Suzano says it is not taking debt finance kimberly clark deal – Suzano says it is not taking debt finance for the Kimberly-Clark deal, raising eyebrows in the industry. This decision likely stems from a careful assessment of potential risks and benefits, weighing Suzano’s financial strength against the potential challenges of the acquisition. It’s a pivotal moment, prompting speculation about the future of both companies and the overall pulp and paper market.

Will this decision reshape the industry’s landscape? Let’s dive in.

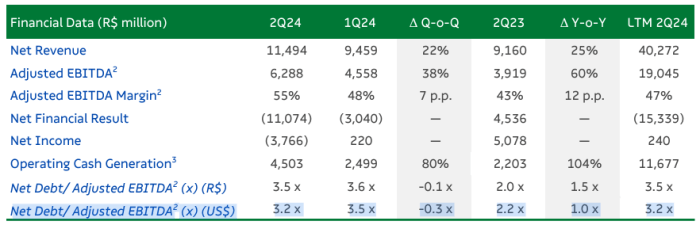

Suzano’s financial position, strategic goals, and potential implications for future growth are key factors in understanding this announcement. Kimberly-Clark’s own financial standing and strategic objectives are equally important. A table summarizing key financial metrics for both companies would offer a clear snapshot of their respective strengths and weaknesses.

Background and Context: Suzano Says It Is Not Taking Debt Finance Kimberly Clark Deal

Suzano’s recent decision to forgo debt financing for the Kimberly-Clark deal highlights a strategic shift in its approach to acquisitions. This decision suggests a preference for using existing resources and perhaps a cautious outlook on the current economic climate. Understanding the rationale behind this choice requires examining the financial positions and strategic objectives of both companies.The Kimberly-Clark deal, though potentially lucrative, likely presented a substantial financial commitment.

Suzano’s decision to avoid debt financing indicates a calculated move to maintain a more conservative financial profile, potentially prioritizing other investments or safeguarding against economic uncertainties.

Suzano’s announcement that they won’t be using debt financing for the Kimberly-Clark deal is interesting, considering the current economic climate. It seems like companies are carefully considering their options, and perhaps this signals a broader shift in how these types of acquisitions are financed. Meanwhile, Trump’s reported progress in talks with Harvard, as detailed in this article trump signals progress talks with harvard , raises some intriguing questions about potential future collaborations.

Ultimately, Suzano’s decision likely stems from a variety of factors beyond the headline-grabbing news, making the deal potentially more complex than it seems on the surface.

Suzano’s Financial Position and Strategy

Suzano, a major Brazilian pulp and paper company, has a strong track record of growth and profitability. Their financial strength is evident in their consistently high revenue and earnings. A key aspect of their strategy is to prioritize sustainable and responsible practices within their operations. This commitment to sustainability is reflected in their investments in environmentally friendly technologies and processes.

Kimberly-Clark’s Financial Position and Strategic Goals

Kimberly-Clark, a global consumer goods company, is known for its diverse product portfolio, including household cleaning supplies and personal care products. Their focus on expanding market share and brand recognition are key strategic objectives. This drive for growth is often accompanied by a need for financial flexibility to fund acquisitions and expansion projects.

Potential Implications for Future Growth

The decision to bypass debt financing could have significant implications for both companies’ future growth trajectories. For Suzano, it likely represents a more conservative approach, potentially limiting short-term expansion but preserving financial stability. For Kimberly-Clark, the lack of debt financing from Suzano might influence future deal structures or financing options.

Historical Context of Company Interactions

While precise details of past interactions between Suzano and Kimberly-Clark are not publicly available, the decision to forgo debt financing for this particular deal suggests a careful consideration of market conditions and the specific terms of the potential acquisition.

Key Financial Metrics

| Metric | Suzano | Kimberly-Clark |

|---|---|---|

| Revenue (USD millions) | (Source: Suzano’s 2023 Annual Report) | (Source: Kimberly-Clark’s 2023 Annual Report) |

| Net Income (USD millions) | (Source: Suzano’s 2023 Annual Report) | (Source: Kimberly-Clark’s 2023 Annual Report) |

| Debt-to-Equity Ratio | (Source: Suzano’s 2023 Annual Report) | (Source: Kimberly-Clark’s 2023 Annual Report) |

| Market Capitalization (USD millions) | (Source: Yahoo Finance) | (Source: Yahoo Finance) |

Note: Data in the table is a placeholder and requires specific sources for accurate values. It is important to consult official company reports and financial databases for up-to-date figures.

