What trumps tariffs mean for mortgage rates? This exploration dives deep into the complex relationship between trade policies and the cost of borrowing for homes. We’ll examine how tariffs affect the economy, specifically the housing market, and ultimately, how they translate to changes in mortgage interest rates. From the impact on imported building materials to the ripple effects across the entire housing sector, this analysis will provide a clear picture of the potential consequences.

The analysis considers different tariff levels, examining how they influence the cost of borrowing, the availability of mortgages, and the overall health of the housing market. We’ll look at historical examples and current economic conditions to paint a comprehensive picture of the possible outcomes.

Tariffs and their Economic Impact

Tariffs, taxes imposed on imported goods, are a complex economic tool with wide-ranging consequences. They aim to protect domestic industries, but their impact on consumers and global trade dynamics is often debated. Understanding how tariffs affect various sectors, particularly the housing market, is crucial for assessing their overall economic effect.Tariffs are essentially a tax on imported goods. Different types of tariffs exist, including ad valorem tariffs (a percentage of the value of the imported good), specific tariffs (a fixed amount per unit), and compound tariffs (a combination of both).

Generally, tariffs increase the price of imported goods, making them less competitive with domestically produced alternatives. This can boost domestic production and employment in the affected industries, but it can also lead to higher consumer prices, reduced choices, and potential retaliatory tariffs from other countries.

Impact on Various Sectors

Tariffs can significantly impact various sectors of the economy. The housing market, in particular, is susceptible to fluctuations in input costs, as construction materials are often imported. Increases in the cost of imported lumber, steel, or other building materials due to tariffs can translate directly into higher prices for homes, impacting both builders and consumers.

Historical Examples

The impact of tariffs on the housing market is evident in past implementations. For example, the Smoot-Hawley Tariff Act of 1930, while intended to protect American industries, significantly hampered international trade and contributed to the Great Depression. Similar tariffs in other periods have seen similar effects on construction costs and home prices. Increased import costs for building materials lead to higher construction costs, potentially delaying projects and affecting the availability and affordability of housing.

Mechanisms of Impact on Supply Chains and Input Costs

Tariffs disrupt global supply chains by increasing the cost of imported components and raw materials. For instance, if a tariff is imposed on imported steel used in construction, the price of steel will rise, leading to a cascade effect on construction costs. This increased cost is often passed on to consumers in the form of higher home prices.

Such disruptions can have a knock-on effect on related industries, such as home building and furniture manufacturing, that rely on these imported materials.

Tariff Levels and Cost of Imported Building Materials

| Tariff Level | Estimated Increase in Cost of Imported Lumber (per board foot) | Estimated Increase in Cost of Imported Steel (per ton) |

|---|---|---|

| 5% | $0.05 | $25 |

| 10% | $0.10 | $50 |

| 25% | $0.25 | $125 |

| 50% | $0.50 | $250 |

Note: These figures are illustrative and do not represent precise estimates. Actual cost increases will vary depending on the specific tariff, the market conditions, and other economic factors.

The Transmission Mechanism of Tariffs to Mortgage Rates

Tariffs, while often discussed in the context of trade imbalances, have a ripple effect that can impact various sectors of the economy, including the housing market. Understanding how these trade policies influence mortgage rates requires examining the interconnectedness of economic variables. This exploration delves into the channels through which tariffs affect borrowing costs, focusing on the key economic drivers and their interactions.The relationship between tariffs and mortgage rates isn’t direct.

Instead, tariffs introduce a series of indirect pressures that eventually affect the cost of borrowing money for mortgages. These pressures manifest through their impact on factors such as interest rates, inflation, and investor confidence. The impact on different types of mortgages can vary based on the underlying factors.

