India tighten remittance rules bar offshore time deposits sources say. This policy shift signals a significant change in how individuals and businesses send money internationally. The new regulations aim to curb illicit financial activities and potentially bolster the Indian economy, but the impact on various stakeholders remains to be seen. The implications for foreign investment and specific industries are also noteworthy, highlighting the complex web of financial interactions.

This article delves into the background of remittance regulations in India, examining the evolution of policies, the current framework, and key stakeholders. It analyzes the potential effects of the new rules on offshore time deposits, comparing them with past policies and discussing their impact on different categories of senders. The article explores potential reasons behind this policy change, including economic, political, and social factors.

It also considers alternative solutions for offshore money transfers, and examines the global context of remittance regulations, comparing India’s approach with international standards. The potential consequences for foreign investment and specific industries are also explored, with a focus on the potential effects on different sectors.

Background on Remittance Rules in India

India’s remittance landscape has undergone significant transformations over the years, driven by economic growth, globalization, and evolving financial technologies. The regulations governing international money transfers reflect these changes, aiming to balance the needs of individuals sending money abroad with the need to manage capital flows and ensure financial stability. This evolution has seen a complex interplay of policies and stakeholders, impacting both the volume and nature of remittances.

Historical Overview of Remittance Regulations

India’s remittance regulations have evolved considerably over time. Initially, regulations were relatively straightforward, focusing on licensing and reporting requirements. As the volume and importance of remittances grew, the need for more nuanced and comprehensive policies became evident. These policies have addressed concerns about money laundering, terrorist financing, and capital flight.

India’s tightening of remittance rules, barring offshore time deposits, is certainly a significant financial move. It’s interesting to consider how these changes might impact global investment strategies. This reminds me of the burgeoning field of AI and its impact on education, particularly how college graduates are adapting to using AI in their essays – a topic explored in detail in this recent article: college graduates ai essay.

Ultimately, these financial regulations will likely ripple through various sectors, requiring careful consideration by individuals and businesses alike.

Evolution of Policies Concerning International Money Transfers

The Indian government’s approach to international money transfers has seen a progression from simple controls to more sophisticated frameworks. Early regulations focused primarily on controlling capital outflows. Later policies integrated international best practices, particularly in areas of transparency and anti-money laundering. This evolution demonstrates the government’s growing awareness of the complexities and global implications of international remittances.

Current Framework for Managing Outward Remittances

The current framework for managing outward remittances in India is multifaceted, encompassing various components. These components include licensing requirements for remittance service providers, stringent Know Your Customer (KYC) procedures, and reporting obligations. The framework is designed to ensure transparency and compliance with international standards.

Key Stakeholders Involved in the Remittance Process

The remittance process involves various stakeholders, each playing a crucial role. These include banks, non-banking financial companies (NBFCs), money transfer operators (MTOs), and individuals. Each stakeholder has specific responsibilities and obligations under the existing regulatory framework. The effective functioning of the remittance system depends on the collaborative efforts of these key actors.

| Year | Policy Change | Impact |

|---|---|---|

| 1990s | Initial licensing and reporting requirements implemented. | Limited impact; primarily focused on controlling capital outflows. |

| 2000s | Introduction of KYC norms and anti-money laundering measures. | Increased transparency and reduced opportunities for illicit activities. |

| 2010s | Expansion of permissible channels for remittances, including digital platforms. | Facilitated greater convenience and accessibility for remitters. |

| 2020s | Recent tightening of rules, focusing on offshore time deposits. | Aiming to curb potential capital flight and ensure financial stability. The exact effects are still unfolding and subject to ongoing analysis. |

Impact of Tightened Rules on Offshore Time Deposits

India’s recent tightening of remittance rules, specifically targeting offshore time deposits, has sparked considerable interest and debate. This move aims to curb potential capital flight and encourage domestic investment. However, the implications for individuals, businesses, and the financial sector are multifaceted. Understanding these impacts is crucial to assessing the overall effect on the Indian economy.The new regulations are intended to discourage the use of offshore time deposits as a means to circumvent capital controls.

