How to feel confident financial future retirement savings is crucial for a peaceful and secure retirement. This guide dives deep into the strategies, planning, and mindset needed to build a comfortable retirement. We’ll explore various retirement saving options, analyze your current financial situation, estimate future needs, and discuss smart investment strategies.

From understanding different retirement accounts (401(k), IRA, Roth IRA) and their tax implications to evaluating your income and expenses, we’ll equip you with actionable steps to achieve your retirement goals. We’ll also cover essential aspects like debt management, future living costs, and long-term investment strategies.

Planning for Retirement Savings

Retirement planning is a crucial aspect of financial well-being. It’s not just about saving; it’s about building a secure and comfortable future. Taking proactive steps now can significantly impact your quality of life during retirement. This guide will explore various retirement saving strategies, their tax implications, and the importance of early planning.

Retirement Saving Strategies

Understanding different retirement savings vehicles is essential. Choosing the right account depends on individual circumstances, risk tolerance, and financial goals. Key options include 401(k)s, IRAs (Traditional and Roth), and others. Each offers unique benefits and drawbacks.

Saving for retirement can feel overwhelming, but taking small, consistent steps toward a secure financial future is key. While global events like the recent passing of Pope Francis and the subsequent funeral, with Joe Biden and Donald Trump expressing grief and grievance here , might seem unrelated, they highlight the importance of focusing on what’s within our control.

Ultimately, a strong retirement plan is built on disciplined saving and smart investment strategies, not external events.

- 401(k): Often offered by employers, 401(k) plans allow pre-tax contributions. The employer may also match a portion of your contributions, increasing your savings potential. This employer-sponsored plan is a popular option, often providing a significant boost to retirement savings.

- Traditional IRA: A retirement account allowing pre-tax contributions. Tax advantages are realized in retirement when withdrawals are taxed as ordinary income. It is beneficial for those in lower tax brackets during their working years.

- Roth IRA: A retirement account that allows after-tax contributions. Withdrawals in retirement are tax-free. This is suitable for those expecting to be in a higher tax bracket during retirement.

Tax Implications of Different Strategies

Tax implications play a vital role in choosing the right retirement savings plan. Understanding the tax treatment of each account can help optimize your savings strategy.

Example: A 401(k) allows you to deduct contributions from your taxable income, reducing your current tax burden. In contrast, a Roth IRA allows you to withdraw contributions and earnings tax-free in retirement.

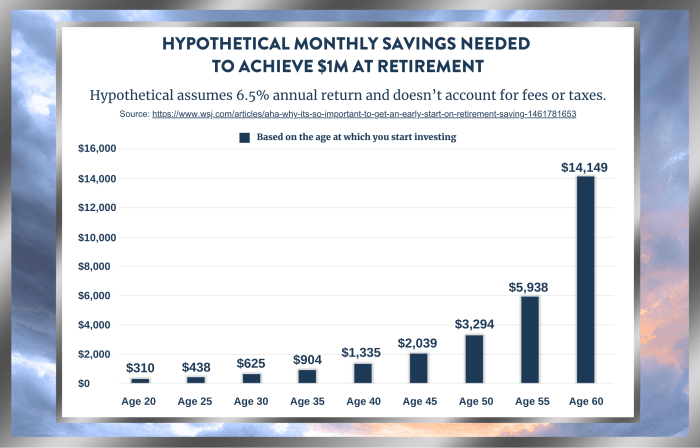

Importance of Starting Early and Compounding Interest

The power of compounding interest cannot be overstated. Starting early allows your investments to grow exponentially over time. Even small contributions made consistently over a long period can accumulate to a substantial sum.

“The earlier you start saving, the less you need to save each month to reach your retirement goals.”

Example: Imagine investing $100 per month at an average annual return of 8%. Starting at age 25, the investment would grow to a significantly larger amount than if started at age 40, demonstrating the power of compounding over time.

Step-by-Step Guide to Creating a Retirement Savings Plan

Developing a personalized retirement savings plan is essential. This guide Artikels a step-by-step approach to creating a plan.

- Assess your current financial situation: Determine your current income, expenses, and debts. This helps in setting realistic savings goals.

- Estimate your retirement needs: Consider your desired lifestyle and estimate the expenses you’ll incur in retirement. Factors like healthcare costs, travel, and hobbies are important to consider.

- Choose suitable retirement accounts: Select the accounts that best align with your financial situation and goals. Research the various options and understand the tax implications of each.

- Develop a savings plan: Set a monthly savings goal and create a budget to ensure you consistently meet this goal.

