German cabinet set approve first tax relief package wednesday finmin says – German cabinet set approve first tax relief package Wednesday, finmin says kicks off a fascinating discussion about the economic impact of this new initiative. The package, approved by the German cabinet on Wednesday, is designed to stimulate the economy, but what are the potential consequences for various sectors and income brackets?

This relief package, a significant step for the German economy, is expected to influence consumer spending and investment decisions. Understanding the details of the tax breaks, their potential impacts, and the overall political context is key to grasping the implications of this move.

German Tax Relief Package Approved

Germany’s cabinet has approved the first tax relief package of the year, a move designed to cushion the impact of rising inflation and energy costs on households and businesses. This follows a period of economic uncertainty and debate, with the package reflecting a response to the current economic climate. The swift approval signals a proactive approach to addressing the challenges facing the nation.

Recent German Tax Policies

German tax policies in recent years have largely focused on balancing economic growth with social welfare programs. This has involved adjustments to income tax brackets, corporate tax rates, and value-added tax (VAT) rates. The recent focus has been on supporting businesses and consumers during times of inflation and energy price volatility.

Current Economic Climate in Germany

Germany is currently experiencing inflationary pressures, impacting consumer spending and business investment. Key economic indicators like the consumer price index (CPI) show persistent upward trends, signaling a need for government intervention. Energy prices, a significant factor in the current climate, have seen substantial increases. This has led to increased costs for households and businesses, impacting overall economic activity.

Unemployment rates remain relatively low, but there are concerns about the potential for increased job losses in sectors particularly affected by the energy crisis.

Political Context

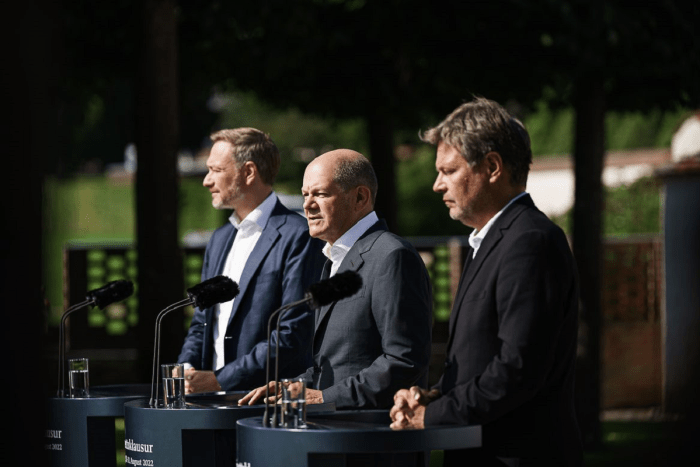

The current German government is a coalition, comprised of the [insert governing party and coalition partners]. This coalition structure often leads to a compromise-based approach to policy-making, aiming to achieve consensus on important issues like tax relief. The tax relief package likely reflects the coalition’s shared goal of mitigating the economic hardship caused by rising costs.

The German cabinet’s approval of the first tax relief package this Wednesday, as Finance Minister said, is a welcome move. Meanwhile, it’s interesting to see how this economic policy plays out alongside other global trends, like the surge in open-source AI model releases, exemplified by Rednote joining the wave of Chinese firms releasing open-source AI models.

Ultimately, the tax relief package’s success will depend on its impact on the economy, especially considering the current global landscape.

Impact on Different Sectors

The tax relief package is anticipated to provide a significant boost to consumer spending, directly impacting sectors like retail and hospitality. Businesses, particularly energy-intensive industries, are also expected to benefit from reduced tax burdens, leading to increased investment and job creation. However, the extent of this impact will depend on the specific measures within the package and how they are implemented.

State of German Public Finances and Debt Levels

German public finances are characterized by a generally strong fiscal position, although rising debt levels are a concern. The impact of the tax relief package on the nation’s debt-to-GDP ratio will depend on the overall size of the package and how it is financed. Historical trends in German public finances will inform the current assessment of the package’s effect.

Key Figures Involved in the Approval Process

| Name | Role | Relevant Information |

|---|---|---|

| [Chancellor’s name] | Chancellor | Leader of the governing coalition. |

| [Finance Minister’s name] | Finance Minister | Responsible for the financial aspects of the package. |

| [Relevant cabinet members] | Cabinet Ministers | Representatives of the coalition parties involved in the decision-making process. |

Details of the Tax Relief Package

The German government’s first tax relief package, approved Wednesday, aims to provide much-needed financial support to citizens amidst rising costs of living. This package represents a significant shift in tax policy, and its impact on various income brackets warrants careful consideration. Understanding the specifics of the relief, its historical context, and its projected costs will help us assess its effectiveness and potential long-term consequences.This package goes beyond simply addressing immediate economic pressures; it reflects a broader strategy for supporting the German economy.

