Money manager Thrivent opens digital bank attract younger retail clients, signaling a bold move into the digital age of finance. This new digital bank promises a fresh approach to financial services, specifically designed to resonate with the needs and preferences of younger generations. Thrivent is likely to offer a suite of innovative financial products and services tailored to this demographic, leveraging technology to improve accessibility and engagement.

The strategy behind this move delves into understanding the motivations and financial needs of young adults and millennials, identifying key factors that attract them to digital-first services. A thorough analysis of the competitive landscape and marketing strategies for this demographic is critical to the success of the new digital bank. Crucially, the bank will need to ensure its security measures are robust to protect customer data, a critical factor for trust and confidence.

Thrivent’s Digital Bank Strategy

Thrivent, a well-established financial institution, is poised to enter the digital age with a new digital bank. This move is crucial for attracting younger generations, who increasingly prefer digital interactions for financial services. This digital strategy will not only modernize Thrivent’s offerings but also potentially reshape its overall business model. A focus on a user-friendly, secure, and comprehensive digital platform is paramount.Thrivent’s current offerings, while solid, may not resonate with younger clients accustomed to seamless online experiences.

A digital bank will provide a new avenue for engagement, empowering users with greater control and flexibility. By understanding the technological landscape and tailoring features to younger preferences, Thrivent can establish a significant presence in the digital financial realm.

Potential Benefits of a Digital-First Approach

A digital-first approach allows Thrivent to reach a wider demographic, specifically younger clients, who are more comfortable with online banking solutions. It enables greater accessibility and convenience, fostering engagement and loyalty. Furthermore, a digital bank streamlines operations, potentially reducing costs and improving efficiency in the long run.

Comparison of Current Offerings and Digital Bank Features

Thrivent’s current offerings likely include traditional banking services, investment products, and financial advisory services. A digital bank, on the other hand, will emphasize a more streamlined user experience. This may include mobile-first design, personalized financial dashboards, AI-powered financial planning tools, and integrated investment options. Features such as real-time account monitoring, automated bill pay, and secure digital wallets will likely be integrated.

Furthermore, robust customer support, through various channels including live chat and video conferencing, will be vital.

Technological Elements for a Successful Digital Bank

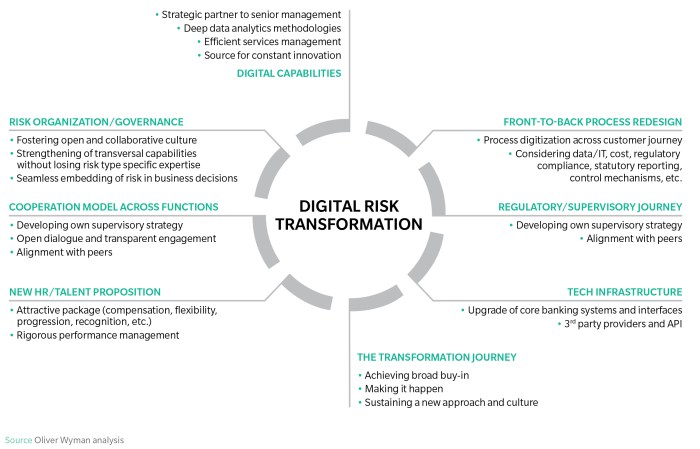

Building a successful digital banking platform requires a strong technological foundation. Crucial elements include robust security measures, such as multi-factor authentication, encryption protocols, and regular security audits. Furthermore, a user-friendly interface is paramount, employing intuitive navigation, clear information architecture, and responsive design for optimal mobile experience. Integration with existing Thrivent systems and third-party providers is also critical for seamless functionality.

Moreover, advanced data analytics tools are needed to personalize user experiences and provide tailored financial recommendations.

Target Market Segmentation for Thrivent’s Digital Bank

| Age Group | Income Level | Investment Goals |

|---|---|---|

| 18-35 | $30,000-$75,000 | Building emergency funds, saving for down payments, investing for long-term goals. |

| 25-45 | $75,000-$150,000 | Retirement planning, wealth accumulation, and investment diversification. |

| 35-55 | $100,000+ | Estate planning, legacy building, and charitable giving. |

This table Artikels potential target market segments based on age, income, and investment goals. These segments represent potential customers who are likely to benefit from the digital bank’s features and services. Further market research can refine these categories.

