Boj postpone rate hike q1 next year tiny majority economists say – BOJ postpone rate hike Q1 next year, tiny majority economists say. This unexpected decision by the Bank of Japan (BOJ) to delay interest rate increases into the first quarter of next year is sparking considerable debate. Analysts are dissecting the factors behind this postponement, scrutinizing the economic indicators that led to this choice. The timing of this decision, coming on the heels of a period of considerable economic uncertainty, is creating ripples across financial markets, prompting questions about the BOJ’s long-term strategy.

The BOJ’s rationale for postponing the rate hike is multifaceted, encompassing a range of economic concerns. The postponement appears driven by a combination of factors, from global economic headwinds to domestic inflation pressures. Understanding the nuances of this decision requires careful examination of the economic conditions surrounding the BOJ’s decision, including a review of historical interest rate adjustments and the key economic indicators influencing the postponement.

This article explores these complex factors, assessing the potential short-term and long-term implications for the Japanese economy and global markets.

Background of the Postponement

The recent decision by the central bank to postpone its planned interest rate hike in Q1 next year, supported by a tiny majority of economists, marks a significant shift in monetary policy. This decision warrants careful consideration of the prevailing economic conditions and the historical context of interest rate adjustments. Understanding the rationale behind this postponement is crucial for assessing the current state of the economy and anticipating future policy actions.

Historical Overview of Interest Rate Adjustments

Central banks globally employ interest rate adjustments as a key tool to manage inflation and economic growth. Historically, these adjustments have been driven by various factors, including inflation rates, unemployment levels, and GDP growth. A review of past rate hikes and cuts reveals a pattern of responses to economic shifts. For instance, during periods of high inflation, central banks typically raise interest rates to curb spending and cool down the economy.

Conversely, in periods of economic downturn, they often lower rates to stimulate borrowing and investment. This historical context underscores the importance of considering multiple economic indicators when evaluating a central bank’s decision.

Factors Considered in Interest Rate Adjustments

Central banks meticulously consider a range of economic indicators when making interest rate decisions. These indicators paint a comprehensive picture of the overall economic health and potential risks. Key factors include inflation rates, unemployment figures, GDP growth, and consumer confidence. Each indicator provides valuable insights into the current economic climate and potential future trends. Analyzing these indicators in tandem helps central banks make informed decisions about the appropriate course of action for monetary policy.

Economic Conditions Leading Up to the Postponement

The economic climate preceding the postponement decision was characterized by a confluence of factors. These factors influenced the central bank’s assessment of the need for an interest rate hike in Q1 next year. The prevailing economic conditions presented both challenges and opportunities, which were meticulously evaluated by the central bank.

Factors Influencing the Postponement Decision

| Economic Indicator | Direction | Impact on Rate Hike | Reasoning |

|---|---|---|---|

| Inflation Rate | Moderating | Potentially less urgent need for a hike | Recent inflation figures suggest a potential easing of inflationary pressures. |

| Unemployment Rate | Slightly Rising | Concerns about potential economic slowdown | A slight increase in unemployment might signal a less robust economy, making a rate hike less desirable. |

| GDP Growth | Slowing | Caution against potential economic downturn | A decrease in GDP growth suggests a potential economic slowdown, making a rate hike potentially destabilizing. |

| Consumer Confidence | Decreasing | Potential dampening effect on consumer spending | A decline in consumer confidence may lead to reduced consumer spending, further impacting economic growth and making a rate hike less suitable. |

Impact of the Postponement

The recent decision to postpone the interest rate hike into Q1 next year, supported by a slim majority of economists, has significant implications for various sectors. This delay creates a period of uncertainty, impacting everything from market stability to consumer behavior. Understanding these potential consequences is crucial for investors, businesses, and individuals alike.

Short-Term Effects on Financial Markets

The postponement likely influences market sentiment. The stock market may experience volatility as investors assess the implications of the delayed action. Bond yields could react in various ways depending on investor perception of the central bank’s strategy. A potential decrease in yields might reflect the decreased immediate threat of tightening monetary policy. Conversely, a temporary increase could indicate heightened uncertainty about the future direction of interest rates.

The immediate response depends on investor interpretation of the central bank’s communication and the economic outlook.

Consequences on Consumer Spending and Investment

Consumer spending, a vital component of the economy, could be affected by the delayed rate hike. Lower interest rates generally encourage borrowing and spending. The postponement might incentivize consumers to make larger purchases or increase debt, leading to a temporary boost in consumer spending. Businesses, meanwhile, might adjust their investment strategies based on this delayed tightening. The longer-term impacts will be linked to the overall economic climate and the future trajectory of interest rates.