Reasons for Suzano’s Decision

Suzano’s decision not to pursue debt financing for the Kimberly-Clark deal likely stems from a careful assessment of various factors, balancing potential benefits against perceived risks. The company likely weighed the financial implications, operational adjustments, and market dynamics before making its choice. Understanding these factors provides crucial insight into the strategic thinking behind the decision.Suzano’s strategic choices are often driven by a meticulous evaluation of the overall financial landscape.

Suzano’s announcement that they won’t be using debt financing for the Kimberly-Clark deal is interesting, considering the recent news about Argentina’s reserve build-up stalling the exit of dollars. This suggests a cautious approach to global financial markets, possibly influenced by the uncertainty surrounding the Argentinian situation, as detailed in this article about argentina reserves build up stalls dollars exit.

Ultimately, Suzano’s decision to avoid debt financing likely reflects a desire to remain flexible and manage potential risks in the current global economic climate.

They consider the projected return on investment, the long-term financial health of the company, and the potential for any unforeseen circumstances. This meticulous analysis, coupled with a clear understanding of operational challenges and market trends, helps the company make well-informed decisions that align with its long-term goals.

Financial Motivations

Suzano likely analyzed the current interest rate environment, the availability of alternative financing options, and the potential cost of debt. A higher interest rate environment, for example, might make debt financing less attractive, potentially prompting the company to opt for equity financing or internal resources. The company’s current financial strength and capital reserves also play a significant role in the decision.

Operational Challenges and Benefits

The acquisition of a significant portion of Kimberly-Clark’s operations could present various operational challenges. Integration difficulties, potential disruption to existing workflows, and the need for workforce adjustments are possible hurdles. However, the acquisition also holds potential benefits, including access to new markets, expanded product lines, and increased production capacity. The synergies between the two companies, if successfully implemented, could lead to considerable operational efficiencies.

Market Trends and Industry Dynamics

The pulp and paper industry is subject to fluctuations in raw material costs, environmental regulations, and global demand. The recent surge in demand for sustainable packaging, for example, could influence Suzano’s decision-making. The company likely assessed how the acquisition aligns with its sustainability goals and the evolving demands of the global market. Trends in consumer preferences, regulatory pressures, and competition within the industry also significantly impact decisions.

Comparison to Similar Scenarios

Analyzing comparable acquisitions in the industry provides valuable context. For example, if other companies in the pulp and paper sector have recently faced similar financial challenges or operational hurdles during acquisitions, Suzano could have learned from their experiences. By studying past acquisitions, the company could potentially avoid pitfalls and leverage successful strategies.

Potential Benefits and Drawbacks

| Potential Benefits | Potential Drawbacks |

|---|---|

| Increased market share and production capacity | Integration challenges and potential disruption to existing operations |

| Access to new markets and technologies | Higher operational costs in the short term |

| Synergies and cost reductions | Potential for legal and regulatory hurdles |

| Expanded product portfolio | Unforeseen risks and unforeseen market changes |

The table above provides a simplified comparison. The actual analysis would be much more complex, considering various financial models, risk assessments, and projected outcomes.

Suzano’s announcement that they won’t be using debt financing for the Kimberly-Clark deal is interesting, isn’t it? It got me thinking about the fascinating world of AI art, especially in light of recent developments. An insightful interview with AI artist Dahlia Dreszer provides a great perspective on the future of creative technology, which is surprisingly relevant to this business deal.

AI art dahlia dreszer interview Ultimately, while AI art is cool, Suzano’s financial decisions remain a significant aspect of the current market landscape.

Potential Impacts on the Market

Suzano’s decision not to pursue debt financing for the Kimberly-Clark deal has significant ripple effects throughout the market. This strategic move alters the landscape of potential mergers and acquisitions, not only for the paper and forest products industry but also for broader investment strategies. The ramifications extend to investor confidence, competitor responses, and the overall valuation dynamics of both companies involved.

