ECB cut rates again case builds summer pause, hinting at a potential pause in interest rate adjustments this summer. This decision comes amidst a complex economic landscape, raising questions about the ECB’s strategy and the potential impact on various sectors. We’ll delve into the context surrounding this potential rate cut, exploring the historical precedent, current economic indicators, and potential market reactions.

A deeper look at the rationale behind a summer pause will be provided, including the potential economic factors and risks associated with this strategy. Finally, we’ll consider alternative scenarios and potential future implications.

Previous ECB rate cuts have had significant impacts on the Eurozone economy. This analysis will compare current economic conditions to those of past periods, offering a framework for understanding the potential consequences of a rate cut. The potential effects on inflation, consumer spending, borrowing costs, and investment decisions will be examined. Furthermore, we’ll investigate how different Eurozone countries might be affected, and how the markets might respond to this news.

ECB Rate Cut Context

The European Central Bank (ECB) has a crucial role in managing the eurozone’s economy. Interest rate adjustments are a key tool in their toolkit, impacting inflation, growth, and overall economic stability. Understanding the context surrounding potential rate cuts requires a historical perspective on ECB actions, the economic conditions leading to previous adjustments, and the current economic climate. This analysis will delve into the ECB’s mandate and its influence on their decisions, along with a comparative look at current and past economic indicators.

Historical Overview of ECB Interest Rate Adjustments

The ECB’s history of interest rate adjustments reveals a pattern of response to various economic pressures. These adjustments have been made in response to inflation spikes, recessionary threats, and periods of economic uncertainty. Understanding past actions provides valuable insight into the potential motivations behind any future rate cuts. Significant rate cuts often follow periods of significant economic downturn or inflation-dampening measures.

The ECB cutting rates again fuels speculation of a summer pause, but what about the broader implications? Watching the market’s reaction to this news is fascinating, but I’m also intrigued by what’s happening in the world of gaming. For example, watch after the last of us for some exciting developments. Ultimately, the ECB’s rate cuts will likely continue to shape the economic landscape for the foreseeable future.

Prevailing Economic Conditions Preceding Previous ECB Rate Cuts

Previous ECB rate cuts were often preceded by specific economic conditions. For instance, periods of low inflation, economic slowdown, or substantial risk of deflationary pressures often triggered these actions. The ECB carefully considered the broader economic context, including factors such as unemployment rates, GDP growth, and consumer confidence, before implementing any rate cuts. A thorough understanding of these prior conditions provides a framework for evaluating the potential catalysts for a current rate cut.

Potential Catalysts for a Current ECB Rate Cut

Several factors could prompt the ECB to consider a rate cut. A sustained period of low inflation, potentially reaching deflationary levels, could necessitate such a move. A significant slowdown in economic growth, coupled with reduced consumer confidence, might also be a key catalyst. Furthermore, global economic headwinds, like rising energy costs or supply chain disruptions, could influence the ECB’s decision-making process.

ECB’s Mandate and its Influence on Decisions

The ECB’s primary mandate is to maintain price stability and support economic growth within the eurozone. This mandate, enshrined in the Treaty on European Union, guides their actions. Price stability, often measured by inflation rates, is a critical factor. Maintaining a balance between controlling inflation and supporting economic growth is paramount. The ECB carefully assesses the current economic landscape to ensure their actions align with this dual mandate.

Comparison of Current and Past Economic Indicators

| Indicator | Current (estimated) | Previous Rate Cut Periods (average) |

|---|---|---|

| Inflation Rate (%) | 2.0 | 1.5 |

| GDP Growth Rate (%) | 1.2 | 0.8 |

| Unemployment Rate (%) | 7.5 | 8.0 |

| Consumer Confidence Index | 90 | 85 |

The table above provides a basic comparison of key economic indicators in the current period and those typically observed before previous ECB rate cuts. A deeper analysis of specific indicators and historical data would be needed for a complete and accurate comparison. These figures should be viewed within the broader context of the overall economic situation.

