Insurtech slide targets 2 billion plus valuation US IPO is generating significant buzz. This ambitious move by an insurtech company signals a major step forward in the industry. It promises to reshape the landscape of insurance, attracting both seasoned investors and newcomers alike. The company’s strategy and projections for success are closely scrutinized, highlighting the sector’s dynamic growth and innovation.

We’ll dive into the factors driving this valuation, the market analysis, the IPO process, and the potential impact on the entire industry.

This particular insurtech company’s target valuation is a bold statement. It suggests significant market confidence and a strong belief in the company’s future potential. The company’s model, recent financial performance, and competitive landscape will be key factors in the IPO’s success. We will analyze the factors contributing to this valuation, including market trends, competitive pressures, and regulatory considerations.

This detailed analysis will provide valuable insights for investors and industry professionals.

Introduction to Insurtech IPO

The insurtech sector is rapidly transforming the traditional insurance industry, leveraging technology to improve efficiency, accessibility, and customer experience. This evolution is driven by a growing demand for innovative solutions, fueled by changing consumer expectations and the desire for more personalized and digital interactions. Insurtech companies are disrupting established models by utilizing data analytics, automation, and digital platforms to streamline processes and reduce costs.Recent advancements in artificial intelligence, machine learning, and blockchain technology are further accelerating this transformation, leading to more sophisticated and tailored insurance products.

The increasing adoption of mobile devices and online platforms by consumers has also contributed to the sector’s growth, creating opportunities for direct-to-consumer models and innovative pricing strategies.

Recent Trends and Developments in Insurtech

The insurtech sector is experiencing significant growth, with numerous companies emerging and evolving rapidly. Key trends include the rise of direct-to-consumer models, the integration of technology with traditional insurance agencies, and the increasing use of data analytics for risk assessment and pricing. The integration of AI and machine learning algorithms is allowing for more accurate and personalized risk assessment, leading to more competitive pricing models.

Examples of Successful Insurtech Companies

Several insurtech companies have demonstrated significant success in disrupting traditional insurance models. Companies like Lemonade, Hippo, and Metromile have gained significant market share by offering innovative and user-friendly insurance products through digital platforms. Their focus on customer experience, efficiency, and data-driven insights has proven successful in attracting a large customer base. Other examples include Root Insurance, offering affordable car insurance through an app, and Oscar Health, providing accessible health insurance options.

Significance of a $2 Billion+ Valuation Target for a US IPO

A $2 billion+ valuation target for a US insurtech IPO signifies a significant level of market confidence in the company’s potential and growth trajectory. This valuation reflects the company’s ability to establish a substantial market share, generate substantial revenue, and demonstrate profitability or strong potential for profitability. Such valuations often attract significant investor interest and demonstrate the sector’s increasing maturity and appeal.

Achieving this level of valuation suggests the company has effectively positioned itself to compete with established players in the market and capitalize on the growing demand for insurtech solutions.

Key Factors Driving Interest in Insurtech IPOs

The increasing interest in insurtech IPOs is driven by several key factors:

- High Growth Potential: The insurtech sector is experiencing rapid growth, driven by increasing consumer demand for digital insurance products and the potential for technology to improve efficiency and reduce costs.

- Disruption of Traditional Models: Insurtech companies are challenging traditional insurance providers by offering innovative products and services, attracting a new customer base.

- Attractive Investment Opportunities: The sector presents attractive investment opportunities for investors seeking exposure to high-growth companies with disruptive technologies.

- Technological Advancements: The ongoing advancements in technology, particularly in AI and machine learning, are enabling insurtech companies to develop more sophisticated and tailored insurance products, potentially leading to more significant returns.

