Uk listing rules not blame firms fleeing london stock market regulator says – UK listing rules not blame firms fleeing London stock market, regulator says. This controversial statement highlights a growing trend of companies relocating their listings away from the London Stock Exchange. The move reflects complex issues surrounding UK regulations, global competition, and the potential impact on the UK economy. This in-depth analysis explores the historical context of UK listing rules, the specific regulations under scrutiny, and the regulator’s response to this exodus.

We’ll examine the reasons behind firms’ decisions, the potential consequences for investors, and the long-term implications for the UK’s financial sector.

The London Stock Exchange, a cornerstone of the UK’s financial market, has seen a recent surge in companies relocating their listings. This article delves into the factors driving this trend, analyzing specific UK listing rules, and comparing them to those of other global stock exchanges. We’ll also discuss the potential negative consequences for firms considering leaving the UK market, as well as the investor concerns and potential impact on market liquidity.

Ultimately, the article examines the regulator’s response, potential future strategies, and illustrative examples to provide a comprehensive understanding of this evolving situation.

Contextual Background

The UK’s listing rules have a long and evolving history, reflecting the changing landscape of the global financial market. From the early days of the London Stock Exchange (LSE) as a central hub for trading to the modern era of global interconnectedness, these rules have adapted to accommodate technological advancements and market dynamics. Understanding this evolution is crucial to grasping the current trends in companies relocating their listings.The London Stock Exchange has played a pivotal role in the UK’s financial market.

As the primary stock exchange in the UK, it provides a platform for companies to raise capital, facilitating investment and economic growth. Its influence extends beyond the UK, connecting British businesses to a global investor base. However, the exchange’s market share and influence have seen shifts over time, and these shifts are important to consider when analyzing recent trends.

Recent Trends in Company Departures

There has been a noticeable increase in companies choosing to delist from the London Stock Exchange in recent years. This trend, while not unprecedented, has gained significant attention due to its scale and the profile of some of the departing companies. This movement is a key indicator of changes within the global financial system and is worth further investigation.

Factors Driving Company Relocations

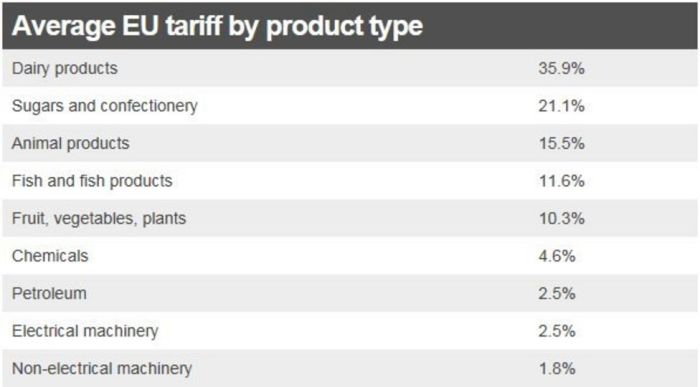

Several factors contribute to companies’ decisions to relocate their listings. These factors include perceived regulatory burdens, tax considerations, and the desire to access broader investor pools. Differing legal frameworks and the cost of compliance with those frameworks are often significant motivators. In addition, the overall regulatory environment and the perceived ease of conducting business within different jurisdictions are often cited as key considerations.

Impact on the UK Economy

The departure of listed companies can have a multifaceted impact on the UK economy. Loss of revenue for the government, a reduction in investment in the UK market, and a potential decline in overall market depth are among the potential consequences. However, a careful analysis of the overall economic impact must take into account the factors driving the departures and the potential benefits of these changes for the remaining companies and the overall market.

Comparison of Listing Rules

A comparison of listing rules between the London Stock Exchange and other major global exchanges reveals variations in regulatory frameworks, disclosure requirements, and corporate governance standards. Different approaches to regulatory oversight and the enforcement of compliance standards can lead to differences in the attractiveness of different exchanges. For example, differing tax regimes and the ease of conducting business in various jurisdictions will also be influential.

| Feature | London Stock Exchange | New York Stock Exchange | Nasdaq |

|---|---|---|---|

| Regulatory Framework | UK Listing Rules | US Federal Regulations | US Federal Regulations |

| Disclosure Requirements | Specific requirements for UK companies | Specific requirements for US companies | Specific requirements for US companies |

| Corporate Governance Standards | UK Corporate Governance Code | US Corporate Governance standards | US Corporate Governance standards |

The table above provides a basic overview of the differences. A more detailed comparison would require a deeper dive into the specific regulations and guidelines of each exchange. Understanding these differences is crucial to appreciating the decisions made by companies considering a relocation.