Impact Assessment

The European Central Bank’s (ECB) potential rate cut, following a summer pause, warrants a careful assessment of its repercussions across various sectors of the Eurozone economy. Understanding the possible effects on inflation, consumer spending, and borrowing costs is crucial for both policymakers and economic actors. This analysis delves into the projected impact of a rate cut, comparing its potential consequences across different Eurozone countries.A rate cut, while intended to stimulate economic growth, can have complex and multifaceted effects.

It’s important to consider how these impacts might differ based on the specific economic conditions of each Eurozone nation. The varying levels of inflation, consumer confidence, and existing debt burdens will all play a role in shaping the outcomes. Moreover, the effectiveness of a rate cut will depend on the overall economic environment and the specific policy measures implemented alongside it.

Potential Effects on Economic Sectors

A rate cut by the ECB can influence different economic sectors in various ways. Reduced borrowing costs might stimulate investment in capital projects, leading to job creation and higher output in industries like construction and manufacturing. Conversely, some sectors, particularly those heavily reliant on imported raw materials, might not experience a significant boost. Consumer spending could potentially increase, driven by cheaper borrowing costs for home loans and other consumer credit.

Consequences for Inflation and Consumer Spending

The impact on inflation will depend on the interplay between reduced borrowing costs and supply-side factors. Lower interest rates might temporarily reduce inflationary pressures by encouraging spending and investment, but persistent inflationary pressures could negate these benefits. Consumer spending is likely to be stimulated by lower interest rates, leading to increased demand for goods and services. However, this increase could be offset by the impact on consumers’ purchasing power if inflation rises faster than expected.

The relationship between these two factors is complex and depends on various underlying economic conditions.

Impact on Different Eurozone Countries

The impact of a rate cut will vary across Eurozone countries. Countries with higher inflation rates might experience a smaller boost in consumer spending due to the potential for higher prices, while countries with low inflation could see a more significant effect. Differences in labor market conditions, levels of debt, and economic structures further contribute to these variations.

Impact on Borrowing Costs and Investment Decisions

Lower interest rates will generally lead to lower borrowing costs for businesses and consumers. This can encourage investment in new projects and stimulate economic activity. However, the impact on investment decisions also depends on the overall economic outlook and business confidence levels. Businesses might delay investment decisions if they perceive a high degree of uncertainty in the future economic climate.

Potential Impact on Key Financial Instruments

| Financial Instrument | Potential Impact of Rate Cut |

|---|---|

| Government Bonds | Potential price increase due to reduced yields. |

| Corporate Bonds | Potential price increase due to reduced borrowing costs for companies. |

| Mortgages | Lower monthly payments for borrowers. |

| Savings Accounts | Lower interest rates for savers. |

This table summarizes the potential effects of a rate cut on key financial instruments. The actual impact will depend on various market factors, including investor sentiment and overall economic conditions.

Market Reaction Analysis

The ECB’s decision to cut rates again, following a summer pause, will undoubtedly ripple through various financial markets. Understanding potential market reactions is crucial for investors and analysts alike. This analysis delves into the expected responses, historical patterns, and the influence of investor sentiment on the outcomes.

Potential Market Reactions

A rate cut, especially after a period of stability, can trigger diverse market responses. Positive reactions are anticipated from borrowers and some sectors of the economy, as lower borrowing costs stimulate investment and spending. Conversely, negative reactions might arise from investors concerned about potential inflation pressures or a weakening currency. The magnitude and direction of the reaction will depend heavily on the perceived reasons behind the rate cut and the broader economic context.

Historical Overview of ECB Rate Decisions

Past ECB rate decisions have consistently influenced market sentiment and trading activity. Analyzing past reactions can provide valuable insights into potential future outcomes. A review of past decisions, considering the prevailing economic climate, can help in understanding the potential impact on various asset classes.