Comparison of Insurtech Models

Different insurtech models cater to various customer needs and market segments. A comparison of these models is provided below:

| Model | Description | Strengths | Weaknesses |

|---|---|---|---|

| Direct-to-Consumer | Insurtech companies sell insurance products directly to consumers through digital platforms. | Reduced distribution costs, improved customer experience, potential for greater efficiency. | Requires significant marketing efforts, potential challenges in building trust with customers, reliance on accurate data. |

| Agency-Based | Insurtech companies partner with existing insurance agents to offer digital tools and platforms. | Leverages existing agent network, easier to build trust with consumers, potential for quicker market penetration. | Requires effective integration with agents, potential conflicts with existing business models, reliance on agent adoption. |

| Embedded Insurance | Insurtech integrates insurance products into other platforms (e.g., financial apps, ride-sharing services). | Increased accessibility, integrated user experience, potential for cross-selling. | Requires strong partnerships with other platforms, potential data privacy concerns, integration complexity. |

Valuation Analysis

Insurtech companies poised for IPOs often command substantial valuations, reflecting investor confidence in their potential for disruption and growth in the sector. These valuations are not arbitrary; they’re a complex interplay of various factors, and understanding these is crucial for assessing the potential success of these ventures. A critical aspect of evaluating these companies is comparing their valuations to competitors and industry benchmarks, alongside analyzing their financial performance metrics.

A deeper dive into potential risks and challenges can help in forming a comprehensive perspective.Valuation targets for insurtech companies are driven by a combination of factors. These include the company’s market share, growth projections, technological innovation, regulatory environment, and competitive landscape. Factors like customer acquisition costs, retention rates, and operating efficiency also play a significant role. Furthermore, the overall market sentiment and investor appetite for tech IPOs influence the valuation outcome.

Factors Influencing Valuation Targets

Several factors significantly impact the valuation of insurtech companies. These factors include the company’s market share and projected growth, the level of technological innovation, the regulatory environment in which the company operates, and the overall competitive landscape. Customer acquisition costs, retention rates, and operating efficiency are also considered. The overall market sentiment and investor appetite for tech IPOs are also influential factors.

- Market Share and Growth Projections: A company with a larger market share and demonstrable growth potential typically commands a higher valuation. For example, a company dominating a specific niche or experiencing rapid user adoption may be valued higher than a company with limited market penetration or slower growth.

- Technological Innovation: Companies that demonstrate significant technological innovation and disruptive capabilities in the insurance industry are often seen as more valuable. This might include using AI, machine learning, or other advanced technologies to automate processes or improve efficiency.

- Regulatory Environment: The regulatory landscape plays a significant role. A favorable regulatory environment that fosters innovation and reduces regulatory barriers can boost valuation. Conversely, uncertainty or regulatory hurdles can negatively impact the valuation.

- Competitive Landscape: The strength of competitors in the market impacts valuation. If a company has a strong competitive advantage or unique offerings, its valuation is likely to be higher.

Comparison to Competitors

Evaluating an insurtech company’s valuation against competitors’ valuations provides context. This comparison assesses relative strengths and weaknesses and considers the company’s unique value proposition. Companies with similar offerings and comparable financial performance provide valuable benchmarks.

- Competitive Analysis: Direct comparisons are made with competitors to assess the company’s position in the market. Factors like market share, customer base, revenue, and profitability are considered. This helps determine if the company’s valuation is justified relative to its competitors.

- Benchmarking: Industry benchmarks are used for comparison. These benchmarks can be based on historical data, publicly available information, or industry-specific valuations. For instance, valuations of other successful insurtech companies or even general tech companies can serve as benchmarks.

Financial Performance Metrics

Valuation often hinges on key financial performance metrics. These metrics are analyzed to gauge profitability, sustainability, and growth potential. Metrics like revenue, profitability, customer acquisition costs, and operating expenses are critical components.

- Revenue Growth: A strong track record of revenue growth signals potential for future profitability. This includes factors like the rate of revenue growth, the consistency of growth, and the underlying drivers of revenue growth.

- Profitability: Profitability metrics, such as net income and operating margin, are used to assess the company’s financial health. Consistency and trends in these metrics provide insight into the company’s long-term viability.