Competitive Landscape for Digital Banking

The retail digital banking market is highly competitive. Major players like Chime, and other fintech companies, offer innovative services. They excel in certain areas, such as mobile-first design and user-friendly interfaces. However, established institutions like Thrivent may have a stronger brand reputation and a wider range of financial products. Differentiation through innovative features, such as unique investment strategies or personalized financial advice, will be crucial.

Thrivent, a money manager, launching a digital bank is a smart move to attract younger retail clients. Meanwhile, news of an official involved in withholding Ukraine aid, as confirmed by the US defense post ( official involved withholding ukraine aid confirmed us defense post ), highlights the complex political landscape impacting global financial markets. This political tension could potentially affect the long-term success of initiatives like Thrivent’s new digital bank, but the bank’s focus on younger clients remains a savvy strategy in a competitive financial environment.

Marketing Strategies for Attracting Younger Clients

Marketing campaigns should focus on younger demographics, leveraging social media platforms, influencer collaborations, and interactive content. Transparency and trust-building are essential, highlighting the secure and user-friendly nature of the digital bank. Furthermore, partnerships with student organizations and young professional groups can enhance brand awareness.

Impact on Thrivent’s Business Model and Future Growth

The introduction of a digital bank is expected to enhance Thrivent’s brand image and attract a younger customer base. This could increase revenue streams, diversify its product offerings, and potentially lead to increased market share. This shift will likely require adjustments to Thrivent’s existing business model, perhaps including restructuring of sales channels and customer support strategies. Such a move could pave the way for sustained growth and adaptation to the evolving financial landscape.

Attracting Younger Retail Clients

The financial landscape is rapidly evolving, and younger generations are driving this change. Understanding their motivations, financial needs, and preferences is crucial for financial institutions like Thrivent to thrive in the future. This involves adapting traditional service models to the digital-first world they inhabit.

Key Motivations and Financial Needs of Young Adults and Millennials

Young adults and millennials are driven by factors beyond simply accumulating wealth. They prioritize financial security and independence, often with an emphasis on building long-term financial stability, including investments and savings for future goals. For example, homeownership, starting a family, or retirement planning are crucial goals that influence their financial decisions. They also often seek transparency and control over their financial data and processes.

Millennials, in particular, value ethical and sustainable financial practices, expecting institutions to reflect their values.

Factors Attracting Younger Clients to Digital-First Financial Services

Younger clients are drawn to digital-first financial services due to their convenience, accessibility, and personalized experiences. They value the 24/7 availability, ease of use, and tailored financial tools that digital platforms offer. The speed and efficiency of online transactions and account management also appeal to this demographic. They appreciate the flexibility of digital channels to manage their finances on their own terms.

Social Media and Digital Marketing in Reaching Younger Clients

Social media platforms are essential for engaging with younger audiences. Targeted advertising campaigns, interactive content, and influencer collaborations can significantly impact their perception of financial institutions. Authenticity and transparency are key. Financial institutions can use these platforms to build trust and rapport with younger clients, sharing relevant and engaging content that resonates with their interests and concerns.

Creating a sense of community through social media can be beneficial.

Traditional vs. Digital Financial Services Preferences

Traditional financial services often lack the speed, accessibility, and personalization that younger clients value. They may prefer self-service digital platforms over in-person interactions. This target market often demands more transparency and readily available data, which are usually not readily available through traditional methods. A significant shift towards digital financial solutions is observed, with younger generations gravitating toward user-friendly apps and online platforms.

Successful Digital Marketing Campaigns

Financial institutions have leveraged various strategies to connect with younger audiences. For example, interactive online quizzes or financial calculators can provide useful information and engagement. Many financial institutions have partnered with popular social media influencers to reach specific segments of the younger demographic. Creating engaging content through video, blogs, or short-form social media posts are effective ways to reach this target market.

Gamification is another approach, offering rewards and incentives to encourage engagement and financial literacy.

