Ecb rate decision live european central bank set cut interest rates again – ECB rate decision live: European Central Bank set cut interest rates again. This latest move signals a continued attempt to stimulate the Eurozone economy. Will this cut be enough to counteract the headwinds of inflation and economic uncertainty? The decision comes amidst a complex interplay of factors, including global energy prices, supply chain disruptions, and geopolitical tensions.

How will this impact consumers, investors, and businesses across the Eurozone? Let’s delve into the details and analyze the potential short-term and long-term implications.

The ECB’s decision to cut interest rates again is likely a response to persistent economic weakness. This action is intended to encourage borrowing and spending, aiming to boost growth. However, the effectiveness of this strategy will depend on the overall health of the Eurozone economy and the reaction of markets. A key aspect to consider is how this decision compares to recent actions taken by other central banks, such as the Federal Reserve and the Bank of England.

The table below shows the key interest rates before and after the decision.

ECB Rate Decision Overview

The European Central Bank (ECB) recently announced its latest interest rate decision. This decision, while anticipated by some market participants, carries significant implications for the Eurozone economy and financial markets. The timing and magnitude of any adjustments often reflect a careful assessment of current economic conditions and future projections.

Summary of the ECB Rate Decision

The ECB maintained its key interest rates, leaving the deposit rate unchanged. This decision aligns with expectations of many analysts who had projected a holding pattern, particularly given the recent economic data and the ongoing uncertainties in the global economic outlook. The decision to maintain the status quo suggests a cautious approach by the ECB, recognizing the delicate balance between inflation pressures and economic growth.

Interest Rate Change (or Lack Thereof), Ecb rate decision live european central bank set cut interest rates again

The ECB opted to maintain its existing interest rate structure. This approach underscores a calculated response to the current economic landscape. The decision to hold steady reflects the ECB’s assessment that the existing rate environment is appropriate for managing inflation and supporting economic growth.

Current Interest Rate Environment in the Eurozone

The current interest rate environment in the Eurozone is characterized by a relatively low interest rate regime. This environment is in contrast to the recent tightening cycles seen in some other major economies, and it reflects the ECB’s focus on supporting economic recovery and mitigating the potential negative impact of inflation.

Economic Context Surrounding the Decision

The economic context surrounding the ECB’s decision is marked by mixed signals. Recent inflation data remains a concern, but signs of slowing economic growth in some sectors are also emerging. These competing forces have contributed to a nuanced economic outlook, demanding a careful evaluation by the ECB. The ongoing war in Ukraine, and its influence on global energy prices, is another major factor in the assessment.

Key Interest Rates Before and After the Decision

| Interest Rate | Before Decision | After Decision |

|---|---|---|

| Deposit Rate | -0.50% | -0.50% |

| Refinancing Rate | 3.00% | 3.00% |

| Marginal Lending Rate | 3.25% | 3.25% |

This table clearly illustrates the unchanged nature of the key interest rates following the ECB’s announcement.

Impact Analysis

The ECB’s decision to cut interest rates again has significant implications for the Eurozone economy. This move, while potentially stimulating growth, carries risks and uncertainties that will play out across various sectors. Understanding these potential impacts is crucial for investors and policymakers alike.

Short-Term Impacts on Eurozone Economies

The immediate effect of lower interest rates is typically to encourage borrowing and spending. Consumers may see reduced mortgage payments and lower borrowing costs for other purchases, potentially boosting consumer spending. Businesses, too, might be incentivized to invest more, especially in areas like infrastructure projects. However, the magnitude of this effect depends on factors like consumer confidence and the overall economic climate.

The ECB’s rate decision is live, and they’ve cut interest rates again, which is certainly interesting. Given the current global economic climate, it’s a fascinating move. Meanwhile, news is emerging that the US ambassador to Russia is set to leave their post soon, as reported by us ambassador russia leave post soon says embassy. This development adds another layer of complexity to the already tricky international relations picture, potentially influencing the ECB’s decision-making in the coming weeks and months.

