With ECB policymakers debate risk inflation going too low, the European Central Bank is grappling with a delicate balancing act. Current economic conditions are prompting intense scrutiny of key indicators like consumer price index, wage growth, and energy prices. Factors like a global economic slowdown, supply chain disruptions, and geopolitical instability are raising concerns about the potential for inflation to fall too low, triggering deflationary pressures.

This could have serious consequences for the European economy, potentially impacting various sectors and even triggering a cascade of negative effects throughout the region.

The debate encompasses various scenarios illustrating the potential impact of a persistently low inflation rate. Past ECB responses to similar situations are being analyzed, providing valuable historical context. The potential policy responses from the ECB to address this risk, including interest rate adjustments and unconventional measures, are also being thoroughly examined. The impact on financial markets, global implications, and historical precedents are also crucial parts of this discussion.

ECB Policymakers’ Concerns

The European Central Bank (ECB) is navigating a complex economic landscape, with inflation remaining a primary concern. While recent data shows signs of easing inflationary pressures, policymakers are keenly focused on the potential for inflation to fall too low, jeopardizing the recovery and potentially triggering deflationary pressures. This concern is further complicated by a multitude of global economic factors.The current economic climate is marked by a mix of factors, including a slowing global economy, persisting supply chain disruptions, and ongoing geopolitical tensions.

These conditions are impacting inflation expectations and could lead to a scenario where inflation falls below the ECB’s target, triggering a potential economic downturn.

Current Economic Climate Influencing Concerns

The ECB is carefully observing various economic indicators to gauge the health of the European economy and the risk of inflation falling too low. These indicators provide crucial insights into the potential risks and the effectiveness of current policies.

- Consumer Price Index (CPI): The CPI is a key indicator of inflation. A sustained decline in the CPI, below the target rate, could signal a weakening of demand and potentially lead to deflationary pressures. The ECB closely monitors the CPI’s trajectory to assess the effectiveness of its monetary policy and to adjust its strategies as needed.

- Wage Growth: Wage growth is a crucial element in maintaining sustainable inflation. Sluggish wage growth could dampen consumer spending, reducing demand and pushing inflation lower. The ECB is observing wage growth trends to evaluate their impact on the inflation outlook and the overall economic climate.

- Energy Prices: Energy prices have a significant influence on inflation. Falling energy prices can exert downward pressure on the overall inflation rate. The ECB assesses the impact of energy price volatility on inflation expectations and its effect on the broader economy.

Potential Factors Contributing to Low Inflation Risk

Several factors could contribute to a scenario where inflation falls below the ECB’s target.

- Global Economic Slowdown: A global economic slowdown reduces demand for goods and services, leading to lower prices and potentially lower inflation. Recent economic data from various regions, including the US and Asia, demonstrate a weakening of growth, raising concerns for the European economy.

- Supply Chain Disruptions: Ongoing supply chain disruptions can lead to reduced availability of goods, impacting pricing dynamics and potentially affecting inflation. The persistence of these disruptions necessitates careful monitoring by the ECB.

- Geopolitical Instability: Geopolitical events can significantly impact energy markets and commodity prices, leading to uncertainty and potentially lower inflation. The ECB closely follows geopolitical developments and their influence on the European economy.

Scenarios Illustrating Impact of Low Inflation

A low inflation rate can have several consequences for the European economy.

- Reduced Consumer Spending: Lower inflation can lead to reduced consumer spending, as purchasing power increases. Consumers might delay purchases, anticipating further price declines, which could negatively impact businesses and the economy as a whole.

- Weakened Economic Growth: A prolonged period of low inflation can weaken economic growth, reducing investment and potentially leading to stagnation.

- Deflationary Pressures: If inflation falls below zero, deflationary pressures can arise. This can cause businesses to delay investment, further impacting economic growth.

