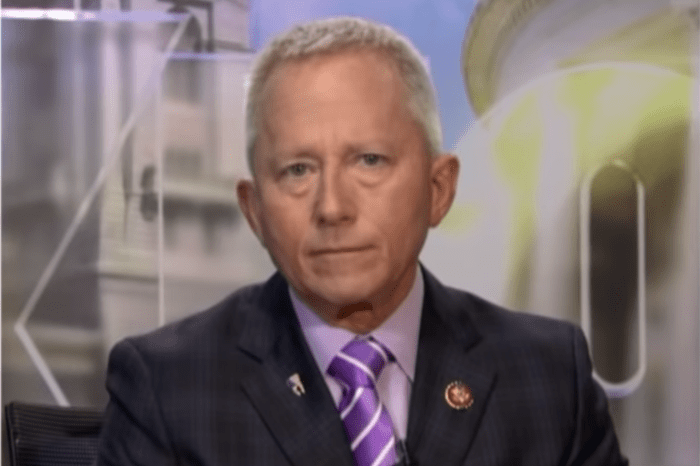

Jeff van Drew trump republican budget bill medicaid cuts concerns sparks a critical debate about the future of healthcare and the economy. The proposed Republican budget bill faces scrutiny over its potential impact on Medicaid, raising concerns about vulnerable populations and healthcare access. Van Drew’s stance adds another layer of complexity, reflecting the political tension surrounding the issue.

This exploration dives deep into the details, examining the potential consequences and contrasting viewpoints.

The proposed budget bill, a complex document, details specific provisions affecting various sectors. From potential economic impacts to the political context surrounding its introduction, we’ll break down the key elements driving this controversy. We’ll also examine historical context, comparing this bill to past attempts, and analyze the potential long-term effects on the healthcare system.

Overview of the Budget Bill

The recently introduced Republican budget bill, a crucial piece of legislation, seeks to reshape the nation’s fiscal landscape. Its proposed cuts to programs like Medicaid have sparked significant debate and concern. This analysis delves into the bill’s key provisions, potential economic impacts, and the political context surrounding its introduction.This bill, while ostensibly focused on fiscal responsibility, raises complex questions about the long-term implications for various sectors of the economy.

The bill’s proposed changes are likely to generate considerable discussion and opposition from stakeholders concerned about its impact on social programs and economic stability.

Summary of the Proposed Republican Budget Bill

The Republican budget bill aims to reduce the national debt by implementing significant spending cuts across various government programs. A central focus is on restructuring entitlement programs, including Medicare and Medicaid. The bill’s specifics are still being debated and refined, but the overall objective is to create a more balanced budget.

Key Provisions of the Bill

The proposed bill includes several key provisions, designed to achieve its stated goals. These include:

- Significant reductions in discretionary spending across multiple federal agencies. This will impact funding for infrastructure projects, scientific research, and other programs.

- Modifications to tax laws, potentially affecting both individual and corporate tax rates. The specific changes and their effects on different income levels are still under discussion.

- Reforms to entitlement programs, particularly Medicaid and Medicare. These reforms aim to curb the growth of these programs, and the long-term effects are uncertain.

Potential Impact on Various Sectors of the Economy

The budget bill’s impact on different sectors will vary. For example, reductions in funding for infrastructure projects could negatively affect construction and related industries. Conversely, changes to tax laws could stimulate investment in specific sectors, depending on the specifics of the tax reform. The precise effects of the bill are highly contingent on the actual provisions of the final legislation.

Political Context Surrounding the Bill’s Introduction

The bill’s introduction occurs within a highly polarized political climate. The bill’s passage is likely to be contingent on the ability of proponents to garner sufficient bipartisan support. The bill’s fate will hinge on the political will to negotiate and compromise.

History of Similar Budget Bills and Their Outcomes

Numerous budget bills have been proposed and debated over the years. Some have led to significant changes in government spending and taxation, while others have stalled or been amended considerably. The outcomes of past bills vary greatly, demonstrating the complexity of balancing competing interests and objectives. Past bills, similar in their intent to curtail spending and reduce the national debt, have yielded mixed results in terms of their economic effects.

