Vanguard expands investor choice proxy voting program, giving individual investors more say in how their investments vote on corporate decisions. This significant move allows investors to tailor their proxy voting strategies to align better with their personal investment goals and values. Historically, Vanguard has played a crucial role in shareholder advocacy, and this expansion builds on that legacy. The new features will empower various investor types, from individual retail investors to sophisticated institutional portfolios.

This impacts investment strategies across the board, offering more flexibility and potentially altering the outcomes of corporate votes.

The expanded program details specific options for investors to directly influence proxy votes. This includes new features and options, enabling a deeper level of control over corporate decision-making. The comparison between previous and new options reveals significant enhancements, offering potential benefits and drawbacks depending on the investor’s specific circumstances. A table outlining the diverse proxy voting choices available provides a clear understanding of the expanded options.

This enables investors to effectively integrate these new choices into their investment strategies, tailoring their approach to align with personal values and goals.

Vanguard’s Proxy Voting Program Expansion

Vanguard, a prominent investment giant, has expanded its investor choice proxy voting program, offering investors more control over how their assets are managed. This move signifies a significant shift in the landscape of institutional investing, empowering individual investors with greater agency in corporate governance. This expansion builds on Vanguard’s long history of engagement in proxy voting, marking a step toward a more democratic and responsive corporate environment.This expanded program reflects a growing awareness that individual investors have a critical role in shaping corporate behavior and promoting long-term value creation.

Vanguard’s initiative not only enhances investor agency but also positions them to influence important corporate decisions, potentially leading to better outcomes for the long-term value of their investments.

Historical Context of Vanguard’s Proxy Voting

Vanguard has long been a significant player in the proxy voting arena. Their involvement stems from their commitment to long-term investment strategies and their belief in the importance of shareholder engagement. Historically, Vanguard has voted proxies based on a set of predefined criteria. This program allowed for a degree of shareholder control but limited the ability of individual investors to directly influence the voting process.

The expansion of the program now enables a wider range of choices.

Key Aspects of the Program Expansion

The expansion of Vanguard’s investor choice proxy voting program features several key aspects. Investors now have the option to customize their proxy voting instructions, choosing from a variety of pre-defined voting options or even specifying their own unique guidelines. This empowers investors to align their voting choices with their specific investment objectives and values. The enhanced platform allows for more detailed and personalized voting instructions, making the process more efficient and user-friendly.

Crucially, the program provides clear communication of voting outcomes, allowing investors to understand how their choices impacted corporate decisions.

Impact on Different Investor Types

The program’s expansion will impact different investor types in various ways. For individual investors, it offers greater control over their investment choices. They can now directly participate in corporate governance decisions, influencing outcomes aligned with their values and long-term investment goals. For institutional investors, the expansion provides flexibility in managing their voting strategies, potentially leading to more nuanced and targeted approaches to corporate governance.

Vanguard’s expansion of their investor choice proxy voting program is a big deal, offering more options for individual investors. While major financial news often focuses on these kinds of developments, it’s interesting to see how other sports news, like Ian Happ rapping half cubs four homers win over the Phillies, here’s the story , can also influence investor behavior.

Ultimately, this broadened investor choice is a positive development for the financial market overall.

Vanguard’s approach is intended to empower a broader range of investors, offering choice and control to a greater segment of the investment community.

Examples of How This Program Affects Investment Strategies

The program’s impact on various investment strategies is significant. For example, socially conscious investors can now actively vote against companies with unsustainable practices. Value investors can use this program to influence companies toward cost-cutting and efficiency improvements. Growth investors may use the program to encourage management teams to adopt innovative practices. The expanded program provides a framework for investors to align their voting decisions with their specific investment objectives.For instance, a responsible investor focused on environmental sustainability can vote against companies with poor environmental records, potentially encouraging more sustainable business practices.

An investor seeking companies with strong governance structures might use the program to vote in favor of directors who promote good governance practices. These examples demonstrate how the expansion can directly influence a variety of investment approaches and strategies.

Enhanced Investor Choice in Proxy Voting

Vanguard’s expansion of its investor proxy voting program provides more control and options for individual investors. This allows for a more tailored approach to voting on corporate decisions, potentially aligning investor interests with company strategies more effectively. This expanded program is a significant step towards empowering investors and potentially leading to more responsible corporate governance.