Historical Context and ECB Responses

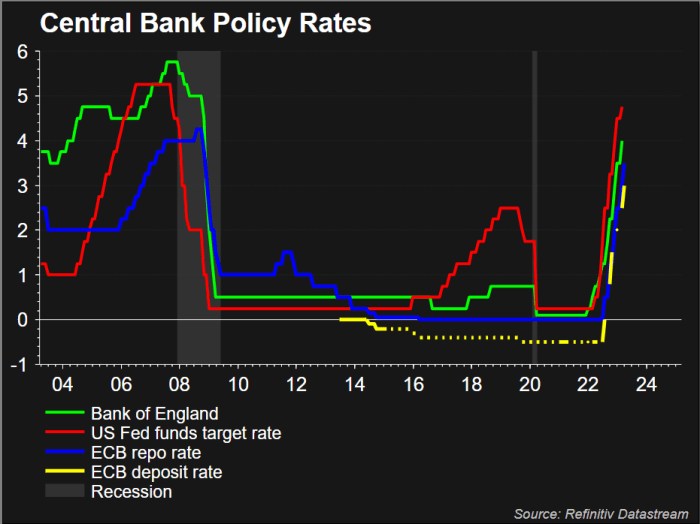

The ECB has faced similar situations in the past. In previous periods of low inflation, the ECB has taken measures to stimulate the economy, such as lowering interest rates. These responses were aimed at boosting demand and preventing deflationary pressures.

Understanding the historical precedents is crucial for policymakers to formulate effective strategies in the present context.

Potential Policy Responses: Ecb Policymakers Debate Risk Inflation Going Too Low

The European Central Bank (ECB) faces a delicate balancing act as it navigates the risk of deflationary pressures. Maintaining price stability while fostering economic growth is crucial for the Eurozone’s continued prosperity. Various policy responses are available to the ECB, each with its own set of potential benefits and drawbacks. This analysis explores these options, examining their economic effects and consequences.

ECB policymakers are grappling with the risk of inflation falling too low, a concern that’s been gaining traction. This economic debate, however, has interesting parallels with the complex realities surrounding third trimester abortion care, as explored in this insightful essay third trimester abortion care realities essay. Ultimately, both highlight the intricate interplay of factors and the need for careful consideration before any policy decisions are made regarding either economic stability or access to healthcare.

Potential Policy Responses to Address Deflation

The ECB has a range of tools to combat deflation, each with varying degrees of impact and potential side effects. These responses span traditional interest rate adjustments to more unconventional measures like quantitative easing. Understanding the nuances of each approach is essential to determining the most effective strategy.

| Policy Response | Potential Economic Effects | Short-Term Consequences | Long-Term Consequences | Pros (Inflation Control/Growth) | Cons (Inflation Control/Growth) | Impact on Sectors |

|---|---|---|---|---|---|---|

| Interest Rate Adjustments | Lowering interest rates can stimulate borrowing and investment, potentially boosting aggregate demand and inflation. | Lower rates can lead to increased consumer spending and business investment in the short term. | Sustained low interest rates can potentially lead to asset bubbles and financial instability in the long term, if not managed carefully. | Positive impact on inflation (stimulates demand) and potentially positive on growth. | Risk of increased inflation if not managed carefully, and possible unintended consequences in the financial markets. | Increased borrowing and investment can benefit sectors like construction and manufacturing, while potentially negatively impacting savings and fixed-income investors. |

| Quantitative Easing (QE) | Purchasing assets (like government bonds) can inject liquidity into the market, potentially lowering long-term interest rates and stimulating borrowing. | Can lead to increased money supply, potentially boosting asset prices in the short term. | Can lead to asset bubbles and inflation if not carefully calibrated, potentially causing long-term inflation or currency depreciation. | Positive impact on inflation (increased money supply) and potentially positive on growth. | Risk of uncontrolled inflation and potential asset bubbles. Can also face political challenges and distrust. | Can provide liquidity to banks, benefitting financial institutions, while potentially leading to price increases in assets like real estate and stocks. |