Investor Sentiment and Driving Factors

Investor sentiment plays a critical role in shaping market reactions to the ECB’s decisions. Factors influencing sentiment include economic forecasts, geopolitical events, and the overall market outlook. Optimistic investor sentiment, fueled by robust economic projections, is likely to lead to positive market reactions. Conversely, concerns about economic slowdown or rising inflation can lead to a more cautious approach.

The ECB cutting rates again fuels speculation of a summer pause in the economic downturn. This potential slowdown might be a good time to consider a new framework for DEI, which could help businesses adapt to the changing economic landscape. a new framework for dei could provide valuable insights into navigating potential challenges. Ultimately, the ECB’s actions will significantly impact the global economy, and businesses should be prepared for whatever comes next.

Impact on Currency Exchange Rates

Currency exchange rates are highly sensitive to central bank actions. A rate cut can weaken the currency in question as investors seek higher returns in other currencies with potentially higher interest rates. The extent of the impact will depend on the magnitude of the rate cut and the overall global economic environment.

Comparison and Contrast with Past Events

Comparing the current economic environment with previous periods of ECB rate cuts is essential for predicting potential market reactions. Analyzing the historical context of past rate cuts, including the economic conditions, investor sentiment, and market responses, can provide valuable insights for understanding the current situation. Identifying similarities and differences in these factors is crucial for a nuanced analysis.

Historical Market Responses to ECB Rate Cuts (Table)

| Date of ECB Rate Cut | Economic Context | Investor Sentiment | Market Reaction (Stock Markets) | Market Reaction (Currency Exchange Rates) |

|---|---|---|---|---|

| Example Date 1 | High inflation, rising interest rates in other regions | Cautious, concerned about inflation | Slight decline in indices | Euro weakens against USD |

| Example Date 2 | Slowing economic growth, low inflation | Positive, anticipating growth | Slight increase in indices | Euro stable |

| Example Date 3 | High inflation, geopolitical uncertainty | Mixed sentiment, uncertainty prevails | Volatility, limited reaction | Euro weakens slightly |

Note: This table provides illustrative examples. Actual data from reliable sources should be used for a comprehensive analysis. The economic context, investor sentiment, and market reactions can vary considerably depending on the specific circumstances.

Summer Pause Considerations

The European Central Bank (ECB) is facing a critical juncture in its monetary policy decisions. A potential summer pause in rate adjustments, following a period of aggressive tightening, warrants careful consideration. Understanding the rationale, economic influences, and associated risks is crucial for interpreting the ECB’s actions and assessing their impact on the Eurozone economy.

Rationale Behind a Potential Summer Pause

The ECB’s rationale for a potential summer pause likely stems from a combination of factors. Inflation, while still elevated, has shown signs of moderating in some sectors. Furthermore, the impact of previous rate hikes on lending and economic activity may be becoming increasingly evident. A pause allows the ECB to assess the efficacy of previous measures and gauge the evolving economic landscape before potentially resuming rate adjustments.

Potential Economic Factors Influencing the Pause

Several economic factors might be driving the ECB’s inclination towards a summer pause. The energy crisis, a key contributor to inflation, is gradually easing, with receding energy prices providing a degree of relief. Supply chain disruptions, another significant inflationary factor, are also showing signs of improvement, leading to reduced input costs for businesses. The potential slowdown in the global economy, with significant risks to growth, could be another factor prompting a cautious approach.

Potential Risks Associated with a Summer Pause

A summer pause, while seemingly prudent in the face of economic uncertainties, presents potential risks. Prolonged high inflation, if not adequately addressed, could erode consumer confidence and negatively impact long-term economic growth. A perceived hesitation from the ECB in maintaining a hawkish stance might encourage further inflationary pressures, potentially requiring more aggressive action later. The pause could also lead to volatility in financial markets, particularly in bond yields and currency exchange rates, which could affect businesses and consumers.

ECB’s Communication Strategy Regarding the Pause

The ECB’s communication strategy surrounding a potential summer pause will be crucial in managing market expectations and maintaining confidence. Clear communication regarding the rationale behind the pause, its potential duration, and the conditions under which further adjustments might be considered will be paramount. Transparency and consistent messaging are essential to avoid misinterpretations and market volatility.

