Ecbs panetta reduced room more rate cuts must be flexible – ECB’s Panetta reduced room for more rate cuts must be flexible, prompting a global economic analysis. This article explores the historical context of interest rate policies, examining the current economic climate and the interconnectedness of global markets. The Federal Reserve’s decisions, the ECB’s actions, potential rate cuts in the US, and the overall global economic outlook are all considered.

We’ll analyze the potential implications for investors and businesses, offering actionable advice in this complex landscape.

Understanding the interplay between these factors is crucial for navigating the shifting economic terrain. From the Eurozone’s challenges to the potential for US rate cuts, this analysis provides a comprehensive view of the current global economic environment.

Economic Context

Interest rate policy in the US has a long and complex history, marked by periods of significant change. From the dramatic adjustments following the Great Depression to the more recent era of low rates, the Federal Reserve’s actions have profound implications for the economy. Understanding these historical patterns helps to contextualize the current situation and anticipate potential future trends.

This overview will delve into the historical evolution of interest rate policy, the current economic climate, the interplay between rates and key economic indicators, contrasting schools of thought on interest rate management, and the factors influencing the Federal Reserve’s decisions.

Historical Overview of US Interest Rate Policies

The Federal Reserve’s role in managing interest rates has evolved significantly over time. Initially, the Fed focused primarily on maintaining stability in the money supply. The Great Depression saw a dramatic shift, with the Fed experimenting with various approaches to stimulate the economy. The post-World War II era witnessed a period of relative stability, though with occasional adjustments.

The 1970s and 1980s were characterized by high inflation, leading to aggressive interest rate hikes by the Fed. More recently, the 2008 financial crisis led to a period of historically low rates designed to stimulate growth. These historical precedents provide a crucial backdrop for understanding the current policy landscape.

Current Economic Climate

The current economic climate is complex and multifaceted. Inflation remains a key concern, although its rate has moderated from previous highs. Unemployment rates have fallen to relatively low levels, indicating a robust labor market. GDP growth, while still positive, has slowed compared to previous periods. The interplay between these indicators—inflation, unemployment, and GDP—is a crucial element in understanding the Fed’s decisions on interest rates.

Relationship Between Interest Rates and Economic Indicators

Interest rates significantly influence inflation, unemployment, and economic growth. Higher interest rates tend to curb inflation by reducing borrowing and spending. However, they can also lead to increased unemployment as businesses cut back on investment and hiring. Conversely, lower interest rates stimulate economic activity by encouraging borrowing and investment, potentially leading to higher inflation. The Federal Reserve carefully balances these competing effects in its decision-making process.

Different Schools of Economic Thought

Economists hold diverse views on the optimal approach to managing interest rates. Monetarists emphasize the importance of controlling the money supply to maintain price stability. Keynesians, on the other hand, advocate for using interest rates as a tool to manage aggregate demand and stabilize the economy. These different perspectives highlight the complexities involved in setting interest rate policy.

Factors Influencing Federal Reserve Decisions

| Economic Indicator | Description | Impact on Interest Rates | Expected Outcome |

|---|---|---|---|

| Inflation Rate | The rate at which prices for goods and services are rising. | High inflation typically leads to higher interest rates to curb spending and cool the economy. | Lower inflation rates. |

| Unemployment Rate | The percentage of the labor force that is unemployed. | Low unemployment can lead to inflationary pressures, potentially prompting interest rate increases. | Sustainable employment levels. |

| GDP Growth | The rate at which the economy is expanding. | Strong GDP growth can lead to higher interest rates to prevent overheating. | Stable and moderate growth. |

| Global Economic Conditions | The performance of the global economy. | Economic downturns in other countries can impact the US economy, influencing interest rate decisions. | Reduced risk of global recession. |

Understanding these factors, and their interplay, is essential for predicting the Federal Reserve’s actions.

