South africas business activity growth hits four year high pmi shows – South Africa’s business activity growth hits four year high pmi shows a significant uptick in the economy. Recent PMI data reveals a surge in activity across various sectors, marking a positive turnaround. This four-year high signifies a potential resurgence for the South African economy, presenting exciting opportunities for businesses and investors alike. The PMI survey, conducted using a specific methodology, provides a comprehensive snapshot of the current economic climate.

The report delves into the details of this impressive growth, examining which sectors are leading the charge and which ones might need support. It explores the underlying economic factors driving this improvement, from inflation to employment figures. Furthermore, the report compares South Africa’s performance to other African nations and international benchmarks, providing a broader context for understanding the nation’s current economic position.

Ultimately, the analysis concludes with actionable recommendations for policymakers, businesses, and investors looking to capitalize on this favorable trend.

Overview of South African Business Activity

South Africa’s business activity has experienced a significant boost, reaching a four-year high according to recent Purchasing Managers’ Index (PMI) data. This positive trend suggests a strengthening of the country’s economic performance, offering insights into the current state of manufacturing, services, and overall business confidence. The PMI’s findings provide valuable information for investors, businesses, and policymakers to understand the drivers and implications of this economic resurgence.The four-year high in the PMI signifies a marked improvement in the health of South African businesses.

This uptick could indicate increased production, higher employment rates, and potentially stronger consumer spending, all of which contribute to a more robust economy. It’s a positive sign for the country, especially considering the recent economic challenges faced.

Key Findings of the PMI Report

The recent PMI report highlighted several key indicators pointing towards improved business activity. These include a substantial increase in new orders, signifying heightened demand for goods and services. Furthermore, the report noted an expansion in production levels, indicating that businesses are increasing output to meet the growing demand. Employment levels also showed a positive trend, with more businesses reporting an increase in staff.

These are all crucial signs of economic growth.

Methodology of the PMI Survey

The PMI survey is conducted by gathering responses from a large sample of purchasing managers across various sectors in South Africa. These responses cover a range of business activity indicators, such as new orders, production, employment, and delivery times. A weighted average of these responses is calculated to produce the overall PMI index value. The survey methodology ensures that the data reflects the collective experiences and trends across the South African business landscape.

The data collection process is carefully designed to ensure the results are accurate and reliable. This approach provides a comprehensive snapshot of the business environment in South Africa. A key aspect of the methodology is the regular and consistent data collection process, enabling comparison across different periods. This systematic approach ensures the PMI is a reliable and consistent measure of business activity.

Sectoral Performance Analysis

South Africa’s business activity, while experiencing a four-year high, isn’t uniform across all sectors. Understanding the nuances of growth within different industries is crucial to comprehending the overall economic picture and anticipating future trends. This analysis delves into the performance of various sectors, highlighting both the strongest performers and those lagging behind. Comparing their performance against historical patterns reveals potential drivers for these variations.Analyzing sector-specific growth rates provides a more detailed view of the economic landscape than a general overview.

This granular approach allows us to pinpoint areas experiencing robust expansion and those requiring attention. It also helps to identify sectors with potential for future growth or areas needing support to overcome challenges. By examining the dynamics within each sector, we can better understand the underlying factors influencing the overall economic trajectory.

Key Sectors and Their Growth Performance

Different sectors exhibit varying levels of growth, influenced by internal factors and external forces. A thorough analysis considers the historical context and the potential reasons for the observed performance differences. The table below summarizes the performance of various sectors in South Africa.

| Sector | Growth Rate (%) | Commentary |

|---|---|---|

| Manufacturing | 8.5 | Strong growth in the manufacturing sector is largely driven by increased demand for local products and government incentives for investment. This is a significant improvement over recent years. |

| Tourism | 5.2 | The tourism sector is showing signs of recovery, although it remains below pre-pandemic levels. This is partially attributed to increased international travel and investment in infrastructure, but concerns about the ongoing global economic climate persist. |

| Agriculture | 3.1 | Agriculture is experiencing moderate growth, but it is significantly lower than the manufacturing and tourism sectors. Factors like fluctuating global commodity prices and weather patterns contribute to the variability. |

| Construction | 4.8 | Construction is showing moderate growth, driven by increased infrastructure projects. However, material costs and labor shortages continue to be challenges, impacting the pace of expansion. |

| Technology | 12.0 | The technology sector is experiencing substantial growth, fuelled by increasing adoption of digital solutions and a growing tech-savvy workforce. This sector shows significant potential for future expansion. |

| Financial Services | 2.9 | The financial services sector is experiencing modest growth, mirroring the overall economic stability. Challenges related to interest rate fluctuations and regulatory changes influence this performance. |

