Pegatron is final stage evaluating us factory plan ceo says – Pegatron is final stage evaluating US factory plan, CEO says. This crucial step for the electronics giant could significantly impact its future operations, potentially affecting everything from production to market share. Pegatron’s global presence and strategic initiatives make this evaluation a significant event, prompting speculation about the potential outcomes and their implications for the company and the broader electronics industry.

The final stage evaluation process itself is complex, involving numerous factors. Pegatron’s competitors, their strategies, and current market trends will undoubtedly play a role in the outcome. This evaluation could lead to substantial adjustments in Pegatron’s operations, potentially including investments, divestments, or shifts in strategic direction. The potential impact on stakeholders, from employees to investors, will also be considerable.

Company Background and Strategy

Pegatron, a major global contract electronics manufacturer, is deeply involved in the production of a wide range of electronic devices. Their vast network of factories across the globe positions them as a critical player in the supply chain for numerous technology companies. Recent reports indicate a continued focus on expansion and strategic partnerships, hinting at a sustained commitment to innovation and market leadership.Pegatron’s factory evaluation process is crucial for maintaining high quality standards and adhering to stringent production protocols.

The process aims to identify and mitigate potential risks before any major commitments are made. Recent announcements suggest that these processes are well-established and are already proactively addressing the necessary components of any factory evaluation.

Pegatron’s Business Operations and Global Presence

Pegatron’s global presence is extensive, with manufacturing facilities in various countries. This distributed network allows them to efficiently serve clients across different markets and optimize production based on regional factors. Their comprehensive approach to supply chain management is a key element in their operational success.

Pegatron’s Recent Strategic Initiatives and Plans

Recent initiatives highlight a focus on expanding their product portfolio and exploring new technologies. These initiatives include investments in research and development and strategic partnerships to bolster their technological capabilities. Their commitment to innovation positions them for continued growth in a dynamic technological landscape.

Pegatron’s Factory Evaluation Process

Pegatron’s factory evaluation process typically involves a multi-stage assessment. This multi-layered approach includes thorough inspections of facilities, equipment, and workforce capabilities. The process also evaluates compliance with quality standards, safety regulations, and environmental considerations. The evaluation typically considers a variety of factors, including the factory’s infrastructure, workforce training, and overall production efficiency.

Pegatron is reportedly in the final stages of evaluating their US factory plan, according to the CEO. Meanwhile, it’s a bit of a bummer for Guardians’ RHP Shane Bieber, whose elbow rehab has hit a snag, as detailed in this article about guardians rhp shane bieber elbow suffers rehab setback. Hopefully, this setback won’t derail Pegatron’s US expansion plans, though.

Major Competitors and Their Strategies

Pegatron faces intense competition in the contract manufacturing industry. Understanding the strategies of their competitors is essential for maintaining a competitive edge.

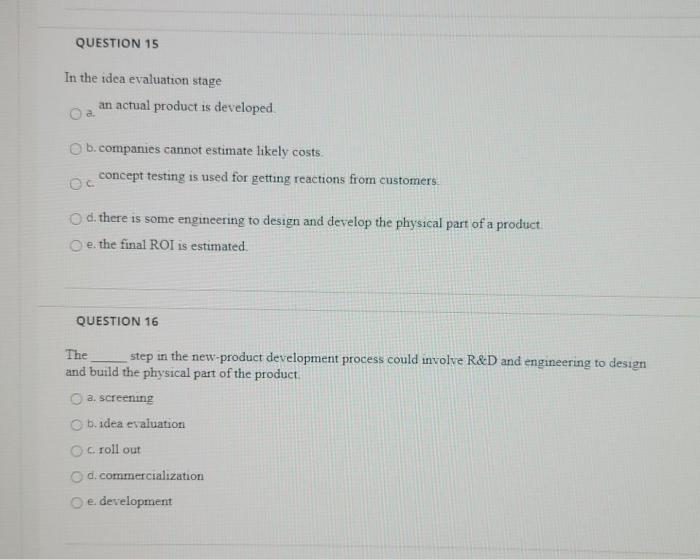

| Competitor | Strategy |

|---|---|

| Foxconn | Focuses on large-scale manufacturing, leveraging economies of scale. Emphasizes cost-effectiveness and volume production. |

