What are tariffs Trump imposing import taxes? This exploration delves into the complexities of import taxes implemented by the Trump administration, examining their economic impact, political ramifications, and global implications. From the initial introduction of tariffs to the resulting trade wars, we’ll analyze the various factors that shaped this significant policy shift.

Understanding the different types of tariffs, their historical context, and the rationale behind their implementation is crucial. This analysis will cover the specific tariffs imposed on various goods and services, along with a detailed examination of their effects on domestic industries, consumers, and international trade relations. The potential economic benefits and drawbacks of these tariffs, their influence on GDP growth, employment rates, and inflation will be explored, as well as the ripple effects on related industries.

Furthermore, we will look at the political responses, social consequences, and the impact on international trade agreements and cooperation.

Introduction to Tariffs

Tariffs are import taxes levied on goods brought into a country. They act as a financial barrier, increasing the cost of imported products and making them less competitive against domestically produced goods. Essentially, tariffs aim to protect domestic industries from foreign competition. This mechanism has been a cornerstone of international trade policy for centuries, shaping global economies and sparking heated debates about its effectiveness and fairness.A core economic principle underpinning tariffs is the concept of protectionism.

Protectionist policies, like tariffs, aim to shield domestic industries from foreign competition by artificially raising the price of imported goods. This advantage can boost domestic production, but it often comes at the cost of higher prices for consumers and can lead to trade wars between nations. Tariffs are a type of trade barrier, which can restrict the flow of goods and services across borders.The historical context of tariffs is rich and complex.

Trump’s tariffs, essentially import taxes, were a pretty big deal. They aimed to protect American industries, but the effects were complex. Speaking of complex, have you seen the list of the 10 scariest movies of all time according to AI? the 10 scariest movies of all time according to ai It’s fascinating how technology can analyze something like fear in movies.

Anyway, back to tariffs, they definitely had a ripple effect on global trade, raising prices for consumers and potentially hurting American businesses in the long run.

From the mercantilist policies of the 17th and 18th centuries, which prioritized national wealth through trade surpluses, to the rise of free trade agreements in the 20th century, tariffs have played a pivotal role in shaping international economic relations. The Smoot-Hawley Tariff Act of 1930, imposing high tariffs on imported goods, is often cited as a contributing factor to the Great Depression, highlighting the potential for tariffs to have unintended and devastating consequences.

Tariff Types and Their Impacts

Understanding the different types of tariffs and their effects on various stakeholders is crucial. Tariffs can be broadly categorized based on their characteristics and objectives.

| Tariff Type | Description | Impact on Consumers | Impact on Producers |

|---|---|---|---|

| Ad Valorem Tariff | A percentage-based tax on the value of imported goods. | Higher prices for imported goods, potentially reducing consumer choice. | Increased revenue for domestic producers, potentially leading to increased market share. |

| Specific Tariff | A fixed amount of tax per unit of imported goods, regardless of value. | Price stability for goods with consistent cost changes. | Revenue that might not correlate with the market value, potentially affecting production decisions. |

| Compound Tariff | A combination of ad valorem and specific tariffs. | Higher prices for imported goods, varying based on value and quantity. | Potential for increased revenue and market share for domestic producers. |

Examples of Tariff Impacts

The impact of tariffs can be seen in various real-world scenarios. For example, tariffs on steel imports can increase the price of steel for domestic manufacturers, potentially impacting the automotive and construction industries. Similarly, tariffs on agricultural products can affect food prices and the livelihoods of farmers. Predicting the exact outcomes of tariffs is complex, as various factors, including the elasticity of demand and the responsiveness of producers, play a significant role.

Trump’s Tariff Policies

The Trump administration’s trade policies, characterized by the imposition of tariffs on various imported goods, significantly altered the global economic landscape. These tariffs aimed to protect American industries, reduce trade imbalances, and renegotiate favorable trade deals. The rationale behind these policies, however, was often debated, with proponents arguing for economic benefits and opponents highlighting potential negative consequences.

Specific Tariffs Imposed

The Trump administration implemented tariffs on a wide range of imported goods, targeting specific countries and industries. These tariffs were often applied in response to perceived unfair trade practices by other nations, including the belief that these practices were costing American jobs and harming domestic industries.