- Review and adjust your plan regularly: Life changes, and your savings plan should adapt to those changes. Regular reviews and adjustments are crucial to stay on track.

Comparison of Retirement Accounts

| Retirement Account | Pros | Cons |

|---|---|---|

| 401(k) | Potential employer match, pre-tax contributions, often convenient | Limited contributions, restrictions on access |

| Traditional IRA | Pre-tax contributions, potential tax deductions, flexibility | Taxed in retirement, may not be suitable for high-income earners |

| Roth IRA | Tax-free withdrawals in retirement, no required minimum distributions | After-tax contributions, may not be suitable for those in low tax brackets |

Sample Monthly Savings Amounts

| Income Level | Sample Monthly Savings Amount |

|---|---|

| $30,000 – $40,000 | $200 – $300 |

| $40,000 – $50,000 | $300 – $400 |

| $50,000 – $60,000 | $400 – $500 |

| $60,000+ | $500+ |

Assessing Current Financial Situation

Before diving into the exciting world of retirement planning, it’s crucial to understand your current financial standing. This assessment forms the bedrock for creating a realistic and achievable retirement strategy. Understanding your income, expenses, debt load, and potential savings streams allows you to tailor your plan to your specific circumstances.

Evaluating Income and Expenses

Accurate income and expense tracking is fundamental to retirement planning. A thorough understanding of your current financial inflows and outflows provides a clear picture of your current financial health and allows you to identify areas where adjustments are needed. Consider all sources of income, including salary, investments, and any other regular income streams. Detailed expense tracking is equally important, encompassing fixed costs like rent or mortgage payments, and variable costs like dining out or entertainment.

This comprehensive view enables you to identify areas for potential savings and inform your future financial decisions.

Strategies for Reducing Unnecessary Expenses

Identifying and eliminating unnecessary expenses is a key component of optimizing your financial health. This often involves careful scrutiny of spending habits. Reviewing your current spending patterns and categorizing expenses into essential and discretionary allows you to pinpoint areas where you can cut back without sacrificing your essential needs. Consider tracking your spending for a month to understand where your money is going.

Look for areas where you can make small changes to your spending habits that add up over time. Examples include reducing subscriptions you don’t use, choosing cheaper alternatives for groceries, or finding free or affordable entertainment options.

Potential Sources of Additional Income

Exploring avenues for increasing your income can significantly bolster your retirement savings. Even modest increases in income can lead to substantial gains in your retirement nest egg. Assess your skills and talents to see if there are any opportunities to generate additional income. This could involve freelancing, selling unused items, or investing in income-generating assets. Consider part-time work, starting a side hustle, or exploring new avenues for income generation.

Debt Management in Retirement Planning

Managing debt effectively is crucial in retirement planning. High-interest debt can significantly impact your ability to save for retirement. Prioritize paying down high-interest debts like credit card debt, personal loans, or outstanding mortgages. A proactive approach to debt management frees up more funds for retirement savings. Consider strategies such as the debt avalanche method (paying off debts with the highest interest rates first) or the debt snowball method (paying off debts in order of smallest balance first).

The optimal strategy depends on your individual financial circumstances.

Sample Budget Template

| Category | Description | Amount |

|---|---|---|

| Salary | Monthly Salary | $5,000 |

| Rent | Monthly Rent Payment | $1,500 |

| Utilities | Monthly Utilities | $300 |

| Food | Monthly Food Expenses | $500 |

| Transportation | Monthly Transportation Costs | $200 |

| Savings | Retirement Savings | $1,000 |

| Other | Miscellaneous Expenses | $1,000 |

Debt Reduction Strategies

Effective debt reduction strategies are crucial for financial stability and can significantly impact your retirement savings. These strategies focus on efficient and sustainable debt management.

- Debt Avalanche Method: This approach prioritizes paying off debts with the highest interest rates first. This strategy, while potentially saving more interest in the long run, may not always be the most motivating. For example, if you have a small, low-interest debt that is easily paid off, you may be more inclined to pay it off quickly, thus building momentum.

- Debt Snowball Method: This approach prioritizes paying off debts in order of smallest balance first. This strategy can be more motivating, especially for individuals who struggle with consistent discipline and may find it more manageable to start with smaller debts. For example, making consistent payments on a smaller debt can build confidence and momentum.

- Balance Transfer Cards: Using balance transfer cards with introductory 0% APR periods can be a temporary strategy to consolidate debts and reduce interest payments, but it is crucial to understand the associated terms and conditions, as the 0% APR period often expires.