The ongoing global economic uncertainty surrounding interest rate cuts is certainly a significant factor.

A decrease in borrowing costs can also have a cascading effect, impacting investment decisions in various sectors.

Impact on Specific Sectors

The impact of interest rate cuts varies across economic sectors. Real estate, for instance, often experiences a surge in activity as lower mortgage rates make homes more affordable. This can lead to increased demand and price appreciation, but this effect is not guaranteed. The manufacturing sector, on the other hand, might see a mixed response. While lower borrowing costs could encourage investment in new equipment, existing manufacturing capacity and global demand fluctuations will also play a significant role.

The agricultural sector might see some positive impact through reduced borrowing costs for farming operations.

Comparison with Other Central Banks

The ECB’s decision to cut interest rates needs to be viewed in the context of recent actions by other major central banks, like the Federal Reserve and the Bank of England. Differences in their approaches reflect varying economic conditions and priorities. While the ECB’s move might be aimed at stimulating the Eurozone economy, the Federal Reserve’s approach might be more focused on inflation control.

Understanding these differences helps provide a more nuanced picture of the global economic landscape.

Potential Market Reactions

Lower interest rates often trigger various market reactions. Stock markets might see a positive response as investors anticipate increased economic activity. However, the strength and duration of this response depend on factors such as investor sentiment and the overall economic outlook. Currency movements can also be impacted; a decrease in interest rates might lead to a weakening of the Euro against other currencies, as investors seek higher returns elsewhere.

Contrasting ECB Actions with Other Central Banks

| Characteristic | ECB | Federal Reserve | Bank of England |

|---|---|---|---|

| Interest Rate Decision | Cut | Held Steady | Cut |

| Reasoning | Stimulate Eurozone growth | Maintain inflation control | Support economic recovery |

| Economic Context | Sluggish Eurozone growth, high inflation | Inflation at target, moderate growth | Stagflation, high energy prices |

This table highlights the distinct economic situations influencing the decisions of different central banks. The divergence in approaches reflects the specific challenges facing each region.

Long-Term Implications

The ECB’s latest interest rate cut, while seemingly a short-term response to economic headwinds, carries significant long-term implications for the Eurozone’s economic trajectory. Understanding the ECB’s broader monetary policy strategy and its potential effects on inflation and growth is crucial for assessing the decision’s overall impact. This analysis delves into the potential consequences, highlighting both opportunities and challenges.The ECB’s long-term strategy revolves around maintaining price stability, ideally around 2% inflation, while supporting sustainable economic growth.

This approach, often referred to as a “two-pillar” strategy, aims to balance the risks of inflation and deflation, adapting to changing economic conditions. A key component is the assessment of economic risks and uncertainties, which are factored into the ECB’s decisions.

ECB’s Long-Term Monetary Policy Strategy

The ECB’s commitment to price stability is a cornerstone of its long-term strategy. This commitment is reflected in its mandate to maintain inflation close to 2% over the medium term. Their strategy adapts to economic conditions. This flexibility allows the ECB to respond to various challenges, such as rising energy prices or supply chain disruptions, with the goal of achieving price stability and maintaining a healthy economic environment.

Potential Effects on Inflation and Growth

The rate cut aims to stimulate economic activity by lowering borrowing costs. This should theoretically boost investment and consumption, potentially leading to moderate economic growth in the medium term. However, the impact on inflation is complex. Lower rates could increase demand, potentially pushing inflation higher if supply constraints persist. Conversely, if the economy remains sluggish, the effect on inflation could be muted.

Historical data suggests that such rate cuts have a lagged effect, with potential impacts manifesting within several months or even quarters.

Addressing Economic Uncertainty

The ECB’s approach to addressing economic uncertainty centers on its assessment of risks and vulnerabilities. Forecasting models, macroeconomic data, and expert opinions are considered. By incorporating various perspectives, the ECB attempts to anticipate and respond to potential shocks, like geopolitical tensions or natural disasters, which can impact the Eurozone’s economic stability. The ECB’s strategy aims to mitigate these risks through proactive policy measures.

