Trump tariffs steel aluminum prices businesses faced a complex web of consequences. The tariffs imposed by the Trump administration on steel and aluminum imports sparked a ripple effect, impacting everything from domestic prices to global trade relations. Understanding the specifics of these tariffs, their impact on various industries, and the responses from businesses is key to grasping the full picture.

This analysis delves into the historical context of these tariffs, examining the rationale behind their implementation, and evaluating the diverse effects they had on businesses, consumers, and the overall economy. We’ll explore price fluctuations, industry-specific impacts, and the subsequent global trade responses.

Introduction to Trump Tariffs on Steel and Aluminum

In 2018, the Trump administration implemented tariffs on imported steel and aluminum, a significant trade policy decision that generated considerable debate and impacted various sectors. These tariffs, while aiming to protect American industries, triggered repercussions across global markets and sparked discussions about their effectiveness and broader economic consequences.The tariffs were a controversial aspect of President Trump’s trade policies, aiming to bolster domestic steel and aluminum production.

Advocates argued the tariffs would safeguard American jobs and national security. However, critics raised concerns about potential negative impacts on consumers, businesses, and international relations. The implementation and impact of these tariffs continue to be a subject of economic analysis and discussion.

Historical Overview of the Tariffs

The tariffs on steel and aluminum were imposed in two phases. First, tariffs of 25% on steel imports and 10% on aluminum imports were implemented in March 2018. These initial tariffs were applied to all countries. A subsequent set of tariffs, with exceptions for some countries, were enacted in June 2018. This initial action was followed by a period of legal challenges and negotiations, which eventually led to exemptions for certain countries.

Trump’s tariffs on steel and aluminum significantly impacted businesses, causing price hikes and supply chain disruptions. These economic pressures, however, are just a small part of a larger global competition, such as the biotech race with China. Biotech race with China is heating up, with both countries vying for dominance in cutting-edge research and development. Ultimately, the initial impact of the tariffs on businesses remains a critical issue to address.

Rationale Behind the Tariffs

Arguments for the tariffs frequently cited national security concerns. Proponents believed that a robust domestic steel and aluminum industry was crucial for national defense capabilities. The administration also highlighted concerns about unfair trade practices by foreign competitors. These were often expressed in terms of unfair subsidies and dumping practices, which harmed American industries.

Types of Tariffs Applied

The tariffs on steel and aluminum were primarily ad valorem tariffs, meaning the tariff rate was a percentage of the imported product’s value. However, some specific tariffs were also applied, meaning the tariff was a fixed amount per unit of the imported product.

- Ad Valorem Tariffs: These tariffs, expressed as a percentage of the imported product’s value, were widely used. For example, a 25% ad valorem tariff on steel would mean that for every $100 worth of steel imported, $25 would be added to the cost as a tariff.

- Specific Tariffs: These tariffs were sometimes used in conjunction with ad valorem tariffs, or as a separate component. They imposed a fixed amount per unit of the imported product, regardless of the product’s value. For example, a $100 per ton specific tariff on aluminum would apply to every ton of aluminum imported, irrespective of its price.

Initial Reactions and Expectations

Initial reactions to the tariffs were mixed. Domestic steel and aluminum producers generally welcomed the tariffs, anticipating increased demand and profitability. However, businesses reliant on imported steel and aluminum, like manufacturers of automobiles and construction materials, voiced concerns about higher costs and potential disruptions in supply chains. Global trade partners expressed displeasure and initiated retaliatory measures. Economic forecasts varied widely, with some predicting job growth in the affected sectors and others anticipating broader economic repercussions.

Impact on Steel and Aluminum Prices: Trump Tariffs Steel Aluminum Prices Businesses

The Trump administration’s 2018 tariffs on imported steel and aluminum sparked significant debate and had a tangible impact on global markets. These tariffs aimed to protect domestic producers, but their effect on prices, both domestically and internationally, proved complex and multifaceted. The following analysis explores the changes in steel and aluminum prices following the implementation of the tariffs.The tariffs aimed to shield American steel and aluminum producers from what the administration perceived as unfair competition from foreign producers, often leading to lower prices for consumers.

However, the unintended consequences of these tariffs on the overall price of steel and aluminum are not always immediately clear. The following discussion provides insight into the effects of the tariffs.