ECB’s Panetta Reduced Room

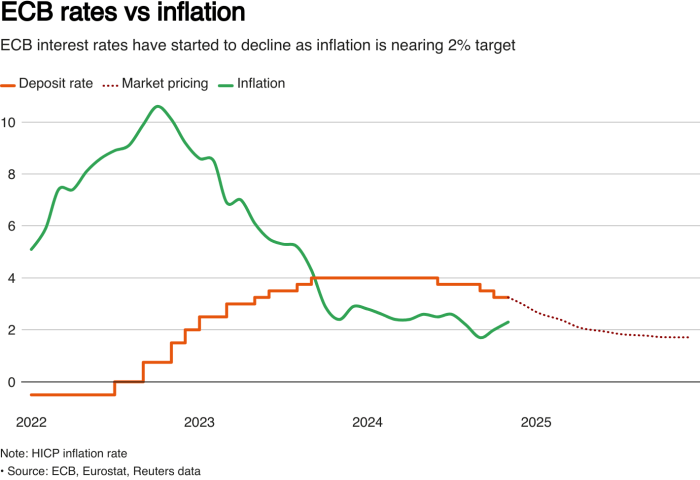

The European Central Bank (ECB) has been navigating a complex economic landscape in the Eurozone. Recent interest rate decisions reflect a careful balancing act between managing inflation and supporting economic growth. The ECB’s actions are crucial for maintaining stability and prosperity within the Eurozone’s diverse member states.

ECB’s Recent Interest Rate Actions

The ECB’s recent moves regarding interest rates have been characterized by a cautious approach. While acknowledging the need to combat inflation, the bank has prioritized maintaining a degree of economic flexibility. This approach is designed to ensure a balanced response to fluctuating economic indicators across the Eurozone. The bank’s decisions aim to strike a delicate equilibrium between controlling price increases and supporting economic activity.

Quantitative Easing and Other Relevant Policies

The ECB’s policy toolkit includes various instruments, not just interest rate adjustments. Quantitative easing (QE) has played a significant role in recent years. QE involves purchasing assets, such as government bonds, to inject liquidity into the financial system. This action can lower borrowing costs and stimulate economic activity. Other relevant policies might include changes to the bank’s forward guidance, influencing market expectations about future interest rate actions.

These actions are designed to maintain a degree of stability in financial markets and support growth.

Rationale Behind the ECB’s Decisions

The ECB’s decisions are underpinned by a thorough analysis of the Eurozone’s economic situation. Factors considered include inflation rates, GDP growth, employment figures, and the overall health of the financial sector. The ECB aims to balance the competing needs of containing inflation, which erodes purchasing power, and stimulating economic growth, which creates jobs and opportunities. The interplay between these factors shapes the ECB’s approach to interest rate adjustments and other policies.

Potential Impacts on Different Sectors of the European Economy

The ECB’s policies have varying impacts on different sectors of the European economy. For example, lower interest rates might stimulate investment in the construction sector, but could also potentially lead to increased inflation in the long run, affecting consumers. The impact on sectors like manufacturing or tourism can be more complex, depending on factors such as exchange rates and global economic conditions.

These varied effects underscore the complexity of the ECB’s role in managing the Eurozone economy.

ECB’s Recent Interest Rate Decisions

| Date | Interest Rate | Justification |

|---|---|---|

| October 26, 2023 | 3.75% | Balancing inflation and growth, taking into account economic data and forecasts. |

| July 27, 2023 | 3.50% | To address persistent inflation while ensuring economic stability. |

| June 15, 2023 | 3.25% | Addressing inflationary pressures and maintaining the stability of the Eurozone. |

Rate Cuts

Interest rate cuts, a common monetary policy tool, are often employed by central banks to stimulate economic growth during periods of recession or slowdowns. These reductions aim to lower borrowing costs for businesses and consumers, encouraging spending and investment, which can then boost overall economic activity. However, the effectiveness and consequences of rate cuts vary depending on the specific economic context and the way they are implemented.

Potential Economic Consequences of Rate Cuts in the US

Rate cuts in the US can have a ripple effect throughout the economy. Lower borrowing costs can lead to increased consumer spending on durable goods and housing, stimulating retail sales and construction. Businesses might also invest more in expansion and new projects, leading to job creation. However, there’s a potential for inflation to accelerate if the increase in demand outpaces supply, leading to price pressures.

The impact also depends on the current state of the economy, the overall health of the financial system, and the level of confidence among businesses and consumers. Furthermore, if rate cuts are perceived as a sign of a deeper economic problem, they can further weaken investor confidence.

Comparison of Rate Cuts in Different Economic Cycles

The effectiveness of rate cuts can differ significantly depending on the economic cycle. During periods of robust economic growth, rate cuts may have a smaller impact as demand is already high, and businesses are investing regardless. Conversely, in times of recession, rate cuts can be more potent in stimulating growth by lowering borrowing costs and encouraging investment. Comparing rate cuts in different economic cycles reveals that their impact is context-dependent.