Rationale Behind Tariffs

The justifications for imposing tariffs varied, often citing national security concerns, intellectual property protection, and the need to address trade imbalances. Official statements frequently highlighted the desire to level the playing field for American businesses and workers, arguing that tariffs would incentivize domestic production and create jobs. Economic justifications often included the assertion that tariffs would reduce imports, stimulate domestic production, and ultimately benefit the American economy.

These justifications were frequently contested by economists and trade partners.

“We will no longer stand for these unfair trade practices. Tariffs will be imposed on those countries that are taking advantage of the United States.”

Statement by President Trump

Comparison of Tariffs Across Goods and Services

The Trump administration’s tariff policies impacted a diverse range of goods and services. While some tariffs were levied on broad categories of imports, others were targeted at specific products or countries. The rates and justifications for tariffs varied significantly, reflecting the administration’s evolving approach to trade.

Tariff Impact on Trade Partners

The imposition of tariffs by the Trump administration led to retaliatory measures from various countries, creating trade disputes and impacting global supply chains. These retaliatory tariffs often resulted in higher prices for consumers, reduced export opportunities for businesses, and disruptions to international trade flows.

Tariff Table

| Product Category | Tariff Rate | Justification | Impact on Trade Partners |

|---|---|---|---|

| Steel and Aluminum | 25% and 10% respectively | National security concerns, protecting domestic producers. | Canada, Mexico, and the European Union retaliated with tariffs on US goods. |

| China (various goods) | Varying rates | Addressing trade imbalances, intellectual property theft, and unfair trade practices. | China imposed tariffs on US agricultural products and other goods. |

| Imported Washing Machines and Solar Panels | 30% and 30% respectively | Protecting domestic manufacturers. | Caused retaliatory measures from affected countries. |

Effects of Trump’s Tariffs

Trump’s imposition of tariffs significantly altered the landscape of international trade, impacting domestic industries, consumers, and global relations. These trade barriers, while intended to protect American businesses, spurred a complex web of repercussions, with consequences that continue to be felt today. Understanding these effects is crucial to evaluating the long-term impacts of protectionist trade policies.

Effects on Domestic Industries

The tariffs imposed by the Trump administration had a mixed effect on domestic industries. Some sectors, particularly those reliant on imported inputs, faced increased costs and reduced competitiveness. For example, the steel and aluminum industries saw increased domestic demand, but manufacturers using these materials faced higher costs, potentially impacting their profitability and competitiveness in the global market. Conversely, some industries, such as those producing goods that were previously imported, experienced a surge in demand and increased domestic production.

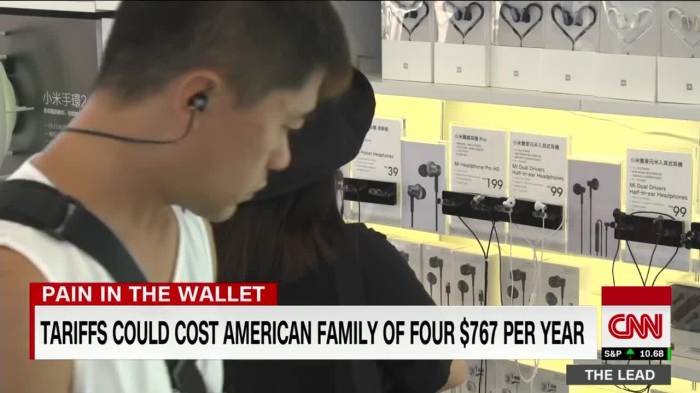

Impact on Consumers

Consumers bore the brunt of tariff-induced price increases. Tariffs raised the cost of imported goods, directly affecting the prices of consumer products such as electronics, clothing, and automobiles. For example, tariffs on imported steel and aluminum led to higher prices for cars and appliances. This led to decreased purchasing power and potentially reduced overall consumer spending. Furthermore, the availability of certain products might have been limited due to increased import costs or trade restrictions.