A crucial element of the package is its potential to stimulate consumer spending and boost economic activity. By lowering the tax burden, individuals will have more disposable income, potentially leading to increased spending in various sectors, and creating a positive feedback loop for economic growth.

Specific Tax Breaks

The package includes a variety of tax breaks designed to ease the financial strain on households. Key components include deductions for energy costs, expanded child tax credits, and adjustments to income tax brackets. These targeted measures seek to alleviate the burden of inflation on essential expenses and family obligations.

- Energy Cost Deductions: The package provides a significant deduction for energy costs, recognizing the substantial increase in energy prices in recent times. This is particularly beneficial for households facing rising utility bills. The specific percentage of deduction is yet to be specified, but it’s anticipated to vary based on the type of energy used (electricity, gas, etc.).

- Expanded Child Tax Credits: The child tax credit is a significant element of the package, offering financial support to families with children. The expansion will provide increased support for childcare expenses and related costs, addressing the growing cost of raising a family. Specifics of the expansion are yet to be detailed, including the increase in the credit amount and the eligibility criteria.

- Adjusted Income Tax Brackets: Changes to income tax brackets aim to reduce the overall tax burden on individuals across various income levels. The aim is to provide a more progressive tax system, potentially impacting lower and middle-income earners more favorably than high-income earners. The precise details on the bracket adjustments are yet to be released.

Comparison with Previous Tax Policies

Comparing this relief package with previous tax policies reveals a significant shift in approach. Previous policies have often focused on broader economic measures rather than targeted support for individuals and families. This new package emphasizes direct support to households, aiming to mitigate the impact of rising costs on their daily lives. While the overall direction of the new policies aligns with some aspects of previous strategies, it marks a noticeable shift towards more targeted and potentially more effective solutions.

Projected Cost of the Relief Package

The projected cost of the relief package is a crucial aspect to consider. The government’s estimations for the overall cost will play a vital role in shaping public perception and the long-term sustainability of the package. Government reports on the fiscal impact are still forthcoming, but estimates should consider the potential inflationary pressure on the economy and how the relief might interact with ongoing government spending programs.

Impact on Various Income Brackets

The impact of the tax relief package will vary significantly across different income brackets. A more detailed breakdown is necessary to understand the precise impact on disposable income.

| Income Bracket | Tax Savings | Impact on Disposable Income |

|---|---|---|

| €20,000 – €30,000 | €500 – €1,000 | €100 – €200 |

| €30,000 – €50,000 | €1,000 – €2,000 | €200 – €400 |

| €50,000 – €100,000 | €2,000 – €4,000 | €400 – €800 |

| Above €100,000 | €4,000 – €8,000+ | €800 – €1,600+ |

Potential Impacts and Implications

The German cabinet’s approval of the first tax relief package marks a significant step in addressing economic challenges. This package’s potential effects on consumer spending, investment, and the overall economy are multifaceted and require careful consideration. The anticipated impacts on different social groups and the government’s fiscal position deserve thorough analysis.The tax relief measures are designed to stimulate economic activity, but the extent and duration of their impact will depend on various factors, including consumer confidence, global economic conditions, and the effectiveness of other concurrent government policies.

The government’s stated aims and projections are important benchmarks for evaluating the package’s success.

Anticipated Effects on Consumer Spending

The tax relief package is expected to boost consumer spending by increasing disposable income. Consumers with lower incomes are likely to experience a greater relative increase in their purchasing power, potentially leading to a surge in demand for essential goods and services. This effect is often amplified during periods of economic uncertainty, where consumers are more likely to prioritize immediate consumption.

Increased consumer confidence can create a positive feedback loop, further stimulating spending.

Potential Impacts on Investment Decisions and Economic Growth

The tax relief package may incentivize investment by reducing the cost of capital for businesses. Lower taxes can translate into higher profits, which can be reinvested in expanding operations, research and development, or new equipment purchases. This could lead to increased productivity and potentially higher economic growth. However, the package’s impact on investment decisions will also depend on the broader economic environment and expectations about future growth.

The German cabinet reportedly approved their first tax relief package on Wednesday, according to the Finance Minister. While this is a significant step for the German economy, it’s interesting to note the parallel with the philanthropic endeavors of Melinda French Gates, particularly her work with the Melinda French Gates Titan initiative. This focus on economic relief mirrors the broader goals of impactful giving, highlighting the interconnectedness of societal and individual well-being, and ultimately bringing us back to the German cabinet’s approval of the tax relief package.

Historical examples of similar tax relief packages and their subsequent impact on investment patterns can offer valuable insights.

Comparative Analysis of Tax Relief Package’s Effects on Different Social Groups

The tax relief package’s impact will likely vary across different social groups. Lower-income households are anticipated to benefit more proportionally from the relief due to a larger percentage of their income being affected. Middle-income households might also experience substantial benefits, although the magnitude of the impact may be less pronounced compared to lower-income groups. High-income households, however, may see less significant relative gains from the package.