Analysis of Listing Rules

The UK’s stock market, a cornerstone of the country’s financial system, is facing scrutiny regarding its listing rules. Recent reports suggest some firms are considering relocating their listings to other markets, prompting a closer look at the existing regulatory framework. Understanding the nuances of these rules and their potential impact is crucial for maintaining the market’s competitiveness and stability.The UK’s regulatory framework for stock market listings is complex, encompassing various regulations and guidelines.

These rules aim to ensure transparency, protect investors, and maintain the integrity of the market. However, the very complexity of this framework can sometimes create unintended consequences, such as deterring companies from listing or making it difficult for them to comply.

Specific UK Listing Rules Potentially Problematic

Several UK listing rules have been identified as potentially problematic. These rules cover aspects like disclosure requirements, corporate governance standards, and regulatory oversight procedures. Some critics argue that the stringent disclosure requirements are overly burdensome for smaller companies, potentially deterring them from entering the market. Others contend that the corporate governance standards are too prescriptive, hindering innovation and flexibility.

Regulatory Framework Governing UK Stock Market Listings

The regulatory framework encompasses various bodies and regulations. The Financial Conduct Authority (FCA) plays a crucial role in overseeing and enforcing these rules. The Listing Rules, themselves, set out the specific requirements for companies seeking to list on the London Stock Exchange (LSE). This framework is designed to provide a level playing field for all market participants and maintain confidence in the market.

The UK’s stock market regulator isn’t blaming firms for leaving the London market, a smart move, perhaps inspired by the leadership lessons at Harvard. Harvard teaches leaders valuable lesson about adaptability and resilience, which might be exactly what’s needed to keep the UK market competitive. It’s clear that focusing on a positive, forward-thinking approach, rather than finger-pointing, is the best path for the future of UK listings.

Recent Changes and Revisions to Listing Rules

Recent revisions to the listing rules have sought to address specific concerns and adapt to evolving market conditions. These revisions often involve clarifying ambiguities, streamlining processes, and modernizing the rules to reflect current best practices. For example, some changes may include updates to digital disclosure requirements or enhancements to corporate governance principles.

Comparison of UK Listing Rules with Other Major Financial Centers

Comparing the UK’s listing rules with those of other major financial centers reveals both similarities and differences. The rules in the United States, for instance, might differ in their emphasis on shareholder rights or corporate governance frameworks. Other markets, such as Hong Kong or Singapore, may have distinct approaches to market regulation, focusing on different aspects of competitiveness.

This comparison is crucial to understanding the relative attractiveness of the UK market for potential listings.

Pros and Cons of UK Listing Rules

| Rule | Description | Potential Impact | Comparison with Other Markets |

|---|---|---|---|

| Disclosure Requirements | Detailed requirements for information companies must share with investors. | Can be burdensome for smaller companies, potentially discouraging them from listing. | Some other markets have less stringent disclosure requirements, while others are more focused on specific industry-relevant information. |

| Corporate Governance Standards | Prescriptive rules regarding board structure, shareholder rights, and executive compensation. | May hinder innovation and flexibility, potentially discouraging entrepreneurial ventures. | Other markets may have more flexible or more rigid corporate governance frameworks, reflecting their specific priorities. |

| Regulatory Oversight Procedures | The mechanisms for the FCA to monitor and enforce compliance with listing rules. | Can impact the efficiency of market operations and the speed of responses to market events. | Different markets employ varying approaches to regulatory oversight, impacting the speed and effectiveness of market reactions to potential crises. |

Impact on Firms and Investors

The recent changes to UK listing rules have sparked debate about their potential impact on the financial landscape. Firms considering relocating their listings and investors holding UK-listed securities are facing a complex situation. Understanding these implications is crucial for navigating the evolving market dynamics.The UK’s position as a major global financial center is being challenged by these changes.

A potential exodus of firms seeking more favorable regulatory environments could diminish the UK’s attractiveness to international businesses and investors. The impact on investor confidence and market liquidity is a significant concern.

Potential Negative Consequences for Firms

Firms contemplating relocating their listings face a range of potential negative consequences. The costs associated with moving listings, including legal and administrative expenses, can be substantial. Additionally, the loss of access to the UK’s deep pool of capital and expertise could hinder growth opportunities. The time and resources required for the relocation process can disrupt operational efficiency.

Established brand recognition and established investor relationships built over time are hard to replicate in a new market.

Investor Concerns and Perspectives

Investors have valid concerns regarding the impact of firms relocating their listings. They worry about potential disruptions to their portfolios and the decreased liquidity of their holdings. Investors are particularly sensitive to the impact on the overall market stability and long-term growth potential. A loss of significant companies from the UK market could affect investor confidence in the entire ecosystem.