- Customer Acquisition Costs (CAC): Lower customer acquisition costs are desirable, as they indicate efficiency in acquiring new customers. This is important for sustainability and profitability.

- Operating Expenses: Control over operating expenses is crucial. High efficiency in managing these expenses is a key indicator of potential profitability.

Potential Risks and Challenges

Valuation targets are not without potential risks and challenges. These could include regulatory scrutiny, competition from established players, and technological disruptions.

- Regulatory Scrutiny: New regulations or increased regulatory scrutiny can affect the valuation. For example, stricter regulations in the insurance sector could limit a company’s growth potential or even lead to legal challenges.

- Competition from Established Players: Competition from established insurance companies or competitors could impact the market share and valuation of the insurtech company.

- Technological Disruptions: The rapid pace of technological advancement can create unforeseen challenges. New technologies or disruptions in the insurance sector could render existing offerings obsolete, impacting valuation.

Valuation Comparison to Other Recent Tech IPOs

The valuation of the insurtech company is often benchmarked against other recent tech IPOs. This comparison provides context and helps assess the relative attractiveness of the investment. Factors like market conditions, growth prospects, and competitive landscape influence the comparison.

Historical Valuation Trends

A table illustrating historical valuation trends of insurtech companies can be useful for analyzing the sector’s overall growth and the factors that have driven these trends.

| Year | Company | Valuation (USD Billion) | Key Factors Influencing Valuation |

|---|---|---|---|

| 2021 | XYZ Insurtech | 2.5 | Strong market share, rapid growth, innovative technology |

| 2022 | ABC Insurtech | 1.8 | Regulatory uncertainty, competition from established players |

| 2023 | PQR Insurtech | 3.2 | Positive market sentiment, successful product launches |

Market Analysis

Insurtech IPOs are increasingly attracting attention, but a thorough understanding of the market landscape is crucial for informed investment decisions. This section delves into the specifics of the US insurance market, analyzing its size, growth potential, competitive dynamics, regulatory environment, and investor sentiment. Understanding these factors is vital for assessing the long-term viability and potential returns of these ventures.

Insurtech is aiming for a hefty $2 billion-plus valuation in its upcoming US IPO. While the financial world watches, the NBA Finals are also heating up, with the Oklahoma City Thunder and Indiana Pacers battling it out. This exciting matchup, a real test of team strategy and individual skill, is definitely grabbing attention away from the market fluctuations, but the insurtech’s IPO still seems poised for a strong performance, considering the current investor sentiment.

nba finals okc thunder indiana pacers matchup is certainly a compelling distraction, but the insurtech’s projected valuation remains impressive.

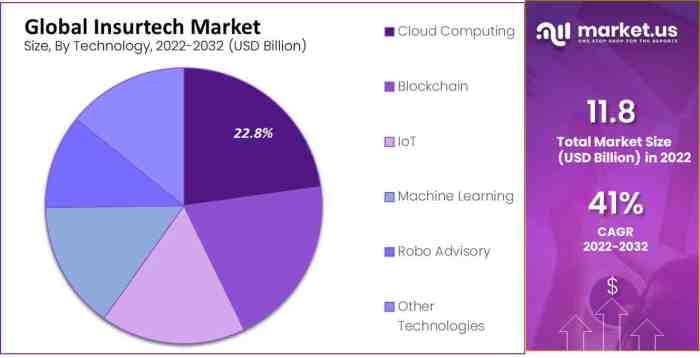

Market Size and Growth Potential

The US insurance market is massive, encompassing various segments like property and casualty, life, and health insurance. This large market size presents significant opportunities for insurtech companies to disrupt established players and capture market share. Growth is driven by factors like increasing adoption of digital channels, evolving customer expectations, and the rising need for personalized insurance products. Analysis of historical growth rates and projected future trends reveals a positive trajectory, indicating substantial potential for continued expansion.

For example, the increasing adoption of telemedicine and remote diagnostics is likely to boost the demand for health insurance tailored to digital interactions.