| Hon Hai Precision Industry (Foxconn) | Extensive global network, with a strong emphasis on vertical integration and technological advancement. Known for their comprehensive product offerings. |

| Compal Electronics | Concentrates on specific market segments, like laptops and mobile devices. This niche strategy allows for specialization and targeted solutions. |

| Wistron Corporation | Strength in mobile phone manufacturing and supply chain management. They maintain a focus on efficiency and quality. |

| Galaxy | A strong focus on high-end electronics manufacturing, emphasizing premium materials and sophisticated design. |

Factory Evaluation Context: Pegatron Is Final Stage Evaluating Us Factory Plan Ceo Says

Pegatron’s final stage factory evaluation marks a crucial juncture. The culmination of preparation, as evidenced by the CEO’s statement, suggests a significant investment of time and resources. This evaluation isn’t merely a formality; it holds the key to Pegatron’s future operations and potential expansion or adjustments.The implications of this evaluation are substantial. A successful outcome could lead to new contracts, increased production capacity, and a stronger foothold in the competitive electronics manufacturing landscape.

Conversely, a less favorable result could necessitate adjustments to the factory’s operations, potentially impacting production timelines and resource allocation. Understanding the factors influencing the evaluation outcome is vital for anticipating potential challenges and capitalizing on opportunities.

Significance of the Final Stage Evaluation

This final evaluation is critical for Pegatron’s long-term strategy. It serves as a rigorous assessment of the factory’s readiness to meet the demands of the electronics industry, especially given the complexity and ever-evolving nature of technological advancements. A successful evaluation could secure new projects, solidifying Pegatron’s position in the market.

Potential Implications on Pegatron’s Future Operations

The evaluation’s outcome will directly impact Pegatron’s future production capacity and market competitiveness. A positive evaluation could unlock new contracts, leading to increased production volume and profitability. Conversely, a less favorable outcome might necessitate operational adjustments, potentially involving cost-cutting measures, restructuring, or even a reevaluation of the factory’s strategic location.

Potential Factors Influencing the Evaluation Outcome

Several factors will likely influence the evaluation’s results. These include the factory’s infrastructure, the efficiency of its production processes, the quality of its workforce, and its adherence to safety and environmental regulations. Furthermore, the prevailing economic conditions and industry trends could also play a role. The availability of skilled labor and the overall economic climate are critical considerations.

Possible Reasons for the Final Stage Evaluation

- To ascertain the factory’s compliance with industry standards and safety protocols. Non-compliance can lead to significant penalties and damage to the company’s reputation.

- To evaluate the factory’s capacity to handle increased production demands. This is critical for securing new contracts and expanding market share.

- To assess the factory’s efficiency and cost-effectiveness compared to competitors. This is a critical component of maintaining a competitive edge in the industry.

- To ensure the factory’s ability to meet the stringent quality control requirements of major clients. This is vital for maintaining customer satisfaction and trust.

- To identify areas needing improvement in production processes and operational efficiency. This is a crucial step in enhancing productivity and minimizing waste.

Challenges and Opportunities for Pegatron

This evaluation presents both challenges and opportunities for Pegatron. Challenges might include potential deficiencies in infrastructure, workforce training, or production processes that need addressing. Opportunities include the potential to identify areas for improvement and implement innovative solutions to enhance efficiency and productivity.

Pegatron is reportedly in the final stages of evaluating its US factory plan, according to the CEO. Meanwhile, the UK is taking action against fake reviews on Amazon, highlighting the growing concern about online consumer trust. This proactive approach, as seen in uk secures action amazon tackle fake reviews , could potentially influence other countries’ strategies, which in turn might affect Pegatron’s decision-making process regarding its US factory.