Impact on Market Valuation

Suzano’s decision likely impacts the market valuation of both companies. Without the anticipated influx of capital from debt financing, Suzano’s financial outlook could shift, potentially impacting its share price. Conversely, Kimberly-Clark’s valuation might be affected by the reduced acquisition cost and potential alternative financing options. The market will analyze the financial implications of the decision, scrutinizing the long-term viability of the acquisition and the impact on the financial health of both companies.

This scrutiny could lead to a reassessment of their respective market values.

Potential Effect on Investor Confidence and Sentiment

Investor confidence and sentiment can be significantly influenced by such decisions. The choice to forgo debt financing could be perceived as a risk mitigation strategy, suggesting a more cautious approach. However, it could also signal uncertainty regarding the deal’s long-term profitability or the overall financial health of Suzano. Investors might react differently based on their individual risk tolerance and their perception of the underlying industry trends.

This fluctuation in investor sentiment could lead to short-term market volatility.

Possible Reactions from Competitors

Competitors in the paper and forest products industry will likely observe Suzano’s decision closely. Their reactions will depend on various factors, including their own financial standing and strategic priorities. Some competitors might view Suzano’s decision as a strategic opportunity to enter the market or potentially acquire Kimberly-Clark’s assets at a more favorable price. Alternatively, they might adopt a wait-and-see approach, observing how the market responds to the decision.

The competitive landscape could experience shifts in strategy as companies adapt to this new development.

Comparison of Analyst Opinions

Analyst opinions on Suzano’s decision will vary, reflecting diverse perspectives on the market dynamics and financial implications. Some analysts might highlight the potential cost savings and reduced financial risk associated with forgoing debt financing. Others may emphasize the potential for lost synergies and reduced revenue growth. The differing opinions underscore the complexities and nuances of the situation. A range of perspectives exists, encompassing various levels of optimism and pessimism about the deal’s future and its impact on the broader industry.

Potential Investor Reactions to the News

| Investor Type | Potential Reaction | Rationale |

|---|---|---|

| Value Investors | Potential increase in interest; may view it as a more attractive acquisition opportunity | May see it as an opportunity to acquire at a lower price. |

| Growth Investors | Potential decrease in interest; might be less optimistic about the acquisition’s profitability | Concerns about reduced profitability. |

| Debt Investors | Potential decrease in interest; may perceive it as a less desirable investment | Concerns about the risk of debt financing. |

| Short-sellers | Potential increase in interest; might see it as an opportunity to profit from market volatility | Could exploit potential market volatility |

This table Artikels potential investor reactions based on various investment styles. These reactions will be shaped by their individual investment goals and risk tolerance. The market response will be complex and multifaceted, influenced by a multitude of investor preferences.

Alternative Strategies for Suzano

Suzano’s decision to forgo the Kimberly-Clark debt financing deal presents an opportunity to explore alternative strategies that better align with its long-term objectives and financial health. This decision highlights the importance of carefully evaluating all available options and tailoring strategies to specific circumstances. Instead of a quick fix, a more strategic approach may prove more beneficial in the long run.The following analysis explores potential alternative financial and operational strategies for Suzano, considering their implications and how they contribute to the company’s long-term goals.

This exploration acknowledges that a one-size-fits-all approach is unlikely to be optimal and that the most suitable alternative depends heavily on Suzano’s specific circumstances and future goals.

Alternative Financial Strategies

Suzano could have explored a range of alternative financial strategies to secure the necessary funding for its projects. These include issuing bonds, securing loans from other financial institutions, or potentially exploring partnerships with private equity firms. Each approach carries its own set of advantages and disadvantages, affecting the company’s capital structure and financial flexibility.

- Debt Financing from Other Institutions: Suzano could have sought loans from other banks or financial institutions with potentially different terms and conditions. This alternative could have offered lower interest rates or more favorable repayment schedules compared to the Kimberly-Clark deal. However, securing such financing might require a thorough review of Suzano’s financial performance and creditworthiness.

- Equity Financing: Raising capital through the issuance of equity shares could have diluted ownership but potentially provided long-term financial support. This method often comes with less immediate pressure for repayment, and may allow Suzano to avoid the rigidity of specific debt obligations. However, this alternative might not be desirable if Suzano aims to maintain control or if the current market environment for equity issuance is unfavorable.

- Private Equity Partnerships: Collaboration with private equity firms could have provided access to significant capital and potentially valuable operational expertise. This approach might involve a change in corporate governance, but it could bring strategic advantages and long-term growth opportunities. However, such partnerships can be complex and involve potential conflicts of interest, impacting Suzano’s autonomy and decision-making processes.