Some produced short-term budget improvements but also resulted in slower economic growth or increased economic inequality. A detailed analysis of past budget bills, including their key provisions and outcomes, would be necessary to draw comparisons with the current bill.

Comparison Table: Current Bill vs. Previous Bills

| Feature | Current Bill | Previous Bill 1 | Previous Bill 2 ||—————–|—————————————————|—————————————————|—————————————————|| Focus | Entitlement program reform, debt reduction | Tax cuts, deregulation | Spending cuts across multiple agencies || Medicaid Cuts | Significant cuts proposed | Moderate cuts proposed | No cuts proposed || Tax Reform | Uncertain specifics, potential individual/corporate changes | Targeted tax cuts for corporations and high earners| Broad tax code overhaul || Economic Impact Predictions | Uncertain, likely sector-specific impacts | Short-term economic boost, long-term economic growth concerns | Mixed outcomes: short-term fiscal stability but longer-term economic stagnation concerns|This table highlights some key differences and similarities between the current bill and past ones.

The specific provisions of the current bill, including the extent of Medicaid cuts and tax reform, will determine its actual impact on the economy.

Medicaid Cuts and Their Implications

The proposed Republican budget bill, as with many such policy documents, features a complex web of potential effects on various segments of the population. A central point of contention and concern revolves around the proposed cuts to Medicaid, a crucial safety net for low-income individuals and families. Understanding the magnitude and nature of these cuts is critical to grasping the potential ramifications on healthcare access, affordability, and the overall well-being of vulnerable populations.The proposed cuts to Medicaid, a vital program for millions, are projected to have significant impacts on healthcare access and affordability.

The implications are far-reaching, extending beyond the immediate beneficiaries to affect the entire healthcare system and the broader economy. This analysis delves into the potential consequences, examining the details of the proposed cuts, their likely impact on various demographics, and the broader implications for the healthcare system.

Proposed Medicaid Cuts

The Republican budget bill proposes significant cuts to Medicaid funding, potentially impacting millions of beneficiaries. These cuts are projected to reduce the overall funding available for the program, leading to decreased services and potentially limiting access for vulnerable populations. Specific figures and details on the cuts are yet to be fully released, but preliminary reports suggest substantial reductions.

The details are crucial to understanding the scale and nature of the anticipated impact.

Potential Consequences on Vulnerable Populations

Medicaid is a critical safety net for low-income individuals, children, pregnant women, and people with disabilities. Reduced funding threatens to limit access to essential healthcare services, potentially leading to increased rates of preventable illness and worsening health outcomes, especially among those already facing systemic disadvantages. The loss of crucial preventive care could lead to more expensive, acute care interventions in the long run.

The impact will disproportionately affect those with pre-existing conditions or chronic illnesses, as they are more likely to require frequent and costly medical attention.

Impact on Healthcare Access and Affordability

Reduced Medicaid funding will likely result in a decline in healthcare access. This means fewer doctors accepting Medicaid patients, reduced availability of specialized care, and longer wait times for appointments and procedures. Affordability will also be significantly impacted. Without Medicaid coverage, many individuals will be unable to afford necessary medical care, potentially leading to delayed or forgone treatment.

This can create a cascade of negative effects on individuals and the healthcare system.

Potential Long-Term Effects on the Healthcare System

The long-term effects of Medicaid cuts are likely to be profound and far-reaching. Decreased access to preventive care and increased reliance on emergency room services could strain the healthcare system, increasing costs for all stakeholders. The cuts could also lead to a decrease in the quality of care available to beneficiaries, impacting health outcomes across various demographic groups.

The overall impact on the healthcare system’s ability to function effectively is substantial.

Comparison to Previous Cuts and Their Outcomes

Analyzing previous Medicaid cuts and their outcomes provides valuable context for evaluating the potential impact of the proposed cuts. Examining historical trends, including the impact on healthcare utilization, access to care, and health outcomes, is crucial to predicting the likely consequences. Past experiences provide insight into the potential challenges and unintended consequences that might arise.