Price Changes in Domestic Steel

The implementation of tariffs led to a complex interplay of factors influencing domestic steel prices. While some domestic producers saw increased profits and market share, the tariffs also raised the cost of raw materials and inputs for manufacturers, potentially impacting the final prices of finished goods. Analysis of data points to fluctuations rather than a simple, direct increase.

Price Changes in Domestic Aluminum

Similar to steel, the aluminum market experienced price adjustments following the tariffs. The initial impact varied based on the specific product and the supply chain. This variation was due to different production methods, varying reliance on imported materials, and differing production processes.

Comparative Analysis of Pre- and Post-Tariff Prices

A thorough comparison of steel and aluminum prices before and after the tariffs requires a detailed dataset, including historical pricing information from reputable sources. Analyzing price trends over a considerable period (pre- and post-tariff implementation) is critical to assess the impact accurately. This analysis would reveal the magnitude and direction of price changes and potentially show correlations between tariffs and price fluctuations.

Potential Explanations for Price Changes, Trump tariffs steel aluminum prices businesses

Several factors could have contributed to the observed price changes in steel and aluminum following the tariffs. These factors include shifts in supply and demand, increased domestic production, and fluctuations in global commodity markets. A comprehensive analysis would consider these elements. For example, the tariffs might have incentivized American steel mills to increase production, potentially offsetting some of the price increases that would otherwise have occurred due to import restrictions.

Conversely, the tariffs might have driven up prices for consumers due to reduced import options.

Effects on Businesses

The Trump administration’s tariffs on steel and aluminum significantly impacted businesses across various sectors. These tariffs, intended to protect domestic industries, had ripple effects throughout the supply chain, affecting manufacturers, distributors, and consumers. The consequences were complex and varied depending on the specific industry and the business’s position within the supply chain.

Automotive Industry

The automotive industry, a major user of steel and aluminum, faced substantial challenges. Manufacturers experienced increased input costs, as the tariffs raised the price of raw materials. This led to higher production costs, potentially impacting profitability and competitiveness. For example, a major car manufacturer might have seen a 10% increase in the cost of steel components, directly affecting the price of their vehicles and potentially reducing sales volume.

The long-term consequences included a possible shift in production strategies, either by sourcing materials from alternative suppliers or by relocating production facilities.

Construction Industry

The construction industry, heavily reliant on steel and aluminum for building materials, was another sector significantly impacted. Increased costs for steel beams, roofing materials, and other components directly translated into higher construction costs. This could lead to delays in project completion, potential price increases for consumers, and a potential decline in the overall construction market. A housing developer, for example, might see a 5% increase in the cost of constructing a new home, which could affect the affordability of housing and potentially deter new construction projects.

Trump’s tariffs on steel and aluminum significantly impacted businesses, raising prices and creating uncertainty. However, the global implications extend beyond just those industries. The upcoming UN Global Ocean Conference, what’s at stake , highlights the interconnectedness of global economies and the importance of sustainable practices. Ultimately, these tariffs, and their effects on businesses, are just a small part of a much larger picture of global trade and environmental concerns.

Manufacturing Businesses

Numerous manufacturing businesses, including those in the appliance, machinery, and equipment sectors, were adversely affected. These businesses were compelled to absorb the higher costs of raw materials or pass them on to consumers. This led to a potential decrease in demand for their products and a potential impact on their market share. A small-scale manufacturer of metal fabrication tools, for instance, might see a 15% increase in the price of steel, affecting their profitability and potentially their ability to compete with larger manufacturers.

Other Sectors

The effects extended beyond the aforementioned sectors. Businesses in the aerospace, energy, and agricultural sectors also felt the impact. For example, the cost of aluminum in the aerospace industry, essential for aircraft production, led to increased costs for manufacturers, potentially affecting the profitability and competitiveness of their products. The impact on different sectors varied significantly based on the sector’s reliance on steel and aluminum.

The short-term consequences were immediate price increases, while long-term consequences included potential shifts in sourcing strategies, business closures, and economic downturns.

Global Trade Responses and Countermeasures

The Trump administration’s 2018 tariffs on steel and aluminum sparked a wave of retaliatory actions from other nations, significantly impacting global trade dynamics. These responses highlight the complex web of interconnectedness in international commerce and the potential for trade wars to disrupt supply chains and economic stability. The ripple effects extended far beyond the steel and aluminum industries, touching various sectors and countries.The retaliatory measures taken by other countries were not merely symbolic; they were calculated responses aimed at mitigating the economic harm inflicted by the tariffs.