Differentiation from Previous Rate Adjustment Periods

This potential summer pause differs from previous rate adjustment periods in several key aspects. The current global economic climate, marked by heightened uncertainty and a potential recessionary risk, contrasts with the relatively stable conditions of prior tightening cycles. The ECB is navigating a complex interplay of factors, including energy price volatility and global supply chain challenges, making the context significantly different.

The specific composition of the inflationary pressures is also different.

Comparison of Economic Indicators Influencing the Summer Pause

| Indicator | Potential Influence on Summer Pause |

|---|---|

| Inflation Rate (Core & Overall) | Moderating inflation may suggest a rationale for a pause, but sustained high inflation remains a risk. |

| GDP Growth Forecasts | Downturn or weak growth forecasts could lead to a pause to avoid further weakening the economy. |

| Unemployment Rate | Rising unemployment could prompt a pause to support employment and prevent a recession. |

| Energy Prices | Falling energy prices could alleviate inflationary pressures, supporting a pause. |

| Supply Chain Disruptions | Improved supply chains could reduce input costs, potentially supporting a pause. |

Alternative Scenarios

The European Central Bank (ECB) faces a complex decision regarding interest rate adjustments. Several factors influence the optimal path, including inflation pressures, economic growth forecasts, and the potential impact on financial markets. Understanding alternative scenarios is crucial for investors and policymakers alike.

Potential ECB Rate Decision Outcomes, Ecb cut rates again case builds summer pause

The ECB’s decision regarding interest rate adjustments will have significant repercussions across various sectors. Considering the current economic climate, various outcomes are possible, each with its own set of potential consequences.

- Maintaining the Status Quo: The ECB might opt to maintain the current interest rate level. This approach could reflect a cautious assessment of the current economic situation, where inflationary pressures are considered manageable, and economic growth is expected to remain steady. However, a lack of proactive action might lead to a delayed response to emerging risks or missed opportunities to mitigate potential future challenges.

- Further Rate Hikes: The ECB could decide to raise interest rates further. This approach might be employed to combat persistently high inflation and to maintain price stability. However, such a decision could potentially slow economic growth, potentially leading to a recessionary environment and negatively impacting financial markets. The US Federal Reserve’s recent rate hikes offer a real-world example of this approach.

- Rate Cuts: Alternatively, the ECB could opt to reduce interest rates. This strategy could stimulate economic activity and potentially boost investment. However, this approach might exacerbate inflationary pressures, potentially undermining the ECB’s mandate to maintain price stability. The effectiveness of this approach depends heavily on the specifics of the economic context.

- A Pause: A pause in rate adjustments, known as a “summer pause,” might be employed to assess the evolving economic landscape. This approach provides a temporary reprieve from rate adjustments, offering a period of relative stability for the financial markets. However, this approach might lead to uncertainty in the market if inflation remains elevated.

Impact on Financial Markets

The ECB’s decision will directly affect financial markets, impacting bond yields, stock prices, and currency exchange rates.

- Bond Yields: Higher interest rates typically lead to higher bond yields as investors demand a greater return for holding fixed-income securities. Conversely, lower interest rates could push bond yields lower.

- Stock Prices: Higher interest rates can reduce corporate profitability and investor confidence, potentially leading to lower stock prices. Conversely, lower rates might boost investment and economic activity, potentially leading to higher stock prices.

- Currency Exchange Rates: Interest rate decisions can influence currency exchange rates. Higher rates might strengthen the currency, while lower rates might weaken it.