This approach, while potentially effective in stemming capital flight, may also create unintended consequences for legitimate financial transactions. The impact will vary across different stakeholders, and understanding these nuances is key to comprehending the full picture.

Potential Effects on Individuals and Businesses

The tightened rules directly affect individuals and businesses sending money abroad. Those relying on offshore time deposits for higher returns or long-term savings will face reduced options. Individuals may see lower returns on their investments compared to alternative domestic options, while businesses that use these deposits for international transactions may face higher transaction costs or complexities.

Impact on Financial Institutions Handling Remittances

Financial institutions play a critical role in facilitating remittances. The new regulations may necessitate changes in their operational strategies, including potentially increased compliance costs, adjustments in product offerings, and adjustments in their pricing structure. These adjustments could impact the cost and accessibility of remittances for both senders and recipients. Some financial institutions might even reduce their involvement in offshore time deposit services.

Comparison with Past Policies

Past remittance policies in India have evolved over time, reflecting changing economic conditions and priorities. Analyzing these historical trends helps to understand the rationale behind the recent changes. Previous policies often had less stringent controls on offshore time deposits, leading to greater flexibility for individuals and businesses. The current changes represent a shift in approach, prioritizing domestic investment and curbing capital flight.

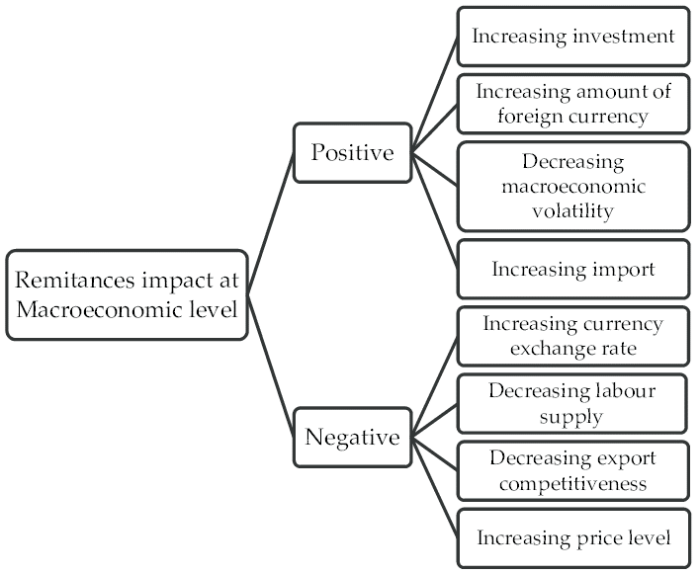

Likely Implications for the Indian Economy

The impact on the Indian economy is complex and not entirely predictable. While curbing capital flight can strengthen the rupee and potentially boost domestic investment, it may also reduce opportunities for individuals and businesses to diversify their financial assets. The long-term effect on economic growth will depend on how the tightened regulations interact with other economic factors.

Impact on Different Categories of Senders

| Category of Sender | Old Rules Impact | New Rules Impact |

|---|---|---|

| Individuals | Relatively flexible access to offshore time deposits, potentially higher returns | Limited access to offshore time deposits, potentially lower returns; increased focus on domestic investment options. |

| Small Businesses | Access to offshore time deposits for international transactions, potentially lower costs | Limited access to offshore time deposits; increased transaction costs, possible need for alternative arrangements. |

| Large Corporations | Flexibility in managing international funds, access to potentially higher returns | Potential for increased compliance costs, need for more complex financial strategies; likely less attractive for offshore investments. |

Potential Reasons Behind the Policy Change

India’s tightening of remittance rules, specifically targeting offshore time deposits, signals a shift in policy. This move likely stems from a complex interplay of economic, political, and social factors. Understanding these motivations is crucial for evaluating the potential impact on both domestic and international financial flows.The Indian government’s decision to restrict offshore time deposits by individuals and companies, while seemingly a regulatory action, may be a response to a multifaceted set of challenges.