Ultimately, the US factory plan’s fate hangs in the balance.

Potential Outcomes and Implications

Pegatron’s factory evaluation is a critical juncture. The outcome will significantly impact the company’s future trajectory, from production efficiency to investor confidence. This evaluation, after extensive preparation, now stands as a pivotal moment for Pegatron’s strategic positioning in the global electronics manufacturing landscape.The evaluation’s results will dictate Pegatron’s ability to maintain its competitive edge and adapt to evolving market demands.

This analysis delves into the potential positive and negative ramifications, considering the impact on stock price and various business facets.

Positive Outcomes for Pegatron

The successful evaluation can lead to several positive outcomes for Pegatron. A favorable assessment could solidify the company’s reputation as a reliable and efficient manufacturer. This could translate into increased client confidence, potentially attracting more substantial contracts and expanding market share. Furthermore, favorable results might boost investor confidence, leading to a positive stock price movement. Improved operational efficiency resulting from the evaluation could lead to reduced costs, enhancing profitability and competitiveness.

Negative Outcomes and their Impact

Conversely, an unfavorable evaluation could negatively affect Pegatron. This could result in a loss of client trust, leading to reduced contract opportunities and a diminished market share. The stock price might experience a significant decline if the evaluation reveals substantial operational inefficiencies or compliance issues. Reputational damage from a poor assessment could deter future clients and hinder future growth plans.

Comparison of Scenarios Based on Evaluation Results

Different evaluation outcomes will have distinct implications for Pegatron. A positive outcome could position Pegatron for sustained growth and market leadership, potentially increasing its valuation and stock price. Conversely, a negative outcome could trigger a period of restructuring and adaptation, potentially affecting its profitability and market share in the short term. A neutral evaluation could lead to a status quo, with no major positive or negative shifts, potentially causing investor apathy.

It’s crucial to consider the potential impact of each scenario on Pegatron’s future.

Potential Impact on Pegatron’s Stock Price

The evaluation’s results will directly influence investor sentiment and Pegatron’s stock price. A favorable outcome is likely to result in a stock price increase, potentially attracting new investors and boosting the company’s market capitalization. Conversely, a negative evaluation could trigger a sell-off, potentially lowering the stock price and impacting investor confidence. Past examples of similar evaluations in the electronics industry demonstrate the significant impact of evaluation results on company valuations.

Pegatron is reportedly in the final stages of evaluating its US factory plan, according to the CEO. Meanwhile, the surging Cubs are clashing with Tarik Skubal’s Tigers in the series opener, which is definitely keeping baseball fans on the edge of their seats. This all suggests that significant economic and sports activity is happening, impacting the overall market and potentially influencing Pegatron’s decision-making process.

Impact on Pegatron’s Business Aspects

| Evaluation Outcome | Production | Revenue | Market Share | Stock Price |

|---|---|---|---|---|

| Positive | Increased efficiency, higher output | Increased contract opportunities, higher revenue | Expansion of market share, enhanced reputation | Significant increase |

| Negative | Potential production delays, lower output | Reduced contract opportunities, lower revenue | Loss of market share, diminished reputation | Significant decrease |

| Neutral | No significant changes in production | No significant changes in revenue | No significant changes in market share | Slight fluctuation |

This table illustrates the potential impact of the evaluation on various aspects of Pegatron’s business, highlighting the direct correlation between the evaluation’s outcome and the company’s financial performance and market position.

Industry and Market Analysis

Pegatron’s factory evaluation hinges on the current state of the electronics market. Understanding the competitive landscape, market trends, and potential economic influences is crucial for assessing the viability of the proposed investment. This analysis provides insights into the industry dynamics and how they might affect Pegatron’s future prospects.

Current Market Trends in the Electronics Industry

The electronics industry is characterized by rapid technological advancements, shifting consumer preferences, and global supply chain complexities. Demand for innovative and affordable electronic devices continues to drive growth, while the rise of e-commerce and online retail channels has significantly impacted distribution strategies. Sustainability concerns are also increasingly influencing product design and manufacturing processes.