These actions demonstrate the potential for escalating trade conflicts and the need for careful consideration of global trade implications.

Retaliatory Actions by Other Nations

Various countries responded to the Trump tariffs with their own trade restrictions. These actions included tariffs on American goods, ranging from agricultural products to manufactured items. This response underscores the interconnected nature of international trade and the potential for retaliatory measures to cascade through various sectors.

- Canada imposed tariffs on American products, including certain types of steel, in response to the tariffs imposed on Canadian steel and aluminum. Canada’s actions demonstrate a commitment to protect its own industries from harm caused by the US tariffs.

- China implemented tariffs on American agricultural products, notably soybeans, as a countermeasure to the US tariffs. This retaliatory action directly impacted American farmers and the agricultural sector. The subsequent trade negotiations between the two nations aimed to address these issues.

- Mexico also imposed tariffs on various US goods as a response to the tariffs on steel and aluminum. This highlights the interconnectedness of supply chains and the significant impact that trade restrictions can have on international commerce.

Implications of Global Trade Responses

The global trade responses to the Trump tariffs had significant implications for various stakeholders. The escalation of trade tensions created uncertainty in global markets, impacting investor confidence and potentially hindering economic growth.

Trump’s tariffs on steel and aluminum significantly impacted businesses, pushing up prices. Understanding the full effect requires looking at the broader context of the US-China trade war, which had a major impact on global markets. For a detailed timeline of the tariffs during the trade war, check out this resource: us china trade war trump tariffs timeline.

Ultimately, these tariffs and the ensuing trade war had a complex ripple effect on businesses dealing in steel and aluminum, and other industries.

- Increased Uncertainty in Global Markets: The retaliatory tariffs created uncertainty in global markets, affecting investor confidence and potentially hindering economic growth. This uncertainty extended beyond the steel and aluminum industries, affecting related sectors and international trade relationships.

- Disruptions to Supply Chains: The tariffs and countermeasures disrupted existing supply chains, leading to higher costs and potential shortages of certain goods. This disruption highlighted the importance of diverse supply sources and the vulnerabilities inherent in relying heavily on single trade partners.

- Impact on Businesses: Companies facing tariffs experienced increased costs, reduced profitability, and challenges in maintaining market share. The trade conflict significantly affected the competitiveness of American businesses in international markets. These impacts were felt across a range of industries.

Comparison of Trade Policies

A comparison of trade policies among nations reveals differing approaches to international trade. Some countries prioritize protectionist measures to safeguard domestic industries, while others favor free trade principles. This contrast highlights the ongoing debate about the optimal balance between domestic interests and global economic integration.

| Country | Trade Policy Approach | Examples |

|---|---|---|

| United States (during the Trump administration) | Protectionist | Imposition of tariffs on steel and aluminum imports |

| Canada | Protectionist | Retaliation with tariffs on US goods |

| China | Mixed | Combination of protectionist and free trade policies |

| Mexico | Mixed | Retaliation with tariffs on US goods |

Domestic Production and Employment

The Trump administration’s tariffs on steel and aluminum aimed to bolster domestic production and employment in these sectors. The theory was that protecting domestic producers would increase their market share, leading to job growth. However, the actual impact has been more complex and less straightforward than initially anticipated.The tariffs were intended to create a more favorable environment for American steel and aluminum producers, but their effects on domestic production and employment are not always clear-cut.

The expected rise in domestic output and jobs did not always materialize as predicted, and the tariffs’ influence on the global market and the behavior of international competitors has also been an important factor.