India’s tightening of remittance rules, barring offshore time deposits, is raising eyebrows. This move could potentially impact global financial flows, mirroring some of the complexities seen in the past, like the china retaliatory tariffs us trade war which significantly affected international trade dynamics. Ultimately, these actions by India suggest a cautious approach to managing financial outflows and inflows.

The tightening of these rules could have both positive and negative consequences, impacting not just the individuals and companies involved, but also the overall economy. Understanding the reasons behind this policy change is critical to anticipating the potential outcomes and their wider implications.

Economic Motivations

India’s economic landscape is dynamic, with fluctuating capital flows and foreign exchange reserves playing a significant role. The government’s actions could be aimed at strengthening the rupee’s value, managing inflation, or consolidating financial resources within the country. The potential for increased domestic investment and reduced capital flight are likely factors considered in the decision-making process.

Political Considerations

Political considerations often intertwine with economic ones. Maintaining a stable and predictable economic environment is vital for any government. The regulation of offshore time deposits may reflect a broader strategy to address perceived vulnerabilities in the financial system, potentially in response to political pressures or global economic events. The government might also be aiming to create a more favorable investment climate within India itself, thus attracting domestic investment and boosting economic growth.

Social or Cultural Influences

Social and cultural factors, while less directly quantifiable, can still influence policy decisions. A desire to promote financial inclusion and reduce the reliance on offshore accounts, potentially stemming from social or cultural norms, might contribute to the decision. The government’s aim could be to encourage financial activity within the country’s formal banking system, potentially fostering a sense of national financial sovereignty.

Summary of Potential Reasons

- Strengthening the rupee and managing inflation.

- Managing capital flight and promoting domestic investment.

- Addressing vulnerabilities in the financial system, potentially in response to political pressures.

- Encouraging financial activity within India’s formal banking system.

The aforementioned points represent potential drivers behind the policy change, and the relative weight of each factor is likely complex and multifaceted.

Potential Economic Benefits and Drawbacks

| Aspect | Potential Benefits | Potential Drawbacks |

|---|---|---|

| Rupee Value | Increased demand for the rupee in the domestic market, potentially leading to a stronger currency. | Potential for reduced foreign investment in Indian assets, potentially leading to decreased foreign exchange reserves. |

| Inflation | Reduced capital flight could curb inflationary pressures, leading to price stability. | Reduced foreign investment could hinder economic growth and lead to reduced access to foreign capital. |

| Domestic Investment | Increased domestic investment, potentially boosting economic growth and creating jobs. | Potential for decreased access to international capital for Indian companies, hindering their growth. |

| Financial Inclusion | Encouraging use of formal banking systems, promoting financial inclusion, potentially leading to a more stable and secure financial system. | Potential for reduced access to remittance services for certain segments of the population, particularly those in rural areas. |

The table above presents a preliminary overview. Further analysis is needed to assess the long-term impacts of this policy change.

Alternative Solutions for Remittance Needs: India Tighten Remittance Rules Bar Offshore Time Deposits Sources Say

India’s tightening of remittance rules, particularly regarding offshore time deposits, has prompted a search for alternative solutions. This shift necessitates exploring diverse avenues for transferring funds internationally, from traditional methods to cutting-edge technologies. This exploration will analyze the pros and cons of various options, enabling a clearer understanding of the landscape post-regulatory changes.

Exploring Alternative Remittance Channels

The current remittance landscape is dynamic, constantly evolving with new technologies and financial instruments. Understanding these options is crucial for individuals and businesses needing to send money across borders.

- Peer-to-Peer (P2P) Transfer Services: P2P platforms offer a streamlined and often more cost-effective way to send money internationally. These platforms leverage digital technology to connect senders and recipients directly, reducing reliance on intermediaries and associated fees. However, security concerns and the need for robust KYC (Know Your Customer) procedures are important considerations. Examples include services like TransferWise and Remitly.

- Cryptocurrency: Cryptocurrency exchanges provide an alternative avenue for international transfers. Cryptocurrencies like Bitcoin and Ethereum offer the potential for lower transaction costs and faster transfer times compared to traditional methods. However, the volatility of cryptocurrencies poses a significant risk, and regulatory clarity is still developing in many jurisdictions. Cryptocurrency use for remittances is not without challenges; ensuring the security and legitimacy of transactions is crucial.