Demographic Impact of the Cuts

The impact of Medicaid cuts will vary significantly across different demographics. A detailed breakdown, though not yet fully available, will likely show disproportionate effects on specific groups.

Jeff Van Drew’s support of the Trump Republican budget bill is raising concerns about potential Medicaid cuts. While these political squabbles dominate headlines, we need to think bigger, focusing on what we really need in the fight against extinction. A crucial element in that fight, as detailed in this important piece, what we really need in the fight against extinction , is a global approach to conservation.

Ultimately, these budget decisions, impacting healthcare, have a ripple effect on the wider world, including the environment, and the very future of our planet.

| Demographic Group | Potential Impact |

|---|---|

| Low-income families | Increased difficulty accessing necessary healthcare services. |

| Children | Increased risk of preventable illnesses and delayed or forgone treatment. |

| Pregnant women | Reduced access to prenatal care and potential complications. |

| Individuals with disabilities | Limited access to specialized care and support services. |

| Rural communities | Reduced availability of healthcare providers. |

Jeff Van Drew’s Stance and Role

Jeff Van Drew, a Republican member of the US House of Representatives, has consistently demonstrated a complex and evolving stance on fiscal policy, particularly regarding proposals affecting Medicaid. His recent voting record and public statements reveal a willingness to prioritize certain economic interests while acknowledging the need for careful consideration of social programs. His position on the recently proposed budget bill, including the proposed cuts to Medicaid, is crucial in understanding his political motivations and the potential impact on the bill’s fate.

Political Stance on the Budget Bill

Van Drew’s political stance on the budget bill is characterized by a focus on economic growth and fiscal responsibility, often coupled with a desire to balance these concerns with the needs of his constituents. He is known to prioritize policies that can create jobs and improve the local economy, while simultaneously expressing concerns about the national debt and the long-term financial stability of the country.

His stance is further complicated by his previous affiliation with the Democratic Party and his current, more conservative, leanings. This shift in political alignment has likely influenced his current approach to policy decisions.

Position Regarding Proposed Medicaid Cuts

Van Drew’s position on proposed Medicaid cuts is not consistently clear-cut. While acknowledging the need to control government spending, he has also expressed concerns about the potential negative impact on vulnerable populations. This nuanced position suggests a balancing act between fiscal responsibility and social welfare. He has publicly stated his desire for more detailed analysis and consideration of the long-term consequences of the proposed cuts.

These statements often emphasize the need for alternative solutions that minimize negative consequences for vulnerable individuals.

Public Statements and Actions

Van Drew’s public statements and actions regarding the budget bill are varied and often reflect his balancing act between fiscal conservatism and social responsibility. For example, he has participated in debates on the floor of the House, offering amendments and speaking in favor of provisions that benefit his constituents while simultaneously supporting measures that aim to curb government spending.

His public appearances and interviews demonstrate a desire to engage with various stakeholders and consider their perspectives on the proposed budget bill. His actions suggest a commitment to representing his constituents’ interests.

Comparison with Past Positions

Comparing Van Drew’s current stance with his past positions reveals a shift toward a more fiscally conservative approach. While his previous Democratic affiliation influenced his support for certain social programs, his recent transition to the Republican party has led him to adopt a more restrictive view on government spending. This evolution is evident in his evolving positions on healthcare policies, where he has increasingly emphasized the need for cost containment.

Jeff Van Drew’s support for the Trump Republican budget bill, with its proposed Medicaid cuts, is raising some serious concerns. While the political climate is currently focused on these budget issues, it’s important to consider the broader context of extreme weather events like the polar vortex collapse. Understanding what to know polar vortex collapse is crucial for comprehending the potential long-term impacts of such events on our society, which, in turn, may influence policy decisions regarding healthcare, and consequently the proposed cuts to Medicaid.

The budget bill’s potential negative consequences for the most vulnerable members of our community remain a significant issue.