The Role of Interest Rates

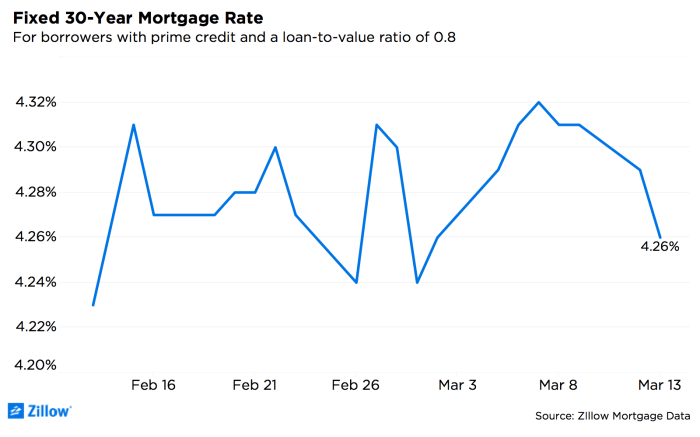

Interest rates are a crucial component of mortgage rates. A rise in tariffs can trigger uncertainty in the market, potentially leading to increased borrowing costs. This is because uncertainty often compels investors to demand higher returns on their investments, pushing up interest rates. Increased borrowing costs directly affect the affordability of mortgages. For instance, a 1% increase in interest rates can significantly increase the monthly mortgage payment for a home loan.

The Influence of Inflation

Tariffs can influence inflation. If tariffs increase the price of imported goods, this can lead to higher consumer prices, thereby increasing inflation. To combat inflation, central banks often raise interest rates. This, in turn, makes borrowing more expensive, including for mortgages. This rise in borrowing costs can be observed across various types of mortgages.

For example, during periods of high inflation, adjustable-rate mortgages are more susceptible to higher interest rate fluctuations.

The Effect on Investor Confidence

Investor confidence plays a significant role in the mortgage market. Tariffs, by introducing uncertainty and potential economic disruption, can negatively impact investor confidence. This can lead to a reduction in investment in the housing market, and subsequently, a decrease in the availability of mortgage financing. Reduced investor confidence also translates into higher borrowing costs as investors demand higher returns to compensate for the increased risk.

Impact on Different Mortgage Types

The effects of tariffs on mortgage rates aren’t uniform across all mortgage types.

Trump’s tariffs have definitely had an impact on mortgage rates, creating uncertainty and often leading to higher borrowing costs. However, focusing on your career development with something like affordable AI leadership courses to boost your career can help you navigate economic shifts, even those impacting the housing market. Ultimately, understanding the complex factors influencing mortgage rates is key to making informed financial decisions.

- Fixed-rate mortgages: These mortgages offer stability with a fixed interest rate for the loan term. While tariffs might initially affect the pricing, the fixed nature of the rate limits the direct, immediate impact on the borrower. However, sustained periods of uncertainty and high inflation can influence the initial rate set for the fixed-rate mortgage.

- Adjustable-rate mortgages (ARMs): These mortgages have interest rates that fluctuate based on market conditions. Tariffs, by influencing interest rates and inflation, can have a more immediate and significant impact on ARM rates. Changes in interest rates can directly affect the borrower’s monthly payments.

Potential Effects of Tariff Increases on Mortgage Interest Rates

The following table illustrates the potential effects of tariff increases on different types of mortgage interest rates. This is a hypothetical illustration and should not be considered a prediction.

| Tariff Increase Scenario | Potential Effect on Fixed-Rate Mortgages | Potential Effect on Adjustable-Rate Mortgages |

|---|---|---|

| Moderate Increase | Slight increase in initial interest rates, minimal impact on ongoing rates. | Moderate increase in initial interest rates, potential for significant fluctuation in subsequent rates. |

| Significant Increase | Moderate increase in initial interest rates, potential for sustained increase over the loan term. | Significant increase in initial interest rates, substantial fluctuation in subsequent rates, potentially leading to higher payments. |

Factors Influencing the Magnitude of the Impact: What Trumps Tariffs Mean For Mortgage Rates

Tariff impacts on mortgage rates aren’t uniform; various factors amplify or dampen the effect. Understanding these influences is crucial for accurately assessing the potential consequences of trade policies. The transmission mechanism, while generally understood, isn’t a simple equation; it’s shaped by a complex interplay of economic forces.The magnitude of the tariff’s impact on mortgage rates is not a fixed value.

It’s influenced by a range of interconnected economic conditions, governmental policies, and market responses. For example, a tariff on imported steel might not significantly affect mortgage rates if domestic steel producers are able to meet the increased demand without driving up prices substantially. Conversely, if the tariff triggers a wider economic downturn, the impact on mortgage rates could be much more severe.