Financial Products and Services for Younger Clients

| Financial Product/Service | Unique Needs |

|---|---|

| Investment Accounts | Low minimum deposit requirements, diverse investment options, transparent fees, and educational resources. |

| Student Loans | Competitive interest rates, flexible repayment options, and clear terms and conditions. |

| Credit Cards | Reward programs, travel benefits, and responsible spending tools. |

| Checking and Savings Accounts | Mobile-friendly banking apps, online bill pay, and low or no monthly maintenance fees. |

| Financial Planning Tools | User-friendly platforms with personalized guidance, educational resources, and goal-setting capabilities. |

Adapting Thrivent’s Products and Services

Thrivent can enhance its product offerings by incorporating digital-first features. For instance, developing user-friendly mobile apps for managing accounts and investments. Providing personalized financial planning tools, especially tailored for young adults and millennials, can be highly beneficial. Transparency in fees and charges, and clear communication are vital aspects to consider. Additionally, incorporating sustainable and ethical investment options can attract environmentally conscious younger clients.

Thrivent, the money manager, is launching a digital bank to snag younger customers. It’s a smart move, considering the changing financial landscape. Meanwhile, the rugby action is heating up, with the Blues securing a spot in the Super Rugby semi-final, facing off against the Crusaders in a fierce grudge match. This intense match highlights the competitive spirit in sports, mirroring the competitive atmosphere in the financial world, where Thrivent is looking to capture a younger market share.

Money Management Strategies for Younger Clients

Navigating the financial world can be daunting, especially in the early stages of adulthood. Young adults often face unique challenges that require specific strategies to build a solid financial foundation. This guide will explore essential financial literacy concepts, common obstacles, and effective money management techniques, with a focus on practical solutions for young adults. Thrivent aims to empower this demographic with the knowledge and tools to thrive financially.Understanding personal finances is paramount for long-term success.

A strong grasp of budgeting, saving, and investing can set a young adult up for a secure financial future. This section Artikels key strategies and considerations for building healthy financial habits, tailored to the specific needs and circumstances of younger clients.

Essential Aspects of Financial Literacy and Money Management

Financial literacy encompasses a range of skills and knowledge related to managing money effectively. For young adults, this includes understanding budgeting, saving, investing, and debt management. A strong foundation in these areas is crucial for achieving financial goals and avoiding common pitfalls.

Common Financial Challenges Faced by Younger Adults

Young adults often face unique financial hurdles. These can include limited income, student loan debt, high living expenses, and the pressure to keep up with peers. Effective strategies to address these challenges are essential to building financial stability.

Strategies for Saving, Investing, and Budgeting Money Effectively

Effective saving, investing, and budgeting are critical components of sound financial management. A well-defined budget helps track income and expenses, identify areas for potential savings, and allocate funds towards financial goals. Regular saving, even small amounts, can accumulate significantly over time. Investing, while potentially riskier, offers the opportunity for long-term growth.

Different Investment Options Suitable for Young Adults

| Investment Option | Description | Risk | Reward Potential |

|---|---|---|---|

| High-Yield Savings Accounts | Offers a slightly higher interest rate than traditional savings accounts. | Low | Moderate |

| Certificates of Deposit (CDs) | Fixed-term deposit accounts that offer a predetermined interest rate. | Low | Moderate |

| Index Funds | Diversified investment portfolios tracking a market index. | Moderate | High (with potential for significant growth over time) |

| Mutual Funds | Managed investment portfolios with varying levels of risk and potential return. | Moderate to High | Moderate to High |

| Individual Stocks | Ownership in a company, offering the potential for high returns but with higher risk. | High | High |

Note: Risk and reward potential are relative and vary depending on specific investment choices. It’s crucial to carefully consider risk tolerance before making investment decisions.

Comparison of Savings Accounts and Investment Vehicles

Various savings accounts and investment vehicles cater to different needs and risk tolerances. High-yield savings accounts offer a safe option for accumulating interest, while CDs provide a fixed rate for a set period. Index funds and mutual funds offer diversification and potentially higher returns, though with increased risk. Individual stocks, while potentially lucrative, carry a higher risk of loss.

A personalized comparison tailored to the individual’s financial goals and circumstances is highly recommended.

Role of Financial Advisors in Helping Younger Clients

Financial advisors can play a critical role in guiding younger clients through the complexities of financial decision-making. They provide personalized guidance, support, and resources to help clients achieve their financial objectives. An advisor can help assess risk tolerance, establish realistic financial goals, and create a tailored investment strategy.