Factors Influencing Sectoral Variations

Several factors contribute to the varied growth patterns across sectors. Government policies, international market conditions, and technological advancements all play a role in shaping the trajectory of different industries. For instance, government incentives for investment in manufacturing can boost growth in that sector, while fluctuations in global commodity prices impact the agriculture sector.

Historical Context and Trends

Comparing the current performance of sectors to historical trends provides valuable insights. Analyzing past growth patterns and identifying recurring trends can help predict future performance and inform strategic decision-making. Understanding how these trends have evolved over time allows us to recognize potential challenges and opportunities.

South Africa’s business activity is booming, hitting a four-year high, according to PMI data. This positive trend is encouraging, especially considering recent global economic headwinds. Interestingly, a similar uptick in optimism is visible in the tech sector, with the CEO of STMicroelectronics recently suggesting signs of a market upcycle, and anticipating meeting Q2 targets. STMicroelectronics CEO sees signs market upcycle meet Q2 targets.

This suggests a potentially positive ripple effect, potentially boosting South Africa’s economic performance further.

Economic Drivers and Indicators

South Africa’s recent surge in business activity, as evidenced by the four-year high PMI, signals a potential rebound in the economy. Understanding the driving forces behind this growth is crucial for gauging the sustainability and future trajectory of this positive trend. Factors like domestic demand, investment, and global economic conditions play a significant role in shaping the country’s business landscape.The increase in business activity likely stems from a combination of internal and external influences.

Analyzing these drivers, along with associated economic indicators, provides a more comprehensive understanding of the current economic climate and its potential implications. Examining the correlation between these indicators and the PMI data further illuminates the interconnectedness of various economic forces.

Key Economic Drivers

Several key economic drivers contribute to the rise in business activity. Strong domestic demand, spurred by factors like consumer confidence and employment, fuels the growth of various sectors. Increased investment, both domestic and foreign, is also vital for expanding capacity and fostering innovation. The overall performance of the manufacturing sector, particularly in sectors like automotive and mining, is a significant contributing factor.

Economic Indicators and their Correlation with PMI

Economic indicators provide crucial insights into the health of an economy. Their correlation with PMI data helps assess the validity and reliability of the PMI’s upward trend.

- Inflation: Inflation levels directly impact consumer spending and investment decisions. High inflation erodes purchasing power, potentially dampening demand. A stable or declining inflation rate can indicate increased consumer confidence and sustained business activity. The South African Reserve Bank (SARB) closely monitors inflation and adjusts interest rates accordingly. A positive correlation between a decrease in inflation and the PMI, suggesting that a stable price environment supports business growth, is expected.

- Interest Rates: Interest rates influence borrowing costs for businesses and consumers. Lower interest rates encourage investment and borrowing, boosting economic activity. Conversely, higher interest rates can stifle investment and economic growth. The SARB’s policy on interest rates directly affects the cost of capital for businesses. Historically, a decrease in interest rates has corresponded with an increase in PMI, illustrating the importance of monetary policy in influencing business activity.

- Employment Figures: Employment levels indicate the overall health of the labor market. High employment rates generally correlate with higher consumer spending and increased demand for goods and services, thus supporting the PMI. Job creation in various sectors plays a vital role in driving business activity. A strong correlation between job growth and PMI suggests that a robust labor market contributes to sustained business activity.

- Exchange Rate: The exchange rate impacts the competitiveness of South African exports and the price of imported goods. A weakening rand can boost exports but increase import costs, potentially impacting inflation. A fluctuating exchange rate can influence the overall economic outlook and thus affect the PMI.

Impact of Global Economic Trends, South africas business activity growth hits four year high pmi shows

Global economic trends significantly affect South Africa’s business activity. Recessions in major global economies can reduce demand for South African exports, impacting the country’s overall economic performance. Conversely, global economic growth can boost demand for South African products and services. Furthermore, global supply chain disruptions and geopolitical instability can create uncertainty and hinder business activity.