Estimating Retirement Needs

Now that we’ve meticulously planned for retirement and assessed our current financial standing, it’s time to estimate our future needs. Accurate projections are crucial for building a retirement nest egg sufficient to cover expenses and maintain a desired lifestyle. This involves understanding the complexities of retirement costs, evaluating various income streams, and adapting our savings goals to accommodate future financial realities.

Methods for Estimating Future Living Expenses

Estimating future living expenses requires a multi-faceted approach, considering various factors that impact costs over time. One common method is to analyze current expenses, adjusting them based on projected inflation rates and anticipated lifestyle changes. For instance, if you currently spend $2,000 per month, you might project a 3% annual inflation rate, which would lead to an estimated monthly cost of $2,060 in one year.

Factors Influencing Retirement Costs

Several factors influence retirement costs, necessitating a comprehensive analysis. Healthcare expenses, often overlooked, can significantly impact retirement budgets. Inflation erodes the purchasing power of savings, requiring adjustments to maintain a comfortable lifestyle. Consider, for example, a scenario where the cost of housing increases by 2% per year. Over time, this small increase can translate into considerable additional expenditure.

Comparison of Retirement Income Sources

Retirement income comes from diverse sources, each with its own characteristics. Pensions, if available, provide a consistent income stream. Social Security benefits offer a crucial safety net, but their adequacy varies based on individual earnings history. Combining these sources with personal savings creates a more robust financial foundation for retirement.

Adjusting Retirement Savings Goals

Based on estimated living expenses, it’s essential to adjust retirement savings goals. If projected costs exceed anticipated income, increasing savings or exploring alternative income strategies is necessary. For instance, if projected expenses are $4,000 per month and anticipated income is $3,000 per month, additional savings are required to bridge the gap. This might involve increasing the rate of savings or considering part-time work after retirement.

Calculating Future Inflation Impacts on Savings

Example: If you have $100,000 in savings and inflation averages 3% annually, your purchasing power will be eroded over time. To maintain the same purchasing power, the investment must earn more than 3% per year.

Inflation’s impact on savings is substantial. To illustrate, if inflation is 3%, $100,000 today will have the purchasing power of roughly $85,500 in 10 years. This underscores the importance of considering inflation when calculating your retirement savings needs.

Estimated Living Expenses at Different Ages

| Age | Estimated Monthly Living Expenses (USD) |

|---|---|

| 65 | $3,500 |

| 70 | $3,800 |

| 75 | $4,100 |

| 80 | $4,400 |

This table provides a basic framework for estimating expenses at different life stages. Note that these are estimates and actual expenses will vary based on individual circumstances, healthcare needs, and lifestyle choices.

Investment Strategies for Retirement

Successfully navigating your retirement savings requires a well-defined investment strategy. This crucial step ensures your nest egg grows steadily and outpaces inflation, allowing you to enjoy a comfortable retirement. Understanding different investment options, their associated risks, and the importance of diversification are key elements in building a robust financial future.

Comparing Investment Options

Various investment options exist, each with unique characteristics and risk profiles. Stocks, bonds, and mutual funds are common choices. Stocks represent ownership in a company, potentially offering higher returns but also greater volatility. Bonds, on the other hand, are loans to corporations or governments, typically providing more stable returns with lower risk. Mutual funds pool money from multiple investors to invest in a diversified portfolio of assets, offering a balanced approach.

Understanding these differences is essential for creating a personalized investment strategy.

Risk Tolerance Levels

Your risk tolerance plays a significant role in choosing investment strategies. A higher risk tolerance might lead to investments with a greater potential for profit, but also a greater chance of loss. Conversely, a lower risk tolerance typically favors investments with more stable returns but potentially lower growth rates. A balanced approach is often recommended, considering both your financial goals and personal comfort level with risk.

Feeling secure about your retirement savings is key to a confident financial future. Building a strong retirement nest egg takes time and strategy, but it’s definitely achievable. Understanding the complexities of police power and public safety, as explored in this insightful essay, police power public safety essay , can help you appreciate the importance of a stable society in which to grow your savings.

Ultimately, a financially secure retirement is directly linked to a safe and prosperous community. So, start planning your savings strategy today for a confident future!

Diversification in Investment Portfolios

Diversification is a crucial aspect of managing investment risk. It involves spreading your investments across different asset classes, industries, and geographic regions. By not concentrating all your funds in a single investment, you mitigate the impact of potential losses in any one area. This strategy reduces overall portfolio volatility and enhances the probability of achieving your long-term financial objectives.