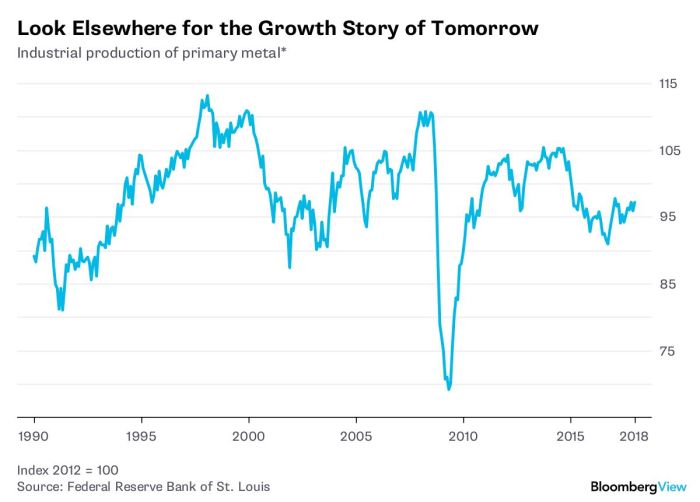

Impact on Domestic Steel and Aluminum Production

The tariffs directly impacted the price of imported steel and aluminum, making them more expensive for American manufacturers. This could, in theory, make American-produced steel and aluminum more competitive in the domestic market. However, the tariffs also prompted retaliatory measures from other countries, impacting American exports and potentially reducing demand for domestic products. The overall effect on domestic production levels was varied and depended on factors like the specific industry, the degree of reliance on imported materials, and the effectiveness of substitute sourcing.

Effects on Employment in the Steel and Aluminum Industries

Initial predictions about job growth in the steel and aluminum industries following the tariffs were often optimistic. However, the actual impact on employment proved more nuanced. While some steel and aluminum manufacturers saw increased production and hiring, others faced challenges related to higher input costs, reduced exports, or shifts in consumer demand. The net effect on employment, therefore, was not uniform across the industry.

Data on job creation or losses was often conflicting and difficult to definitively attribute solely to the tariffs.

Potential Benefits and Drawbacks of Increased Domestic Production

Increased domestic production of steel and aluminum could bring several benefits, such as reduced reliance on foreign suppliers, greater national security regarding critical materials, and enhanced competitiveness for some domestic industries. However, potential drawbacks included higher costs for consumers and businesses, potential retaliatory measures from trading partners, and disruptions to supply chains. The benefits and drawbacks were not evenly distributed across all sectors or companies.

Data on Job Creation or Losses

Reliable, definitive data directly linking job creation or losses solely to the tariffs is difficult to obtain. Different studies and analyses offer varying results, and attributing employment changes to a single factor like tariffs is complex due to numerous concurrent economic shifts. Overall, the impact on employment appears to be mixed and varied depending on the specific sector and company.

Some companies experienced job growth, while others saw reductions or no change.

Consumer Price Impacts

The Trump administration’s tariffs on steel and aluminum significantly impacted consumer prices, ultimately affecting purchasing power and inflation rates. These tariffs, intended to protect domestic industries, inadvertently raised costs for businesses reliant on these materials, leading to price increases for consumers. Understanding the ripple effect of these tariffs on the economy requires examining the specific goods affected and the resulting inflationary pressures.The tariffs on steel and aluminum, by increasing input costs for businesses, directly translated to higher prices for finished goods.

This phenomenon is a classic example of how supply chain disruptions can affect end consumers. The price hikes were not limited to just the steel and aluminum industries themselves, but cascaded through the broader economy.

Impact on Consumer Goods

The tariffs triggered a chain reaction in numerous industries, leading to increased costs for consumer goods. Businesses, faced with higher material prices, had to absorb some of the cost increase or pass it on to consumers. This often resulted in a decrease in the purchasing power of consumers, as the same amount of money bought fewer goods and services.

- Automobiles: The automotive industry is a significant user of steel and aluminum. Increased costs for these raw materials directly affected the prices of new vehicles. Consumers experienced higher prices for vehicles, potentially impacting demand. This was particularly evident in the case of vehicles reliant on particular types of steel or aluminum alloys.

- Construction Materials: Steel and aluminum are essential in construction. Higher costs for these materials translated into increased prices for building materials, such as roofing, siding, and appliances. Consequently, homebuyers faced higher costs for new construction and renovations, potentially hindering housing market activity.

- Household Appliances: Many household appliances contain steel and aluminum components. Price increases for these materials inevitably led to higher prices for refrigerators, washing machines, and other appliances, putting a strain on household budgets.

Evidence of Inflationary Pressures

The tariffs’ impact on consumer prices is evident in various economic indicators. Government reports on inflation often showcase the rise in consumer prices following the implementation of these tariffs.