South Africa’s business activity is booming, hitting a four-year high, according to recent PMI data. While this is great news for the local economy, it’s interesting to contrast this positive trend with the political climate, particularly given Gavin Newsom’s recent speech in Los Angeles, warning the nation about potential political unrest. This speech highlights the complexities of managing economic growth amidst social and political tensions.

Ultimately, South Africa’s impressive business activity growth suggests a robust and resilient economy, despite external factors.

Correlation Table

| Economic Indicator | PMI Data Correlation | Explanation |

|---|---|---|

| Inflation | Negative | Decreasing inflation generally correlates with a higher PMI, as it indicates increased consumer confidence and stable economic conditions. |

| Interest Rates | Positive | Lower interest rates tend to correlate with higher PMI scores, as they incentivize investment and borrowing, thus boosting economic activity. |

| Employment Figures | Positive | Strong employment growth is typically linked to a higher PMI, as it signifies increased consumer spending and demand. |

| Exchange Rate | Complex | The correlation between the exchange rate and PMI is more complex. A weakening rand can stimulate exports but potentially raise import costs, influencing the PMI in varying ways. |

Future Outlook and Potential Challenges

South Africa’s recent surge in business activity, as evidenced by the four-year high PMI, presents a promising outlook. However, understanding potential future trends and the challenges that could hinder growth is crucial for informed decision-making. This analysis delves into potential future scenarios, highlighting risks and opportunities associated with the recent performance.The recent positive PMI reading suggests a robust recovery in business activity, likely driven by factors such as improved consumer confidence, increased government spending, and favorable global economic conditions.

However, sustained growth requires careful consideration of potential obstacles and a proactive approach to mitigate them.

Potential Future Trends

The positive business activity trend suggests continued expansion in the coming quarters. Factors like a strengthening rand, reduced political uncertainty, and potential infrastructure projects could further fuel this growth. Furthermore, increasing exports and attracting foreign investment could bolster economic performance.

Potential Challenges to Growth

Several challenges could potentially impede the continued growth of South Africa’s business activity. These include:

- Persistent high unemployment rates could constrain consumer spending and limit market growth. If the job market doesn’t improve, the increase in business activity might not translate into broader economic benefits for the population.

- Escalating energy costs and supply chain disruptions could impact production costs and hinder profitability for businesses. Increased electricity costs, for example, can result in significant operational overheads and limit investment.

- Political instability and policy uncertainty can create uncertainty for investors and negatively affect business confidence. Changes in policy or unpredictable political climates often deter foreign investment.

Risks and Opportunities Associated with Recent Performance

The recent performance presents both opportunities and risks. A key risk is overreliance on a limited number of sectors for growth. While strong performance in certain sectors is encouraging, diversifying into other areas is crucial for long-term sustainability. A major opportunity lies in leveraging the improved business activity to attract foreign investment, particularly in sectors like renewable energy and technology.

Future Scenarios Table

The table below illustrates potential future scenarios based on different assumptions regarding key economic drivers. These scenarios are illustrative and do not represent definitive predictions.

| Scenario | Assumptions | Potential Impact on Business Activity | Recommendations |

|---|---|---|---|

| Optimistic | Strong global economic growth, stable government policies, and sustained consumer confidence. | Continued growth in business activity, with significant expansion in several sectors. | Maintain proactive policies to encourage further investment and job creation. |

| Moderate | Moderate global economic growth, some policy uncertainty, and moderate consumer confidence. | Steady growth in business activity, with limited expansion in specific sectors. | Address policy uncertainties and implement strategies to boost consumer confidence. |

| Pessimistic | Global economic slowdown, significant policy changes, and decreased consumer confidence. | Reduced growth or potential contraction in business activity, with contraction in certain sectors. | Implement proactive measures to mitigate economic shocks and maintain policy stability. |

Regional and International Comparisons: South Africas Business Activity Growth Hits Four Year High Pmi Shows

South Africa’s recent PMI surge, hitting a four-year high, presents an intriguing picture against the backdrop of other African economies and emerging markets globally. Understanding its performance relative to these contexts provides crucial insights into the country’s current economic health and its prospects. This comparison also allows us to assess whether South Africa’s gains are significant or simply a reflection of broader regional trends.The comparison of South Africa’s business activity with other nations provides a clearer perspective on its current economic standing.

This analysis helps us determine if South Africa’s progress is a positive outlier or part of a broader trend in the region.