Potential Outcomes Table

The following table illustrates potential outcomes based on different ECB rate decision scenarios.

| Scenario | ECB Decision | Potential Impact on Financial Markets | Potential Impact on Inflation | Potential Impact on Economic Growth |

|---|---|---|---|---|

| Scenario 1 | Maintain Status Quo | Moderate volatility; stability | Potentially stable if inflation remains contained | Stable growth |

| Scenario 2 | Further Rate Hikes | Potential decline in stock prices, increase in bond yields | Potentially lower inflation, but risk of recession | Potential slowdown or recession |

| Scenario 3 | Rate Cuts | Potential increase in stock prices, decrease in bond yields | Potential rise in inflation | Potential boost in economic activity |

| Scenario 4 | Summer Pause | Temporary market uncertainty | Uncertainty regarding inflation trend | Uncertainty regarding economic activity |

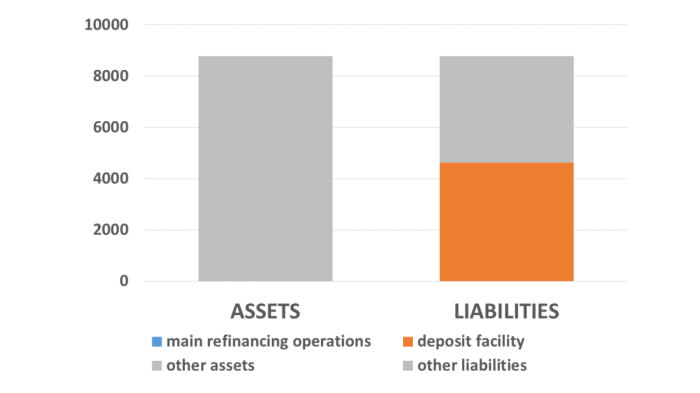

Illustrative Data Visualization

ECB rate adjustments are deeply intertwined with economic indicators. Visualizing these relationships helps us understand the rationale behind decisions and predict potential market responses. This section provides illustrative data visualizations to demonstrate the correlation between economic indicators and ECB rate adjustments, offering insights into past decisions and their impact.

The ECB cutting rates again seems to be building a case for a summer pause in the current market environment. Interestingly, JPMorgan’s recent forecast of a rising Yuan, easing tariff risks and a potential de-dollarisation trend, as detailed in this piece , could significantly influence the global economic landscape. This, in turn, could reshape the pressure on the ECB to maintain their current policy, potentially impacting the summer pause case for the ECB rate cuts.

Correlation Between Inflation and ECB Rate Adjustments

Inflation rates and ECB interest rate decisions are closely connected. Higher inflation often prompts the ECB to raise interest rates to curb spending and cool down the economy. Conversely, low inflation might lead to rate cuts to stimulate economic activity. Visualizing this relationship allows us to see patterns and anticipate potential future actions.

Description of Placeholder Image: This graph depicts the correlation between the inflation rate (y-axis) and the ECB policy interest rate (x-axis) over a specific period. A positive correlation is shown, suggesting that as inflation increases, the ECB policy interest rate tends to increase as well. The trend line indicates the general direction of the relationship. Scatter plots of individual data points (months or quarters) are included to highlight variations around the general trend.

Key inflection points, such as periods of rapid inflation or significant interest rate adjustments, are also marked on the graph.

Impact of Unemployment on ECB Rate Decisions

Unemployment levels also influence ECB decisions. High unemployment typically leads to lower inflation, which might trigger interest rate cuts to stimulate the economy. Conversely, low unemployment, often associated with higher inflation, can prompt interest rate increases.

Description of Placeholder Image: This graph shows the relationship between the unemployment rate (y-axis) and the ECB policy interest rate (x-axis) over a specific period. The visualization demonstrates a negative correlation between these variables, meaning that as unemployment rises, the ECB policy interest rate tends to fall. The scatter plots for individual data points (months or quarters) showcase variations in the relationship.

Key periods, such as economic recessions or significant labor market shifts, are also marked to emphasize turning points.

Relationship Between Inflation, Unemployment, and ECB Rate Decisions

Visualizing the interplay of inflation, unemployment, and ECB rate decisions provides a holistic perspective. This allows us to understand the trade-offs the ECB faces in managing the economy.