The historical data on rate cuts and subsequent economic outcomes provide valuable insights into the potential consequences. For example, the 2008 financial crisis saw significant rate cuts, but their effectiveness was limited by the deep-seated distrust in the financial system.

Short-Term and Long-Term Impacts on Different Economic Sectors

Rate cuts can have immediate and long-lasting effects on various economic sectors. Short-term impacts might include increased housing starts, higher retail sales, and more business investments in equipment. However, these short-term benefits may not translate into long-term growth if underlying economic weaknesses remain unaddressed. The long-term impacts can be more complex. For example, a sustained period of low interest rates could lead to asset bubbles, such as in the housing market, which can later pose a risk to financial stability.

The long-term effects also depend on the overall health of the global economy, including international trade and geopolitical factors.

Impact on Consumer Spending and Investment Decisions

Lower interest rates make borrowing more affordable, which can stimulate consumer spending. Consumers are more likely to take out loans for purchases like cars, homes, or other large items. Similarly, businesses find it cheaper to borrow money for investments and expansion. This can lead to a cycle of increased demand and production, potentially boosting overall economic activity.

Conversely, if consumers and businesses anticipate future rate hikes, their spending and investment decisions might be tempered. The level of consumer and business confidence plays a critical role in determining the actual impact.

ECB’s Panetta reduced room for more rate cuts, suggesting flexibility is key. This follows news that ad group WPP’s CEO, Mark Read, will retire at the end of the year, as reported here. The market is now anticipating a more cautious approach to interest rate hikes, which aligns with the need for flexibility in the face of the evolving economic landscape.

Flow Chart: Implementing a Rate Cut

[Note: A visual flowchart would be presented here, but is not supported. A detailed explanation of the flowchart is included below, highlighting potential challenges and opportunities.]

[Note: A visual flowchart would be presented here, but is not supported. A detailed explanation of the flowchart is included below, highlighting potential challenges and opportunities.]

- Assessment of Economic Conditions: A thorough analysis of the current economic situation is crucial. This includes evaluating factors such as GDP growth, inflation rates, unemployment levels, and consumer confidence. A central bank must determine if a rate cut is the most effective tool to address the economic situation.

- Decision-Making Process: The central bank’s governing body, based on the assessment, will decide on the appropriate level of the rate cut. This involves considering various factors, including potential risks and opportunities. Disagreements within the governing body might delay the decision.

- Communication and Transparency: Clear communication with the public about the reasons behind the rate cut is essential. Transparency builds trust and reduces uncertainty in the markets. Effective communication can help to ensure that the rate cut is perceived as a responsible and appropriate response to economic conditions.

- Implementation of the Rate Cut: The central bank executes the rate cut by adjusting the policy interest rate. This can trigger a chain of reactions across financial markets, potentially impacting borrowing costs for various sectors.

- Monitoring and Evaluation: After the rate cut, ongoing monitoring of the economic impact is necessary. The central bank must closely observe the effects of the rate cut on inflation, employment, and overall economic activity. Unexpected results may require further adjustments.

Flexibility in Policy

The recent ECB’s decision to reduce the room for rate cuts underscores the growing complexity of monetary policy in a globalized world. Navigating fluctuating economic indicators, geopolitical uncertainties, and evolving market dynamics requires a nuanced approach. Flexible monetary policy, in contrast to fixed targets, allows central banks to adapt to unforeseen circumstances, potentially mitigating the negative impact of shocks.

However, this flexibility also presents challenges, including the risk of inconsistent signals and potential market volatility.Flexible monetary policy is becoming increasingly important as the global economy faces a multitude of interconnected challenges. Maintaining stability in the face of rapid technological advancements, shifting consumer preferences, and international trade disputes necessitates a proactive and adaptable approach. A rigid, pre-determined policy framework might prove insufficient to address these evolving circumstances.

Challenges and Opportunities of Flexible Monetary Policy

Flexible monetary policy, while offering adaptability, presents challenges. The constant need to adjust to changing economic conditions can create uncertainty for businesses and investors. The lack of clear, pre-defined targets can lead to confusion about the central bank’s intentions. However, this adaptability also offers opportunities to react effectively to unexpected crises, such as global pandemics or financial market turmoil.