Moreover, tax implications and compliance issues are not always clear-cut, and regulatory scrutiny can vary considerably.

- Mobile Money Platforms: Mobile money platforms offer a convenient option for transferring money, especially in regions with limited access to traditional banking services. These platforms often leverage existing mobile phone infrastructure to facilitate transactions. However, reliability and security measures vary considerably across different platforms. It is important to choose platforms with robust security features and proven track records. Mobile money solutions, while convenient, may have limited international coverage or compatibility with specific banking systems in certain countries.

Comparing Existing Methods with New Technologies, India tighten remittance rules bar offshore time deposits sources say

The traditional methods of remittance, such as bank transfers and money orders, are still prevalent, but new technologies offer potential advantages in terms of cost and speed. This comparison underscores the shift toward digital solutions.

| Method | Advantages | Disadvantages |

|---|---|---|

| Bank Transfers | Established infrastructure, widely accepted | High fees, slow transfer times, complex processes |

| Money Orders | Relatively simple, physical form | Limited geographic coverage, often slower than digital methods, security risks |

| P2P Transfer Services | Lower fees, faster transfers, digital convenience | Security concerns, limited regulatory oversight in some areas |

| Cryptocurrency | Potential for lower fees, faster transfers, global reach | High volatility, regulatory uncertainty, security risks |

| Mobile Money Platforms | Convenience, accessibility in underserved areas | Limited international coverage, variable security |

Financial Instruments for International Transfers

Innovative financial instruments are emerging to cater to international money transfer needs. These include specialized remittance accounts and dedicated platforms for cross-border transactions.

- Remittance Accounts: Specialized accounts designed specifically for facilitating remittances offer streamlined processes and potential cost savings. These accounts often incorporate features for tracking and managing international transfers, ensuring greater transparency and efficiency. However, the availability and functionality of these accounts can vary based on the provider and the recipient’s location.

- Dedicated Platforms: Dedicated platforms for cross-border transactions are becoming increasingly common, offering a range of services for individuals and businesses engaged in international trade. These platforms aim to provide a user-friendly interface and specialized tools to navigate the complexities of international transfers, providing an alternative to traditional methods.

Global Context of Remittance Regulations

India’s recent tightening of remittance rules highlights a global trend of nations scrutinizing cross-border financial flows. Understanding this global context is crucial to appreciating the nuances of India’s policy shift and its potential impact on individuals and businesses. Remittance policies are complex and often influenced by domestic economic conditions, international relations, and global financial stability.The global landscape of remittance regulation is characterized by a mix of approaches, reflecting diverse economic priorities and geopolitical considerations.

India’s tightening remittance rules, barring offshore time deposits, is a significant move, sources say. While this might seem a purely financial issue, it’s worth considering how this affects broader economic trends. Thinking about how this impacts personal finance decisions, it’s interesting to ponder whether protein shakes are actually a healthy part of a balanced diet. Learning more about the potential benefits and drawbacks of protein shakes could provide valuable insights, and you can explore this further by checking out this helpful article on are protein shakes good for you.

Ultimately, the new remittance restrictions will likely have a cascading effect on international money flows, potentially impacting everything from individual investment strategies to large-scale trade patterns.

Countries employ various strategies, including restrictions on specific types of remittances, regulations on the use of offshore accounts, and requirements for transparency in cross-border transactions.

Remittance Policies in Other Countries

Different countries have different approaches to remittance policies, reflecting their specific economic circumstances and priorities. For example, some countries have specific restrictions on the amount that can be remitted, while others focus on transparency and reporting requirements. Many nations also prioritize the use of domestic financial channels for remittances, seeking to bolster their own financial systems and reduce reliance on international intermediaries.