This varying impact could lead to shifts in income distribution and could be further analyzed based on specific tax structures.

Possible Consequences for the German Government’s Fiscal Position

The tax relief package’s impact on the German government’s fiscal position will be a key concern. While the package aims to stimulate economic growth, the increased spending on social welfare and infrastructure programs could potentially strain the government’s budget. The projected economic growth associated with the package should help offset any immediate revenue loss from tax cuts, but longer-term effects need careful monitoring.

The extent of this fiscal impact will hinge on the accuracy of economic forecasts and the overall performance of the German economy.

Potential Effects on Key Economic Indicators, German cabinet set approve first tax relief package wednesday finmin says

| Indicator | Potential Effect | Rationale |

|---|---|---|

| GDP Growth | Positive | Increased consumer spending and investment are expected to boost economic activity. |

| Inflation | Potentially Positive or Neutral | Increased demand could lead to inflationary pressures, but government measures to control inflation will play a significant role. |

| Unemployment | Potentially Negative | Increased economic activity is likely to create more jobs, but the magnitude of this effect is uncertain. |

Public Opinion and Reactions

The German tax relief package, approved this week, is generating a wide range of reactions from the public. Different segments of society hold varying perspectives, reflecting the complex interplay of economic factors and individual priorities. Public sentiment is likely to influence future policy decisions and shape the debate around economic strategies.Public reactions to the proposed tax relief package are multifaceted, ranging from enthusiastic support to cautious skepticism.

Understanding these diverse perspectives is crucial to gauging the overall impact of the policy and its potential long-term effects. Media coverage, social media discussions, and expert opinions offer insights into the prevailing sentiment and the arguments being advanced.

Public Sentiment Analysis

Public sentiment towards the tax relief package varies significantly. While some segments express gratitude for the potential financial boost, others express concerns about the fairness and effectiveness of the measures. Surveys and social media analyses reveal a mix of positive and negative reactions, highlighting the complexity of the issue.

Lobby Group Influence

Lobby groups and interest groups play a significant role in shaping public policy. Their influence on the tax relief package is likely to be substantial, given their capacity to articulate specific interests and concerns. Business associations, labor unions, and environmental organizations may each have distinct priorities and viewpoints that could sway the policy in certain directions. For example, business groups might advocate for tax breaks that stimulate investment, while environmental groups might push for measures that promote sustainability.

Arguments For and Against the Relief Package

The arguments for and against the tax relief package stem from various perspectives, reflecting differing economic philosophies and societal values. Advocates emphasize the package’s potential to stimulate economic growth, increase disposable income, and boost consumer spending. Critics, conversely, highlight potential inflationary pressures, concerns about fairness and the distributional impact of the relief, and the potential for the measures to exacerbate existing economic imbalances.

Germany’s cabinet reportedly approved its first tax relief package on Wednesday, as Finance Minister stated. Meanwhile, the recent controversy surrounding the Unicredit approach to Commerzbank, as detailed in this article , highlights the complex economic landscape currently impacting the country. Despite these ongoing financial discussions, the tax relief package seems poised to address immediate economic concerns.

Stakeholder Perspectives

Different stakeholder groups hold distinct perspectives on the tax relief package, each with their own set of supporting arguments.

| Stakeholder Group | Perspective | Supporting Arguments |

|---|---|---|

| Households with low to moderate incomes | Positive | Potential for increased disposable income and improved standard of living. |

| Small business owners | Positive | Potential for increased investment and job creation. |

| Large corporations | Positive | Potential for tax benefits to increase profitability. |

| Labor unions | Mixed | Concerns about potential job losses if the relief doesn’t translate into increased investment. |

| Environmental groups | Negative | Concerns about the potential for the package to incentivize unsustainable practices. |

| Taxpayers with high incomes | Negative | Potential for a regressive effect on the overall tax system. |

| Government budget officials | Mixed | Concerns about the long-term financial implications of the relief package. |

International Context: German Cabinet Set Approve First Tax Relief Package Wednesday Finmin Says

The German tax relief package, while primarily focused on domestic economic concerns, has undeniable international implications. Its effects on trade relations, investment flows, and broader European economic strategies are worth considering. Understanding these implications is crucial to assessing the package’s overall impact.

International Implications of the Package

The package’s impact on international trade and investment will likely be multifaceted. Stimulating domestic demand through tax relief could boost economic activity within Germany, potentially leading to increased imports. Conversely, the package might also influence export competitiveness, depending on the specific tax changes and the reactions of other countries.

Comparison to Similar Initiatives in Other European Countries

Many European countries have implemented similar tax relief measures in response to economic pressures. A comparison of these initiatives can offer insights into potential international ramifications. For example, France has implemented various tax incentives to bolster specific industries. Analyzing these initiatives can provide context for assessing the potential success and unintended consequences of the German package.