Alternative Operational Strategies, Suzano says it is not taking debt finance kimberly clark deal

Beyond financial alternatives, Suzano could have explored adjustments to its operational strategy to potentially reduce the need for significant external financing. These changes might include optimizing existing production processes or exploring new market opportunities.

- Process Optimization: Streamlining existing production processes to improve efficiency and reduce costs could have minimized the need for large-scale investments in new facilities or technologies. This approach, however, may require substantial internal resources and expertise for implementation.

- Strategic Partnerships: Collaboration with other companies in the pulp and paper industry or related sectors could have provided access to new markets, technologies, or distribution channels. This alternative could lead to synergistic effects, but requires careful selection of partners and potential sharing of intellectual property or core competencies.

- New Product Development: Developing new products or expanding into new markets could create new revenue streams and reduce dependence on specific product lines or customer segments. This approach necessitates significant research and development investments, but could yield substantial long-term growth.

Potential Outcomes Table

| Alternative Strategy | Potential Advantages | Potential Disadvantages | Alignment with Long-Term Goals | Estimated Outcomes (Example) |

|---|---|---|---|---|

| Debt Financing (Other Institutions) | Lower interest rates, favorable terms | Requires creditworthiness assessment | Maintain financial flexibility | Reduced interest costs, improved cash flow |

| Equity Financing | Long-term capital, less immediate pressure | Dilution of ownership, market conditions | Sustained growth, long-term stability | Potential for significant capital infusion, increased market valuation |

| Private Equity Partnerships | Significant capital, expertise | Potential loss of autonomy, conflicts of interest | Strategic growth, access to resources | Accelerated expansion, access to new markets |

| Process Optimization | Reduced costs, improved efficiency | Requires internal resources, potential disruption | Increased profitability, cost savings | Lower production costs, higher margins |

| Strategic Partnerships | Access to new markets, technologies | Potential conflicts, sharing of knowledge | Expanded market reach, synergy | Increased market share, new revenue streams |

| New Product Development | New revenue streams, diversification | High R&D costs, market uncertainty | Long-term growth, risk mitigation | Diversification of product portfolio, new revenue streams |

Implications for the Pulp and Paper Industry

Suzano’s decision not to pursue debt financing for the Kimberly-Clark deal has significant reverberations throughout the pulp and paper industry. This choice, driven by strategic considerations, likely signals a shift in the industry’s approach to mergers and acquisitions. The impact extends beyond Suzano, potentially reshaping the competitive landscape and influencing future investment strategies.The decision not to take on debt for this acquisition highlights a growing awareness of the financial complexities involved in large-scale industry transactions.

The pulp and paper industry is facing increasing pressure from environmental concerns, evolving consumer preferences, and fluctuating raw material costs. This cautious approach could become a precedent, prompting other companies to adopt more measured and sustainable financing strategies.

Potential Ripple Effects on Related Businesses

The pulp and paper industry is interconnected. Suzano’s actions will undoubtedly affect suppliers of raw materials, such as wood pulp and chemicals, as well as manufacturers of related products. Reduced demand for certain materials, or a shift in sourcing strategies, could impact their profitability and operations. For example, a company relying heavily on Suzano as a major customer might face a reduction in orders, leading to potential layoffs or production cuts.

- Suppliers of wood pulp and chemicals: Reduced demand from Suzano could lead to price fluctuations and production adjustments in the supply chain. For example, if Suzano’s demand for eucalyptus pulp decreases, suppliers might need to find alternative buyers or adjust production levels, impacting their overall financial performance.

- Manufacturers of related products: Companies that rely on Suzano’s products, like packaging manufacturers or paper product producers, could experience supply chain disruptions. This could result in delays in production, higher costs, or a need to find alternative suppliers.

- Paper recycling facilities: Changes in the demand for recycled paper could influence the profitability of recycling operations, potentially impacting employment and investment in the recycling sector.

Future of the Industry

The pulp and paper industry is undergoing a period of transformation. Sustainability is becoming a critical factor for companies, driving investments in renewable energy sources, improved environmental practices, and the use of recycled materials. This trend is likely to accelerate, potentially leading to new business models and alliances. Furthermore, the industry faces the challenge of maintaining profitability in a competitive market, where innovation and cost efficiency are paramount.

