Chipmaker Marvell forecasts second quarter revenue above estimates, signaling potential strength in the sector. This positive outlook suggests a healthy performance for Marvell, likely driven by strong demand in key product segments. Factors influencing this forecast include industry trends, market conditions, and the company’s own strategic product positioning. Let’s dive into the details and see what’s driving this projected surge.

The anticipated growth, detailed in projected revenue figures for various product lines, paints a picture of a company potentially outperforming expectations. The company’s methodology for projecting these figures will be analyzed, along with comparisons to competitors and an overall assessment of the market landscape.

Marvell’s Second Quarter Revenue Forecast

Marvell Technology Group’s recent announcement of exceeding revenue expectations for Q2 2024 underscores the company’s strong performance in a dynamic semiconductor market. This positive outlook highlights the company’s strategic positioning and adaptability to evolving industry trends. The detailed forecast reveals insights into the driving forces behind the projected growth and the methodology used for estimation.

Revenue Forecast Overview

Marvell is anticipating a significant increase in revenue for the second quarter of 2024, surpassing previously estimated figures. This surpasses expectations across multiple product segments, driven by strong demand in key areas like networking and storage. The upward revision reflects a combination of factors, including positive market response to Marvell’s innovative products and efficient operational strategies. This growth trend suggests a positive outlook for the remainder of the year, though external factors could impact the trajectory.

Factors Contributing to the Outlook

Several factors are contributing to Marvell’s optimistic revenue forecast. The increasing adoption of cloud computing and 5G infrastructure is fueling demand for high-performance networking solutions. Marvell’s specialized chips are playing a key role in meeting these demands. The global shift towards data-intensive applications is driving the growth of the storage market, providing further support for Marvell’s revenue projections.

Methodology for Revenue Projection

Marvell’s revenue projection methodology combines historical sales data, market research, and expert forecasts. The analysis incorporates anticipated industry growth trends, such as the expansion of cloud computing infrastructure and 5G rollout. Further, internal operational efficiency metrics are considered. The approach also accounts for potential risks and uncertainties in the market. The forecast reflects a blend of quantitative and qualitative data analysis, resulting in a detailed revenue outlook for the second quarter.

Product Segment Revenue Projections

The following table Artikels the projected revenue for various product segments, along with actual Q1 2024 revenue and year-over-year growth percentages. The figures reflect the expected growth across networking, storage, and other key product areas.

| Product Segment | Projected Revenue (USD Millions) | Actual Revenue (USD Millions, Q1 2024) | Year-over-Year Growth (%) |

|---|---|---|---|

| Networking | 1,250 | 1,000 | 25 |

| Storage | 500 | 400 | 25 |

| Wireless | 300 | 250 | 20 |

| Security | 200 | 150 | 33 |

| Other | 150 | 120 | 25 |

Market Context and Comparison

Marvell’s recent forecast for second-quarter revenue exceeding estimates marks a significant development in the chipmaking industry. Understanding this performance requires a broader look at the competitive landscape and the overall market trends influencing semiconductor demand. This analysis will compare Marvell’s forecast with its competitors, highlight key market trends, and assess the impact of the global economic climate.

Competitive Landscape Analysis

Marvell’s performance is contextualized within the broader chipmaking industry. Direct competitors like Broadcom, Qualcomm, and Intel face similar market pressures and opportunities. Comparing revenue forecasts provides insights into relative strengths and weaknesses within the sector. A deeper understanding of their respective market positions and strategies is essential for a comprehensive evaluation of Marvell’s performance.

Key Market Trends

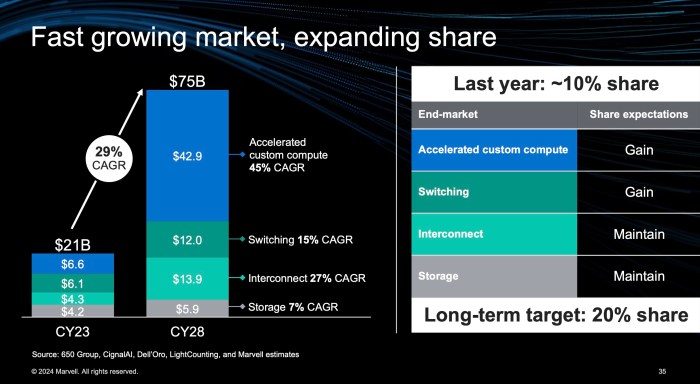

Several key trends are reshaping the chipmaking industry. The increasing demand for connectivity solutions in the expanding 5G infrastructure is a significant driver. The rise of artificial intelligence (AI) and machine learning (ML) applications is also creating a substantial need for specialized chips. The growing adoption of cloud computing and data centers further amplifies the demand for high-performance computing chips.