Specific Ways Investors Gain More Control

The expansion offers investors more granular control over their proxy votes. Instead of a simple “yes” or “no” vote, investors can now choose from a wider range of options. This allows investors to express more nuanced opinions on specific resolutions, potentially impacting corporate behavior and shareholder returns. This more granular approach encourages investors to carefully consider the implications of each vote and weigh the potential outcomes against their individual investment strategies.

New Features and Options Introduced

Several new features are available to investors. These include the ability to vote on individual resolutions, rather than just the entire proxy statement. Investors can also cast “withhold” votes, which allows them to express their opposition to specific resolutions without necessarily voting against the entire proposal. This flexibility enables investors to target specific concerns, encouraging a more engaged and proactive approach to proxy voting.

The introduction of a “no” vote on specific resolutions empowers investors to challenge decisions that they believe are not in the best interest of the company or their investments.

Comparison of Previous and New Options, Vanguard expands investor choice proxy voting program

Previously, investors often faced a binary choice, making it challenging to express specific concerns. The expanded program allows for a more nuanced approach, providing investors with more choices in expressing their viewpoints. This new program allows for detailed feedback on proposals, increasing the potential impact of individual investor votes. The prior approach, often relying on a “yes” or “no” vote, was less effective in reflecting the diverse perspectives of investors.

The new approach offers more precise and targeted feedback, which could lead to more beneficial outcomes for the shareholders.

Potential Benefits and Drawbacks

The expanded options can lead to a more engaged and informed investor base. Investors can better align their votes with their investment goals, potentially leading to better corporate governance and improved returns. However, the increased complexity could also lead to a more time-consuming process for some investors. Navigating the new choices might require more research and analysis, which could be a significant hurdle for some.

It’s also possible that this increased control might not always translate to tangible improvements, especially if the decisions are already aligned with shareholder interests.

Different Proxy Voting Choices

| Option | Description | Impact on Investors | Example Use Case |

|---|---|---|---|

| Yes | Support of the entire proposal. | Affirms agreement with the proposal. | Supporting a company’s dividend policy. |

| No | Opposition to the entire proposal. | Expresses disagreement with the proposal. | Opposing a merger agreement. |

| Withhold | Opposition to a specific resolution within a proposal. | Expresses targeted opposition without opposing the entire proposal. | Disagreeing with a compensation package for executives. |

| Specific Resolution Vote | Vote on individual resolutions within the proposal. | Enables detailed feedback on specific elements of the proposal. | Agreeing with a change to company policy while opposing a particular financial transaction. |

Implications for Corporate Governance and Shareholder Activism

Vanguard’s expanded proxy voting program offers a significant opportunity for enhanced shareholder engagement and influence on corporate governance. This expanded access to voting choices empowers investors with greater control over how companies are managed, potentially leading to more responsible and shareholder-centric decision-making. This shift toward greater investor involvement has the potential to reshape the landscape of corporate governance and investor activism.

Impact on Corporate Governance

The expansion of Vanguard’s proxy voting program directly impacts corporate governance by increasing shareholder participation in the decision-making processes of publicly traded companies. Investors now have more tools to influence company policies and practices, leading to a more active and engaged shareholder base. This increased scrutiny can drive companies to be more transparent and accountable in their operations and financial reporting.

Vanguard’s expansion of investor choice in proxy voting is a significant move, offering more control to individual investors. Meanwhile, it’s interesting to see how this ties into other market activity, like the recent sale of the Dutch unit Cefetra by a Baywa unit for roughly 143 million euros. This sale highlights broader trends in the global investment landscape.

Ultimately, Vanguard’s program seems designed to empower investors in a complex market, regardless of the happenings of other companies.

By giving investors more choices in how they vote, the program encourages a more thoughtful and strategic approach to proxy voting.

Vanguard’s expansion of investor choice in proxy voting is a big deal for financial freedom. It’s exciting to see more options for individual investors, but let’s be honest, it’s a bit like the Yankees hoping for a different outcome against the Red Sox’s Walker Buehler here. Ultimately, this new program empowers investors to have a greater say in how their money is managed, which is a positive step forward for the future of the financial markets.

Influence on Shareholder Activism

This program empowers shareholders to act more strategically. By offering a wider range of proxy voting options, Vanguard is effectively amplifying the voice of shareholders, especially smaller or individual investors. This heightened engagement can fuel shareholder activism, encouraging investors to advocate for changes in corporate policies, practices, or even management. Increased access to information and voting tools can potentially result in more effective campaigns aimed at achieving specific shareholder goals.