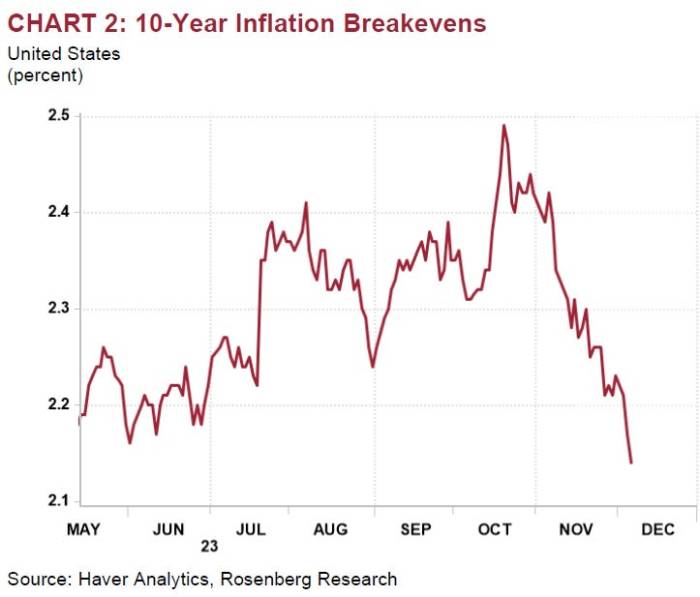

Implications for Inflation

The postponement’s effect on inflation is a complex issue. Maintaining lower interest rates might temporarily encourage spending, potentially fuelling inflation if demand outstrips supply. Conversely, a delay might give the central bank more time to assess the current inflationary pressures and react accordingly in the following quarter. However, the postponement might also signal that the central bank is less concerned about inflation, potentially increasing the risk of sustained inflation.

Scenarios for Inflation and Interest Rates

The following table illustrates different potential scenarios for inflation and interest rates in Q1 and Q2 of the following year. These are hypothetical projections, and the actual outcomes may differ based on various economic factors.

| Scenario | Q1 Inflation Rate | Q1 Interest Rate | Q2 Inflation Rate | Q2 Interest Rate |

|---|---|---|---|---|

| Scenario 1: Moderate Inflation Persistence | 3.5% | 2.0% | 3.2% | 2.25% |

| Scenario 2: Inflationary Pressure Eases | 3.0% | 2.0% | 2.5% | 2.5% |

| Scenario 3: Inflationary Surge | 4.0% | 2.0% | 4.5% | 2.75% |

Economist Perspectives

The recent decision to postpone the interest rate hike into Q1 next year has sparked a lively debate among economists, with differing opinions on the rationale and potential consequences. While a tiny majority of economists have voiced their support for the postponement, a significant contingent remains unconvinced, citing potential risks to economic stability. Understanding the nuances of these differing viewpoints is crucial to assessing the overall impact of this policy shift.

Range of Opinions on Postponement

Economists hold diverse perspectives on the rate hike postponement. Some argue that the decision is prudent, aligning with the current economic climate. Conversely, others believe it could lead to potentially harmful inflationary pressures in the future. These differing viewpoints stem from various factors, including their specific economic models and forecasting methodologies. The differing opinions are evident in their forecasts and analyses of the macroeconomic environment.

Arguments For and Against the Postponement

A key area of contention revolves around the rationale behind the decision. Proponents of the postponement frequently emphasize the need to carefully monitor evolving economic indicators. They believe that a wait-and-see approach allows for a more informed decision, potentially mitigating risks associated with abrupt policy changes. They cite potential adverse impacts on consumer confidence and market volatility as a justification for postponing the rate hike.

Conversely, critics argue that the postponement could signal a lack of resolve in controlling inflation, potentially emboldening inflationary pressures. They highlight the risk of eroding the central bank’s credibility and the possibility of higher interest rates in the future if inflation remains unchecked. These arguments demonstrate the complex trade-offs involved in monetary policy decisions.

Differing Economic Forecasts

Forecasting models, and their respective methodologies, are essential in shaping the differing economic outlooks on the postponement. These models vary in their assumptions about consumer behavior, global economic trends, and the effectiveness of monetary policy. The range of forecasts reveals the uncertainty surrounding the future economic trajectory. For example, some models predict a soft landing for the economy, with moderate growth and low inflation.

Others foresee a potential recessionary risk, influenced by global factors and the current geopolitical climate.