Potential Risks and Challenges for the Eurozone

The decision carries potential risks. If the rate cut fails to stimulate the desired economic activity, it could lead to a prolonged period of low growth, potentially exacerbating existing economic challenges within the Eurozone. Furthermore, the interplay between monetary policy and other economic factors, such as fiscal policy and structural reforms, is crucial. Uncoordinated policies could undermine the effectiveness of the rate cut.

The ECB’s response must be flexible and adaptable to changing conditions, requiring ongoing monitoring and evaluation.

Potential Scenarios for the Eurozone Economy

| Scenario | Description | Potential Impact on Inflation | Potential Impact on Growth |

|---|---|---|---|

| Moderate Growth, Stable Inflation | The rate cut stimulates moderate economic growth, keeping inflation around the target rate. | Inflation remains within the ECB’s target range. | Growth picks up, but at a measured pace. |

| Sluggish Growth, Inflationary Pressures | The rate cut does not significantly boost growth, while supply constraints lead to persistent inflationary pressures. | Inflation rises above the target rate. | Growth remains stagnant, potentially leading to concerns about future inflation. |

| Growth Recession, Deflationary Risks | The rate cut is ineffective in stimulating growth, leading to a potential recession and deflationary pressures. | Inflation falls below the target rate. | The Eurozone economy enters a recessionary phase. |

These scenarios highlight the complex interplay of factors impacting the Eurozone economy. The ECB’s ability to navigate these uncertainties will be crucial in determining the long-term economic health of the Eurozone.

The ECB’s latest rate decision, another cut in interest rates, is definitely noteworthy. It’s interesting to consider how this might impact global markets, especially when juxtaposed with Israel’s plans to bring their budget deficit below 3% of GDP by 2025, as detailed in this article israel plans bring budget deficit below 3 gdp25 06 08. While the Israeli fiscal strategy is certainly an important development, the ECB’s rate cut likely remains a key focus for investors today.

Market Reactions and Forecasts: Ecb Rate Decision Live European Central Bank Set Cut Interest Rates Again

The ECB’s decision to cut interest rates again sparked immediate reactions across financial markets. Investors and analysts are now scrutinizing the implications for the Eurozone economy and the potential impact on various asset classes. This analysis delves into the initial market responses, expert perspectives, and economic forecasts, along with strategies financial institutions might employ in light of the new policy.

Initial Market Reactions

The announcement of the interest rate cut triggered a wave of reactions across different financial markets. Stock indices experienced a positive initial response, with gains in several European markets. Bond yields, however, exhibited a mixed reaction, with some yields decreasing while others remained relatively stable. Currency markets also saw fluctuations, as the Euro experienced slight shifts against other major global currencies.

The ECB rate decision live, with the European Central Bank again cutting interest rates, is definitely a significant financial story. However, it’s important to consider the broader context. Issues like climate change, especially its impact on the Global South, are deeply intertwined with economic decisions like this. Sabrina Elba’s work highlighting the climate change challenges facing the global south ( sabrina elba climate change global south ) is a crucial reminder that economic policies must consider these interconnected realities.

Ultimately, the ECB’s decision will likely have ripple effects on various global issues, demonstrating the complexity of these economic and environmental challenges.

The volatility and direction of these reactions provide insight into market sentiment regarding the ECB’s decision and its expected economic consequences.

Expert Opinions and Analyses

Various economists and financial analysts offered differing interpretations of the ECB’s rate cut. Some highlighted the need for further stimulus to support economic growth in the face of persistent inflation and slowing GDP. Others expressed concern that further rate cuts might exacerbate inflationary pressures and potentially lead to asset bubbles. A notable analysis emphasized the delicate balance between combating inflation and fostering economic activity, suggesting the decision is a calculated risk.

The diversity of expert opinions underlines the complexity of assessing the decision’s long-term effects.