Potential Outcomes of Increased Shareholder Involvement

Increased shareholder involvement, facilitated by expanded proxy voting programs, can result in several positive outcomes. Companies might adopt more sustainable practices, improve financial transparency, and focus on long-term value creation. Investors might see a more responsive corporate culture, potentially leading to better risk management and improved financial performance. Increased pressure on companies to address social and environmental concerns can lead to more ethical and responsible business practices.

Effects on Corporate Decision-Making

The program’s impact on corporate decision-making is multi-faceted. Increased shareholder engagement can prompt companies to prioritize long-term value over short-term gains. By holding companies accountable for their actions, the program fosters a more responsible and sustainable corporate culture. This enhanced engagement can lead to a more collaborative dialogue between management and shareholders, potentially leading to better informed and more shareholder-friendly decisions.

Potential Scenarios Impacting Corporate Decisions

| Scenario | Description | Outcome | Investor Impact |

|---|---|---|---|

| High Shareholder Activism | Significant shareholder engagement and vocal advocacy for specific issues. | Companies potentially altering policies to align with shareholder preferences, leading to improved environmental, social, and governance (ESG) performance. | Increased influence on corporate decisions, potentially leading to better alignment of corporate practices with shareholder values. |

| Low Shareholder Engagement | Limited shareholder participation in proxy voting and engagement activities. | Companies may not feel the pressure to adapt their policies or practices, potentially leading to a gap between corporate actions and shareholder expectations. | Reduced influence on corporate decision-making, potentially leading to a disconnect between investor interests and corporate strategies. |

| Targeted Shareholder Campaigns | Shareholders focus on specific issues like executive compensation or board diversity. | Companies may be pressured to revise compensation packages or improve board representation. | Direct impact on specific corporate policies and practices, influencing governance structure and executive decisions. |

Impact on Portfolio Management and Investment Decisions

Vanguard’s expansion of its investor choice proxy voting program significantly impacts portfolio management strategies and investment decision-making processes. This enhanced transparency and shareholder empowerment will force investors to reassess their approach to corporate governance and shareholder engagement. The program’s influence extends beyond simply voting proxies; it prompts a deeper analysis of company policies and future investment potential.

Impact on Portfolio Management Strategies

The expanded proxy voting program compels portfolio managers to integrate shareholder engagement into their investment strategies. This involves more than just voting; it necessitates actively researching and understanding the impact of corporate governance practices on long-term value creation. Managers must now weigh not only financial performance metrics but also a company’s commitment to ESG (Environmental, Social, and Governance) factors, which are becoming increasingly important for investors.

Influence on Investment Decision-Making

The program influences investment decision-making by placing a greater emphasis on companies with strong corporate governance practices and a demonstrable commitment to shareholder value. Investors can now use proxy voting data to identify companies with potential risks or opportunities. This expanded access to voting information allows for a more nuanced understanding of company behavior, leading to more informed investment decisions.

Investors are no longer limited to financial reports; they can now access and utilize proxy voting data to assess a company’s long-term prospects.

Strategies for Integrating the Program into Portfolios

Several strategies can integrate this program into portfolio management:

- Thorough Due Diligence: A crucial strategy is to conduct in-depth research on companies’ proxy voting records. This will allow for a more comprehensive evaluation of their corporate governance practices, identifying potential risks or opportunities. Managers must scrutinize companies’ stances on environmental and social issues, as well as their governance structures.

- Portfolio Diversification: Diversifying portfolios by considering companies with strong voting records can mitigate risks associated with poor governance. This strategy is becoming increasingly relevant, as ESG factors are becoming integral to investment decisions.

- Engagement with Management: Some managers may directly engage with management teams of companies in their portfolios, highlighting their voting preferences and advocating for better corporate governance practices. This active engagement could influence future decisions and demonstrate a commitment to shareholder value.

Examples of Different Investment Advisors’ Utilization

Various investment advisors employ diverse approaches to utilize the expanded program.

- Activist Funds: Activist funds often use the program to identify companies with weak governance and then directly engage with management to advocate for changes.

- ESG Focused Funds: ESG-focused funds prioritize companies with strong ESG records, and the program provides a direct tool to assess these factors. They typically filter their investments based on voting patterns on environmental and social issues.