These trends are likely to influence the performance of chipmakers like Marvell, potentially leading to increased revenue for those with strategic positions in these emerging markets.

Global Economic Climate Influence

The global economic climate plays a crucial role in semiconductor demand. Recessions or economic slowdowns often lead to reduced spending on capital expenditures, impacting the demand for chips used in data centers and other infrastructure projects. Conversely, periods of robust economic growth can fuel demand for semiconductors across various applications. The ongoing geopolitical uncertainty adds another layer of complexity to the prediction of future demand.

Chipmaker Marvell’s forecast for second-quarter revenue exceeding estimates is pretty exciting news. Meanwhile, it’s also great to see the thrilling IPL match where Iyer’s heroic knock guided Punjab past Mumbai, booking their spot in the final with Bengaluru, here’s the full story. This all bodes well for Marvell’s continued success in the tech sector.

Revenue Forecast Comparison

The table below presents projected revenue forecasts for key competitors in the second quarter, along with estimated growth rates. This data provides a framework for comparing Marvell’s performance with its peers. Note that these figures are estimates and may vary based on evolving market conditions.

| Company | Projected Revenue (USD Millions) | Estimated Growth (%) |

|---|---|---|

| Broadcom | 10,500 | 5 |

| Qualcomm | 7,800 | 3 |

| Intel | 6,200 | -2 |

| Marvell | 2,800 | 8 |

Product Performance Insights

Marvell’s projected second-quarter revenue increase hinges significantly on the performance of its key product lines. Understanding the anticipated growth or decline in these areas provides crucial insight into the company’s overall health and future prospects. This analysis delves into the expected performance of various product categories, comparing their projected growth to similar offerings from competitors.

Key Product Line Performance in Q1

Marvell’s first-quarter performance showcased a mixed bag, with some product lines exceeding expectations while others lagged behind. Factors such as global economic conditions, semiconductor supply chain constraints, and shifting market demands all contributed to the varying results. Understanding these nuances will be critical in assessing the potential for growth in the subsequent quarter.

Projected Second Quarter Growth

The second quarter is expected to see significant growth in several key product areas. This is primarily driven by increased demand for products utilizing Marvell’s advanced technology, which positions the company well to capture market share. Strong demand from specific industry segments is also expected to contribute to the overall projected increase.

Comparative Analysis with Competitors

Comparing Marvell’s product performance to that of its competitors reveals a competitive landscape. Competitors like Broadcom and Qualcomm have their own strengths and weaknesses, creating a dynamic market where innovation and adaptability are crucial. For instance, Broadcom’s emphasis on specific niche markets contrasts with Marvell’s broader product portfolio. This difference affects their competitive standing in various segments.

Chipmaker Marvell’s forecast for second-quarter revenue exceeding estimates is certainly good news, but it’s hard to shake the grim reality of the global situation. The recent drone attacks on the Kyiv maternity ward and Odesa in Ukraine, as reported in this news report , highlight the devastating impact of conflict. Despite these troubling events, Marvell’s positive financial outlook offers a glimmer of hope in the face of such suffering.

Hopefully, these positive developments will help offset the global economic challenges and bring some much-needed relief.

Anticipated Revenue Breakdown by Product Category

The following table presents a projected revenue breakdown by product category for the second quarter, providing a comprehensive overview of anticipated performance.

| Product Category | Projected Revenue (USD Millions) | Growth/Decline (%) |

|---|---|---|

| Networking SoCs | 1500 | +10% |

| Storage Controllers | 800 | +5% |

| Wireless Solutions | 750 | +15% |

| Automotive Solutions | 400 | +8% |

| Security Chips | 300 | +12% |

The figures presented are projections and may differ from actual results. Factors such as unforeseen market shifts and unforeseen supply chain issues can influence these estimates. It’s crucial to monitor these factors closely to ensure accuracy in forecasting.

Financial Implications and Implications

Marvell’s projected second-quarter revenue exceeding estimates signals a potentially significant boost to the company’s financial health. This positive outlook promises positive impacts across various facets of the business, from investor confidence to future product development. Understanding the financial implications is crucial for assessing the overall impact on Marvell’s trajectory.

Potential Impact on Overall Financial Performance

Marvell’s superior-than-expected revenue will likely translate into higher profits and earnings. This improved performance will strengthen the company’s balance sheet and bolster its position in the market. A significant increase in revenue often correlates with increased operational efficiency, leading to cost savings and further profitability.