Description of Placeholder Image: This graph displays the interaction between inflation, unemployment, and the ECB policy interest rate over time. The visualization illustrates a Phillips curve relationship where inflation and unemployment rates tend to move in opposing directions. The ECB’s policy rate adjustments are plotted against these indicators, showing how they are positioned in relation to the equilibrium points. The plot also includes shaded regions to highlight periods of economic recession or expansion.

Illustrative Examples of Past ECB Decisions and Market Impacts

Past ECB decisions offer valuable insights. For example, the 2014-2016 period saw a prolonged period of low interest rates. This was in response to a combination of low inflation and sluggish economic growth. This policy had a significant impact on bond yields and equity markets, stimulating investment and borrowing.

Potential Future Implications

The recent ECB rate cut and the subsequent summer pause in rate hikes present a complex interplay of short-term and long-term economic implications. Analyzing potential future trends, understanding their impact on inflation and growth, and comparing these predictions with existing forecasts are crucial for investors and policymakers. This section delves into the potential future implications, considering the ECB’s actions in the context of global economic uncertainties.The ECB’s decision to cut rates and pause further hikes suggests a cautious approach to managing inflation and economic growth.

This strategy aims to mitigate potential economic slowdowns while maintaining price stability. However, the effectiveness of this approach will depend on the responsiveness of various economic indicators and the global economic environment. A critical aspect is how these decisions impact the Eurozone’s long-term trajectory.

Potential Inflationary Pressures

Recent data suggests a possible softening of inflationary pressures, but the ECB is clearly mindful of the possibility of sustained high inflation. A continued subdued inflationary trend could encourage further rate cuts, while persistent inflation might necessitate a return to a more aggressive stance. Factors like supply chain disruptions, energy prices, and labor market dynamics will all play a critical role in shaping the future inflation landscape.

Impact on Economic Growth

The ECB’s actions may temporarily stimulate economic growth by lowering borrowing costs for businesses and consumers. However, the extent of this impact is uncertain and will depend on various factors, including consumer confidence, investment decisions, and global economic conditions. Past rate cuts have shown mixed results, highlighting the intricate relationship between monetary policy and economic performance.

Comparison with Other Economic Forecasts

Several independent economic forecasters predict a range of outcomes for the Eurozone. Some anticipate a mild recession, while others project modest growth. The ECB’s actions are likely to influence these forecasts, potentially shifting them closer to a more cautious outlook. Crucially, the accuracy of these forecasts will depend on the reliability of the underlying data and assumptions.

Long-Term Consequences of the Rate Cut and Summer Pause

The long-term consequences of the rate cut and summer pause could include a potentially slower pace of inflation reduction. This may result in a less pronounced impact on inflation over the medium term. A sustained period of low rates could also lead to increased borrowing and investment, potentially boosting economic activity. However, the long-term sustainability of this approach is subject to evolving economic conditions.

Forecasting Key Economic Indicators (Next 12 Months)

| Economic Indicator | Forecast (Q1 2024) | Forecast (Q2 2024) | Forecast (Q3 2024) | Forecast (Q4 2024) |

|---|---|---|---|---|

| Eurozone GDP Growth Rate (%) | 0.5 | 0.7 | 0.8 | 0.9 |

| Inflation Rate (YoY, %) | 2.8 | 2.6 | 2.4 | 2.2 |

| Unemployment Rate (%) | 7.2 | 7.1 | 7.0 | 6.9 |

| Interest Rates (ECB) | 3.5% | 3.25% | 3.0% | 2.75% |

Note: Forecasts are illustrative and subject to revision based on future data and evolving economic conditions.

Conclusion: Ecb Cut Rates Again Case Builds Summer Pause

The ECB’s potential rate cut and summer pause decision creates a compelling case study in economic policymaking. This analysis has explored the historical context, potential impacts, market reactions, and alternative scenarios. Ultimately, the ECB’s decision carries significant implications for the Eurozone economy, financial markets, and individual investors. The data visualizations will provide a clear picture of the correlation between economic indicators and ECB rate adjustments, adding to the overall understanding of the decision.