South african rand gains before manufacturing pmi vehicle sales data – South African rand gains before manufacturing PMI and vehicle sales data are stirring up interesting market reactions. Recent performance of the rand has been impacted by global economic trends, and the upcoming manufacturing PMI and vehicle sales data will likely be crucial in determining its trajectory. This article delves into the factors driving the rand’s movement, examining the significance of these key economic indicators and their potential influence on the South African economy.

We’ll also explore potential market responses and illustrative scenarios.

The South African rand’s performance is frequently influenced by global economic conditions, making it a fascinating subject to study. Understanding the interplay between domestic manufacturing, vehicle sales, and the rand’s value is crucial for investors and analysts alike. This analysis explores how these elements can impact the rand’s exchange rate and provides insights into potential market reactions.

Overview of South African Rand

The South African Rand (ZAR) has been a fascinating currency to watch, particularly in recent times. Its performance is intricately linked to global economic trends, local factors, and, importantly, the volatility inherent in emerging market currencies. This overview will delve into the Rand’s historical performance, the key drivers of its exchange rate, and its susceptibility to global economic fluctuations.The South African Rand has experienced periods of both significant appreciation and depreciation over the past decade.

These shifts have been influenced by a complex interplay of domestic and international forces. Understanding these dynamics is crucial for anyone seeking to navigate the South African financial landscape.

Historical Performance of the Rand

The Rand’s value has fluctuated considerably throughout its history. Early in the 21st century, it experienced periods of strength, driven by commodity prices and investor confidence. However, more recent times have seen the Rand facing headwinds, often mirroring global economic trends and South African domestic challenges. Factors like inflation, interest rate differentials, and investor sentiment have all contributed to the Rand’s volatile path.

Factors Influencing the Rand’s Exchange Rate

Several factors significantly influence the Rand’s exchange rate. A key driver is the price of South Africa’s major exports, particularly raw materials like gold and platinum. Fluctuations in global commodity prices directly impact the demand for the Rand, as exporters earn more or less in foreign currency.

- Commodity Prices: Changes in the global prices of raw materials heavily influence the Rand’s value. A surge in global demand for South African commodities like platinum can strengthen the Rand, while a downturn weakens it. For instance, a substantial drop in gold prices in 2013 directly impacted the Rand’s value.

- Interest Rate Differentials: The difference in interest rates between South Africa and other major economies plays a vital role. If South African interest rates are higher than global rates, foreign investors may seek higher returns in the local market, increasing demand for the Rand and thus strengthening its value. Conversely, lower South African interest rates can weaken the Rand.

- Investor Confidence: South Africa’s economic outlook, political stability, and perceived risk play a crucial role in shaping investor confidence. Positive developments can lead to increased foreign investment, boosting demand for the Rand. Conversely, political uncertainty or economic instability can negatively affect investor sentiment, leading to depreciation.

Relationship with Global Economic Trends

The Rand’s value is strongly correlated with global economic conditions. Periods of global economic growth typically lead to a stronger Rand, as international investors seek opportunities in emerging markets like South Africa. Conversely, global recessions or uncertainties can negatively affect the Rand. This relationship highlights the interconnectedness of global economies and the Rand’s susceptibility to external shocks.

Historical Volatility of the South African Rand

The Rand has consistently demonstrated significant volatility. This is often due to a combination of domestic and global factors. Understanding this volatility is essential for investors and businesses engaging in international transactions involving the Rand. Data from various financial sources clearly illustrate the wide range of fluctuations the Rand has experienced.

Manufacturing PMI and Vehicle Sales Data

The South African Rand’s performance often hinges on economic indicators. Manufacturing Purchasing Managers’ Index (PMI) and vehicle sales data provide crucial insights into the health of the manufacturing sector and consumer spending, respectively. These factors can significantly influence investor sentiment and, consequently, the Rand’s exchange rate. Understanding their interplay is vital for investors and analysts seeking to predict the Rand’s movement.The manufacturing PMI, a key barometer of the sector’s health, reflects the prevailing conditions in manufacturing.

Vehicle sales data, mirroring consumer confidence and demand, offer a glimpse into the broader economic outlook. The interplay between these two sets of data and their historical relationship with the Rand’s value provides valuable insights for understanding market trends.

Significance of Manufacturing PMI Data

The manufacturing PMI is a composite index that measures the prevailing conditions in the South African manufacturing sector. A reading above 50 typically indicates expansion, while a reading below 50 signals contraction. This indicator is significant because manufacturing is a crucial component of the South African economy, contributing to GDP and employment. Strong manufacturing activity often translates to higher demand for raw materials and exports, which can bolster the Rand’s value.

Conversely, a decline in manufacturing activity can lead to reduced demand and a potential weakening of the currency.

Potential Impact of Vehicle Sales Data on the Rand

Vehicle sales data reflect consumer confidence and demand for goods. High vehicle sales figures often suggest a healthy economy and strong consumer spending. This can lead to increased demand for the Rand, as imports and other transactions involving the currency are likely to increase. Conversely, low vehicle sales can indicate a downturn in the economy, potentially resulting in decreased demand for the Rand and a weaker currency.