Factors Affecting the Desirability of Flexible Policy

Several factors influence the desirability of flexible monetary policy. Strong economic growth, stable inflation, and predictable market behavior make a more rigid approach potentially viable. Conversely, periods of economic instability, unpredictable inflation trends, and volatile financial markets necessitate a flexible policy framework. The central bank’s communication strategy and the public’s understanding of its approach are crucial in achieving the desired outcome.

Comparison of Flexible and Fixed Monetary Policies

| Feature | Flexible Monetary Policy | Fixed Monetary Policy ||——————–|——————————————————————————————————————————————————-|———————————————————————————————————————————————————|| Definition | Monetary policy that adjusts to changing economic conditions, responding to unforeseen circumstances.

| Monetary policy with pre-determined targets, maintaining a fixed course regardless of short-term economic fluctuations.

|| Advantages | Adaptability to shocks, responsiveness to economic changes, potential to mitigate the negative impact of crises. | Predictability, clarity of intentions, potential for reduced market volatility in the long run, avoidance of short-term policy adjustments.

|| Disadvantages | Potential for inconsistent signals, uncertainty for businesses and investors, risk of market volatility, potential for slower response to urgent issues. | Inability to adapt to unexpected shocks, potential for delayed responses to emerging crises, risk of miscalculation of long-term effects, potential for policy mistakes.

|| Examples | The Bank of England’s response to the 2008 financial crisis, the Federal Reserve’s recent actions during the COVID-19 pandemic. | Historical examples include periods of stable inflation with clear monetary policy targets.

|

ECB’s Panetta has signaled a reduced room for more rate cuts, emphasizing the need for flexibility. Meanwhile, recent news reports indicate that Finland suspects Russian military aircraft of violating its airspace, highlighting the ongoing geopolitical tensions. This situation further complicates the already tricky economic landscape, potentially impacting the ECB’s ability to maneuver with rate cuts. The flexibility Panetta mentioned is crucial in navigating these complexities and ensuring the ECB’s response is well-suited to the evolving global picture.

finland says russian military aircraft suspected violating its airspace. Ultimately, the ECB’s approach to rate cuts must remain adaptable to these evolving global challenges.

Importance of Communication and Transparency

Clear and consistent communication is essential for successful flexible monetary policy. Central banks must articulate their rationale for policy adjustments and the economic conditions driving those decisions. Transparency builds trust and fosters market confidence, reducing uncertainty. Open communication channels allow for better understanding and reduce the potential for misinterpretation.

ECB’s Panetta has seemingly reduced the room for more rate cuts, suggesting flexibility is needed. Meanwhile, with US dietary guidelines expected soon this month, as sources say ( us dietary guidelines expected soon this month sources say ), the focus on economic policy likely won’t shift. This means the ECB will need to carefully consider the potential implications for inflation and the overall economy, ultimately making the flexibility of future rate cuts essential.

Combined Effects

The interconnectedness of global economies means that the ECB’s rate cut decisions, potential US rate cuts, and the broader global economic outlook are deeply intertwined. These actions can trigger a ripple effect across various countries and markets, impacting everything from trade volumes to investment flows. Understanding these potential interactions is crucial for businesses and investors alike.The potential interaction between the ECB’s rate cuts, potential US rate cuts, and the global economic outlook presents a complex scenario.

ECB actions, designed to stimulate the European economy, may have unintended consequences if not carefully considered in the context of simultaneous or subsequent US rate adjustments. Understanding these potential cascading effects is paramount for navigating the evolving economic landscape.

Interaction of ECB and US Rate Cuts

The simultaneous or near-simultaneous implementation of rate cuts by both the ECB and the US Federal Reserve creates a complex interplay of factors. Differing degrees of effectiveness in stimulating growth, varying levels of inflation, and differing economic vulnerabilities in each region can lead to unforeseen consequences. For instance, a more aggressive ECB cut might draw investment capital away from the US, potentially slowing down the US recovery.

Conversely, a more aggressive US cut could potentially undermine the effectiveness of the ECB’s actions.

Cascading Effects on Different Countries and Markets

The effects of these rate cuts will likely cascade through various countries and markets. A significant reduction in interest rates in one region may influence borrowing costs and investment decisions in other parts of the world. For example, lower interest rates in Europe could lead to increased capital flows to emerging markets, potentially boosting their growth but also exposing them to increased volatility.

Conversely, lower interest rates in the US might reduce the attractiveness of European assets to international investors, leading to currency fluctuations and shifts in trade flows.