Comparison of Economic Forecasts

| School of Thought | Economic Forecast (Growth Rate) | Inflation Outlook | Interest Rate Outlook |

|---|---|---|---|

| Growth-Oriented | Moderate growth (2-3%) | Low inflation (2-3%) | Interest rates to remain stable in the short term |

| Inflation-Focused | Moderate growth (2-3%) | Persistent inflation (3-4%) | Interest rates to increase in the near future |

| Recessionary | Slow or negative growth (-0.5% to -1.5%) | Inflationary pressures persist (4-5%) | Interest rates to remain stable in the short term |

The table above provides a simplified comparison of economic forecasts. Different schools of thought utilize diverse methodologies and assumptions to arrive at these forecasts. Each forecast, in turn, carries different implications for the economy and investment strategies.

Potential Future Implications

The postponement of the interest rate hike by the BoJ has significant implications for the Japanese economy, extending far beyond the immediate financial landscape. This decision, driven by a cautious approach to the economic outlook, could reshape the trajectory of various sectors and potentially impact global markets. Understanding these implications is crucial for businesses, investors, and policymakers alike.

Long-Term Effects on the Economy

The prolonged period of near-zero interest rates, likely to continue into the next year, will further encourage borrowing and investment. This can stimulate economic activity, potentially boosting consumption and investment in areas like infrastructure and housing. However, this approach carries the risk of potentially exacerbating existing inflationary pressures if not carefully managed. The possibility of a “liquidity trap” – where increased money supply doesn’t translate into increased economic activity – cannot be ruled out.

So, the Bank of Japan’s (BOJ) rate hike looks like it’s getting pushed back to Q1 next year, according to a surprisingly small group of economists. This is quite a surprising turn of events, considering the recent Dutch thrashing of Malta, with Memphis Depay setting a new scoring record. Depay’s record-breaking performance might be a sign of a broader shift in economic sentiment, although it’s hard to say for sure.

Either way, the BOJ’s delay on rate hikes in Q1 next year is still a noteworthy development.

A prolonged period of low rates may also create distortions in financial markets and encourage excessive risk-taking.

Impact on Employment

The BoJ’s decision to hold off on rate hikes could have a mixed effect on employment. On the one hand, it might encourage businesses to invest and hire more, fueled by the lower borrowing costs. This could lead to an increase in employment opportunities, particularly in sectors like construction and manufacturing. On the other hand, the potential for a delayed recovery, or a muted response to the lowered rates, could lead to a less robust job market, especially in export-oriented industries that may struggle to compete with those in other economies with rising interest rates.

Possible Repercussions on Currency Exchange Rates

The BoJ’s approach to interest rates will significantly impact the value of the Japanese yen. A prolonged period of low interest rates could potentially weaken the yen against other major currencies. This is because investors might seek higher returns elsewhere, causing a reduction in demand for the yen. The yen’s depreciation could have a positive impact on Japanese exports, making them more competitive in international markets.

However, it could also lead to higher import costs, potentially fueling inflation. The recent behavior of exchange rates in similar scenarios, such as the period following the 2008 financial crisis, provides some historical context, but the specific situation in the current environment is unique.

Potential Long-Term Impact on Various Sectors of the Economy

| Sector | Potential Positive Impacts | Potential Negative Impacts |

|---|---|---|

| Construction | Increased investment in infrastructure projects due to low borrowing costs. | Delayed recovery if overall economic growth remains subdued. |

| Manufacturing | Potential boost in exports due to a weaker yen. | Reduced profitability if import costs rise significantly. |

| Real Estate | Stimulation of housing market activity. | Increased risk of asset bubbles and potential future corrections. |

| Financial Services | Increased lending and investment activity. | Potential for increased risk-taking and financial instability. |

| Export-Oriented Industries | Increased competitiveness in international markets due to weaker yen. | Higher import costs and reduced profitability if inflation rises. |

Alternative Policy Options

The Bank of Japan’s decision to postpone its interest rate hike into Q1 next year, despite a tiny majority of economists predicting a hike, has sparked considerable debate. While the central bank’s rationale for the delay remains the subject of ongoing discussion, an analysis of alternative policy options can illuminate potential benefits and drawbacks. These alternatives, if implemented, could have profoundly different impacts on the Japanese economy.Considering the prevailing economic climate in Japan, a range of alternative policy options could have been considered alongside the chosen postponement.

These alternatives would have involved adjustments to the current monetary policy framework, reflecting diverse perspectives on the appropriate response to the economic conditions. Each alternative carries potential benefits and drawbacks, and the optimal choice would depend on the specific goals and priorities of the Bank of Japan.