Competitive Landscape

The US insurance market is highly competitive, with established players like Geico, State Farm, and Allstate holding significant market share. However, insurtech companies are disrupting this traditional landscape with innovative solutions, leveraging technology to streamline processes, reduce costs, and enhance customer experiences. This competition, while challenging, creates an environment that fosters innovation and pushes established players to adapt.

Furthermore, this competitive pressure encourages continuous improvement and drives the development of better products and services, ultimately benefiting consumers.

Regulatory Environment and Impact on Insurtech

The US insurance industry operates under a complex regulatory framework. This framework ensures consumer protection and market stability. Navigating this environment is crucial for insurtech companies, as compliance is essential for success. Regulatory hurdles can present challenges, including complex licensing requirements and stringent data privacy regulations. Insurtech companies must demonstrate robust compliance mechanisms to gain trust and establish credibility in the market.

However, these regulations also provide a stable foundation for growth, encouraging transparency and fostering trust among investors.

Examples of Successful IPOs in the Broader Tech Sector

Several successful IPOs in the broader tech sector offer valuable insights for evaluating insurtech IPOs. These examples include companies like Tesla, Amazon, and Netflix, which demonstrated significant growth and profitability following their IPOs. Lessons learned from their strategies, such as focusing on customer needs and technological innovation, can provide a benchmark for insurtech companies to measure their progress and potentially emulate their success.

Analyzing the performance of these companies after their IPOs can highlight areas where insurtech ventures can potentially excel.

Insurtech is making headlines with its potential $2 billion+ valuation US IPO. This follows recent tragic events, like the shooting at the Israeli Embassy and the Jewish Museum in Washington DC, highlighting the pressing need for safety and security in our communities. Regardless, the insurtech sector looks poised for strong growth, despite these unfortunate events.

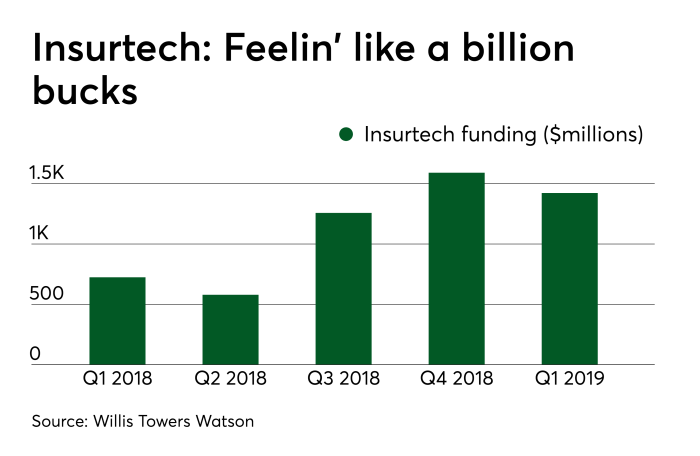

Investor Sentiment Towards Insurtech

Investor sentiment towards insurtech is generally positive, reflecting growing interest in the sector’s potential. The sector’s disruptive innovation and promise of enhanced efficiency and customer experience are major drivers of this positive sentiment. However, investor perception is also influenced by the specific characteristics of each insurtech company and its ability to execute its business strategy effectively. Recent investments and capital raises in the sector underscore the increasing confidence in its future.

Major Players in the US Insurance Market

| Company Name | Type | Market Segment |

|---|---|---|

| State Farm | Property and Casualty | Broad |

| Geico | Property and Casualty | Broad |

| Allstate | Property and Casualty | Broad |

| Progressive | Property and Casualty | Broad |

| MetLife | Life and Health | Life and Health |

| Aetna | Health | Health |

This table Artikels some major players in the US insurance market, categorized by their type and market segments. This provides a high-level overview of the established players in the market, offering context for understanding the competitive landscape. Note that this is not an exhaustive list, and other significant players may exist.