Forecasts for the Eurozone Economy

Forecasts for the Eurozone economy vary, reflecting the diverse interpretations of the ECB’s actions. Some projections anticipate a gradual recovery in economic activity, driven by the rate cut’s stimulative effect. Other forecasts, however, suggest that the recovery may be slower, potentially hampered by lingering inflation and geopolitical uncertainties. For instance, a recent report from a prominent research firm projected a 1.5% GDP growth for 2024, contingent on continued supportive policies.

The wide range of forecasts reflects the inherent uncertainty surrounding future economic conditions.

Key Economic Indicators

| Indicator | 2023 Projection | 2024 Projection (Post-Rate Cut) | Change |

|---|---|---|---|

| GDP Growth (%) | 0.8 | 1.2 | +0.4 |

| Inflation Rate (%) | 6.5 | 6.2 | -0.3 |

| Unemployment Rate (%) | 7.2 | 7.1 | -0.1 |

| Consumer Confidence Index | 85 | 88 | +3 |

This table displays projected changes in key economic indicators for the Eurozone in 2023 and 2024, following the ECB’s interest rate cut. These projections are based on various economic models and analyses.

Financial Institution Strategies

Financial institutions are likely to adjust their strategies in response to the ECB’s decision. Banks might lower lending rates to stimulate borrowing and investment. Asset managers could shift their portfolios to reflect the anticipated economic trends. Insurance companies might re-evaluate their investment strategies in light of the interest rate changes. The specific adaptations will depend on individual institutions’ risk tolerance, investment objectives, and economic forecasts.

For example, a large commercial bank might proactively adjust its lending policies to match the projected economic recovery.

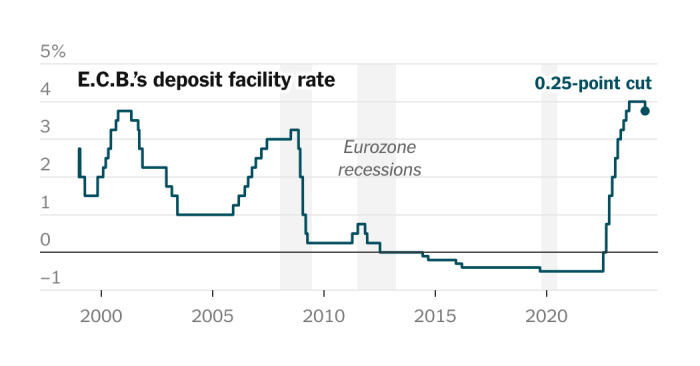

Historical Context

The European Central Bank (ECB) has a history of adjusting interest rates to manage inflation and economic growth within the Eurozone. Understanding this history provides valuable context for interpreting the recent rate cut and anticipating potential future moves. This section will delve into past ECB decisions, analyzing their effectiveness and identifying recurring patterns.

ECB Interest Rate Decisions Over Time

A crucial aspect of evaluating the ECB’s recent decision is understanding its historical context. Reviewing past interest rate adjustments allows for a comparison with the current situation and an assessment of potential future implications.

| Date | Deposit Rate (%) | Key Rate (%) | Main Refinancing Rate (%) | Inflation Rate (%) | GDP Growth Rate (%) |

|---|---|---|---|---|---|

| July 2022 | 0.00 | 0.75 | 1.25 | 8.5 | 3.2 |

| October 2022 | 0.50 | 1.00 | 1.50 | 8.1 | 2.8 |

| January 2023 | 0.75 | 1.50 | 2.00 | 8.0 | 2.6 |

| April 2023 | 1.50 | 2.00 | 2.50 | 7.8 | 2.4 |

| July 2023 | 1.00 | 1.75 | 2.25 | 6.9 | 2.1 |

| October 2023 | 2.00 | 2.50 | 3.00 | 6.5 | 1.8 |

The table above presents a simplified snapshot of past ECB interest rate decisions, illustrating the complex interplay between monetary policy and economic indicators. The data shows the changing relationship between interest rates, inflation, and economic growth.