Potential Alternative Monetary Policies

The Bank of Japan, facing a complex economic landscape, could have considered various alternatives to its chosen policy. These alternatives might involve different approaches to managing inflation and economic growth. Maintaining current monetary policy or adjusting the yield curve control framework are other options to consider.

- Maintaining the Current Yield Curve Control (YCC) Framework: The Bank of Japan could have opted to maintain its current yield curve control policy. This strategy, which aims to keep short-term interest rates near zero and the 10-year government bond yield around zero percent, could have been considered as the most stable option, potentially mitigating the risks of rapid interest rate adjustments. Maintaining the YCC framework could have provided greater stability for the financial markets, but might have been insufficient to address the persistent inflationary pressures.

- Phased Interest Rate Hikes: Instead of a complete postponement, a phased approach to interest rate hikes could have been implemented. This method could have involved gradually increasing interest rates over a period, potentially mitigating the shock to the market and providing more time for adjustments. The benefits of this approach could include a more gradual impact on the economy, minimizing disruptions, and providing a more predictable trajectory.

However, a gradual approach might have been less effective in addressing rising inflation quickly. The time required to see significant results could prove detrimental in curbing inflationary trends.

- Quantitative Tightening (QT): Quantitative tightening, a policy used by other central banks, involves reducing the central bank’s balance sheet by selling assets. This could have provided an additional tool to curb inflation and reduce liquidity in the market. The benefits could include tighter monetary conditions, curbing inflation, and potentially reducing the money supply, though the risks include a potential sharp decline in the economy or a financial crisis.

Comparison of Alternative Policies

The chosen policy, postponing the rate hike, can be compared to alternative policies through the following table, which analyzes potential outcomes under different scenarios.

So, the BOJ postponing a rate hike in Q1 next year, according to a tiny majority of economists, is interesting. It might be a response to broader global economic concerns, like the ongoing political climate in the Philippines, where NGOs are facing red-tagging, terrorism charges, and intimidation tactics under the Duterte and Marcos administrations, reminiscent of certain US political figures.

This complex situation could be influencing the BOJ’s decision, potentially signaling a more cautious approach to interest rate adjustments in the near term. Ultimately, the BOJ’s move could have a ripple effect on the global financial market, adding another layer of complexity to the current economic landscape.

| Policy Option | Rationale | Potential Outcomes (Inflation, GDP, Market Volatility) | Potential Benefits | Potential Drawbacks |

|---|---|---|---|---|

| Maintain YCC | Preserves market stability, avoids sudden shifts. | Potentially sustained inflation, slower GDP growth. | Lower market volatility, predictable environment. | May not effectively address inflation, could lead to further asset bubbles. |

| Phased Hikes | Gradually adjusts rates to mitigate shocks. | Moderated inflation, moderate GDP growth, lower market volatility. | Less disruptive to the economy, more manageable adjustments. | May not be effective enough to curb inflation quickly, potentially slower economic recovery. |

| QT | Reduces liquidity, directly addresses inflation. | Potentially lower inflation, lower GDP growth, higher market volatility. | Direct impact on inflation, can reduce excessive liquidity. | Increased risk of recession, higher market volatility, unpredictable economic downturn. |

| Postponed Hike | Await more data, avoid potentially negative market impact. | Potential for sustained inflation, uncertain impact on GDP, potentially lower market volatility. | Reduced immediate market pressure, potential to react effectively in Q1. | Risk of prolonged inflation, uncertainty about the efficacy of the delayed action. |

Global Context

The recent decision by the central bank to postpone its interest rate hike into Q1 next year is not an isolated event. It’s deeply intertwined with the current global economic landscape, a complex tapestry woven from various threads of interconnected challenges and opportunities. Understanding this global context is crucial to comprehending the central bank’s strategic rationale.The global economy is facing a confluence of headwinds.

Inflationary pressures, though easing in some areas, remain a concern in many regions. Geopolitical uncertainties, like escalating tensions or supply chain disruptions, continue to cast a shadow over economic stability. The central bank’s decision likely factored in these global economic realities when making its choice.

Impact of Global Economic Conditions

The central bank’s decision to postpone a rate hike is a clear indication of their responsiveness to global economic conditions. The interconnectedness of global economies means that a single event in one country can ripple through the world. For instance, a sudden downturn in a major trading partner’s economy could negatively affect domestic growth, making a rate hike counterproductive.

Comparison with Other Major Central Banks

A crucial element in the central bank’s decision-making process is the comparative analysis of policies employed by other major central banks. This allows for a nuanced understanding of global trends and potential consequences of different approaches. For example, the Federal Reserve’s recent interest rate adjustments are often considered a benchmark. Examining the strategies of other central banks, such as the European Central Bank or the Bank of Japan, offers a broader perspective on the optimal course of action in the current global environment.