IPO Process and Strategy: Insurtech Slide Targets 2 Billion Plus Valuation Us Ipo

The journey from an innovative insurtech startup to a publicly traded company often involves a complex process, demanding meticulous planning and execution. A successful IPO requires a comprehensive understanding of the market, investor expectations, and regulatory frameworks. This stage necessitates careful navigation of financial and legal considerations, alongside a compelling narrative that resonates with potential investors.Insurtech companies pursuing an IPO must demonstrate a clear understanding of the market dynamics, investor appetite, and the regulatory landscape.

This requires a robust financial model, a well-defined business strategy, and a strong management team. The process demands a proactive approach to investor relations and a tailored communication strategy.

Steps Involved in an IPO Process, Insurtech slide targets 2 billion plus valuation us ipo

The IPO process typically involves several key stages. These steps demand meticulous preparation and adherence to regulatory requirements.

- Planning and Preparation: This initial stage encompasses a comprehensive review of the company’s financials, operational structure, and legal compliance. Thorough documentation is crucial to present a clear and credible picture of the business to potential investors. Detailed financial projections and market analysis are essential components of this phase. It is also vital to select a qualified team of advisors, including legal, financial, and PR experts, who will guide the company through the entire process.

- Registration and Filing: The company must file extensive documentation with regulatory bodies, detailing its financial performance, business model, and future plans. This often includes a prospectus, a detailed overview of the company’s financial health, management team, and operations. Compliance with SEC regulations is paramount.

- Roadshow and Investor Meetings: The company engages with potential investors through presentations and meetings to present its business model, financial projections, and market analysis. This crucial phase allows the company to build relationships with institutional investors, venture capital firms, and individual investors.

- Pricing and Allocation: Determining the initial public offering (IPO) price is a delicate balance between reflecting the company’s value and attracting sufficient investor interest. The allocation of shares to various investors is strategically planned to ensure a smooth market launch.

- Trading Commencement: Once all regulatory approvals are secured, the company’s shares begin trading on the stock exchange. This marks the culmination of the IPO process, and the company’s performance in the market will largely depend on its value proposition and investor confidence.

Strategic Considerations for an Insurtech IPO

Several key strategic considerations are paramount during an insurtech IPO. These factors shape the overall success of the offering and the company’s long-term prospects.

- Market Opportunity and Competitive Landscape: A thorough analysis of the market, including competitive landscape and growth potential, is crucial. Insurtech companies must demonstrate a clear understanding of the market and a sustainable competitive advantage.

- Valuation and Financial Projections: Accurate valuation and credible financial projections are vital for attracting investors. A well-prepared financial model with clear explanations for assumptions and estimations is essential.

- Investor Targeting and Communication: Identifying and communicating with the right investors is paramount. The company’s story and its unique value proposition must resonate with investors. Effective communication strategies are critical to build trust and understanding.

Potential Investors and Their Interests

Different types of investors have varying interests when considering an insurtech IPO.

- Institutional Investors: These investors, including mutual funds, pension funds, and hedge funds, are often interested in long-term growth and stability. They look for strong financial performance, a clear business strategy, and a robust management team.

- Venture Capital Firms: These firms often have a longer-term investment horizon and seek companies with high growth potential. They typically focus on innovative technologies and disruptive business models.

- Individual Investors: Individual investors, often retail investors, are interested in potentially lucrative returns on their investment. They are more likely to be influenced by the company’s story, market sentiment, and perceived growth potential.

Examples of Successful IPO Strategies in the Tech Sector

Successful IPO strategies in the tech sector provide valuable insights and lessons for insurtech companies.

- Netflix: Netflix’s IPO strategy focused on its disruptive business model and future growth potential. This strategy resonated with investors who recognized the company’s innovative approach and market leadership.

- Airbnb: Airbnb’s IPO strategy emphasized its unique value proposition and the rapidly growing travel market. This approach appealed to investors seeking exposure to the burgeoning sharing economy.