Effects on International Trade Relations

Trump’s tariffs significantly strained international trade relations. The retaliatory tariffs imposed by other countries, such as China, Canada, and the European Union, created trade wars that disrupted global supply chains and reduced overall trade volumes. These trade disputes led to uncertainty and instability in international markets. For instance, the imposition of tariffs on Chinese goods prompted China to retaliate, causing trade tensions and economic friction.

Influence on Global Supply Chains and Production Networks

The tariffs significantly influenced global supply chains and production networks. Companies had to adjust their sourcing strategies to account for higher import costs and trade barriers. This led to a diversification of supply sources, but also increased complexity and uncertainty in the global economy. For example, manufacturers may have shifted production from countries subject to tariffs to other countries with lower import costs.

Comparison of Effects on Different Countries

| Country | Export Sector | Impact | Countermeasures |

|---|---|---|---|

| China | Consumer goods, electronics | Reduced exports to the US, increased costs for domestic producers, economic slowdown in some sectors. | Retaliatory tariffs on US goods, diversification of export markets. |

| Mexico | Automobiles, agricultural products | Reduced exports to the US, increased costs for US manufacturers relying on Mexican parts, potential job losses. | Negotiations for trade agreements, diversification of export markets. |

| Canada | Agricultural products, automotive parts | Reduced exports to the US, increased costs for Canadian businesses, trade disputes. | Negotiations for trade agreements, diversification of export markets. |

| United States | Agricultural products, manufacturing | Increased costs for consumers, potential job losses in import-dependent sectors, mixed effects on domestic industries. | Negotiations for trade agreements, support for domestic industries. |

Economic Impact Analysis

Trump’s tariffs, designed to protect domestic industries, had significant and multifaceted effects on the US economy. While proponents argued for benefits like job creation and reduced trade imbalances, the actual consequences were far more complex and often negative. Understanding the potential economic benefits and drawbacks is crucial to assessing the overall impact of such policies.

Trump’s tariffs were import taxes, basically fees on goods coming into the US. Understanding how these taxes work is important, but equally crucial is teaching kids about digital safety, like protecting their personal information online. Learning about digital privacy, a crucial life skill in today’s world, is just as important as understanding how international trade works. This is a vital lesson for our children and a necessary aspect of our current global economy, and understanding tariffs, and the complexities of international trade, is also key.

teach kids digital privacy to ensure they’re prepared for the digital world. Knowing about import taxes, like Trump’s, is part of being an informed global citizen.

Potential Economic Benefits of Tariffs

Tariffs, by increasing the cost of imported goods, aim to encourage domestic production and consumption. This theoretical boost in domestic demand could potentially lead to increased employment in related industries. Furthermore, tariffs might reduce the trade deficit, though the extent and sustainability of this effect are debatable.

Potential Negative Economic Consequences of Tariffs

Tariffs can trigger retaliatory measures from other countries, leading to trade wars. These trade wars can harm export-oriented industries and disrupt global supply chains. Higher prices for imported goods, due to tariffs, can lead to inflation, negatively impacting consumers. The negative consequences often extend beyond the direct target industries, affecting related sectors through ripple effects.

Impact on GDP Growth, Employment Rates, and Inflation

The impact of tariffs on GDP growth is frequently debated. Some studies suggest that tariffs can reduce GDP growth by decreasing trade volumes and increasing prices. The impact on employment rates is also contested, as job losses in import-competing industries might not be fully offset by gains in export-oriented sectors. Tariffs, by increasing the cost of imported inputs, often lead to higher prices for domestic goods, contributing to inflation.

The actual magnitude of these impacts depends on factors like the size of the tariffs, the retaliatory measures, and the overall economic climate.

Ripple Effects on Related Industries and Sectors

Tariffs’ effects aren’t limited to the targeted industries. Tariffs can impact related sectors through supply chain disruptions, reduced availability of imported inputs, and the ripple effect of higher prices throughout the economy. For example, a tariff on steel could raise costs for automakers, potentially affecting their profitability and production volumes, which then impact related sectors like dealerships and suppliers.