- Long-Term Value Investors: Long-term value investors use the program to identify companies with strong corporate governance and potential for long-term growth. They scrutinize the voting records to assess the company’s commitment to shareholder value.

Integration into Various Investment Strategies

| Strategy | Integration Method | Benefits | Drawbacks |

|---|---|---|---|

| Active Management | Thorough research of proxy voting records; direct engagement with management | Identification of potential risks/opportunities; influence on corporate governance | Increased time commitment for research; potential for conflicts of interest |

| Passive Management | Scrutinizing voting records for companies in index funds; using proxy voting data to assess companies | Improved portfolio alignment with long-term values; reduced risk of exposure to poor governance | Limited influence on corporate governance; potential for passive strategies to become less diversified |

| ESG Investing | Prioritizing companies with strong ESG records; filtering investments based on proxy voting patterns | Alignment with environmental and social values; improved risk mitigation | Potential for bias in ESG ratings; limited availability of data on certain aspects |

Program’s Accessibility and Usability for Investors: Vanguard Expands Investor Choice Proxy Voting Program

Vanguard’s expanded proxy voting program aims to empower all investors, regardless of their background or resources. This accessibility is crucial for fostering a more inclusive and equitable investment landscape, where diverse voices can contribute to corporate governance. The program’s user-friendliness and intuitive design are vital to its success in engaging a broader investor base.The program’s design considers various investor groups, recognizing the diverse needs and technical proficiency levels within the investment community.

This includes individual investors, institutional investors, and sophisticated high-net-worth investors. The focus is on creating a seamless experience that caters to the varying degrees of familiarity with proxy voting procedures.

Accessibility for Different Investor Groups

The program strives to be accessible to investors with varying levels of technical expertise and access to resources. This includes providing multilingual support, readily available FAQs, and interactive tutorials. For investors who prefer hands-on assistance, dedicated support channels are also available. For example, the program could offer a dedicated phone line for investors requiring detailed explanations or step-by-step guidance.

Usability and User Experience

The user experience is a paramount consideration. A clear, intuitive interface is essential for navigating the program’s features. The program should use simple language, avoid jargon, and provide ample visual aids to help users understand complex concepts. Consistent design elements, such as clear labeling and intuitive navigation, are key to creating a positive user experience. For example, a well-organized dashboard displaying voting recommendations, historical voting records, and relevant company information could significantly enhance usability.

Resources and Tools for Investor Support

Comprehensive resources are vital for assisting investors in effectively utilizing the program. These resources should include detailed FAQs, video tutorials, and interactive guides. Furthermore, the program should offer a comprehensive help center with detailed instructions and examples. For instance, a tutorial explaining the voting process, highlighting different voting options, and demonstrating how to use the voting tools would be a valuable resource.

Examples of User Interfaces and Tools

The program should incorporate user-friendly features, such as interactive charts and graphs that visually represent voting data and company performance. Tools that allow investors to compare their voting decisions with those of other investors or with benchmark indexes could be beneficial. Furthermore, intuitive search functionality would enable investors to quickly find the information they need. A well-designed voting recommendation tool, complete with clear explanations and supporting evidence, could empower investors to make informed decisions.

User Guide for Utilizing the Program

This guide provides a step-by-step approach to utilizing the Vanguard Proxy Voting Program.

| Step | Action | Screenshot Description |

|---|---|---|

| 1 | Log in to your Vanguard account. | A screen displaying the Vanguard login page, with clear fields for username and password. A “Forgot Password?” link is visible. |

| 2 | Navigate to the Proxy Voting section. | A screen showcasing the navigation menu with a clearly labeled “Proxy Voting” section. |

| 3 | Review the voting recommendations. | A dashboard displaying voting recommendations for the relevant companies. The dashboard should clearly highlight the voting recommendations, and the supporting rationale is clearly presented. |

| 4 | Make your voting selections. | A screen with voting options for each company. The screen should provide clear explanations for each voting choice. |

| 5 | Submit your voting selections. | A confirmation screen showing the submitted voting selections and a summary of the actions taken. |

Future Trends and Potential Developments

Vanguard’s expansion of its investor choice proxy voting program marks a significant step towards greater shareholder empowerment. This evolution suggests a growing trend of investor engagement and a potential shift in the balance of power within corporate governance. The implications for the future of investment strategies and the overall market dynamics are substantial and warrant careful consideration.