How Thrivent Can Offer Educational Resources and Tools

Thrivent can provide valuable educational resources and tools to enhance financial literacy among younger clients. These resources might include online courses, workshops, financial calculators, and personalized guidance from financial advisors. Thrivent can equip younger clients with the knowledge and tools needed to navigate the financial landscape effectively.

Digital Bank Features and Services

Attracting younger clients requires a digital bank to offer more than just basic banking services. This means a focus on intuitive technology, seamless experiences, and innovative financial tools. A modern digital bank must understand and cater to the needs of today’s tech-savvy generation. This includes not only offering the convenience of online banking but also providing engaging and informative resources.The future of banking is digital, and younger clients expect a bank that understands their financial needs and provides a streamlined experience.

This includes not just basic account management but also a wealth of financial tools and resources integrated into a single platform.

Essential Digital Bank Features

A digital bank aiming to attract younger clients must offer a range of features that enhance the overall user experience. These features go beyond simply mirroring traditional banking services and delve into the realm of personalized financial management tools. This necessitates a streamlined, intuitive interface and a focus on providing comprehensive and easily accessible information.

- Mobile-first approach: A mobile-optimized banking app is crucial. The app should be accessible on various devices, ensuring consistent functionality across platforms. This is critical as younger clients are predominantly mobile users.

- Real-time transaction monitoring: Young adults value transparency. Real-time transaction monitoring allows them to track their spending and budget effectively.

- Personalized financial insights: Features that provide personalized financial advice, such as budgeting tools, investment calculators, and financial goal tracking, are highly desirable.

- Secure and reliable platform: Security should be paramount. Strong encryption, multi-factor authentication, and regular security updates are essential to protect sensitive financial data.

- 24/7 customer support: Providing readily available customer support, such as live chat, FAQs, and email, is vital for resolving issues quickly and efficiently. This addresses the demands of a globally connected and constantly available digital world.

Financial Products and Services

A comprehensive digital bank must offer a wide array of financial products and services to cater to the diverse needs of its clientele. The offerings should be designed with a focus on simplicity and ease of access, especially for younger users who may be unfamiliar with complex financial instruments.

| Product/Service | Description |

|---|---|

| Savings Accounts | Traditional savings accounts with potentially higher interest rates than brick-and-mortar banks, along with potentially attractive features such as cashback or rewards programs. |

| Checking Accounts | Basic checking accounts with various features such as overdraft protection and free ATM access. |

| Investment Accounts | Low-cost investment options, including robo-advisors, tailored to meet diverse investment goals. |

| Loans | Personal loans and student loans with competitive interest rates and flexible repayment options. |

| Bill Pay | A streamlined platform for paying various bills, such as utilities, rent, and subscriptions. |

Mobile Application Features

The mobile application should be designed with a focus on intuitive navigation and ease of use. The user interface should be clean, uncluttered, and visually appealing. Clear labeling and simple language are essential to guide users. The interface should be responsive to various screen sizes, ensuring compatibility across different devices.

Thrivent, the money manager, launching a digital bank is a smart move to attract younger retail clients. This new approach is likely a response to the changing financial landscape, and it’s a good strategy to remain competitive. However, one can’t help but wonder how this move might be impacted by larger political shifts, like the previous administration’s attempts to dismantle the Department of Education, trump dismantle department of education.

Ultimately, the success of Thrivent’s new digital bank will depend on its ability to meet the evolving needs of younger consumers and adapt to any further policy changes.

Security Measures

Robust security measures are critical to protect customer data and transactions. These measures should include:

- Strong encryption: Data should be encrypted both in transit and at rest.

- Multi-factor authentication: Implementing multiple authentication layers (e.g., passwords, biometrics) increases security.

- Regular security updates: Keeping the platform updated with the latest security patches mitigates vulnerabilities.

- Data breach protocols: Implementing a comprehensive data breach response plan is crucial.

Customer Support and Service Options

Customer support is crucial for building trust and loyalty. A digital bank should offer a variety of support channels, including:

- Live chat: Provides immediate assistance.

- Email support: Allows for detailed communication.

- FAQ section: Provides answers to common questions.