Potential Impact on Different Sectors of the Economy

| Sector | Positive Impact | Negative Impact | Mitigation Strategies |

|---|---|---|---|

| Automobiles | Potential increase in domestic steel production. | Increased costs for imported steel components, potentially reducing competitiveness. | Diversification of steel sourcing, investment in domestic steel production, lobbying for reduced tariffs on steel. |

| Consumer Goods | Possible increase in demand for domestically produced goods. | Higher prices for imported consumer goods, potentially reducing consumer purchasing power. | Investment in domestic production, exploration of alternative import sources, advocacy for fair trade practices. |

| Agriculture | Potential increase in demand for domestically produced agricultural products. | Retaliatory tariffs from other countries on US agricultural exports. | Negotiation of trade agreements, diversification of export markets, government support programs. |

| Technology | Potential increase in demand for domestically produced tech products. | Higher costs for imported components, potentially affecting competitiveness. | Investment in domestic component production, diversification of global supply chains. |

| Energy | Limited direct impact. | Indirect impact through higher prices for imported energy products. | Energy efficiency programs, diversification of energy sources, promoting innovation. |

Political and Social Ramifications

Trump’s imposition of tariffs sparked a complex web of political and social reactions, both domestically and internationally. The policies generated significant debate, dividing stakeholders along ideological and economic lines. The effects reverberated through global trade relations, influencing political alliances and creating economic hardship for some segments of society.The political fallout from tariffs was immediate and multifaceted. Domestically, the policies faced strong opposition from some segments of the business community and labor unions, who argued that tariffs harmed American competitiveness and led to job losses.

Conversely, proponents argued that tariffs protected American industries and fostered national self-reliance. Internationally, tariffs strained relations with trading partners, leading to retaliatory measures and trade wars.

Political Responses to Tariffs

The political landscape was significantly altered by the implementation of tariffs. Countries retaliated with tariffs of their own, leading to trade disputes and global uncertainty. This was especially evident in the trade wars between the United States and China, impacting global supply chains and economic growth. Political alliances shifted, with some nations aligning with the United States in its trade stance, while others sought to forge alternative trade agreements.

These complex diplomatic maneuvers highlighted the far-reaching implications of tariff policies on international relations.

Social Implications of Tariffs

Tariffs can have profound social impacts, potentially leading to job displacement and economic hardship for certain sectors of the population. Industries reliant on imported goods or materials might face higher production costs, potentially leading to reduced competitiveness and job losses. Consumers often bear the brunt of higher prices, as tariffs increase the cost of imported goods. This can result in reduced purchasing power and increased living expenses, impacting the overall standard of living for households.

Trump’s tariffs, essentially import taxes, were a pretty big deal. While the specifics got complicated, it’s worth noting that the AI’s ranking of the top 10 TV shows of all time according to AI the top 10 tv shows of all time according to ai is quite interesting, but these economic policies clearly had a ripple effect on global trade and consumer prices, further impacting the economic landscape.

Examples of this can be seen in the steel industry, where tariffs led to price increases for consumers of steel-based products.

Influence of Tariffs on International Political Relations

Tariffs significantly influenced international political relations. They fostered tensions and disputes between nations, leading to trade wars and impacting diplomatic efforts. The disputes disrupted existing trade agreements and prompted the negotiation of new ones. The breakdown of existing trade agreements had repercussions across many countries, especially in developing nations that relied on trade for economic growth. Tariffs fostered a sense of protectionism and nationalism, which had an impact on global trade relations.

Arguments for and Against Tariffs

| Argument | Supporting Evidence | Counterargument |

|---|---|---|

| Tariffs protect domestic industries | Tariffs can raise prices for imported goods, making domestic products more competitive. | Increased prices for consumers and reduced choice can lead to economic hardship. Domestic industries might become less innovative due to lack of competition. |

| Tariffs promote national self-reliance | Tariffs can reduce reliance on foreign goods and boost domestic production. | Reduced trade can hinder economic growth and innovation. Other countries might retaliate with tariffs, creating trade wars. |

| Tariffs can increase government revenue | Tariffs generate revenue for the government, which can be used for public spending. | The revenue increase may be offset by reduced trade and economic activity. Consumers may bear the cost of higher prices. |

| Tariffs can protect jobs in specific industries | Tariffs can limit imports, potentially preserving jobs in domestic industries. | Job losses in other industries or sectors, due to reduced trade, can negate the gains. Retaliatory tariffs can create a negative cycle of job losses. |