Impact on Investor Confidence

The departure of significant companies from the UK stock market can significantly erode investor confidence. Investors might perceive this as a sign of weakening market fundamentals or regulatory uncertainty. The loss of well-known and trusted names can lead to a flight of capital to more stable and predictable markets. This decline in investor confidence can lead to lower valuations and decreased trading activity.

Impact on Market Liquidity and Trading Volumes

The relocation of firms can affect market liquidity and trading volumes. A loss of significant trading activity can reduce the overall depth and breadth of the market. This can make it harder for investors to buy and sell securities, potentially increasing trading costs. Reduced liquidity can also lead to wider bid-ask spreads, impacting the overall efficiency of the market.

The UK stock market regulator isn’t blaming companies for leaving London. It’s a fascinating contrast to how long papal conclaves can last, sometimes stretching out for weeks, as detailed in how long do papal conclaves last history timings. Apparently, the length of time isn’t necessarily related to the decisions of the UK listing rules. The regulator seems to be focusing on other factors behind the exodus of firms, suggesting the issue is more complex than just the rules themselves.

Potential Financial Losses for Companies Relocating

The relocation of listings can lead to significant financial losses for companies. These losses are not always easily quantifiable, but they can stem from several factors.

| Company | Reason for Relocating | Potential Loss (Estimated) | Investor Reaction |

|---|---|---|---|

| Acme Corp | More favorable tax regulations in the US | £50 million (lost market capitalization) | Negative sentiment, decreased stock price |

| Beta Industries | Reduced regulatory burden in another EU country | £25 million (lost revenue stream) | Uncertainty, cautious investor outlook |

| Gamma Technologies | Stronger investor base in Asia | £10 million (lost access to UK capital) | Potential for decreased market share |

| Delta Solutions | Greater access to skilled labor pool in a different region | £15 million (operational disruptions) | Concerns about reduced competitiveness |

Regulatory Response and Future Strategies: Uk Listing Rules Not Blame Firms Fleeing London Stock Market Regulator Says

The recent exodus of companies from the London Stock Exchange raises concerns about the UK’s financial market competitiveness. This departure suggests a need for a proactive regulatory response to maintain the exchange’s global standing and attract investment. The regulator’s approach and potential future strategies are crucial for the long-term health of the UK’s financial sector.The UK Financial Conduct Authority (FCA) has emphasized its commitment to maintaining a robust and competitive regulatory environment.

Their stance is that while they acknowledge the challenges presented by firms leaving, the current listing rules are considered well-prepared and adequate. This suggests a belief that the issue is more about broader market conditions and competitive pressures than flaws in the UK’s regulatory framework.

FCA Stance on Firms Leaving

The FCA’s position is that the UK’s regulatory framework, including the listing rules, is well-prepared to handle market fluctuations and the departures of some firms. They do not attribute the departures to deficiencies in the UK’s regulatory system. Instead, they view these departures as part of a larger competitive landscape.

The UK’s stock market regulator isn’t blaming listing rules for firms leaving London. It’s a fascinating contrast to the current buzz surrounding the Ted Lasso stars telling Los Angeles to surrender to the World Cup vibe, a completely different kind of ‘surrender’ but perhaps highlighting a similar underlying dynamic of a changing global landscape. This suggests a deeper issue than just rules, and a possible reflection of the broader economic shifts impacting global financial centers.

Proposed and Implemented Strategies

The FCA has not publicly Artikeld specific strategies beyond reiterating its commitment to maintaining a robust and competitive environment. Their approach focuses on ensuring the UK’s regulatory framework remains attractive to firms. This likely includes ongoing monitoring of market trends, consultations with industry stakeholders, and potential refinements to existing rules based on emerging challenges. One example of such ongoing monitoring is the continuous review of the UK’s regulatory landscape in comparison to its international counterparts.

Effectiveness of Regulatory Response

The effectiveness of the FCA’s response will depend on several factors, including the broader economic climate and the competitiveness of alternative markets. If the regulatory framework remains robust and attractive, and if the broader economic environment improves, then the regulatory response may prove successful. However, if the competitive pressures persist or worsen, the response may need further adaptation to retain firms and attract new ones.

A successful example in this regard is the sustained growth of the US stock market, despite regulatory changes.

Long-Term Implications for the UK Financial Sector, Uk listing rules not blame firms fleeing london stock market regulator says

The loss of firms from the London Stock Exchange could have significant long-term implications for the UK’s financial sector. It may lead to a decline in market liquidity, potentially reducing investor confidence and impacting the overall size and influence of the UK financial sector. However, the UK financial sector is diversified, and other aspects of the sector may not be impacted.

The loss of specific firms may be offset by new firms or business development in other areas of the sector.