| Negative Interest Rates | Charging banks for holding reserves can incentivize lending and discourage hoarding of cash. | Can encourage banks to lend more and stimulate economic activity in the short term. | Potentially problematic for banks and savers, leading to disincentives for savings. Can also negatively impact fixed-income investors. | Positive impact on inflation (increased lending) and potentially positive on growth. | Risks of harming the banking system and discouraging savings, as well as unintended consequences for fixed-income markets. | Can benefit borrowers and those reliant on credit, while potentially hurting savers and fixed-income investors. |

| Fiscal Stimulus | Government spending or tax cuts can directly increase aggregate demand, potentially boosting inflation. | Can quickly stimulate economic activity, but may also lead to higher budget deficits. | Potentially lead to higher government debt, which could negatively affect long-term growth if not carefully managed. | Positive impact on inflation (increased demand) and positive on growth. | Risk of increased inflation if not carefully managed, and potential long-term budgetary issues. | Government spending on infrastructure projects can benefit the construction sector, while tax cuts may benefit various sectors based on the specifics of the policy. |

Comparison of Potential Economic Effects

Each policy response has different impacts on various economic indicators. Interest rate adjustments, for example, can influence borrowing costs and investment decisions. Quantitative easing can alter the money supply and long-term interest rates. Negative interest rates can encourage lending, while fiscal stimulus directly affects aggregate demand. The choice of policy will depend on the specific economic conditions and desired outcomes.

Elaboration on Short-Term and Long-Term Consequences

The short-term consequences of each policy can vary significantly. Lowering interest rates can quickly boost consumer spending, but may also lead to asset bubbles. Quantitative easing can inject liquidity quickly, but could lead to unintended inflation pressures. Negative interest rates can encourage lending, but might also harm savings. Fiscal stimulus can provide immediate economic relief, but may lead to increased government debt.

The long-term consequences are equally important to consider. Sustained low interest rates could lead to financial instability, while uncontrolled quantitative easing could create inflationary pressures. Negative interest rates could damage the banking system and discourage savings. Fiscal stimulus, if not managed carefully, can lead to higher levels of government debt.

Impact on Financial Markets

The debate within the ECB regarding the risk of inflation remaining too low has significant implications for financial markets. Policymakers’ differing views on the appropriate course of action can create uncertainty, potentially affecting investor sentiment and driving volatility across various asset classes. Understanding how past ECB decisions have impacted markets provides context for assessing the potential effects of future policy responses.The ECB’s actions often trigger chain reactions within the financial system.

For example, changes in interest rate expectations can directly influence bond yields, while shifts in monetary policy can impact the value of the euro and investor confidence in the economy. This uncertainty can cause market participants to adjust their portfolios, potentially leading to significant price fluctuations.

Bond Yields

The ECB’s policy decisions, particularly regarding interest rates, have a profound impact on bond yields. Lowering interest rates to stimulate the economy typically leads to lower yields on government bonds, making them more attractive to investors. Conversely, raising interest rates can increase yields, making bonds more expensive. The current debate regarding inflation and potential policy responses could trigger fluctuations in bond yields as investors adjust their expectations of future interest rate movements.

For instance, if the ECB signals a more aggressive approach to combating inflation, even if it’s currently low, bond yields might rise as investors anticipate higher interest rates.

ECB policymakers are wrestling with the risk of inflation falling too low, a concern that’s been bubbling under the surface for a while. This echoes recent pronouncements about the “French fairytale” being over, with ranking rises just beginning, as highlighted by Bublik in this insightful piece french fairytale is over ranking rise has just started says bublik.

Ultimately, the ECB’s predicament underscores the delicate balancing act required to manage inflation without stifling economic growth.

Stock Prices

Stock prices are sensitive to changes in economic conditions and investor sentiment. When the ECB is perceived as taking action to support the economy, stock prices often increase as investors anticipate economic growth and corporate earnings. Conversely, if the ECB’s actions are perceived as potentially harmful to the economy, stock prices might decrease. The current debate and potential policy responses, especially if they involve substantial changes in monetary policy, could lead to significant volatility in stock markets as investors assess the impact on corporate profitability and economic growth.