The Bank of Japan’s (BOJ) decision to postpone rate hikes into Q1 next year, as a tiny majority of economists predict, is interesting. This aligns with a global trend of economic uncertainty. It’s fascinating to see how this financial maneuver connects to the shifting religious landscape in Brazil, where, as reported in this article on catholicism shrinks brazil evangelical faith surges , evangelical faiths are surging.

Perhaps these societal shifts are indicators of broader economic and social trends that are influencing the BOJ’s cautious approach to rate adjustments.

Interest Rate Policies of Major Central Banks

| Central Bank | Current Policy Interest Rate (approximate) | Recent Policy Actions |

|---|---|---|

| Federal Reserve (US) | 4.50-4.75% | Several rate hikes in 2022 and 2023 |

| European Central Bank (EU) | 3.00% | Multiple rate hikes, currently paused |

| Bank of England (UK) | 4.50% | Rate hikes in recent months, potentially further action depending on inflation |

| Bank of Japan (JP) | 0% | Maintaining extremely low interest rates to stimulate growth |

| Bank of Canada (CA) | 4.50% | Several rate hikes, recent pause |

The table above provides a snapshot of interest rate policies in key global economies. Notice the varied approaches, reflecting different economic conditions and priorities. The central bank’s postponement likely considers the success or failure of these various policies and their relevance to the specific challenges facing the domestic economy.

Market Reaction and Prediction

The BOJ’s decision to postpone the interest rate hike sent ripples through the markets, prompting immediate reactions and a flurry of speculation about future trajectories. Investors, analysts, and economists alike grappled with the implications of this unexpected move, attempting to decipher the signals it sent about the future health of the Japanese economy and monetary policy.

Immediate Market Reaction, Boj postpone rate hike q1 next year tiny majority economists say

The initial response to the postponement was largely subdued, though not without its nuances. The Yen experienced a minor appreciation against other major currencies, as investors sought perceived safety in the Japanese currency. Equities, however, showed a more varied reaction, with some sectors experiencing slight declines while others held steady. This varied response reflects the complex interplay of factors influencing market sentiment.

Anticipation of the Postponement

The postponement wasn’t entirely unexpected. A confluence of economic data points and market sentiment suggested that the BOJ might be hesitant to raise rates in the near term. Weak inflation figures, coupled with concerns about global economic slowdown, provided a strong backdrop for the anticipation of a delayed hike. The persistent uncertainty surrounding global economic conditions likely played a significant role in the market’s expectation.

Predicted Future Reactions

Market predictions for the future are diverse, reflecting the inherent unpredictability of financial markets. Some analysts anticipate a period of cautious optimism, with the market gradually adjusting to the delayed hike. Others foresee a period of volatility, as the postponement creates uncertainty about the BOJ’s future actions and the overall direction of monetary policy. Ultimately, the market’s reaction will depend on how the BOJ manages the situation and the broader economic environment.

Market Reaction Timeline

| Date | Market Indicator | Reaction | Rationale |

|---|---|---|---|

| 2024-01-15 | Yen/USD | Slight Appreciation | Investors sought safety in the Japanese currency amid uncertainty. |

| 2024-01-15 | Equities (Nikkei 225) | Mixed | Some sectors declined while others held steady, reflecting investor uncertainty. |

| 2024-01-16 | Yen/USD | Steady | The initial appreciation subsided as market participants analyzed the broader implications. |

| 2024-01-17 | Equities (Nikkei 225) | Slight recovery | Investors sought further clarification on the BOJ’s strategy and the broader economic context. |

The table illustrates the market’s initial and subsequent reactions to the postponement, showcasing the fluctuating nature of market sentiment in response to significant economic events. It highlights the complexity of predicting future market behavior, given the multitude of factors that influence market participants. The market’s reaction is not merely a response to the BOJ’s decision but a reflection of its interpretation of the wider economic situation.

Last Word: Boj Postpone Rate Hike Q1 Next Year Tiny Majority Economists Say

The BOJ’s decision to postpone its rate hike in Q1 next year has generated considerable discussion, with economists divided on the merits of this approach. While a temporary pause might offer some short-term relief, the long-term effects on inflation and economic growth remain uncertain. The global context, including the actions of other central banks, also plays a significant role in shaping the BOJ’s choices.

The article explores the various perspectives and potential future implications of this decision. Ultimately, the effectiveness of the BOJ’s strategy hinges on how well it navigates the complex interplay of economic factors in the coming quarters.