This shift reflects broader political trends and his personal political journey.

Potential Influence on Bill’s Outcome

Van Drew’s stance on the budget bill, including the proposed Medicaid cuts, could potentially influence its outcome in a variety of ways. His ability to garner support from other members of Congress, particularly those who share his concerns about government spending, is crucial. His public statements and voting record on similar bills in the past may serve as a crucial indicator of his future actions.

His voting record on previous budget bills is vital in understanding his stance.

Voting Record on Similar Budget Bills

| Year | Bill | Vote |

|---|---|---|

| 2022 | Budget Resolution | Yes |

| 2021 | COVID Relief Package | No |

| 2020 | Economic Stimulus Package | Yes |

This table presents a simplified overview of Van Drew’s voting record on past budget bills. A more comprehensive analysis would require examining the details of each bill and the specific provisions he voted on.

Public Concerns and Opposition

The Republican budget bill, with its proposed cuts to Medicaid, has sparked significant public opposition. Concerns range from the potential impact on vulnerable populations to the overall fiscal responsibility of the plan. Public outcry highlights the delicate balance between economic policies and social welfare. This opposition underscores the importance of public engagement in policymaking and the need for comprehensive analysis of such impactful legislation.

Common Public Concerns

Public concern revolves around the projected impact on low-income individuals and families who rely heavily on Medicaid for healthcare. The proposed cuts raise fears of reduced access to essential medical services, potentially leading to a worsening of health outcomes. The concern extends beyond individual health, touching upon the broader implications for the healthcare system’s capacity to address the needs of its constituents.

The financial implications of reduced Medicaid coverage are a major source of worry, as they could lead to significant strain on state budgets.

Arguments Against the Bill

Concerns about the Republican budget bill are multifaceted, encompassing several critical areas.

- Impact on Vulnerable Populations: Critics argue that the proposed cuts disproportionately affect low-income individuals and families, exacerbating existing health disparities. They point to the potential for increased hospitalizations and emergency room visits due to lack of preventative care and timely access to treatment.

- Fiscal Irresponsibility: Opponents argue that the budget cuts are fiscally irresponsible, potentially leading to long-term financial instability. They cite examples of past budget cuts and their negative consequences to illustrate their concern.

- Erosion of Social Safety Nets: The proposed cuts are viewed as an erosion of the social safety net, harming vulnerable populations and jeopardizing the overall well-being of society. This is linked to a potential increase in poverty and reduced access to basic necessities.

Key Groups Opposing the Bill

Various groups and individuals have voiced their opposition to the budget bill. These groups include:

- Advocacy Groups for Low-Income Individuals: Organizations dedicated to advocating for the rights and needs of low-income communities have actively protested the bill, emphasizing the disproportionate impact on their constituents. These groups highlight the potential for increased poverty and reduced access to critical services.

- Healthcare Providers and Professionals: Healthcare providers and professionals are concerned about the potential for reduced access to care and the deterioration of the healthcare system. They have expressed concerns about the potential loss of jobs and the impact on the quality of care.

- Community Leaders: Local community leaders and representatives have voiced their concerns about the bill’s potential negative effects on their constituents. They represent the concerns of their community members and advocate for the maintenance of crucial services.

Potential Impact of Public Opposition

Public opposition to the budget bill could significantly influence its passage. Public outcry and demonstrations can create political pressure, potentially leading to amendments or a complete withdrawal of the bill. Past examples demonstrate the power of public mobilization in shaping political outcomes.

Examples of Public Protests and Demonstrations

Public protests and demonstrations against the bill have taken various forms, from rallies and marches to organized community meetings and letter-writing campaigns. These actions underscore the level of public concern.

Jeff Van Drew’s support for the Trump Republican budget bill is raising eyebrows, particularly the proposed Medicaid cuts. Meanwhile, the recent cancellation of the FDA flu vaccine meeting, as reported on denikenews.com , highlights the complex interplay between public health priorities and political agendas. This further fuels concerns about the potential negative impacts of the budget bill on vulnerable populations.