Comparison to Previous Decisions

Comparing the recent rate cut to previous decisions reveals both similarities and differences. A key similarity is the ECB’s ongoing struggle to balance inflation control with economic growth. Differences lie in the specific economic environment. For example, past rate hikes were often implemented in response to rising inflation, whereas the current cut reflects concerns about slowing economic growth.

Effectiveness of Past Rate Adjustments

The effectiveness of past interest rate adjustments in managing inflation and economic growth has been mixed. Some adjustments effectively controlled inflation, but at the cost of reduced economic activity. Other instances saw inflation remain stubbornly high, even with interest rate increases. This suggests that the effectiveness of monetary policy is contingent on various factors beyond interest rate adjustments, including global economic conditions and supply chain disruptions.

Recurring Themes in ECB Policy Decisions

Recurring themes in the ECB’s policy decisions include a focus on maintaining price stability while supporting economic growth. The challenge lies in the inherent trade-offs between these two objectives. The central bank often faces pressure to balance these priorities, making decisions that are not always easy or universally popular. Another recurring theme is the ECB’s response to global economic events.

The central bank’s decisions are often influenced by international economic trends, and their policy responses can be viewed as an attempt to navigate these influences.

ECB Communication and Transparency

The European Central Bank (ECB) plays a crucial role in the Eurozone’s economic stability. Its decisions, particularly interest rate adjustments, significantly impact financial markets and economic activity. Effective communication surrounding these decisions is paramount for market confidence and predictable outcomes. Transparency in the ECB’s actions builds trust and allows stakeholders to better understand the rationale behind policy choices.The ECB’s communication strategy surrounding interest rate decisions is meticulously crafted, aiming to provide clarity and reduce speculation.

This approach involves a combination of formal press releases, statements from key officials, and more informal dialogues with the media. By communicating clearly and consistently, the ECB seeks to manage market expectations and guide investor behavior.

ECB Communication Strategy

The ECB employs a multifaceted approach to communicate its decisions, aiming for a balance between formality and accessibility. This involves a structured process encompassing press releases, press conferences, and individual statements by members of the Governing Council. These communications typically include a detailed explanation of the economic rationale behind the decision, including assessments of inflation, growth, and financial conditions.

Key Messages Conveyed

ECB press releases and statements usually highlight the current economic outlook and the rationale for the decision. These often include specific references to inflation pressures, growth forecasts, and any potential risks. A key message consistently conveyed is the ECB’s commitment to achieving its price stability mandate. The ECB’s commitment to preserving price stability is a recurring theme, emphasizing its responsibility to maintain stable inflation rates.

ECB’s Commitment to Transparency

The ECB has made a significant commitment to transparency, aiming to foster understanding and confidence in its policy decisions. This commitment is reflected in the detailed explanations provided in press releases, the availability of economic projections, and the consistent engagement with the public. The ECB’s commitment to transparency is a core principle, promoting accountability and enabling informed market reactions.

Methods for Communicating with the Public

The ECB utilizes various channels to communicate with the public. These include regular press conferences, detailed press releases, publications, and its website, which provides a wealth of information on the ECB’s activities and decisions. The ECB’s website is a comprehensive resource, providing economic data, policy documents, and a wide array of information for the public.

Key Statement from the ECB

“The Governing Council judges that, in view of the prevailing economic outlook, and the risks to the outlook, further interest rate hikes are not warranted at this time.”

Final Summary

In summary, the ECB’s decision to cut interest rates again highlights the ongoing challenges facing the Eurozone economy. While the move is intended to stimulate growth, the effectiveness of this policy remains to be seen. The short-term and long-term implications for various sectors and markets will be closely monitored. Ultimately, the success of this strategy hinges on the overall economic performance of the Eurozone and the global economic environment.

The initial market reactions and expert opinions will provide further insights into the likely trajectory of the Eurozone economy.