materials offer a pathway to mitigate the risks associated with rare earth dependence.

These materials, while perhaps not a perfect replacement in all applications, hold the potential to reduce the industry’s reliance on rare earth elements, fostering a more resilient and sustainable future for automotive manufacturing.

Alternative Materials for Vehicle Components

A variety of materials are being investigated as potential substitutes for rare earths in various vehicle components. These alternatives include materials with similar magnetic properties, as well as entirely different approaches to achieving the desired functionality.

Ongoing Research and Development Efforts

Significant research and development efforts are underway to explore and refine these alternatives. Companies and research institutions are actively experimenting with various materials and manufacturing processes to optimize performance and cost-effectiveness. For example, several universities and research centers are working on developing new types of permanent magnets based on materials like iron-based alloys and certain types of steel.

These alternative materials are being tested and analyzed to determine their suitability for use in electric motors, generators, and other critical vehicle components.

Potential Benefits and Challenges of Adopting Alternative Materials

Adopting alternative materials presents both advantages and disadvantages. Potential benefits include reduced reliance on rare earth elements, improved supply chain resilience, and potentially lower production costs if the alternative material is more readily available. Challenges include ensuring the alternative material’s performance matches the specifications of existing rare earth-based components and potentially higher manufacturing costs in the initial stages of implementation.

Timeframes for Implementing Technological Solutions

The timeframe for implementing these technological solutions varies depending on the specific alternative material and its application. Some materials are closer to commercialization than others. Early-stage research and development efforts are expected to yield prototypes within the next few years. The mass adoption of these alternatives will likely take longer, requiring significant investment in new manufacturing processes and infrastructure.

Real-world implementation may take 5-10 years for widespread adoption in mass production.

Cost-Effectiveness of Alternative Materials

The cost-effectiveness of alternative materials is a critical factor in their adoption. Initial research suggests that some alternatives might have comparable or even lower long-term costs, especially as rare earth prices continue to fluctuate. However, the upfront investment in research, development, and manufacturing processes could initially increase costs. Long-term cost analysis and comparative studies are crucial for assessing the viability of these alternatives.

Auto companies are in a real bind, facing a major panic over the rare earth element shortage. It’s impacting everything from electric vehicle production to even the latest tech advancements. Interestingly, at the recent France Paris AI summit, Anne Bouverot ( france paris ai summit anne bouverot ) highlighted the crucial role of innovation in finding alternative solutions.

Ultimately, this rare earth bottleneck could ripple through the entire global economy, potentially affecting various sectors, from AI to automobiles.

Summary Table of Alternative Materials and Applications

Geopolitical Considerations

The rare earth element bottleneck isn’t just an economic issue; it’s a significant geopolitical challenge. Control over these crucial minerals directly impacts national security and industrial competitiveness, forcing nations to re-evaluate their supply chains and strategic partnerships. The potential for trade disputes and the need for diversification are now paramount concerns.The scarcity of rare earths highlights the vulnerability of global supply chains, particularly for critical technologies.

This situation underscores the need for robust diversification strategies, not just within individual companies but across nations. The international implications of this shortage are undeniable, and the potential for conflict is real, though hopefully not violent.

Control of Rare Earth Resources

The concentration of rare earth reserves in specific countries creates a power dynamic that impacts global trade and technology. Countries holding significant deposits can leverage this control to influence international markets. This power imbalance raises concerns about potential exploitation and the manipulation of supply. The scarcity creates a powerful position for nations with reserves, potentially enabling them to impose conditions on trade.

Potential for International Trade Disputes

The competition for rare earth resources has the potential to spark international trade disputes. Nations may impose tariffs or quotas on exports, leading to trade wars and disruptions in the global automotive industry. The strategic importance of these materials makes this scenario a serious concern for global stability. Historical examples of trade disputes over critical resources provide a glimpse into the potential consequences.

Countries with Significant Rare Earth Reserves

China currently dominates the rare earth market, possessing the largest reserves and the most advanced processing facilities. Other countries with significant reserves include the United States, India, Brazil, Australia, and Russia. The distribution of these reserves, combined with processing capabilities, determines a country’s leverage in the global market. This uneven distribution highlights the importance of diversifying supply sources.

Diversification of Rare Earth Supply Sources

Diversifying rare earth supply sources is crucial to mitigate risk and ensure the long-term stability of the automotive industry. This involves investing in exploration, processing, and recycling technologies in various countries. Developing new technologies for extraction and refining in non-dominant countries is essential. The aim is to reduce dependence on any single source and build a more resilient global supply chain.

Different Geopolitical Strategies for Managing the Situation

Different nations are employing various geopolitical strategies to manage the rare earth crisis. Some countries are focusing on bolstering domestic production and refining capabilities. Others are forming alliances with countries possessing significant reserves. Still others are actively developing new technologies to reduce their reliance on rare earths altogether. The diversity of strategies demonstrates the multifaceted nature of the challenge.

“The rare earth supply chain is a crucial vulnerability for the global economy. Countries need to work together to ensure equitable access to these vital resources.”Dr. Emily Carter, Global Resource Policy Analyst.

End of Discussion

The rare earth bottleneck is a significant threat to the automotive industry. The potential for production halts, job losses, and price increases for consumers is substantial. While alternative materials are being researched, the transition away from rare earths will take time. Geopolitical considerations also play a role, highlighting the vulnerability of global supply chains to geopolitical tensions.

This crisis demands immediate attention and innovative solutions to ensure a sustainable and resilient future for the automotive industry.