- Consumer Price Index (CPI): The CPI tracks changes in the prices of consumer goods and services. Analysis of CPI data post-tariffs often reveals a noticeable upward trend, demonstrating the impact on the cost of living. Official government data sources, such as the Bureau of Labor Statistics, can provide specific figures on this.

- Retail Sales Data: Declines in retail sales figures can often be linked to higher consumer prices. As the cost of goods increases, consumers may cut back on discretionary purchases, impacting sales figures in retail sectors reliant on the products affected by tariffs.

Specific Goods and Services Affected

The tariffs had a widespread effect on numerous consumer goods.

- Canned Goods: Aluminum cans used for beverages and food are a key area of impact. Higher aluminum prices lead to increased costs for canned goods, which ultimately affects consumers.

- Aerospace: The aerospace industry, heavily reliant on both aluminum and steel, saw increased costs for raw materials, translating to higher prices for airplanes and related services. This could have a domino effect on the cost of air travel.

Illustrative Case Studies

The Trump tariffs on steel and aluminum, while aiming to bolster domestic production, had ripple effects across various sectors. Understanding these impacts requires examining specific case studies to see how businesses adjusted, innovated, or ultimately suffered due to the changes in global trade. The following sections delve into the experiences of different industries and product categories, illustrating the varied consequences of the tariffs.

Automotive Industry Impacts

The automotive sector faced significant challenges. Manufacturers reliant on imported steel and aluminum components experienced increased production costs. These higher costs were often passed on to consumers in the form of higher prices, potentially impacting sales volume. Companies had to find alternative sourcing strategies or adjust their production plans. For example, some automakers might have had to negotiate new contracts with domestic steel producers or explore using different alloys to reduce reliance on imported materials.

Construction Industry Impacts

The construction sector, heavily dependent on steel and aluminum for materials, saw price increases for building materials. This translated into higher project costs, which could have reduced profitability for construction companies. Examples include residential and commercial building projects. The increased prices for steel and aluminum likely influenced construction timelines and potentially led to delays. Some contractors might have had to absorb these increased costs or pass them on to clients.

Appliance Industry Impacts

The appliance industry, utilizing steel and aluminum in various components, faced similar cost pressures. Washing machines, refrigerators, and other appliances saw a corresponding increase in prices, potentially impacting consumer purchasing decisions. Manufacturers might have had to explore sourcing alternative materials or adjust their production methods to offset the tariff-induced price hikes.

Tariff Impacts on Product Categories

| Product Category | Impact of Tariffs | Example |

|---|---|---|

| Steel-intensive products | Increased production costs, potential for reduced demand. | Construction materials (beams, rebar) |

| Aluminum-intensive products | Increased costs of production for companies using aluminum in their products. | Aerospace components, beverage cans |

| Automotive components | Increased costs for parts, potential for reduced profits. | Car bodies, bumpers |

| Appliances | Higher prices for consumers, potential for reduced sales. | Refrigerators, washing machines |

Comparison of Tariff Impacts Across Businesses

| Business Type | Impact of Tariffs | Example Company |

|---|---|---|

| Automotive | Increased costs for parts, potential for reduced profits. Some companies might have had to absorb the increased costs or pass them on to consumers. | Ford, General Motors |

| Construction | Higher project costs, potential for reduced profitability. Some companies might have had to absorb these increased costs or pass them on to clients. | ABC Construction |

| Appliances | Higher prices for consumers, potential for reduced sales. Companies might have had to explore alternative materials or adjust their production methods. | Whirlpool, Samsung |

| Aerospace | Increased costs for components, potential for delays in production. | Boeing, Airbus |

Long-Term Economic Effects

The Trump administration’s tariffs on steel and aluminum, while aiming to protect domestic industries, had far-reaching consequences that extended beyond the immediate price increases. These policies introduced a complex web of economic interactions with significant potential for long-term ramifications, impacting not only the United States but also the global economy. Understanding these potential long-term effects is crucial for assessing the overall impact of these trade policies.

Potential Impacts on U.S. Economic Growth

The tariffs, while intended to boost domestic steel and aluminum production, may have inadvertently hindered overall economic growth. Higher input costs for businesses using these materials could lead to reduced production, lower profits, and potentially job losses in related sectors. This ripple effect, affecting numerous industries, could potentially dampen the overall pace of economic expansion.