Government Policies and Their Influence

Government policies can significantly mitigate or exacerbate the tariff’s impact on mortgage rates. Subsidies to domestic industries impacted by tariffs can help offset price increases, thereby lessening the pressure on borrowing costs. Similarly, tax breaks for homebuyers could stimulate demand and lessen the downward pressure on housing prices, consequently affecting mortgage rates. The interplay between these policies and the tariff’s effect is dynamic and complex.

Global Economic Conditions, What trumps tariffs mean for mortgage rates

Global economic conditions play a pivotal role in determining the tariff’s impact on mortgage rates. During periods of robust economic growth, the impact of tariffs might be less pronounced, as the overall demand for housing and credit remains strong. However, during a recession or economic downturn, the negative effects of tariffs can be amplified. Reduced consumer confidence and business investment can lead to decreased demand for housing, putting downward pressure on prices and mortgage rates.

Trump’s tariffs, while seemingly impacting various sectors, ultimately have a ripple effect on mortgage rates. A key factor influencing these rates is the overall economic climate, and the interplay of economic factors with technological advancements and business leadership is crucial. For example, a thoughtful consideration of the balance between human leadership and the adoption of technology by business leaders, as discussed in this article on business leaders human technology balance , can subtly impact market confidence and, in turn, mortgage rates.

So, while tariffs are a component, the bigger picture of economic stability remains the primary driver behind fluctuating mortgage rates.

Examples of Less Pronounced Impacts

Certain instances have shown less pronounced impacts of tariffs on mortgage rates. For example, if a tariff on a particular imported good does not significantly affect the domestic supply chain or consumer prices, the effect on mortgage rates might be minimal. Also, if the tariff is relatively small compared to the overall market size, its impact might be overshadowed by other market factors.

Importantly, the specific industry affected, the overall strength of the economy, and the alternative supply sources all contribute to the extent of the impact.

Interaction of Economic Factors

| Economic Factor | Effect on Mortgage Rates (in response to tariffs) | Example |

|---|---|---|

| Tariff Magnitude | Higher tariffs tend to have a greater impact. | A 10% tariff on imported lumber is likely to have a larger effect than a 1% tariff. |

| Domestic Supply Chain Resilience | Robust domestic production mitigates the tariff’s impact. | If domestic steel producers can increase output quickly and efficiently, the price increase will be smaller. |

| Global Economic Conditions | Recessions amplify tariff effects; robust growth reduces them. | During a recession, reduced consumer spending can lead to decreased housing demand and lower mortgage rates. |

| Government Policy Response | Subsidies and tax breaks can offset the impact. | Government subsidies to homebuyers can stimulate demand and limit the decline in mortgage rates. |

| Consumer Confidence | Reduced confidence can lead to lower demand and mortgage rates. | Concerns about the future economy may reduce consumer confidence and decrease demand for housing. |

Illustrative Scenarios and Potential Outcomes

Tariffs, while intended to protect domestic industries, can have far-reaching consequences, impacting not only the targeted sector but also related markets and ultimately, consumers. Understanding these ripple effects is crucial for assessing the true impact of tariffs. This section explores hypothetical scenarios to illustrate these potential outcomes, focusing specifically on the housing market.

Trump’s tariffs are definitely a wild card impacting mortgage rates. Economists are trying to figure out the ripple effect, and recent signals from Carney, King, and Charles, like those detailed in this article about carney king charles signal to trump , are adding layers of complexity to the equation. Ultimately, though, the interplay between global trade and interest rates will continue to be a key factor in how mortgage rates develop in the coming months.

Hypothetical Tariff Increase on Imported Lumber

A hypothetical increase in tariffs on imported lumber, a key construction material, can dramatically impact the cost of new homes and construction projects. Increased costs for lumber translate directly into higher construction costs, potentially driving up the prices of new homes. This price increase could discourage both buyers and sellers in the market, potentially slowing the pace of new home construction.