Past examples demonstrate that periods of uncertainty surrounding central bank policy can cause stock markets to fluctuate significantly.

Currency Exchange Rates

The value of the euro is closely tied to ECB policies. If the ECB signals a more hawkish stance to combat potential inflation, investors might perceive the euro as a more attractive investment, leading to a strengthening of the currency. On the other hand, a more dovish stance might weaken the euro. The debate surrounding the appropriate response to potentially low inflation and the ECB’s policy responses could influence the euro’s exchange rate against other major currencies, potentially affecting international trade and investment flows.

Potential Investor Reactions

Investors will likely react to the ECB’s potential policy responses based on their assessment of the effectiveness and potential risks. Investors anticipating a strong response to combat potentially rising inflation might move into higher-yielding assets, while those anticipating a less aggressive approach might opt for riskier assets. This will likely depend on the specifics of the policy response, such as the scale of the intervention and the accompanying communication from the ECB.

Past examples of investor reactions to central bank policy decisions illustrate the significant impact of anticipated policy shifts on financial markets.

Implications for Asset Classes

The ECB’s actions could have differing implications for various asset classes. For instance, government bonds might see increased demand if interest rates are expected to remain low, while stocks could experience volatility depending on the perceived impact on economic growth. The debate regarding inflation and potential policy responses could lead to significant shifts in investor preferences across different asset classes, influencing the overall market sentiment and valuations.

For example, if the ECB takes a more cautious approach, it might affect the price of commodities, depending on the anticipated economic growth.

Potential Risks and Opportunities, Ecb policymakers debate risk inflation going too low

Investors need to carefully assess the potential risks and opportunities associated with the ECB’s debate and policy responses. The risks include market volatility, potentially leading to losses, if the responses are perceived as ineffective or overly aggressive. Opportunities could arise if investors anticipate favorable policy decisions, potentially leading to higher returns in specific asset classes. It’s crucial to conduct thorough research and understand the implications for various asset classes before making investment decisions.

Investors should also closely monitor the ECB’s communication and actions to gauge the market’s reaction and adjust their strategies accordingly.

Global Implications

The ECB’s actions regarding inflation have significant ripple effects extending far beyond the Eurozone. Its decisions regarding interest rates and monetary policy impact global financial markets, influencing investor confidence, exchange rates, and ultimately, global economic growth. Understanding these interconnected dynamics is crucial to assessing the potential consequences of the ECB’s choices.The Eurozone’s economic performance is intrinsically linked to global economic conditions.

For example, global trade patterns, commodity prices, and geopolitical events can all affect the ECB’s ability to achieve its inflation targets. A slowdown in global growth could negatively impact demand for Eurozone exports, potentially putting downward pressure on inflation and forcing the ECB to adjust its strategy.

Influence on Other Central Banks

The ECB’s actions often serve as a benchmark for other central banks. If the ECB adopts a more aggressive approach to combat inflation, it could prompt other central banks, such as the Federal Reserve, to follow suit, potentially leading to a synchronized tightening of global monetary policy. Conversely, a more cautious approach by the ECB might signal a less urgent need for rate hikes elsewhere, allowing other central banks to adopt a more accommodative stance.

This interaction highlights the interconnected nature of global financial markets.

Ripple Effects on Global Economic Growth and Stability

The ECB’s policy decisions can have substantial ripple effects on global economic growth and stability. A synchronized tightening of monetary policy, for instance, could lead to a global slowdown in investment and consumption. This, in turn, could affect emerging economies that rely on global trade and foreign investment. Conversely, a more dovish approach could lead to increased risk-taking in financial markets and potentially higher inflation in some countries, although it could boost economic activity in the short term.

A balanced approach is critical to mitigate these risks.

Comparison with Other Major Central Banks

The ECB’s approach to inflation differs from that of other major central banks, such as the Federal Reserve. For example, the Federal Reserve often prioritizes full employment alongside price stability, whereas the ECB’s mandate is more explicitly focused on price stability. These differing mandates can lead to differing policy responses in the face of similar economic challenges. The Federal Reserve’s focus on employment could lead to a more gradual and less aggressive approach to rate hikes compared to the ECB’s.