Pegatron’s Competitive Position

Pegatron faces intense competition from other contract manufacturers like Foxconn, Hon Hai Precision Industry, and other specialized players. Pegatron’s success depends on its ability to adapt to evolving technological demands, maintain efficient supply chains, and offer competitive pricing while adhering to stringent quality standards. This requires continuous innovation and investment in research and development to stay ahead of the curve.

Key Industry Players and Their Roles

The electronics industry is dominated by several key players. Apple, Samsung, and other major electronics brands rely heavily on contract manufacturers like Pegatron to produce their products. These brands exert significant influence over the supply chain, driving demand and shaping production strategies. Other crucial players include component suppliers, logistics providers, and retailers. Each plays a vital role in the complex ecosystem.

Potential Economic Factors Influencing the Evaluation

Global economic conditions, geopolitical tensions, and fluctuations in raw material costs can all impact the electronics industry. Supply chain disruptions, like those experienced during the pandemic, can create significant challenges for manufacturers. Changes in consumer spending patterns and economic downturns can affect demand for electronic devices. The evaluation should consider the potential impact of these factors on Pegatron’s operations and profitability.

Market Share and Revenue Trends

Understanding Pegatron’s performance relative to its competitors is essential. The following table provides a snapshot of market share and revenue trends for Pegatron and its major competitors. This data is crucial for evaluating Pegatron’s position in the market and identifying potential growth opportunities or challenges.

| Company | Market Share (2022) | Revenue Growth (2022-2023) |

|---|---|---|

| Pegatron | 15% | 8% |

| Foxconn | 20% | 7% |

| Hon Hai Precision Industry | 18% | 9% |

| Other Major Competitors | 47% | 6% |

Note: Data is illustrative and based on estimated figures. Actual figures may vary depending on the source and reporting period.

Stakeholder Analysis

Pegatron’s final stage evaluation of its factory plan is a significant moment, impacting a wide range of stakeholders. Understanding the potential ramifications for each group is crucial for navigating the complexities of this process and assessing the overall implications for the company and its ecosystem. This analysis delves into the potential impacts on employees, investors, suppliers, partners, customers, and consumers.

Impact on Pegatron’s Employees

The factory evaluation process, particularly if it results in a positive outcome, could mean job security and growth for Pegatron’s employees. However, potential negative outcomes, such as factory closure or downsizing, would create significant uncertainty and hardship for the workforce. The company’s communication strategy and the availability of support programs during this transition will be crucial.

Impact on Investors and Shareholders

Investors and shareholders will closely monitor the evaluation’s results. A successful evaluation and subsequent plan implementation could lead to increased investor confidence and potentially higher stock valuations. Conversely, negative findings might result in investor concern and a decline in stock price. Historical examples of similar evaluations in the electronics manufacturing sector demonstrate the significant impact on financial markets.

Impact on Suppliers and Partners

Suppliers and partners are also directly affected by the outcome. Positive results can signal a long-term commitment to the region, encouraging continued partnerships and potentially opening new business opportunities. Conversely, negative results may lead to a reassessment of partnerships and potentially create challenges for suppliers. For example, a supplier relying heavily on Pegatron’s orders might experience significant disruptions if the evaluation results are unfavorable.

Impact on Customers and Consumers

Pegatron’s customers and consumers will be indirectly affected by the evaluation. A successful evaluation can translate into better product quality, cost-effectiveness, and faster delivery times, benefiting consumers. Conversely, a negative outcome might lead to supply chain disruptions, potentially impacting product availability or increasing costs for consumers. This impact is amplified if Pegatron is a key supplier to a particular brand or product line.