- Help center: Offers a wealth of information and resources.

Integration of Financial Tools and Resources

The platform should seamlessly integrate various financial tools and resources to enhance the overall user experience. Examples include:

- Budgeting tools: Allow users to track expenses and create budgets.

- Investment calculators: Assist users in determining investment strategies.

- Financial goal tracking: Help users achieve their financial aspirations.

Impact on Thrivent’s Existing Business

Thrivent’s foray into the digital banking space presents both exciting opportunities and potential challenges for its existing customer base. Understanding how this shift will affect current clients, and how Thrivent can leverage its existing strengths, is crucial for a successful transition. A strategic approach is vital to ensure that the existing customer base feels supported and valued throughout this evolution.Existing clients, particularly those accustomed to traditional financial services, might be hesitant to embrace a completely digital experience.

Thrivent must carefully manage expectations and address any concerns proactively. This involves transparent communication about the benefits of the digital bank, emphasizing how it will enhance existing services rather than replace them.

Leveraging Existing Resources and Expertise, Money manager thrivent opens digital bank attract younger retail clients

Thrivent possesses a substantial foundation of financial expertise and client relationships. Capitalizing on these assets is essential for a successful digital bank launch. Thrivent can leverage its existing network of financial advisors to guide clients through the transition. Training programs for advisors on the new digital platform will be essential for them to effectively assist clients. This will help clients feel more comfortable and confident in utilizing the new digital tools.

This expertise can be seamlessly integrated into the digital bank’s user interface and support systems.

Potential Challenges and Opportunities

Transitioning to a digital-first model presents both opportunities and challenges. Thrivent’s core strength lies in its human touch. However, the digital bank presents the opportunity to expand access and offer services to a wider range of customers. Careful consideration must be given to maintaining the quality of personal service while streamlining processes through technology. The potential to cross-sell and upsell existing products is significant.

The digital bank can serve as a hub for clients to discover and engage with additional Thrivent offerings. Careful planning and execution will mitigate potential challenges and realize the opportunities.

Comparison of Costs and Benefits

| Factor | Maintaining Current Operations | Launching a New Digital Bank |

|---|---|---|

| Initial Investment | Low, primarily ongoing maintenance costs | High, encompassing platform development, marketing, and infrastructure |

| Customer Acquisition Cost | High, typically through traditional methods | Potentially lower, leveraging digital marketing strategies |

| Operational Costs | Relatively stable, with predictable expenses | Variable, with potential for economies of scale over time |

| Customer Retention | Relies on established relationships | Requires engaging digital strategies for loyalty and retention |

| Revenue Potential | Limited to current product offerings | Expanded through new products and cross-selling |

The table above illustrates the key differences in costs and benefits between maintaining current operations and launching a new digital bank. Careful analysis of these factors is critical for a sound financial strategy.

Successful Business Transitions

Several financial institutions have successfully transitioned to digital models. Examples include the rise of mobile banking apps, which have revolutionized access to financial services. Similarly, companies like Schwab and Fidelity have successfully adapted their platforms to better serve a digitally savvy clientele. By examining these successful transitions, Thrivent can develop strategies to effectively manage the transition.

Cross-Selling and Upselling Opportunities

A digital bank provides an excellent platform for cross-selling and upselling existing Thrivent products. Clients can easily access information on various investment options, insurance plans, and other financial services through the digital platform. This increased accessibility can drive sales and improve client satisfaction. For example, a client researching retirement planning through the digital bank may discover and be guided towards a relevant investment strategy.

Internal Process Changes

Implementing a digital bank requires significant changes to Thrivent’s internal processes. This includes adopting new technologies, training staff, and adjusting workflows. The digital platform needs to be seamlessly integrated with Thrivent’s existing systems. This will allow for efficient data management and seamless client interactions. Effective implementation of new technologies and training will be key to success.

Final Conclusion: Money Manager Thrivent Opens Digital Bank Attract Younger Retail Clients

Thrivent’s foray into digital banking presents a compelling opportunity to capture a significant share of the younger retail market. By understanding and addressing the unique needs of this demographic, the new digital bank could redefine financial accessibility and engagement. The success of this venture hinges on effectively integrating technology, financial products, and customer service to create a seamless and trustworthy experience.