Impact on Global Trade and International Relations

The ECB’s policies can affect global trade and international relations. For example, if the ECB raises interest rates significantly, it could make Eurozone exports more expensive relative to those from other countries, potentially impacting global trade flows. Similarly, fluctuating exchange rates, influenced by the ECB’s decisions, could affect international competitiveness and create trade tensions between countries. Understanding these dynamics is crucial to navigating potential geopolitical risks.

How Different Global Economic Situations Influence ECB Policy Decisions

Different global economic situations can influence the ECB’s policy decisions. For example, if emerging markets experience a significant downturn, it could affect the demand for Eurozone exports, potentially pressuring the ECB to adopt a more cautious approach to interest rate hikes. Alternatively, robust global growth could allow the ECB to pursue a more aggressive strategy to control inflation.

Therefore, the ECB needs to consider a broad range of global economic indicators when making policy decisions.

Historical Precedents

Low inflation or deflationary periods are not entirely novel occurrences in economic history. Understanding these past episodes can offer valuable insights into the potential consequences of the current situation and the policy responses that might be effective. Studying historical precedents helps us contextualize the present and potentially anticipate future outcomes.

The Great Depression (1929-1939)

The Great Depression, a period of severe economic contraction, saw deflationary pressures significantly impacting global economies. Governments and central banks struggled to manage the situation, often adopting policies that exacerbated the problem rather than alleviating it. The lack of effective monetary policy responses contributed to the prolonged nature of the downturn.

ECB policymakers are wrestling with the risk of inflation dipping too low, a concerning trend. Meanwhile, the White House, in a statement regarding the South Korean election, expressed concern about Chinese influence, highlighting geopolitical tensions. This, coupled with the ongoing debate about the optimal inflation target, further complicates the ECB’s delicate balancing act in managing economic conditions.

The White House’s statement adds another layer of complexity to the already challenging task of getting inflation back on track for the ECB.

- Significant deflation occurred during this period, with prices falling dramatically. This was accompanied by a sharp decline in economic activity, widespread unemployment, and bank failures. The data reveals a strong negative correlation between inflation and economic growth during this period. Historical records show that inflation rates were well below zero in several countries, while economic growth was almost nonexistent.

- Central banks, particularly the Federal Reserve in the United States, struggled to effectively address the deflationary pressures. Early attempts to raise interest rates to curb the economy further contributed to the crisis, and the policy responses of the time were largely inadequate.

- The Great Depression differed from the current situation in several key aspects. The current global economic landscape is far more complex and interconnected, with different policy tools available. The financial system is also significantly more sophisticated and regulated than it was during the Great Depression.

- Economic conditions during the Great Depression were markedly different from today’s, characterized by a lack of globalization, a simpler financial system, and limited government intervention. The tools available to central banks to stimulate the economy were much more limited compared to today’s array of fiscal and monetary policies.

The 1980s-1990s Japanese Economic Stagnation

Japan experienced a period of prolonged stagnation in the 1980s and 1990s, marked by a combination of deflation and slow economic growth. This period is often referred to as the “lost decade” in Japan. A key factor contributing to the issue was a sustained period of declining prices.

- Japan faced persistent deflation, with inflation rates consistently below zero for an extended period. This was coupled with stagnant economic growth, contributing to a decline in consumer spending and business investment.

- Central banks in Japan implemented various measures to combat the deflationary pressures, including aggressive monetary easing. However, the results were often inconsistent, highlighting the complexities of addressing prolonged deflationary periods.

- The Japanese experience illustrates the challenges of dealing with deflationary periods, particularly in a country with a significant level of debt.

- The economic and financial systems in Japan during that period were different from today’s, and the global economic environment was less interconnected. The policy responses and tools available to the Bank of Japan during that period were also distinct from the tools and instruments used by central banks today.