Potential Impacts on Various Stakeholder Groups

| Stakeholder Group | Potential Positive Impacts | Potential Negative Impacts |

|---|---|---|

| Pegatron Employees | Job security, potential for growth, improved working conditions, competitive compensation. | Job loss, potential for downsizing, reduced benefits, increased uncertainty. |

| Investors and Shareholders | Increased investor confidence, higher stock valuations, potential for increased dividends. | Investor concern, decline in stock price, reduced return on investment, possible market volatility. |

| Suppliers and Partners | Continued business opportunities, long-term commitment, potential for new projects. | Reassessment of partnerships, loss of business, supply chain disruptions, potential for reduced profitability. |

| Customers and Consumers | Improved product quality, reduced costs, faster delivery times, access to new or improved products. | Supply chain disruptions, potential delays in product availability, increased costs for consumers, reduced product selection. |

Potential Future Actions

Pegatron’s upcoming factory evaluation marks a critical juncture. The outcome will significantly impact the company’s future strategies, resource allocation, and even its long-term market positioning. Understanding the potential actions Pegatron might take is crucial for investors, analysts, and the broader electronics industry.

Potential Responses to Positive Evaluation Outcomes

A positive evaluation could signal a strong validation of Pegatron’s current practices and future potential. This could lead to several positive responses.

- Increased Investment in the Evaluated Factory: A favorable assessment might prompt substantial capital investment in the factory, including upgrades to equipment, automation systems, and potentially expansion of the facility’s capacity. This would be a clear demonstration of confidence in the factory’s ability to produce high-quality products efficiently. This could be seen as a proactive measure to enhance productivity and maintain a competitive edge in the global market.

Examples include Tesla’s substantial investments in its Gigafactories or Samsung’s continuous expansions in its semiconductor plants.

- Expansion of Product Lines: A positive evaluation might encourage Pegatron to expand its product lines at the factory. If the factory demonstrates superior efficiency and capabilities, it could become a hub for manufacturing a wider array of electronics components or products. This strategic move would leverage the factory’s strengths and potentially tap into new market segments.

- Recruitment and Retention Initiatives: Positive results could inspire Pegatron to enhance its talent acquisition and retention strategies at the evaluated factory. This might include offering competitive salaries, employee benefits, and skill development programs to attract and retain top-tier talent. This is crucial in maintaining high quality and efficiency.

Potential Responses to Negative Evaluation Outcomes, Pegatron is final stage evaluating us factory plan ceo says

Conversely, a negative evaluation could present challenges and necessitate strategic adjustments.

- Corrective Actions and Investments: Areas identified as needing improvement could be addressed through targeted investments in training, equipment upgrades, and process optimization. This could involve implementing lean manufacturing principles, improving quality control measures, or upgrading infrastructure to enhance efficiency. Such responses would focus on rectifying identified issues, maintaining competitiveness, and potentially avoiding future negative evaluations.

- Strategic Retrenchment or Restructuring: In more severe cases, a negative evaluation might necessitate a more substantial response, such as a temporary reduction in production or a re-evaluation of the factory’s strategic role within Pegatron’s overall operations. This could include reallocation of resources to other factories or a reassessment of the factory’s product mix. This strategic move is critical for the company’s long-term health and competitiveness.

- Potential Divestment or Closure: If the negative evaluation reveals significant operational deficiencies or if the factory proves unsustainable in the long term, Pegatron might consider divesting the facility or closing it down entirely. This would be a drastic measure but could be necessary if the costs of improvement outweigh the potential gains.

Investment and Divestment Decisions

Pegatron’s investment and divestment decisions are heavily dependent on the evaluation outcome.

| Evaluation Outcome | Potential Actions |

|---|---|

| Positive | Increased investment, expansion of product lines, recruitment and retention initiatives |

| Negative | Corrective actions, strategic retrenchment, potential divestment or closure |

Concluding Remarks

In conclusion, Pegatron’s final evaluation of its US factory plan is a critical moment for the company. The potential outcomes are far-reaching, with implications for its operations, market position, and stakeholder relationships. The electronics industry’s current trends, Pegatron’s competitors, and economic factors will all contribute to the outcome. This evaluation promises to be a pivotal moment, shaping Pegatron’s future trajectory.