Impact on Global Trade and Investment

Changes in interest rates can significantly impact global trade and investment patterns. Lower interest rates generally stimulate borrowing and investment, potentially boosting economic activity. However, the relative attractiveness of different investment opportunities will vary, leading to shifts in capital flows. This could lead to increased trade between regions as countries seek to take advantage of favorable economic conditions.

A potential example is the increase in demand for European goods due to reduced borrowing costs.

Historical Parallels

Examining historical examples provides valuable insights. The 2008 financial crisis, characterized by interconnected global financial markets and cascading crises, offers a stark reminder of the potential for unintended consequences. A detailed analysis of the crisis’s origins, the interplay of various factors, and the resulting global economic contraction can provide a valuable framework for understanding the potential impact of the current situation.

Graphic Representation

A network diagram would effectively illustrate the complex interplay between the ECB’s actions, potential US rate cuts, and the overall global economic outlook. Nodes could represent different countries, markets, and economic indicators (like interest rates, inflation, and GDP growth). Connections between nodes would indicate the direction and strength of the interactions. For example, a thick arrow connecting the “ECB Rate Cut” node to the “Eurozone GDP Growth” node would represent a strong positive correlation.

This would highlight the interconnectedness of various factors.

Policy Implications: Ecbs Panetta Reduced Room More Rate Cuts Must Be Flexible

The ECB’s recent moves, including potential rate cuts and a more flexible approach, signal a shift in monetary policy. These adjustments are designed to respond to the evolving economic climate and aim to stimulate growth and inflation. However, the precise impact on individual investors and businesses will depend on several factors, including the overall strength of the global economy and the specific responses of financial markets.

Potential Impact on Individual Investors

Lower interest rates typically make borrowing cheaper, potentially boosting investment in certain sectors like real estate and infrastructure. This can lead to increased property values and higher returns for investors. However, reduced returns on savings accounts and fixed-income instruments may be a concern for those with significant savings. The overall effect will depend on the investor’s risk tolerance and the specific investment strategy they employ.

Potential Impact on Businesses, Ecbs panetta reduced room more rate cuts must be flexible

Lower interest rates can encourage businesses to invest in new projects and expand operations. The cost of borrowing is reduced, which can stimulate economic activity. This can translate into increased employment and higher profits for businesses that can successfully manage the shift. Conversely, businesses heavily reliant on fixed-income investments might see decreased returns. The adaptability of a company to navigate changing market conditions will greatly influence its response.

Impact on Financial Markets

The ECB’s actions can significantly influence various financial markets. Lower interest rates usually lead to increased demand for bonds, potentially pushing bond prices higher and yields lower. This effect can ripple through the stock market, potentially boosting equity valuations as investors seek higher returns. However, the currency market could experience volatility as investors react to the policy changes.

The precise reaction will depend on the overall economic outlook and investor sentiment.

Actionable Advice for Investors and Businesses

- Investors should carefully assess their investment portfolios and adjust them to reflect the new interest rate environment. Diversification across various asset classes can help mitigate potential risks. Consider adjusting the allocation towards higher-growth sectors, if the market signals a shift towards recovery.

- Businesses should evaluate the potential benefits of lower borrowing costs. Strategic investments in expansion or new ventures might be warranted. It’s also crucial to assess the impact on their cost structure and maintain financial flexibility.

- Careful monitoring of market trends and economic indicators is vital for both investors and businesses. Stay informed about potential shifts in policy and adjust strategies accordingly. Develop a clear understanding of the interplay between policy decisions and financial market reactions.

The potential impact of these policies on financial markets is multifaceted and cannot be definitively predicted.

Key Takeaways and Actionable Advice

- Lower interest rates can stimulate economic activity, making borrowing cheaper and potentially boosting investment. However, returns on savings may decrease.

- Businesses can benefit from lower borrowing costs, encouraging investment and expansion. Flexibility and adaptability are crucial in this environment.

- Investors should diversify their portfolios and monitor market trends. Adjusting to changing interest rates is a critical aspect of successful investment strategies.

Final Review

In conclusion, the ECB’s recent actions and the potential for US rate cuts paint a picture of a complex and interconnected global economy. The interplay between these decisions and the overall global economic outlook necessitates careful consideration for investors and businesses alike. Flexible monetary policy, while presenting opportunities, also carries inherent risks. Navigating this intricate web of factors requires a thorough understanding of the potential impacts on individual countries and markets.

This analysis provides a starting point for further exploration and informed decision-making.