Comparison with International Standards

India’s regulations, while specific to its economic needs, can be compared to international standards and best practices. International organizations like the World Bank and the IMF often provide frameworks for remittance policies, emphasizing the importance of efficiency, transparency, and consumer protection. However, each country interprets and implements these standards differently, leading to variations in regulations across the globe.

Trends in Global Remittance Regulation

Global trends in remittance regulation generally show a shift towards greater transparency and scrutiny. The increasing use of digital platforms for remittances has also led to discussions about regulatory frameworks for these new technologies. The need to combat money laundering and terrorist financing is another factor driving the evolution of remittance policies worldwide.

Similarities and Differences in Approaches

Countries share some common ground in their approaches to remittance regulation. Many countries aim to ensure the safety and security of funds sent abroad and received domestically. However, the specific instruments and mechanisms used to achieve these goals differ greatly, influenced by factors like the size and structure of the domestic financial system, and the nature of international trade relationships.

Table of Remittance Regulations in Different Countries

| Country | Regulations | Impact |

|---|---|---|

| India | Tightened rules on offshore time deposits, increased scrutiny on remittance channels. | Potential reduction in offshore remittance options, increased compliance costs for remitters. |

| United States | Regulations focusing on transparency and reporting, particularly for large transactions. | Increased reporting requirements for financial institutions, potential impact on international trade flows. |

| United Kingdom | Focus on anti-money laundering and counter-terrorism financing measures. | Increased compliance costs for financial institutions, potential impact on cross-border transactions. |

| China | Regulations aimed at controlling capital outflow and promoting domestic financial systems. | Restrictions on remittance options, potential impact on businesses relying on overseas investments. |

| United Arab Emirates | Regulations focused on promoting transparency and combating illicit financial flows. | Increased compliance requirements for businesses involved in remittances, potential impact on the volume of remittances. |

Potential Consequences for Foreign Investment

India’s tightening of remittance rules, particularly those affecting offshore time deposits, could significantly impact foreign investment. These changes might alter the perceived attractiveness of India as a global financial hub, potentially influencing investor behavior and, consequently, the overall Indian economy. Understanding the nuances of this shift is crucial for stakeholders across various sectors.

Impact on Foreign Direct Investment (FDI)

The new regulations could discourage foreign investment in certain sectors, especially those reliant on remittances. For instance, businesses requiring substantial capital inflows for expansion or those employing significant numbers of migrant workers might face difficulties in securing necessary funding. Reduced foreign investment could hinder economic growth and job creation, potentially impacting the long-term prosperity of the country.

Shift in Investor Perception of India

India’s image as a stable and attractive financial destination could be affected by the perceived tightening of regulations. Investors might be wary of a regulatory environment that appears less predictable or accommodating. This could lead to a decrease in foreign investment, especially from those seeking a stable and predictable investment climate. A shift in investor sentiment could impact various sectors, from technology and manufacturing to infrastructure and services.

Potential Shifts in Investor Behavior

Investors might seek alternative destinations for their investments. This could lead to a loss of potential capital inflow and hinder India’s economic development. For instance, countries with more flexible or less stringent remittance regulations might become more attractive to foreign investors. The ability to quickly and easily move funds in and out of the country is a critical component of the global financial system, and changes to these rules can have a wide-ranging effect.

Overall Impact on the Indian Economy

The tightening of remittance rules could have a domino effect on various sectors of the Indian economy. Reduced foreign investment could lead to slower economic growth, job losses, and a decrease in overall prosperity. The impact on the Indian economy is multi-faceted, impacting everything from infrastructure development to employment opportunities. A reduction in foreign investment could affect the availability of capital for growth and innovation.