Potential Trends in Investor Engagement

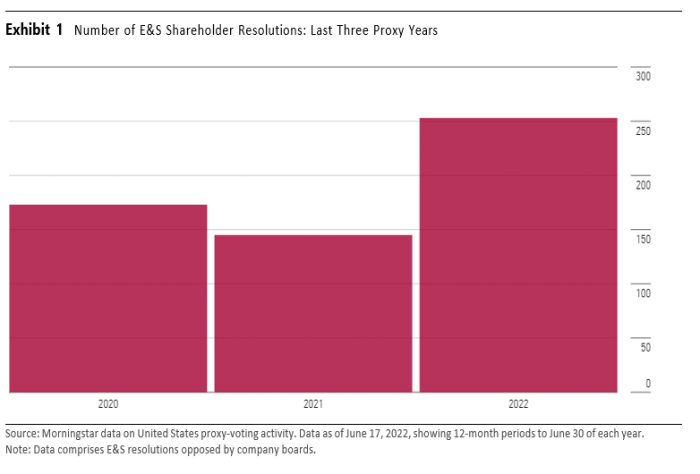

Investor activism is on the rise, driven by factors like environmental, social, and governance (ESG) concerns and a desire for more direct influence over corporate decisions. This trend is likely to continue, with investors seeking greater transparency and accountability from companies. Consequently, the ability to effectively participate in proxy voting, as offered by Vanguard’s expanded program, will become increasingly important for individual investors.

The program’s success will likely inspire other financial institutions to follow suit, further democratizing investment participation.

Potential Improvements and Enhancements

The program’s accessibility and user-friendliness are crucial for widespread adoption. Future enhancements could include more detailed explanations of proxy voting proposals, intuitive interfaces for navigating complex voting procedures, and potentially even tools for investors to collaboratively research and discuss proposals. Integration with other investor platforms and resources would also significantly enhance usability and provide a more holistic view of investment options.

For example, seamless integration with ESG reporting platforms could allow investors to directly link voting decisions to their ethical investment objectives.

Impact on Portfolio Management and Investment Decisions

The expanded proxy voting program will likely influence portfolio management strategies, as investors will have more nuanced ways to align their investments with their values. This will require portfolio managers to consider the voting records of companies they invest in and potentially adjust their holdings based on shareholder votes. The ability to filter investments based on ESG criteria and proxy voting outcomes will become a key consideration in constructing portfolios.

Consider how a company’s voting record on climate change policies could impact an investor’s decision to hold shares.

Potential Impact on the Investment Landscape

The increased investor participation enabled by programs like Vanguard’s could lead to more engaged and informed shareholders. This, in turn, could pressure companies to adopt more sustainable and ethical practices. Increased shareholder activism could reshape corporate governance, demanding greater accountability and transparency. It might also create a more competitive market, as companies strive to attract and retain investors who prioritize responsible investment.

Future Scenarios

- Increased Shareholder Activism: Investors become more involved in corporate decision-making, leading to a greater focus on ESG issues and potentially pushing companies to adopt more sustainable practices. This could result in a paradigm shift where companies prioritize long-term value creation over short-term gains.

- Enhanced Transparency and Accountability: Companies proactively disclose their voting records and engagement in ESG initiatives, leading to greater transparency in corporate governance. This will likely be facilitated by the development of standardized reporting frameworks for proxy voting data.

- Rise of Algorithmic Voting: Sophisticated algorithms could analyze proxy voting proposals, helping investors make more informed decisions. This could democratize access to complex information, but also raise concerns about potential bias and lack of human judgment in decision-making.

- Diversification of Investment Strategies: Investors increasingly consider proxy voting records and ESG factors alongside traditional financial metrics, leading to a more nuanced and diverse range of investment strategies.

- Increased Collaboration Among Investors: Investors may collaborate to advocate for common goals through coordinated proxy voting, leading to collective impact on corporate behavior. This would potentially be facilitated through online platforms and investor networks.

Final Review

In conclusion, Vanguard’s expanded investor choice proxy voting program represents a significant advancement in shareholder engagement. This program will potentially impact corporate governance, shareholder activism, and investment strategies. Increased investor participation can influence corporate decision-making, impacting portfolios and investment returns. The program’s accessibility and usability for different investor groups, along with available resources and tools, are key considerations.

Potential future trends and developments, such as the impact on market trends and potential improvements to the program, will shape the future of this program and investment landscape.