Types of Advocacy Groups and Individuals

Advocacy groups and individuals involved in protesting the bill include:

- Community Action Groups: These groups are specifically focused on the needs of local communities and have actively participated in protesting the proposed cuts. They organize rallies, protests, and other forms of advocacy to voice their opposition.

- Healthcare advocacy groups: These groups are directly impacted by the proposed budget cuts, and they actively work to raise awareness about the bill’s potential effects on the healthcare system.

- Individual Citizens: Many individuals have expressed their opposition through various means, including social media, letters to elected officials, and participating in public demonstrations. This broad-based opposition underscores the bill’s unpopularity.

Public Viewpoints on the Budget Bill

| Public Viewpoint | Description |

|---|---|

| Support | A minority of individuals and groups may support the bill, citing potential economic benefits or fiscal responsibility. Their reasoning often focuses on a belief in the long-term economic benefits of the proposed budget cuts. |

| Opposition | The majority of individuals and groups oppose the bill, citing the potential for harming vulnerable populations and the erosion of the social safety net. |

| Neutral | Some individuals may hold neutral or ambivalent views, unable to form a definite stance or undecided about the bill’s potential impact. |

Trump’s Influence and Potential Impact

Donald Trump’s influence on the Republican Party and, by extension, the fate of this budget bill, is a significant factor to consider. His past actions and pronouncements on similar issues offer a window into how he might approach this particular bill, potentially shaping its trajectory through the political landscape. Understanding his position is crucial for predicting the bill’s reception and ultimate success.Trump’s stance on budget issues has been highly variable and often reactive to current events.

His public statements and actions often depend on the specific context, making it difficult to establish a consistent pattern. His influence stems from his significant base of support within the Republican Party, and the potential for his pronouncements to sway public opinion and political strategy. This impact, however, can be complex and multifaceted, varying based on the specifics of the issue and the prevailing political climate.

Trump’s Past Stances on Budget Issues

Trump’s approach to budget issues has shown a degree of inconsistency throughout his political career. He has supported various initiatives at different times, sometimes advocating for significant tax cuts, and other times for more focused spending on specific areas. This inconsistency, coupled with his frequent public pronouncements, can make predicting his stance on any given budget bill challenging. It’s essential to examine specific statements rather than relying on generalized summaries.

Public Statements and Actions Regarding the Bill, Jeff van drew trump republican budget bill medicaid cuts concerns

Assessing Trump’s potential influence requires analyzing his public statements and actions related to the bill. This is critical to gauging his support and the potential impact on the bill’s passage. While Trump’s public pronouncements are often characterized by their brevity and strong opinions, a deeper analysis is needed to understand the specifics of his position on the budget bill.

Potential Influence on the Republican Party

Trump’s position on the budget bill could significantly influence the Republican Party’s stance. His strong support base within the party could sway opinions and create a more unified front. However, disagreements within the Republican party regarding specific aspects of the budget may still emerge.

Comparison to Past Positions on Similar Issues

Comparing Trump’s current position to his past positions on similar budget issues reveals patterns and inconsistencies. Understanding these past stances provides valuable context for assessing his current position. By reviewing his statements and actions on previous budget proposals, we can gain a more nuanced understanding of his potential influence on this particular bill.

Table of Trump’s Public Statements on Budget Issues

| Date | Statement/Action | Context |

|---|---|---|

| 2017 | Advocated for substantial tax cuts | Part of the Tax Cuts and Jobs Act |

| 2018 | Supported increased military spending | Focus on national security |

| 2020 | Called for a large infrastructure package | Economic stimulus |

Note: This table provides a very limited overview of Trump’s budget-related statements. A more comprehensive table would require extensive research. The context provided in the table is a brief summary, and further investigation is necessary to understand the full implications of these statements.

Alternative Solutions and Proposals

The Republican budget bill’s proposed Medicaid cuts sparked considerable controversy, prompting a search for alternative approaches to healthcare funding and social welfare. These alternative solutions, often championed by Democrats and progressive groups, aim to maintain or improve access to healthcare while addressing fiscal concerns in a more equitable manner. The following sections explore potential solutions and their potential impacts.