Potential Effects on Different Sectors of Foreign Investment in India

| Sector | Potential Positive Effect | Potential Negative Effect |

|---|---|---|

| Technology | Potentially limited impact if the investment is not directly tied to remittances. | Reduced foreign investment could slow down innovation and growth. |

| Infrastructure | Foreign investment in infrastructure projects might be affected if linked to remittance inflows. | Slower infrastructure development could hamper economic growth and future development. |

| Manufacturing | Minimal direct impact if not tied to remittances. | Could face difficulty in attracting foreign investment if linked to remittances. |

| Services | Limited impact if not tied to remittances. | Reduced foreign investment could impact the growth of the service sector. |

| Real Estate | Indirect impact if tied to remittances. | Reduced investment could impact the property market. |

Impact on Specific Industries/Businesses

India’s tightening of remittance rules, particularly those affecting offshore time deposits, is poised to impact several industries heavily reliant on these financial instruments for international transactions. The shift in policy will necessitate adjustments in strategies and operations for businesses needing to manage international capital flows. The ripple effects will be felt across various sectors, from those directly involved in international trade to those leveraging remittances for worker compensation.The new regulations will create a need for alternative solutions for transferring funds and managing foreign exchange.

This will likely increase costs and complexity for businesses operating in a globalized environment. The impact will vary depending on the extent of reliance on offshore remittances and the adaptability of each industry.

Industries Most Dependent on Offshore Remittances

Several industries rely heavily on offshore remittances for various purposes. These include businesses operating in the following sectors:

- Construction: Many construction companies, especially those involved in projects with international participation or employing foreign workers, often receive a substantial portion of their payments via offshore remittances. This allows for direct compensation of workers and payment of materials, equipment, and other project costs.

- Information Technology (IT): The IT sector, while employing many people domestically, also interacts with international clients. Offshore remittances are often involved in payments for projects or services delivered across borders. Remittances from workers located abroad also influence the sector.

- Gems and Jewelry: The gems and jewelry sector frequently relies on international transactions and remittances to purchase raw materials, complete international sales, and compensate employees in locations outside India.

- Agriculture: Some agricultural export businesses utilize offshore remittances to facilitate payments for produce or services related to international sales, potentially impacting the sector’s efficiency and profitability.

Potential Adjustments Required by Businesses

Businesses reliant on offshore remittances will need to adapt to the new regulatory landscape. These adjustments might include:

- Exploring alternative payment methods: Businesses may need to explore alternative channels for sending and receiving remittances, such as international wire transfers, digital wallets, and other secure online payment platforms. This will require businesses to investigate the cost-effectiveness and security features of these alternative options.

- Implementing stricter internal controls: To ensure compliance with the new regulations, companies will need to implement and enforce more stringent internal controls related to money transfers. This includes maintaining accurate records of all transactions and adhering to reporting requirements.

- Re-evaluating financial strategies: Businesses will need to re-evaluate their financial strategies and investment options, potentially reducing reliance on offshore time deposits and exploring alternative investment avenues within India or other locations. This will involve a thorough assessment of risk tolerance and return potential.

Examples of Business Adaptations

Several businesses are already adapting to changing regulations by implementing strategies such as:

- Diversification of payment channels: Companies are diversifying their payment channels, using a mix of domestic and international methods to ensure payment continuity. This involves establishing strong relationships with financial institutions offering various remittance options.

- Shifting investment portfolios: Some businesses are shifting their investment portfolios to more domestically accessible options to minimize reliance on offshore time deposits. This is a strategy to ensure compliance and maintain liquidity within India’s financial framework.

Industry Impact Summary Table

| Industry | Reliance on Offshore Remittances | Potential Responses to Policy Change |

|---|---|---|

| Construction | High | Explore alternative payment options, strengthen internal controls, diversify project financing. |

| IT | Medium | Utilize alternative payment methods, consider local investment avenues, adjust international project contracts. |

| Gems & Jewelry | High | Shift to more secure and compliant payment options, diversify sourcing of raw materials. |

| Agriculture | Low to Medium | Explore alternative financing mechanisms for international sales, adapt to changes in export procedures. |

End of Discussion

In conclusion, India’s tightening of remittance rules, particularly the ban on offshore time deposits, represents a significant shift in financial policy. The potential impacts on various stakeholders, including individuals, businesses, and foreign investors, are complex and multifaceted. While the government likely anticipates benefits, the long-term effects on the Indian economy and global financial markets remain to be seen.

The article highlighted alternative solutions and the broader global context, offering a comprehensive perspective on this important development.