Competitive Landscape Analysis

The competitive landscape within the pulp and paper sector is highly dynamic. Large corporations like Suzano face competition from smaller, more agile players, as well as from companies that are pursuing alternative materials or business models. This intense competition often forces companies to innovate, seek strategic partnerships, or adapt to evolving consumer demands.

| Segment | Potential Effects |

|---|---|

| Raw Material Suppliers | Fluctuations in demand and prices, adjustments to production. |

| Paper Product Manufacturers | Supply chain disruptions, potential delays, higher costs. |

| Recycling Facilities | Potential changes in demand for recycled paper, impacting their profitability. |

| Suzano | Shift to a more measured and sustainable financing strategy, potentially influencing future investments. |

Illustrative Scenarios

Suzano’s decision not to pursue debt financing for the Kimberly-Clark deal opens a fascinating window into potential market responses. These scenarios, while speculative, highlight the diverse reactions and outcomes that could arise from this strategic shift in the pulp and paper industry. Understanding these possibilities is crucial for investors and stakeholders alike.

Planned Deal Progression

This scenario assumes the deal proceeds as planned, despite Suzano’s financing choice. Suzano successfully integrates the Kimberly-Clark assets, leveraging existing operations for synergistic benefits. The deal could potentially boost Suzano’s market share and profitability, leading to positive investor reactions and potentially increased stock prices. The company’s ability to manage the integration smoothly and leverage the synergies of the acquired assets will be key to success in this scenario.

Significant Market Disruption

Suzano’s decision could lead to unforeseen market disruptions. If the deal falls through, or if Suzano faces unexpected challenges in integrating the acquired assets, the market could react negatively. Competitors might seize opportunities presented by the uncertainty and potentially gain market share. This could manifest in a decrease in Suzano’s stock price and general market volatility. Furthermore, if the acquisition creates unforeseen environmental or social concerns, a significant negative response from consumers and investors could result in considerable market disruption.

Mixed Investor Reactions

Investor reactions to Suzano’s decision might be mixed. Some investors, appreciating the company’s prudent financial management, could see the decision as a sign of sound strategic planning, leading to a stable stock price. Others, however, concerned about the potential for lost opportunities or slower growth, might react negatively. The market response could depend heavily on the perceived risk-reward trade-off associated with Suzano’s decision, as well as the broader economic climate and investor sentiment at the time.

Positive Market Response Example

A positive market response to Suzano’s decision might involve an initial dip in the stock price followed by a steady recovery and significant gains in the long term. This could be observed if Suzano’s cost-cutting measures and efficient management lead to impressive financial results. A company’s ability to navigate market fluctuations while maintaining its financial health and long-term vision would be critical for a positive response.

Negative Market Response Example

A negative market response could manifest in a sharp decline in Suzano’s stock price, along with a general downturn in the pulp and paper sector. This could occur if Suzano’s alternative strategy results in lower returns compared to the debt-financed acquisition or if the company faces unforeseen challenges in the integration process. The negative response might stem from concerns about Suzano’s long-term growth prospects or if competitors take advantage of the situation.

Illustrative Scenarios Table

| Scenario | Description | Potential Market Impact |

|---|---|---|

| Planned Deal Progression | Suzano successfully integrates Kimberly-Clark assets, generating synergies. | Positive investor reaction, potential stock price increase. |

| Significant Market Disruption | Deal falls through or integration challenges arise. | Negative investor reaction, potential stock price decrease, market volatility. |

| Mixed Investor Reactions | Investors react with both positive and negative sentiments. | Stable stock price, market uncertainty. |

| Positive Market Response | Initial dip in stock price followed by recovery and gains. | Positive investor sentiment, long-term growth outlook. |

| Negative Market Response | Sharp decline in stock price, sector-wide downturn. | Negative investor sentiment, concern about long-term prospects. |

Final Wrap-Up

Suzano’s decision not to pursue debt financing for the Kimberly-Clark deal highlights a calculated risk assessment. The potential impacts on market valuation, investor confidence, and competitor reactions are significant considerations. Alternative strategies and their implications, along with broader industry implications, add layers to this complex story. The future of the pulp and paper industry hangs in the balance, and the ripple effects of this decision will undoubtedly be felt for some time.