Alternative Funding Mechanisms for Medicaid

Medicaid expansion and funding are critical components of healthcare access for low-income individuals. The Republican budget bill’s proposed cuts have raised concerns about the adequacy of existing funding models. Alternative funding mechanisms are crucial to maintain current levels of coverage and support. These include:

- Increased federal funding: Increased federal contributions to state Medicaid programs could help alleviate the burden on states, allowing them to maintain current levels of service. This approach, supported by many Democrats, would require Congressional action to raise the federal budget. Past examples include increases in federal funding for other social programs, demonstrating the feasibility of such measures, though political realities often hinder such efforts.

- Progressive taxation: A shift towards more progressive taxation, where higher earners contribute a larger percentage of their income to taxes, could generate additional revenue for healthcare programs. This approach, while potentially controversial, could provide a stable and sustainable funding source for Medicaid. A well-structured progressive tax system, like those found in many European countries, has shown the potential to support robust social safety nets.

- Controlling healthcare costs: Addressing rising healthcare costs through preventative care initiatives and negotiations for lower drug prices could significantly reduce the overall expenditure. Many groups advocate for greater transparency and negotiation power in healthcare costs. Successfully controlling costs through these measures has been demonstrated in some countries and regions with robust healthcare systems, showing that preventative measures can effectively decrease costs over time.

Proposals from Opposing Political Parties and Groups

Diverse political and social groups propose alternative solutions, including:

- Universal healthcare: Proponents of a universal healthcare system advocate for a single-payer system, where the government would be the primary insurer. This approach, championed by some Democrats, would likely address access concerns but would also require substantial shifts in healthcare infrastructure and financing. Examples from countries with universal healthcare systems, such as Canada or the UK, illustrate the potential benefits of this approach but also highlight the complexities of implementation.

- State-level solutions: Some states are exploring innovative approaches to Medicaid, such as expanding eligibility criteria or creating new funding sources. These initiatives highlight the flexibility and potential of state-level experimentation. State-level Medicaid expansions, like those observed in several states following the Affordable Care Act, demonstrate how state-level actions can enhance access to healthcare, although these are often subject to federal regulations.

- Community-based initiatives: Community-based programs that support healthcare access and preventative care initiatives are often advocated by various interest groups. These programs often leverage community resources to improve access and affordability. These initiatives, if properly implemented, could significantly reduce the overall burden on government funding.

Economic and Social Impacts of Alternative Solutions

The economic and social impacts of alternative solutions are diverse and depend on the specific proposal. For instance, increased federal funding for Medicaid could lead to increased government spending but also potentially improve health outcomes and reduce healthcare-related poverty.

| Proposed Alternative | Key Features | Potential Economic Impacts | Potential Social Impacts |

|---|---|---|---|

| Increased Federal Funding | Increased federal contributions to state Medicaid programs. | Increased government spending, potential for job creation in healthcare sector. | Improved access to healthcare, reduced healthcare-related poverty. |

| Progressive Taxation | Higher earners contribute a larger percentage of income to taxes. | Increased government revenue, potential for redistribution of wealth. | Potentially reduced income inequality, increased funding for social programs. |

| Universal Healthcare | Government as primary insurer. | Potential for significant cost savings through bulk purchasing and negotiation. | Guaranteed access to healthcare for all citizens. |

Last Point: Jeff Van Drew Trump Republican Budget Bill Medicaid Cuts Concerns

In conclusion, the Jeff van Drew trump republican budget bill medicaid cuts concerns highlight a critical juncture in American healthcare and politics. The proposed cuts to Medicaid, coupled with Van Drew’s evolving position, raise serious questions about the future of healthcare access for vulnerable populations. The debate extends beyond party lines, with public opposition and alternative solutions vying for consideration.

This analysis underscores the complex interplay of political will, economic factors, and societal needs in shaping healthcare policy.