Comparison and Contrast

The similarities and differences between these historical precedents and the current situation require careful consideration. While deflationary periods have occurred in the past, the current global economic context and the policy tools available to central banks today are different. These factors contribute to the unique nature of the present challenge.

Alternative Perspectives

The ECB’s recent deliberations on potential policy responses to the risk of deflationary pressures highlight a spectrum of opinions among economists and market analysts. These differing perspectives stem from contrasting interpretations of current economic data, varying expectations for future growth, and different models used to predict the impact of potential policy actions. Understanding these alternative viewpoints is crucial for assessing the potential implications of each perspective for the European economy.Divergent views on inflation risk and appropriate policy responses reflect the complexities of the current economic environment.

The debate underscores the need for a nuanced understanding of the various factors at play and the potential trade-offs associated with different policy choices.

Different Interpretations of Inflationary Pressures

The ECB’s concern about inflation falling too low is not universally shared. Some economists argue that the current level of inflation, while potentially below the ECB’s target, is a natural consequence of the global economic slowdown and is not necessarily a cause for immediate concern. They suggest that focusing solely on the current inflation rate may overlook the underlying structural changes shaping the global economy.

Alternative Economic Models and Their Predictions

Different schools of economic thought utilize varying models to forecast future economic conditions. Some models, emphasizing supply-side factors, suggest that sustained low inflation may reflect underlying productivity improvements and efficiency gains, rather than a lack of demand. Conversely, demand-side models, emphasizing aggregate demand, predict that persistent low inflation could indicate a potential recessionary trend.

Arguments Supporting Different Perspectives

- Supply-Side Focus: Proponents of this view highlight recent technological advancements and increased global competition, leading to reduced production costs and potentially lower prices. They argue that this is a natural market adjustment and not necessarily a cause for concern, as long as underlying growth remains positive. The prediction of this perspective is that the low inflation rate will be temporary and will return to target levels as economic activity recovers.

- Demand-Side Emphasis: This perspective emphasizes the current global economic slowdown and the potential for a protracted period of weak aggregate demand. Arguments for this perspective point to decreased consumer confidence and business investment, which are leading to a stagnation in demand and thus lower inflation.

- Financial Market Indicators: The evolution of financial market indicators, such as bond yields and equity valuations, is used by some analysts to gauge future inflationary pressures. A prolonged period of low yields may suggest that markets are anticipating lower inflation rates. This perspective suggests that the ECB should consider these indicators to fine-tune its policy response. The argument is that market expectations are a crucial component of economic reality and should not be disregarded.

They argue that persistent low inflation, as reflected in financial markets, warrants proactive policy responses.

Comparison and Contrast of Expert Arguments

A comparison of the arguments reveals that differing perspectives often hinge on the emphasis placed on various economic factors. Supply-side economists often focus on long-term structural trends, while demand-side economists concentrate on short-term aggregate demand dynamics. Financial market analysts emphasize the role of market expectations and anticipations in shaping inflationary outcomes. A crucial distinction is that supply-side arguments suggest a temporary deviation from the target inflation rate, while demand-side arguments point to a more substantial and potentially prolonged problem.

Potential Implications for the European Economy

The differing perspectives on inflation risks have significant implications for the European economy. A policy response based on a supply-side perspective might involve a more relaxed approach, focusing on supporting structural reforms and long-term growth. Conversely, a policy response rooted in a demand-side perspective might advocate for more aggressive measures to stimulate aggregate demand and boost inflation. The potential impact of each perspective on employment, investment, and overall economic growth warrants careful consideration.

Outcome Summary

In conclusion, the ECB’s debate on the risk of inflation falling too low is a complex issue with significant implications for the European and global economies. Policymakers are carefully weighing the potential consequences of different scenarios and considering a range of policy responses. The outcome of this debate will likely influence financial markets, impact various sectors, and have broader implications for global economic stability.

Ultimately, the ECB’s decisions will be closely watched by investors and policymakers worldwide.