Long-Term Investment Strategies

Long-term investment strategies are essential for achieving significant returns over time. The power of compounding allows your investments to grow exponentially over extended periods. Consistency and patience are key elements in these strategies. Resisting the temptation to react to short-term market fluctuations is crucial for long-term success.

Investment Options and Risk Levels

| Investment Option | Risk Level | Potential Return | Example |

|---|---|---|---|

| Stocks | High | High | Investing in a technology company’s stock. |

| Bonds | Low | Moderate | Purchasing government bonds. |

| Mutual Funds | Moderate | Moderate | Investing in a diversified mutual fund portfolio. |

Tips for Managing Investment Risk

Effective risk management is vital for achieving your retirement goals. A well-defined strategy can help mitigate potential losses and maintain a positive trajectory for your investments.

- Establish clear financial goals and time horizons for your investments. This will help you tailor your strategy to your specific needs.

- Regularly review and adjust your investment portfolio to reflect changing market conditions and personal circumstances. This allows you to adapt to evolving needs and maintain a balanced approach.

- Seek professional financial advice to gain insights into investment strategies that align with your risk tolerance and goals.

- Diversify your investments across different asset classes and geographic regions to mitigate potential risks and maximize returns.

- Avoid making impulsive investment decisions based on short-term market fluctuations. Long-term strategies are crucial for success.

Building Confidence in Retirement Planning

Retirement planning can be a daunting task, filled with uncertainties and anxieties. Many people struggle with the sheer magnitude of saving enough for a comfortable retirement, leading to feelings of stress and overwhelm. However, with a structured approach, realistic expectations, and the right support system, these anxieties can be effectively managed, paving the way for a confident and secure retirement.Financial anxieties about retirement are common and often stem from a lack of understanding, a feeling of being overwhelmed by the complexities of the process, or simply a fear of the unknown.

This feeling can be further amplified by economic downturns or personal life events. However, proactive planning, seeking expert advice, and developing a clear strategy can significantly reduce these anxieties.

Overcoming Financial Anxieties

Financial anxieties about retirement can be overcome through a combination of realistic goal setting, informed decision-making, and a positive mindset. Understanding the factors contributing to these anxieties is the first step towards addressing them. For example, if the anxiety stems from a fear of outliving savings, a more thorough retirement income projection can alleviate these concerns.

Seeking Professional Financial Advice

Seeking professional financial advice is crucial in navigating the complexities of retirement planning. A qualified financial advisor can provide personalized guidance, tailored to your specific circumstances, risk tolerance, and financial goals. They can help you develop a comprehensive retirement plan, manage investment strategies, and create a robust savings plan. An advisor can also help you understand your current financial situation, assess potential risks, and make informed decisions about your investments.

Feeling confident about your retirement savings is key to a peaceful future. Diversifying your investments and consistently contributing to a retirement account are great strategies. Recent events like the Russia-Ukraine prisoner swap, while concerning, shouldn’t overshadow your financial planning. Remember to focus on your long-term goals and stay disciplined with your savings plan. A strong retirement fund will help you weather any economic storm, regardless of global headlines.

For more details on the recent Russia-Ukraine prisoner swap, check out this article: russia ukraine prisoner swap. Ultimately, staying the course with your retirement plan is the best way to ensure a secure financial future.

Staying Motivated and Focused on Long-Term Goals

Maintaining motivation throughout the retirement savings process requires a multifaceted approach. Setting realistic and achievable short-term goals can provide a sense of accomplishment and reinforce the importance of long-term planning. Regularly reviewing your progress and celebrating milestones can keep you motivated and focused on your ultimate retirement objectives. Visualizing your desired retirement lifestyle and the benefits of a secure financial future can further enhance your motivation.

Benefits of Regularly Reviewing and Adjusting Retirement Plans

Regularly reviewing and adjusting your retirement plan is essential for maintaining a course correction. Market fluctuations, changes in your personal circumstances (such as a career change or family growth), and shifts in investment strategies all necessitate adjustments to your retirement plan. This regular review allows you to stay on track, adapt to unforeseen events, and optimize your investment choices for maximum return.

Maintaining a Positive Mindset, How to feel confident financial future retirement savings

Maintaining a positive mindset throughout the retirement savings process is crucial for long-term success. A positive mindset allows you to stay focused on your goals, persevere through challenges, and avoid succumbing to feelings of anxiety or overwhelm.

- Focus on the positive aspects of retirement planning, such as the freedom and flexibility it offers.