Effects on Trade Relationships and Global Competitiveness

The tariffs sparked retaliatory measures from other countries, leading to trade disputes and strained international relationships. This erosion of trust and cooperation in global trade could have long-lasting consequences, impacting the ability of U.S. companies to access foreign markets and compete effectively in the global marketplace. Loss of market share in export-oriented industries could negatively affect U.S. global competitiveness.

Impact on International Trade Agreements and Supply Chains

The tariffs challenged the existing framework of international trade agreements. Disruptions to established supply chains, with increased costs and delays, affected businesses reliant on global trade. Uncertainty and instability in trade relationships made long-term planning more difficult for companies and potentially discouraged foreign investment in the United States.

Data on Long-Term Impacts on GDP and Related Metrics

Studies on the long-term impact of the tariffs on U.S. GDP are ongoing and have yielded mixed results. Some studies suggest a negative correlation between the tariffs and GDP growth, while others point to the limited impact on macroeconomic indicators. Comprehensive and conclusive data on the exact extent of long-term economic consequences is still being compiled and analyzed.

For example, the Congressional Budget Office (CBO) provided various assessments of the economic impact of the tariffs, offering different insights depending on the specific aspects of the analysis.

Illustrative Case Studies of Long-Term Effects

Numerous businesses reported increased production costs due to the tariffs. Automotive manufacturers, for instance, faced higher expenses for steel, potentially impacting their profitability and pricing strategies. The subsequent effects on consumers, through higher vehicle prices, were also evident. Such ripple effects through the supply chain can significantly impact various sectors, from manufacturing to retail. This highlights the complex interplay between trade policies and the broader economy.

Illustrative Examples (No Images)

Tariffs on steel and aluminum imposed by the Trump administration created ripple effects throughout various industries. Businesses faced significant challenges, forcing them to adapt their strategies and operations to navigate the new economic landscape. This section provides hypothetical and real-world examples to illustrate the impact on businesses and industries.

Hypothetical Scenario: A Metal Fabrication Company

A hypothetical metal fabrication company, “Precision Metals Inc.”, specialized in producing custom metal parts for the automotive industry. Before the tariffs, they sourced steel from domestic and international suppliers at competitive prices. Following the implementation of tariffs, the price of imported steel increased substantially. This translated into higher production costs for Precision Metals Inc.

- Increased input costs directly impacted their profit margins, as the higher steel costs were passed on to their customers to some extent, or absorbed to maintain market share.

- The company considered options to mitigate the impact of the tariffs. These options included exploring alternative steel sources, possibly from less affected regions or utilizing domestic suppliers even if it meant compromising on quality or delivery times.

- Another approach involved negotiating with customers to absorb some of the tariff-related cost increases.

- If the cost increases were too substantial to pass on or absorb, the company might have faced the possibility of reduced profitability or even temporary production slowdowns.

Impact on the Automotive Industry

The automotive industry, heavily reliant on steel for manufacturing vehicles, experienced substantial disruptions. The tariffs directly increased the cost of steel used in vehicle production. The subsequent rise in input costs led to increased vehicle prices, which could potentially impact consumer demand.

- Manufacturers were forced to either absorb the additional cost, increasing production costs, or raise the prices of their products, potentially impacting sales volume and market share.

- Some manufacturers explored strategies to reduce their reliance on steel, like substituting steel with aluminum or other materials in some components, which often came with design challenges and higher costs.

- The tariffs contributed to the rising prices of vehicles, affecting affordability and consumer demand.

Company Decision-Making Process

A specific example from the appliance manufacturing sector illustrates how tariffs influenced decision-making. “ApplianceCorp” faced a choice: absorb the increased steel costs or pass them on to consumers. The company opted for a phased approach, absorbing a portion of the cost increases initially, while simultaneously exploring alternative suppliers and negotiating with customers to mitigate the full impact. This strategy allowed them to maintain market share but potentially reduced profitability in the short term.

Final Summary

In conclusion, the Trump tariffs on steel and aluminum presented a multifaceted challenge for businesses. The initial expectations were met with a range of impacts, from price increases and production adjustments to global trade tensions and long-term economic ramifications. This analysis underscores the complex interplay between trade policies, domestic production, and consumer prices. Further research is warranted to fully understand the long-term economic consequences of such trade actions.