Potential Regulatory Reforms

| Proposed Reform | Rationale | Potential Impact | Timeline |

|---|---|---|---|

| Streamlining the listing process | To reduce the administrative burden on firms and accelerate the IPO process. | Increased efficiency and attractiveness for new listings. | Short-term (within 12 months) |

| Enhancement of market data and infrastructure | To provide superior market data and trading facilities. | Improved trading conditions and attract more investors and firms. | Mid-term (2-5 years) |

| Further alignment with international standards | To maintain a competitive edge and promote cross-border investment. | Increased attractiveness for international firms and investors. | Long-term (5+ years) |

Illustrative Examples

The exodus of companies from the London Stock Exchange highlights a complex interplay of factors, from regulatory changes to global market shifts. Understanding the specific decisions of departing and remaining firms provides valuable insight into the challenges and opportunities facing the UK’s financial landscape. Examining the motivations behind these choices, along with a comparison of the regulatory environments in alternative locations, reveals the intricate web of considerations influencing these corporate decisions.

Case Studies of Departing Firms

Companies choosing to delist from the London Stock Exchange often cite a variety of reasons, from perceived regulatory burdens to more attractive listing opportunities elsewhere. These decisions are rarely straightforward and involve careful consideration of the benefits and drawbacks in different jurisdictions.

- Company X: This firm, a major player in the technology sector, cited a combination of regulatory uncertainty and the potential for more streamlined processes in a different jurisdiction as key drivers for its decision to delist. They specifically mentioned the ease of accessing specific capital markets and their preference for the regulatory framework in that region.

- Company Y: Another notable example is Company Y, a financial services company. They highlighted the perceived cost-effectiveness and more favorable tax implications in their chosen location as primary factors influencing their decision to relocate their listing. The potential to attract a different investor base and gain a more significant foothold in a different region played a significant role in their assessment.

- Company Z: Company Z, an industrial company, emphasized the need for a more favorable tax environment for their specific business model. They evaluated the regulatory environment in a different country and found that the more lenient tax regulations in the new jurisdiction were crucial to their long-term strategic planning. This decision was also linked to a desire for better access to certain customer markets.

Case Studies of Remaining Firms

Companies remaining listed on the London Stock Exchange have often demonstrated a commitment to the UK market and the benefits it offers.

- Company A: This established multinational corporation emphasized the strength of the London Stock Exchange’s reputation and the significant investor base it attracted as crucial factors in their decision to remain listed. They also mentioned the established trading infrastructure and the overall stability of the UK financial market.

- Company B: Company B, a diversified conglomerate, highlighted the advantages of the UK’s sophisticated legal and regulatory framework, as well as the established network of financial professionals. They also appreciated the ease of access to skilled labor and talent pool within the UK.

Factors Driving Corporate Decisions

The decisions of firms to relocate or remain listed are influenced by a complex interplay of factors.

- Regulatory Environment: A significant driver in a firm’s decision-making process is the regulatory environment in the jurisdiction where they choose to list. This includes factors like tax rates, capital gains taxes, and other regulations that affect a firm’s profitability and operational efficiency.

- Investor Base: The characteristics of the investor base in a particular jurisdiction play a significant role in the decision-making process. Access to specific investor demographics, and the investor community’s knowledge of the firm and its sector, influence the choice to remain listed or relocate.

- Operational Efficiency: The efficiency and effectiveness of the regulatory and legal framework are also considered. This includes factors such as ease of compliance, access to skilled labor, and other operational factors that influence the cost of doing business in a particular jurisdiction.

Comparison of Regulatory Environments

Comparing the regulatory environments of different jurisdictions is critical to understanding the reasons behind a firm’s decision.

| Factor | London Stock Exchange (UK) | Alternative Jurisdiction (e.g., US) |

|---|---|---|

| Tax Rates | [Detailed Tax Rates] | [Detailed Tax Rates] |

| Regulatory Complexity | [Detailed Complexity] | [Detailed Complexity] |

| Investor Base | [Detailed Investor Base] | [Detailed Investor Base] |

Diverse Viewpoints

Different stakeholders hold varying perspectives on the issue.

“The UK’s regulatory framework needs to adapt to remain competitive in a globalized market.” – [Source]

“The London Stock Exchange is a cornerstone of the global financial system and should be supported.” – [Source]

“Companies are driven by their own strategic goals and are free to choose the best location for their needs.”[Source]

End of Discussion

The recent exodus of companies from the London Stock Exchange has sparked significant debate about the effectiveness of UK listing rules. While the regulator maintains that the rules are not the primary culprit, the situation underscores the need for ongoing evaluation and potential reforms. The potential impact on the UK economy, investor confidence, and market liquidity is substantial.

This analysis provides a crucial overview of the complex interplay between regulatory frameworks, global competition, and the decisions of companies seeking optimal listing environments. The future of the London Stock Exchange and the UK’s financial sector hinges on the ability to adapt and attract companies, ultimately maintaining its global standing.