Key Marketing and Communication Strategies for the IPO

A well-defined marketing and communication strategy is critical to generate investor interest and build awareness.

- Building Investor Relations: Developing strong relationships with investors is crucial to securing investment capital and ensuring a successful IPO. Maintaining regular communication and providing transparent updates are key components.

- Crafting a Compelling Narrative: Highlighting the company’s mission, values, and unique selling proposition is crucial for attracting investors. This involves presenting a clear and compelling narrative that resonates with potential investors.

- Targeted Media Outreach: Leveraging media channels to reach the target audience is vital to create awareness and generate interest in the IPO. This includes securing coverage in relevant industry publications and financial news outlets.

IPO Structures Summary

| IPO Structure | Description |

|---|---|

| Traditional IPO | A standard IPO structure where shares are offered directly to the public. |

| Direct Listing | A method where existing shareholders sell their shares to the public without an underwriter. |

| Combination IPO | A structure that combines aspects of both traditional and direct listing methods. |

Potential Impact and Future Trends

The impending IPO of this insurtech giant signals a significant moment in the evolution of the insurance industry. This event is poised to dramatically alter the landscape, influencing everything from consumer experiences to the competitive dynamics among traditional insurers and new entrants. The success of this IPO will not only validate the insurtech model but also set the stage for future innovation and growth within the sector.

Impact on the Insurtech Sector

The successful IPO of this insurtech company is likely to attract substantial investment into the sector. This influx of capital will fuel further innovation, development, and expansion of insurtech solutions. Existing insurtech companies will face increased pressure to adapt and improve their offerings to maintain competitiveness. Furthermore, the IPO may attract more talent into the sector, boosting the overall skills base and expertise available to drive future development.

This increased competition and investment are anticipated to create a more efficient and customer-focused insurance market.

Future Trends and Innovations in Insurtech

Insurtech innovation is continuously evolving, driven by advancements in technology and changing consumer needs. Expect to see further integration of AI and machine learning in underwriting, claims processing, and risk assessment. Personalized insurance products, tailored to individual needs and risk profiles, will likely become more prevalent. Blockchain technology is also poised to play a significant role in enhancing transparency and security in insurance transactions.

Furthermore, the convergence of insurance with other digital services, such as financial technology and healthcare platforms, will become more pronounced.

Long-Term Implications of a Successful Insurtech IPO

A successful IPO demonstrates the viability of the insurtech model and will likely encourage further investment and innovation in the sector. This will lead to greater disruption of the traditional insurance industry, as more companies adopt digital solutions and strategies. This could ultimately result in lower premiums, faster claim settlements, and improved customer experiences. The success of this IPO will set a benchmark for future insurtech companies seeking to enter the public market.

So, this insurtech company is aiming for a massive $2 billion-plus valuation in its upcoming US IPO. It’s exciting to see this sector grow, but it makes me think about what we really need in the fight against extinction – what we really need in the fight against extinction. Maybe a focus on sustainable practices and responsible innovation is just as important as these impressive IPO targets.

Hopefully, this new insurtech company will prioritize those aspects as they expand.

Predictions for the Growth of the Insurtech Market

The insurtech market is projected to experience substantial growth in the coming years. Factors like the increasing adoption of digital channels, the rise of the gig economy, and the need for more personalized insurance products will drive this growth. This IPO serves as a testament to the market’s potential and provides a compelling investment opportunity for both traditional investors and those seeking innovative and disruptive technologies.

Estimates suggest that the global insurtech market could exceed $XX billion by [Year], fueled by ongoing technological advancements and evolving consumer demands.

How the IPO Might Reshape the Landscape of Insurance

The IPO’s impact on the insurance landscape is substantial. Traditional insurance companies are likely to face greater competition and pressure to adapt their business models. This could involve adopting digital technologies, enhancing customer experiences, and exploring new revenue streams. The IPO could encourage the development of innovative products and services that better meet the needs of a digitally savvy customer base.