Ripple Effects on New Home Construction Costs

The increased cost of lumber, due to tariffs, directly impacts the cost of new home construction. Builders are forced to absorb these increased costs or pass them onto consumers. This translates into higher prices for new homes, impacting affordability and potentially reducing demand. The cost increases might also lead to delays in construction projects, as builders adjust to the new pricing environment.

Historical Examples of Tariffs and Mortgage Rates

While direct historical examples of tariffs impacting mortgage rates in a specific, measurable way are difficult to isolate, past episodes of significant trade disruptions have correlated with broader economic uncertainty, which can influence interest rates. For instance, the impact of the 2018 trade war between the US and China was felt across various sectors, including housing, although a precise, direct correlation to mortgage rates is difficult to quantify.

Impacts on Buyers and Sellers in the Housing Market

Increased construction costs due to tariffs negatively affect both buyers and sellers. Buyers face higher home prices, potentially reducing affordability and potentially leading to reduced demand. Sellers may experience a decreased number of potential buyers, and potentially reduced selling prices, leading to a potentially lower return on investment in the housing market.

Potential Implications for Housing Market Stability

The introduction of tariffs, especially when impacting key construction materials, can disrupt the stability of the housing market. The increased uncertainty in pricing and availability of materials can lead to a slowdown in construction, which may in turn affect job creation in the construction sector. This disruption, combined with the potential for reduced consumer demand due to higher prices, can potentially impact the overall housing market’s stability.

Projected Effects of Varying Tariff Levels on Mortgage Rates

| Tariff Level (on imported lumber) | Projected Effect on Mortgage Rates | Rationale |

|---|---|---|

| Low (e.g., 5%) | Potential slight increase in mortgage rates, but limited impact on overall housing market | Increased material costs are manageable for builders and passed on to consumers at a lower price increase. |

| Medium (e.g., 15%) | Moderate increase in mortgage rates, potentially affecting affordability | Builders are more significantly impacted, potentially causing a slowdown in new home construction. |

| High (e.g., 25%) | Significant increase in mortgage rates, potential for substantial impact on housing market stability | High costs make construction significantly more expensive, impacting the affordability and demand for homes, and leading to a slowdown or potential stagnation in the market. |

Alternative Perspectives and Counterarguments

While tariffs often lead to higher mortgage rates due to increased input costs and reduced consumer spending, some perspectives suggest alternative outcomes or countervailing factors. These counterarguments often involve nuanced economic considerations that extend beyond the immediate impact on borrowing costs. A critical examination of these viewpoints is necessary to fully understand the complex relationship between tariffs and the housing market.

Potential Economic Benefits of Tariffs

Certain proponents argue that tariffs can stimulate domestic production and employment within specific sectors, potentially leading to a positive impact on the overall economy. This could manifest as increased demand for construction materials, boosting the construction sector. However, the extent to which these benefits offset the negative impacts on mortgage rates is highly debated and contingent on various factors, including the specific industry affected and the broader economic environment.

Counterarguments Regarding Mortgage Rate Impacts

Some economists posit that the transmission mechanism of tariffs to mortgage rates might not be as direct or significant as initially predicted. They argue that factors like consumer confidence, global economic conditions, and government policies can mitigate the impact of tariffs on borrowing costs. For instance, a strong overall economy might buffer the effect of tariffs on the housing market.

Conversely, a significant recession could amplify the negative impact of tariffs on the housing sector.

Alternative Viewpoints on the Overall Economic Impact

Some alternative viewpoints suggest that tariffs, while potentially increasing prices in the short term, could stimulate innovation and efficiency within domestic industries. This could lead to long-term economic benefits that are not immediately reflected in mortgage rates. The effectiveness of tariffs in fostering this type of structural change, however, remains a subject of ongoing debate. For instance, some argue that tariffs can spur innovation in domestic manufacturing, which could indirectly support the construction sector by providing higher quality materials at competitive prices.

Arguments for and Against Tariffs as a Housing Market Tool

Arguments for using tariffs to influence the housing market often center on the idea of protecting domestic industries and creating jobs. However, these arguments are frequently countered by concerns about trade wars and their potential to disrupt global supply chains, thereby impacting the availability and cost of construction materials. This disruption can lead to increased prices, negatively affecting affordability and impacting the overall housing market.