International Trade Implications

Trump’s imposition of tariffs sparked a ripple effect across the global trade landscape, triggering retaliatory measures and significantly altering the dynamics of international commerce. The ensuing trade wars demonstrated the complex interconnectedness of global economies and the potential for unintended consequences when employing protectionist trade policies. This section delves into the specific impacts of these tariffs on international trade.

Retaliatory Tariffs

The tariffs imposed by the Trump administration prompted a wave of retaliatory measures from other countries. These responses aimed to counter the negative effects of the tariffs on their own industries and economies.

- China: China retaliated against the US tariffs with its own tariffs on various US goods, including agricultural products, technology, and manufactured goods. This action directly impacted US agricultural exports, causing economic hardship in some sectors.

- Canada: Canada, a significant trading partner of the US, implemented tariffs on American goods in response to the US tariffs, particularly on steel and aluminum. This resulted in disruptions in supply chains and increased costs for businesses.

- Mexico: Mexico also responded with tariffs on US goods in retaliation for the tariffs imposed on Mexican imports. This impacted sectors like agriculture and manufacturing, adding to the complexity of the trade dispute.

- European Union: The European Union imposed tariffs on US goods, targeting products like whiskey and motorcycles. These retaliatory tariffs aimed to mitigate the negative economic effects of the US actions.

Effects of Trade Wars

The trade wars initiated by the tariffs had substantial effects on global trade. Supply chains were disrupted, leading to increased costs and reduced efficiency. Consumer prices were affected as the tariffs often resulted in higher import costs for goods.

- Reduced Trade Volumes: Overall trade volumes decreased as businesses navigated the complexities of tariffs and retaliatory measures. Companies faced uncertainty, delaying investments and potentially reducing production.

- Increased Costs for Consumers: Consumers bore the brunt of higher import costs, which translated into higher prices for goods and services. This was particularly evident in sectors reliant on imported components or raw materials.

- Economic Uncertainty: The uncertainty surrounding the tariffs created a negative impact on investor confidence and economic growth in affected countries. This uncertainty impacted investment decisions and overall economic activity.

Comparison with Alternative Trade Policies

Alternative trade policies, such as free trade agreements or targeted negotiations, offer a more sustainable and potentially beneficial approach to fostering international commerce.

- Free Trade Agreements: Free trade agreements can create a more predictable and stable trading environment by reducing barriers to trade and promoting cooperation between countries. These agreements can benefit consumers through lower prices and increased choice.

- Negotiation and Diplomacy: Targeted negotiations between countries can resolve trade disputes and avoid the escalation of protectionist measures. This approach allows for more nuanced solutions tailored to specific industries or concerns.

Global Impact on Trade Agreements

The trade wars significantly impacted existing trade agreements and international cooperation. Trust and cooperation between nations were eroded, potentially setting a precedent for future disputes.

- Erosion of Trust: The use of tariffs as a primary tool for resolving trade disputes eroded trust between nations, making future negotiations and cooperation more challenging.

- Weakening of International Institutions: The trade wars potentially weakened international institutions designed to promote cooperation and regulate trade, such as the WTO. This weakening of institutions could lead to more trade disputes in the future.

Case Studies

Tariffs, particularly those imposed during the Trump administration, had profound impacts on various industries. Understanding these impacts requires examining specific examples and the consequences they brought about. Analyzing the experiences of affected companies and industries provides valuable insights into the complex interplay between trade policies and economic realities.The following case studies delve into the effects of tariffs on specific sectors, highlighting the ripple effects throughout the supply chain and the long-term consequences for businesses and consumers.

These examples illustrate the significant disruptions that can arise from trade protectionism.

Automotive Industry

The automotive industry felt the brunt of tariffs, primarily on steel and aluminum imports. These tariffs increased the cost of raw materials, impacting both domestic and foreign automakers. The increased costs were then passed on to consumers in the form of higher prices for vehicles.