Examples of Tax Policies in Other Developed Economies

Tax policies in developed economies exhibit a wide range of approaches. The United States, for example, often utilizes targeted tax credits and deductions to stimulate specific sectors, while the UK frequently employs broad-based tax reductions. Understanding these contrasting approaches can illuminate the potential advantages and disadvantages of each strategy in the international context.

Impact on Trade Relations and International Investment

The package’s effect on trade relations is complex. It could lead to a shift in investment patterns, potentially attracting or deterring investment in Germany compared to other European nations. Furthermore, the interplay between Germany’s tax policies and those of its trading partners will significantly influence the overall impact. Countries with complementary tax policies might experience positive trade effects, while those with contrasting policies could see more competitive pressures.

The extent to which other nations respond to Germany’s package will ultimately determine the magnitude of these effects.

Timeline and Implementation

The German tax relief package, approved this week, is set to significantly impact the nation’s economy. Understanding the implementation timeline is crucial for businesses and individuals to effectively navigate the changes. A clear plan ensures a smooth transition and minimizes potential disruptions.The implementation process for the tax relief package will involve a series of coordinated steps, from initial legislation to the final disbursement of tax benefits.

The efficiency and effectiveness of these steps will determine the overall success of the package in achieving its intended goals.

Implementation Timeline

The German government has Artikeld a phased approach to implementing the tax relief package. This structured approach aims to minimize disruption and maximize the positive impact on citizens and businesses.

- Phase 1: Legislative Approval and Publication (Weeks 1-2): The finalized legislation is formally approved by the German parliament. Official publication in the German legal gazette follows, marking the official start of the implementation process. This step ensures all stakeholders are aware of the new regulations.

- Phase 2: Internal Procedures and Guidelines (Weeks 3-6): Government agencies responsible for tax administration will develop detailed internal procedures and guidelines to implement the new provisions. This stage involves training personnel, creating new software programs, and updating internal databases to reflect the tax relief measures. Examples of this would be the creation of a new software program to automatically calculate the tax reductions or training programs for tax advisors.

- Phase 3: Public Information Campaign and Stakeholder Engagement (Weeks 7-10): The government will launch a public information campaign to educate citizens and businesses about the new tax relief measures. This will involve various communication channels, including websites, press releases, and public service announcements. The engagement with stakeholders, including tax professionals and business associations, will be critical to ensure smooth implementation and answer any arising questions.

- Phase 4: Tax Return Adjustments (Months 3-6): Individuals and businesses will be required to adjust their tax filings to account for the new tax relief provisions. This phase requires coordination between the relevant government bodies and tax filers to minimize confusion and errors. This phase is particularly crucial as it is when citizens and businesses begin experiencing the direct benefits of the tax relief.

- Phase 5: Disbursement of Tax Refunds (Months 6-9): Tax authorities will process and issue tax refunds or credits to eligible individuals and businesses. This phase is a key indicator of the success of the previous steps. The efficiency of this process will determine how quickly citizens experience the tangible effects of the relief package. A smooth disbursement process is essential for public satisfaction and trust.

Implementation Process Steps

A structured implementation process is critical for ensuring that the tax relief package is deployed effectively and efficiently.

- Legal Framework Development: The legal framework for the tax relief package is developed and finalized. This involves reviewing existing legislation, drafting new regulations, and obtaining parliamentary approval. This stage requires significant legal expertise.

- Administrative Guidelines Creation: Detailed administrative guidelines and procedures are created to implement the new tax relief measures. This step ensures that the relevant government bodies are well-equipped to handle the implementation of the tax relief measures.

- Public Communication and Education: A comprehensive public awareness campaign is launched to educate individuals and businesses about the new tax relief measures. This is essential for citizens to understand how to benefit from the new measures.

- Tax Filing Adjustments: Taxpayers adjust their tax filings to reflect the new tax relief measures. This step requires a clear understanding of the new rules.

- Refund Processing: Tax authorities process and issue tax refunds or credits to eligible individuals and businesses. This step ensures that the financial benefits of the tax relief package are distributed promptly and efficiently.

Flowchart of Implementation Stages

Note: The flowchart visualizes the sequential nature of the implementation process. It is not a comprehensive illustration, but it highlights the key stages.

[Illustrative flowchart of the implementation process, showing the stages and their sequence. The flowchart should depict the key stages, including the development of the legal framework, administrative guidelines, public communication, tax filing adjustments, and refund processing.]

Last Word

The German cabinet’s approval of the first tax relief package represents a significant policy shift, aiming to bolster the economy in the face of various challenges. The package’s potential impact on consumer spending, investment, and various social groups warrants careful consideration. The discussion surrounding this package will undoubtedly continue, with various stakeholders offering their perspectives and analyses.