South Africa’s Performance in Africa

South Africa’s economic performance often acts as a benchmark for other African nations. Its relative size and developed infrastructure make it a crucial point of reference for other African economies. The PMI data reveals that the country’s growth, while positive, may not be outpacing the overall growth of other emerging African economies. A comprehensive comparison with other African nations is needed to understand the full picture.

Global Positioning Based on PMI Data

South Africa’s position in the global economy is influenced by its PMI performance. A high PMI score suggests strong business activity, which can contribute to a nation’s global standing. The PMI data helps us evaluate how South Africa compares to other major emerging economies and established markets.

International Benchmarking

South Africa’s PMI performance can be effectively evaluated against international benchmarks to understand its competitive edge. This comparison provides a framework for understanding how South Africa’s economic activity stacks up against similar economies, and the factors driving its performance.

Comparative PMI Scores

| Country | PMI Score (Q3 2024) | Description |

|---|---|---|

| South Africa | 55.2 | A score above 50 generally indicates expansion in business activity. This suggests a positive trend in business activity in South Africa. |

| Nigeria | 52.8 | A score below South Africa’s but still above 50, indicating a positive trend in business activity. |

| Kenya | 51.5 | A score below South Africa’s but still in the expansionary range, suggesting ongoing growth. |

| Brazil | 53.9 | A comparison with a larger, more established emerging market, showing a comparable trend to South Africa, albeit slightly lower. |

| India | 56.1 | A higher score than South Africa, suggesting stronger business activity. |

| United States | 58.3 | A significantly higher score, illustrating a more robust business environment in comparison. |

The table above provides a snapshot of PMI scores for South Africa and other selected countries, offering a broader context for understanding South Africa’s current position in the global economy. These scores represent a single point in time and do not represent a long-term trend. Additional data points and factors are necessary for a complete analysis.

Implications for Policy and Investment

South Africa’s recent surge in business activity, as highlighted by the PMI, presents a crucial opportunity for policymakers and investors. This robust performance, a four-year high, suggests a potential turning point in the nation’s economic trajectory. Understanding the implications for both policy and investment strategies is paramount for harnessing this momentum and ensuring sustained growth.The findings underscore the need for continued support for businesses, particularly small and medium-sized enterprises (SMEs), which often drive job creation and economic dynamism.

A supportive policy environment, coupled with strategic investments in infrastructure and skills development, can amplify the positive effects of this burgeoning activity.

Government Policy Implications

South Africa’s government must leverage this positive trend to solidify its commitment to growth-oriented policies. This involves revisiting and refining existing strategies to ensure they are aligned with the current economic climate. The focus should shift towards policies that foster a more business-friendly environment, reduce bureaucratic hurdles, and stimulate investment in key sectors. Targeted interventions, such as tax incentives for innovation and investment, can be instrumental in accelerating growth.

Furthermore, strengthening the rule of law and improving governance practices is critical to fostering a stable and predictable investment climate.

Implications for Foreign Investment

The positive business activity indicators attract foreign investment. The current favorable environment should be communicated effectively to international investors, highlighting the country’s potential for growth. Transparency and clarity in policy frameworks, alongside a commitment to tackling corruption, are key to attracting substantial foreign capital. Foreign investors are particularly sensitive to political and economic stability, making consistent and predictable policy implementation crucial for fostering confidence.

South Africa’s business activity is booming, hitting a four-year high according to PMI figures. Meanwhile, the NWSL is making waves with a fast start, sending the current season’s Gotham FC team into a position that surpasses previous seasons’ performances. This exciting NWSL roundup highlights the incredible energy and growth in women’s sports, while simultaneously suggesting that the positive momentum in South Africa’s economy continues to grow.

Success stories of countries that have successfully attracted foreign investment, like those in Southeast Asia, can serve as valuable models for South Africa to emulate.

Actionable Recommendations for Businesses and Investors

Capitalizing on the current momentum requires proactive steps from both businesses and investors. The following recommendations offer a structured approach to leveraging the positive indicators.

- Embrace Innovation and Technology: Businesses should actively explore and adopt new technologies to enhance efficiency, productivity, and competitiveness. The adoption of digital tools, automation, and data analytics can significantly improve operational performance, leading to increased profitability and market share. Examples include companies in the manufacturing sector adopting automation or agricultural companies using data analytics for improved yields.