- Ford, General Motors, and Stellantis (formerly Fiat Chrysler) all faced higher input costs due to tariffs on steel and aluminum. This impacted their profitability and ability to compete in the market.

- Manufacturers were forced to consider alternative sourcing strategies, potentially increasing lead times and logistics costs. The effect on the supply chain was substantial, from raw materials to finished products.

- Increased costs also affected vehicle prices for consumers, impacting the overall market demand for new and used vehicles.

Agricultural Sector

The agricultural sector, particularly farmers exporting to countries like China, faced significant challenges due to retaliatory tariffs. The tariffs on agricultural products from the United States reduced export opportunities and decreased revenue for farmers.

- Farmers, especially those specializing in agricultural exports, experienced reduced demand and income due to the tariffs imposed on their products.

- The tariffs disrupted existing trade relationships and created uncertainty in the global agricultural market, impacting market prices and farmer profitability.

- Farmers faced challenges adapting to new market conditions and finding alternative export destinations.

Technology Sector

The technology sector, while not as directly targeted as other sectors, was affected by tariffs indirectly through the increased costs of components and intermediate goods. The tariffs on components like semiconductors and other electronic parts raised production costs for technology companies.

- The technology sector faced a significant challenge in maintaining competitiveness due to the tariff-induced rise in component costs.

- Increased costs were inevitably passed on to consumers through higher prices for electronics and technology products.

- Companies operating in this sector sought ways to mitigate the impact, including diversifying their supply chains and exploring alternative sourcing options.

Specific Companies Affected

- Harley-Davidson

- Boeing

- Apple

- Caterpillar

- Cargill

- Coca-Cola

- General Motors

- Ford

The long-term effects of tariffs on these industries include a potential decline in profitability, a shift in global trade patterns, and increased uncertainty for businesses.

Alternative Perspectives on Trump’s Tariffs: What Are Tariffs Trump Imposing Import Taxes

Trump’s imposition of tariffs sparked a flurry of debate, with proponents often highlighting the protection of American industries and jobs. However, alternative perspectives offer a more nuanced understanding of the motivations and consequences of these policies. These alternative viewpoints challenge the simplistic narrative and expose the complexities inherent in international trade.Alternative explanations for the economic motivations behind Trump’s tariffs extend beyond the protectionist rhetoric.

Some argue that the tariffs were a strategic tool to pressure other countries into renegotiating trade deals more favorable to the US. Others posit that the tariffs were driven by domestic political considerations, designed to appeal to certain segments of the electorate and bolster Trump’s image as a strong leader. These alternative perspectives suggest that economic motivations were intertwined with political and strategic goals.

Economic Motivations Beyond Protectionism

Proponents of tariffs often claim that they safeguard domestic industries and jobs. However, critics argue that tariffs ultimately harm consumers by increasing the prices of imported goods, potentially reducing overall economic efficiency. Tariffs can also lead to retaliatory measures from other countries, disrupting global trade patterns and impacting businesses reliant on international markets. This often results in reduced exports, as retaliatory tariffs from other nations affect American products.

Counterarguments to Pro-Tariff Claims

A central counterargument to the claims of proponents of tariffs centers around the concept of comparative advantage. The argument posits that countries should specialize in producing goods and services where they have a comparative advantage, leading to greater overall efficiency and economic benefit for all parties involved. Imposing tariffs can disrupt this natural flow of trade, leading to decreased global output and potentially higher costs for consumers.

Arguments Against Tariffs from Various Stakeholders

The negative impact of tariffs extends beyond the realm of economists and policymakers. Consumers bear the brunt of higher prices, while businesses reliant on imported inputs face increased production costs. American farmers, for example, saw their exports to China significantly reduced due to retaliatory tariffs, resulting in substantial financial losses. Furthermore, foreign companies with operations in the US experienced increased production costs and decreased profits.

Comparative Analysis of Different Approaches to International Trade

A comparative analysis reveals different approaches to international trade, ranging from protectionism, exemplified by tariffs, to free trade agreements that promote open markets. A comparison of these approaches highlights the potential benefits of free trade, including increased competition, innovation, and consumer choice. A free trade approach can result in lower prices for consumers, greater economic growth, and enhanced global prosperity.