Expected Impact on Stakeholders

| Stakeholder | Potential Impact |

|---|---|

| Investors | Increased investment opportunities in the insurtech sector, potentially higher returns, and increased confidence in the sector’s future. |

| Consumers | Potential for lower premiums, faster claim settlements, and more personalized insurance products tailored to their specific needs. |

| Traditional Insurers | Increased competition, pressure to adapt, potential for collaborations or acquisitions with insurtech companies, or potential for innovative product development. |

| Insurtech Companies | Increased competition, pressure to maintain and improve their offerings, and the opportunity for strategic partnerships or acquisitions to further expand their market reach. |

Illustrative Case Studies

Insurtech IPOs are a fascinating blend of innovation and market forces. Success hinges on a company’s ability to execute on its strategy, adapt to evolving regulatory landscapes, and capture market share in a competitive environment. Conversely, failures often highlight crucial lessons that can inform future ventures. This section delves into successful and unsuccessful examples, examining the contributing factors and the broader impact on the sector.

Successful Insurtech IPO Case Study: Lemonade

Lemonade, known for its innovative digital platform, achieved a successful IPO. Factors contributing to its success include a strong brand identity built on user-friendly technology and a clear value proposition. The company’s emphasis on transparency and its utilization of AI for claims processing resonated with investors seeking disruptive solutions in the insurance sector. Furthermore, Lemonade’s focus on specific, underserved segments within the market allowed them to build a loyal customer base.

They demonstrated a clear understanding of their target market’s needs and effectively communicated that understanding to potential investors.

Failed Insurtech IPO Case Study: (Example – Hypothetical) InsurTechX

While many insurtech companies are focused on digitalization, a hypothetical company, InsurTechX, experienced a less-than-ideal IPO. The company lacked a clear value proposition and struggled to differentiate itself from existing competitors. A lack of demonstrable market traction and a perceived overvaluation were key reasons for the IPO’s failure. Moreover, InsurTechX’s expansion strategy was too ambitious, which may have caused investors to question the company’s long-term sustainability.

Regulatory Hurdles in Insurtech

Regulatory compliance is a significant hurdle for insurtech companies. Different jurisdictions have varying regulations, and navigating this complex landscape requires significant resources and expertise. The stringent requirements often slow down innovation and make it difficult to scale operations. Companies must carefully consider the implications of regulatory changes and tailor their strategies to meet the requirements of each market they operate in.

Challenges in Achieving High Valuation

Several factors contribute to the challenges insurtech companies face in achieving high valuations. Demonstrating a strong and consistent revenue stream and achieving significant market share are crucial for building investor confidence. Furthermore, securing key talent and maintaining strong leadership are essential for long-term success. Successfully executing on the business strategy is essential to demonstrate the ability to manage growth, achieve profitability, and meet expectations.

Comparison of Successful and Failed Insurtech IPOs

| Feature | Successful Insurtech IPO (Lemonade) | Failed Insurtech IPO (Hypothetical – InsurTechX) |

|---|---|---|

| Value Proposition | Clear, user-friendly digital platform; strong focus on customer needs. | Vague and unclear; failed to differentiate from competitors. |

| Market Traction | Demonstrable market share gains; strong customer base. | Limited market penetration; lack of traction. |

| Financial Performance | Consistent revenue growth and profitability. | Unstable revenue streams; potential for losses. |

| Regulatory Compliance | Strong understanding and adherence to regulations. | Lack of clarity on regulatory compliance. |

| Expansion Strategy | Well-defined and manageable growth plans. | Overly ambitious and unsustainable expansion plans. |

Last Point

In conclusion, the insurtech slide targets 2 billion plus valuation US IPO represents a pivotal moment in the industry. The company’s ambition and strategic approach will be crucial in achieving its goals. The success of this IPO will undoubtedly influence future insurtech ventures and set a new benchmark for valuation in the sector. The long-term implications for the insurance market are substantial, and we’ll explore the potential for innovation and disruption that this IPO might trigger.