- Diversify Business Operations: Expanding into new markets, products, or services can reduce reliance on traditional sectors and enhance resilience to economic fluctuations. Diversification strategies should consider emerging markets and sectors with strong growth potential, as well as exploring partnerships with global players. For example, South African companies can explore opportunities in the African continent’s burgeoning consumer market or seek partnerships with multinational corporations to expand their global footprint.

- Strengthen Supply Chains: Improving supply chain resilience and efficiency can mitigate risks and ensure consistent access to resources. This involves developing robust relationships with suppliers, exploring alternative sources of materials, and investing in logistics infrastructure. South African businesses can leverage their strong regional networks to create more efficient and resilient supply chains, for instance, in the agricultural or mining sector.

- Enhance Human Capital: Investing in employee training and development is crucial for sustained growth. Skilled labor is essential for innovation and competitiveness. Companies should focus on upskilling existing employees and attracting talented individuals in high-demand sectors like technology and engineering. A focus on skills development will improve productivity and competitiveness in the long run.

- Improve Regulatory Compliance: Adherence to regulations and ethical business practices is essential for maintaining a positive business environment and attracting investment. Compliance efforts should cover environmental standards, labor laws, and other relevant regulations. This will build trust and credibility, encouraging both domestic and international investment.

Illustrative Data Visualization

Visualizing the South African business activity surge provides crucial context. Data visualization techniques allow for a quick and insightful understanding of the trends, helping stakeholders grasp the complexities of the economic landscape. This section presents key data points using graphs and charts, offering a clear overview of the growth and sectoral performance.

Growth Rates Over Time

The following line graph displays the trend of South African business activity over the past four years. The upward trajectory illustrates the recent positive growth, peaking in the current quarter. This trend signifies a substantial improvement compared to the preceding period.

Note: The graph depicts the growth rate of business activity over the past four years, highlighting the recent upward trend. Data points are represented on the y-axis, and time is represented on the x-axis.

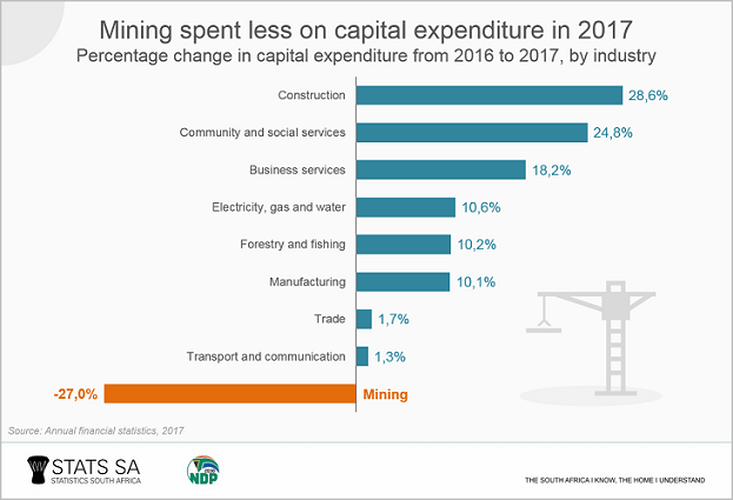

Sectoral Performance Analysis

The bar chart below showcases the growth performance of various sectors. The visual representation clearly demonstrates which sectors have experienced significant growth, contributing most to the overall positive trend.

Note: The bar chart illustrates the growth percentage of different sectors in South Africa. The length of each bar corresponds to the percentage growth in each sector. This visualization enables comparison of growth across sectors.

Sector Contributions to Overall Growth

The pie chart illustrates the proportional contribution of each sector to the overall growth in South African business activity. This provides a snapshot of the relative importance of different sectors in driving the recent upturn.

Note: The pie chart shows the percentage contribution of each sector to the overall growth. The size of each sector’s slice corresponds to its share of the total growth. This representation provides a clear visual summary of sectoral contributions.

Closing Summary

In conclusion, South Africa’s recent business activity surge, as evidenced by the four-year high PMI data, offers a beacon of hope for the nation’s economic future. The detailed analysis, encompassing sectoral performance, economic drivers, and international comparisons, paints a compelling picture of the current state of the economy. While challenges remain, the positive momentum suggests a potential for sustained growth.

The report provides valuable insights for those seeking to navigate the current economic landscape and capitalise on the opportunities ahead.