Different Perspectives on Trump’s Tariff Policies

“Tariffs are a necessary tool to protect American industries from unfair competition.”

Proponents of tariffs

“Tariffs are a harmful protectionist measure that will ultimately harm the US economy.”

Critics of tariffs

“Tariffs can be a strategic tool to pressure other countries into renegotiating trade deals.”

Alternative perspective

These varying perspectives highlight the complexity of international trade and the diverse range of potential outcomes associated with different approaches. Examining these diverse viewpoints provides a more complete understanding of the nuances surrounding Trump’s tariff policies.

Illustrative Examples

Tariffs, essentially taxes on imported goods, can have far-reaching consequences. Understanding how they impact specific companies, consumers, supply chains, and industries is crucial for comprehending the broader economic and social effects. These examples illustrate the tangible effects of tariffs in different contexts.The following sections explore how tariffs manifest in real-world scenarios, highlighting the diverse ways in which they reshape economic activity.

Hypothetical Company Affected by Tariffs, What are tariffs trump imposing import taxes

A hypothetical American-based electronics manufacturer, “TechCo,” imports components from China for its smartphones. A 25% tariff on Chinese components increases the cost of these imports significantly. This added expense directly translates into higher production costs for TechCo. To maintain profitability, TechCo might absorb some of the increase, potentially reducing profit margins. Alternatively, it could pass the cost onto consumers through higher prices for its smartphones, impacting consumer demand.

This scenario illustrates how tariffs can impact both businesses and consumers.

Impact on Consumers in a Specific Region

Tariffs on imported steel, for example, can impact consumers in the construction industry in the Midwest. If tariffs increase the cost of steel, construction companies will likely pass these higher costs on to consumers in the form of higher home prices. This can disproportionately affect first-time homebuyers and those in lower income brackets, limiting their access to affordable housing.

The resulting increase in housing costs can further exacerbate economic disparities within the region.

Effects of Tariffs on the Global Supply Chain for a Specific Product

Consider the global supply chain for automobiles. Tariffs on imported car parts can disrupt the production process. If a significant component, like car batteries, faces a tariff, it will increase the cost of production, potentially leading to decreased output and higher prices for the final product. This ripple effect can extend to various stages of the supply chain, impacting manufacturers, suppliers, and ultimately, consumers.

Furthermore, the reliance on specific regions for specific components can be severely impacted, forcing a restructuring of the global supply chain.

Effects of Tariffs on Specific Industries in Different Countries

Tariffs on agricultural products, like soybeans, can have a profound effect on farmers in the Midwest. If the US imposes tariffs on soybean imports from Brazil, for example, Brazilian farmers face reduced export opportunities, impacting their income and overall agricultural production. Simultaneously, this can create new market opportunities for domestic producers. The specific industry and the countries involved will dictate the extent of the impact.

Illustrative Charts and Diagrams

| Scenario | Impact | Diagram |

|---|---|---|

| Tariff on imported steel | Increased cost of construction materials, potentially higher housing prices | (Imagine a simple bar graph with two bars representing steel prices before and after tariff implementation, showing a significant increase in the second bar.) |

| Tariff on imported electronics components | Higher production costs for electronics manufacturers, potential price increases for consumers | (Imagine a flow chart illustrating the supply chain, with a highlighted segment representing the tariff impact, leading to higher costs for the final product.) |

The above table illustrates how tariffs can affect different sectors, with charts and diagrams (in the form of simplified examples) demonstrating the impact. The specific visual representations would be more sophisticated to fully capture the complex relationships and the extent of the impact.

Concluding Remarks

In conclusion, Trump’s tariffs represented a significant departure in trade policy, prompting a global response and substantial economic repercussions. The analysis reveals the multifaceted nature of tariffs, impacting domestic industries, consumers, and international relations. The long-term effects of these policies remain a subject of ongoing debate and analysis. This exploration highlights the importance of understanding the complex interplay between economic, political, and social factors in shaping trade policies.