- Celebrate milestones in your savings journey, acknowledging your progress and reinforcing your commitment.

- Seek support from friends, family, or financial advisors.

- Practice gratitude for what you have and the progress you’ve made.

- Develop a healthy savings routine that aligns with your lifestyle and financial capacity.

- Embrace learning about retirement planning and investment strategies.

- Avoid comparing your progress to others.

Success Story

A successful example is Sarah, who started saving for retirement at age 25. She diligently contributed a portion of her income each month, and over time, her savings grew. Regular reviews of her retirement plan allowed her to adjust her investment strategy as her risk tolerance changed. By staying motivated and focused on her long-term goals, Sarah successfully built a substantial retirement nest egg, ensuring a secure and comfortable retirement.

Staying on Track and Adapting to Changes

Retirement planning isn’t a one-time event; it’s a journey that requires ongoing adjustments. Life throws curveballs, and unexpected expenses or economic shifts can significantly impact your savings goals. Staying motivated and disciplined, while adapting to these changes, is crucial for achieving a secure financial future. This section delves into practical strategies for navigating these inevitable challenges.Financial hardship, whether temporary or prolonged, can test your resolve.

Maintaining discipline during these periods is vital. Remembering your long-term goals and the value of compounding returns can be powerful motivators. Tracking your progress and celebrating milestones, no matter how small, can help maintain momentum. Consider creating a detailed budget to pinpoint areas where you can cut back temporarily without sacrificing essential needs. This allows you to re-allocate funds to retirement savings when possible.

Maintaining Motivation During Financial Hardship

Sustaining motivation during financial setbacks often requires a proactive approach. Focus on the long-term benefits of your retirement savings plan. Visualizing your desired retirement lifestyle and the freedom it provides can be incredibly motivating. Regular review of your progress, even if it’s just a quick glance at your savings accounts, can reinforce your commitment. Small victories, such as meeting a savings target for a month, can boost morale and encourage continued dedication.

If possible, consider seeking support from a financial advisor or a trusted friend or family member who can provide encouragement and guidance.

Adjusting Plans Based on Unexpected Events

Life’s unpredictable nature necessitates flexibility in your retirement plans. Unexpected events, such as significant medical expenses, job loss, or family emergencies, can disrupt your savings trajectory. A crucial aspect of robust retirement planning involves having an emergency fund to handle these situations. Having a dedicated emergency fund, separate from retirement savings, can protect your retirement plan from unexpected financial shocks.

Review and adjust your retirement contributions based on the severity and duration of the financial strain. Consider temporarily reducing contributions if necessary, but ensure you resume them as soon as possible.

Adapting to Economic Changes

Economic shifts are inherent in any long-term plan. Understanding how these changes might impact your retirement savings is essential for making informed adjustments. Inflation, for example, erodes the purchasing power of your savings over time. A crucial step is to ensure your retirement income keeps pace with inflation. Consider diversifying your investment portfolio to mitigate potential risks associated with economic fluctuations.

Managing Unexpected Expenses While Saving

Unexpected expenses are unavoidable. A key strategy is to maintain an emergency fund. This fund serves as a buffer against unforeseen costs. When an unexpected expense arises, consider using this fund to cover it, without jeopardizing your retirement savings. Explore options for negotiating costs or finding alternative solutions to reduce the financial burden.

This may involve negotiating bills or finding ways to cut expenses in other areas.

Potential Economic Shifts and Retirement Plan Adjustments

| Potential Economic Shift | Corresponding Adjustments to Retirement Plans |

|---|---|

| Inflationary periods | Increase investment allocations to assets with higher returns, like stocks, to keep pace with inflation. Re-evaluate retirement income projections to ensure they maintain purchasing power. |

| Recessions | Maintain a disciplined approach to saving and investing. Diversify investments to mitigate potential losses. Consider temporarily adjusting contributions if necessary, but prioritize resuming them as soon as possible. |

| Interest rate changes | Re-evaluate investment strategies and allocate funds to assets that align with the new interest rate environment. Monitor your portfolio regularly to assess performance. |

| Technological advancements | Stay informed about new investment opportunities and adjust your portfolio accordingly. |

Ending Remarks: How To Feel Confident Financial Future Retirement Savings

Successfully navigating retirement planning requires careful consideration, diligent effort, and a positive mindset. By following the strategies Artikeld in this guide, you can build a strong foundation for a confident financial future. Remember to regularly review and adjust your plan, seek professional advice when needed, and stay motivated throughout the process. A well-structured retirement plan is the cornerstone of a worry-free future.