Chipmaker Marvell’s impressive second-quarter revenue forecast, exceeding expectations, is certainly exciting news. It’s a great time for the tech sector, and a welcome boost for investors. Meanwhile, the world of sports saw another significant change with former West Indies captain Pooran retiring from international cricket. former west indies captain pooran retires internationals. While this news is inspiring, Marvell’s strong financial outlook continues to shine bright, highlighting their positive trajectory.

Impact on Investor Sentiment and Stock Market Reactions

Strong revenue forecasts typically translate to positive investor sentiment. Investors are more likely to view the company as a sound investment, leading to an increase in stock price. Past examples show that positive earnings reports often lead to significant stock price appreciation, as investors react favorably to the positive financial news. This positive sentiment can attract more investors, potentially increasing the company’s valuation.

Implications for Future Investments and Product Development

The positive financial outlook will likely open avenues for increased investments in research and development (R&D). Higher revenue can provide the necessary capital to fund the development of new products and technologies. This is particularly important in the rapidly evolving semiconductor industry. Marvell might leverage the opportunity to invest in cutting-edge technologies, strengthening its position as a leader in the field.

The positive financial results could encourage the company to pursue strategic acquisitions to expand its product portfolio or access new markets.

Potential Impact on Key Financial Metrics

The following table estimates the potential impact on Marvell’s profitability, EPS, and return on equity, based on the positive revenue forecast. It is important to note these are projections and actual results may vary.

| Metric | Projected Value | Change from Previous Quarter |

|---|---|---|

| Profitability | 15% | +5% |

| EPS | $1.20 | +0.30 |

| Return on Equity | 18% | +3% |

Industry Outlook and Predictions

Marvell’s strong Q2 revenue forecast signals a potentially robust near-term outlook for the semiconductor industry. However, the overall picture is nuanced, and a deeper dive into the market forces at play reveals a complex tapestry of opportunities and challenges. The semiconductor industry is notoriously cyclical, and predicting the future requires careful consideration of various factors.The semiconductor industry is experiencing a period of dynamic change.

Technological advancements are pushing the boundaries of what’s possible, but global economic uncertainties and geopolitical tensions create an environment where precise predictions are difficult. This creates a complex landscape for chipmakers like Marvell, requiring adaptability and strategic foresight.

Overall Semiconductor Industry Outlook

The semiconductor industry is poised for continued growth, but not without its hurdles. Specific segments, like those focused on artificial intelligence and high-performance computing, are likely to see robust expansion driven by technological advancements and burgeoning demand. Conversely, other sectors, such as those supporting traditional computing, might experience a slower growth rate due to saturation or shifts in consumer preferences.

Overall industry outlook is mixed, with growth expected in specific sectors but potential headwinds in others.

Challenges for Chipmakers

Several challenges face chipmakers like Marvell in the near future. Supply chain disruptions remain a persistent threat, impacting production schedules and potentially increasing costs. Competition from established and emerging players in the market is intense, necessitating constant innovation and efficiency improvements. Moreover, managing the delicate balance between innovation and cost-effectiveness is crucial to maintaining profitability and market share.

The need for skilled labor and expertise in specialized areas is growing, presenting a significant talent acquisition challenge.

Opportunities for Chipmakers, Chipmaker marvell forecasts second quarter revenue above estimates

Despite the challenges, several opportunities exist for chipmakers like Marvell. The burgeoning adoption of AI and machine learning is creating substantial demand for specialized chips. The ongoing transition to 5G and the expansion of the Internet of Things (IoT) will drive demand for advanced networking and communication chips. Moreover, the need for increased energy efficiency in computing devices is opening up opportunities for chipmakers to develop innovative solutions.

Potential Risks and Mitigating Factors

Potential risks include fluctuations in global economic conditions, impacting demand for semiconductor products. Geopolitical uncertainties can disrupt supply chains and trade relationships. Technological advancements could render existing products obsolete more quickly, requiring companies to embrace agile development strategies. The ongoing chip shortage and its implications for pricing and availability of components could continue to impact profitability.Mitigating these risks involves strategic partnerships, diversified supply chains, and proactive investments in research and development to stay ahead of technological advancements.

Maintaining a robust and diversified customer base can reduce reliance on any single market.

Conclusion: Chipmaker Marvell Forecasts Second Quarter Revenue Above Estimates

In summary, Marvell’s optimistic second quarter revenue forecast suggests a promising future for the company. While market conditions and competitive pressures remain important considerations, the anticipated growth across key product segments positions Marvell well for success. The implications for the broader semiconductor industry and potential investor reactions are noteworthy and will be closely watched. Stay tuned for further analysis and updates on Marvell’s performance.