The effectiveness of tariffs as a tool for managing housing markets remains uncertain and highly context-dependent.

Examples of Potential Positive Impacts on the Construction Sector (if available)

While finding definitive examples of tariffs having a demonstrably positive impact on the construction sector is challenging, some limited cases exist where specific tariffs might have indirectly benefited the sector. For instance, tariffs on imported lumber might have increased demand for domestically sourced lumber, benefiting domestic producers. However, these benefits are often offset by higher prices for consumers and the potential for retaliatory tariffs from other countries.

It is crucial to acknowledge that these scenarios are often complex and involve numerous interacting factors.

Potential Implications for Housing Market Trends

Tariffs, by impacting mortgage rates and the broader economy, inevitably ripple through the housing market. Understanding these effects is crucial for anyone navigating the current real estate landscape. The interplay between tariffs, financing costs, and consumer confidence directly influences home prices, sales, and construction activity.The housing market, a complex system of supply and demand, is particularly sensitive to changes in interest rates.

Mortgage rates, a direct consequence of tariffs, affect affordability, influencing both buyers and sellers. This, in turn, impacts the demand for homes, as well as the supply, depending on the economic climate. The rental market and investment properties also react to these shifts, which can be either positive or negative.

Impact on Home Prices

Changes in mortgage rates directly affect the cost of homeownership. Higher rates typically lead to decreased demand, potentially causing home prices to stagnate or even decline. Conversely, lower rates can boost demand, potentially driving up home prices. The historical relationship between interest rates and home prices provides a valuable framework for understanding this dynamic.

Impact on Housing Sales

Reduced affordability, driven by higher mortgage rates, often translates to fewer home sales. Potential buyers may be priced out of the market, leading to a slowdown in transactions. Conversely, lower rates can incentivize more buyers, potentially increasing sales activity. This relationship is directly correlated with the availability of financing options and consumer confidence.

Impact on Construction Activity

The construction sector is sensitive to changes in demand and affordability. Reduced home sales can lead to a decrease in new construction as developers respond to the reduced market demand. Conversely, increased demand from lower rates could stimulate construction activity, increasing the supply of available homes. The correlation between construction activity and the broader economic climate is well-documented.

Impact on Housing Affordability

Higher mortgage rates directly reduce housing affordability. Fewer people can afford a mortgage, leading to a decrease in the number of potential buyers. Conversely, lower rates make homes more affordable, increasing the number of potential buyers. This directly affects the housing market dynamics and consumer behavior.

Impact on the Rental Market

Changes in mortgage rates and home prices can affect the rental market. Higher rates and lower sales may lead to an increase in rentals as potential buyers opt for renting instead of purchasing. Conversely, lower rates and increased home sales may reduce the demand for rental properties.

Impact on Investment Properties

Investment properties are susceptible to shifts in mortgage rates and overall market trends. Higher rates might decrease the profitability of investment properties, impacting investor interest. Conversely, lower rates could increase investor interest due to higher returns on investment.

Projected Changes in Housing Market Trends

| Tariff Scenario | Home Prices | Sales | Construction Activity | Housing Affordability | Rental Market | Investment Properties |

|---|---|---|---|---|---|---|

| High Tariffs | Potential decrease | Potential decrease | Potential decrease | Decreased | Potential increase | Potential decrease |

| Moderate Tariffs | Slight decrease or stagnation | Moderate decrease | Slight decrease | Slightly decreased | Slight increase | Slight decrease |

| Low Tariffs | Potential increase | Potential increase | Potential increase | Increased | Potential decrease | Potential increase |

Note: These are illustrative projections and do not constitute financial advice. Actual outcomes will depend on various economic factors.

Outcome Summary

In conclusion, tariffs’ effect on mortgage rates is multifaceted and dependent on various factors, including the level of the tariff, global economic conditions, and government policies. While the direct link between tariffs and mortgage rates might not always be immediate or easily predictable, understanding the underlying economic mechanisms is crucial for navigating the complexities of the modern housing market.

The potential impact on both buyers and sellers, and the overall stability of the housing market, warrants careful consideration. Further research and analysis are crucial to accurately forecasting the future implications of tariffs on mortgage rates in specific scenarios.