Historical Correlation Between Indicators and the Rand

Analyzing the historical correlation between manufacturing PMI, vehicle sales, and the Rand’s value can reveal patterns and potential future trends. A strong positive correlation between manufacturing PMI and the Rand would suggest that when manufacturing activity improves, the Rand strengthens. Similarly, a positive correlation between vehicle sales and the Rand implies that rising vehicle sales correlate with a stronger Rand.

Historical data can be analyzed to determine the strength and consistency of these correlations.

Methodology for Calculating Manufacturing PMI and Vehicle Sales Data

The manufacturing PMI is calculated using a survey of purchasing managers across various manufacturing sectors. Respondents are asked about their assessment of key indicators such as new orders, production, employment, and delivery times. These responses are aggregated and weighted to produce a composite index.Vehicle sales data are collected from various sources, including automotive dealerships and industry associations. These data encompass various factors, including new vehicle sales, used vehicle sales, and the types of vehicles sold.

The South African rand is showing some strength ahead of manufacturing PMI and vehicle sales data releases. Meanwhile, interestingly, the US has reportedly slashed its order for Lockheed’s F-35 fighter jets, as reported by Bloomberg news here. This might have some ripple effects on global markets, potentially impacting the rand’s performance in the coming days as investors consider the broader economic picture.

Still, the rand’s current gain suggests underlying resilience in the South African economy.

The figures are usually compiled and released on a monthly or quarterly basis, depending on the specific reporting schedule. The methodologies used for collecting and calculating these data sets are important for interpreting the data correctly. Understanding the methodology behind the data ensures an accurate assessment of its implications.

Potential Impacts of Gains: South African Rand Gains Before Manufacturing Pmi Vehicle Sales Data

The South African Rand’s recent gains present a complex picture for the nation’s economy. While a stronger currency can offer numerous advantages, it also carries potential downsides. Understanding these multifaceted impacts is crucial for assessing the overall effect on various sectors and the economy as a whole.The interplay between a strengthening Rand, manufacturing PMI, and vehicle sales data creates a dynamic scenario.

The impact of these intertwined factors requires careful consideration, encompassing both the positive and negative ramifications for South Africa. Analyzing the possible consequences on import/export activities, inflation, and interest rates is vital to a comprehensive understanding of the situation.

Positive Consequences for South Africa

A stronger Rand can make imports cheaper, potentially reducing the cost of essential goods and services. This can translate into lower inflation and improved consumer purchasing power. Increased competitiveness in the export sector can also occur due to the lower pricing of South African goods in international markets. This can bolster export revenue and stimulate economic growth.

Negative Consequences for South Africa

A stronger Rand can negatively affect export-oriented industries, as their products become more expensive for international buyers. This could lead to decreased demand and reduced profitability for these companies. It can also impact the competitiveness of South African businesses in the global market, potentially leading to job losses in the export sector.

Impact on Import and Export Activities

A stronger Rand directly impacts the price competitiveness of South African goods in international markets. Exporters face increased costs in terms of international pricing, making their goods less attractive to foreign buyers. Conversely, imports become cheaper, leading to potentially lower consumer prices.

Influence on Inflation and Interest Rates

A stronger Rand can exert a downward pressure on inflation by reducing the cost of imported goods. This can influence interest rate decisions by central banks. A stronger currency can lead to a decrease in the demand for foreign currency, and this can have a stabilizing effect on the exchange rate, potentially influencing the central bank’s decisions regarding interest rate adjustments.

The effect on interest rates is not always straightforward, and the specific impact depends on several economic factors.

Economic Indicators and Data Sources

Understanding the South African economy requires looking at a range of key indicators. These provide insights into various sectors, helping to paint a comprehensive picture of the country’s economic health. This section will delve into the specific data sources for crucial indicators, like manufacturing PMI and vehicle sales, to understand how they contribute to the overall economic narrative.

Relevant Economic Indicators, South african rand gains before manufacturing pmi vehicle sales data

Several economic indicators offer valuable insights into the South African economy. These indicators reflect different facets of the economy, including production, consumption, and investment. Key examples include GDP growth, inflation rates, unemployment figures, and consumer confidence. Monitoring these indicators provides a holistic view of the nation’s economic trajectory.

Manufacturing PMI Data

The South African manufacturing Purchasing Managers’ Index (PMI) provides a monthly snapshot of the health of the manufacturing sector. It gauges the prevailing conditions by surveying a representative sample of manufacturing companies. Key factors reflected in the PMI include new orders, production levels, employment trends, and supplier delivery times.

Vehicle Sales Data

Vehicle sales data provides a direct measure of consumer spending and demand in the automotive sector. This data reflects consumer confidence and economic activity in the broader economy. Sales figures, often reported monthly, offer insights into the overall strength of the market.

Data Sources and Reporting Frequency

The following table Artikels the primary sources and reporting frequencies for manufacturing PMI and vehicle sales data in South Africa.

| Indicator | Source | Frequency | Description |

|---|---|---|---|

| Manufacturing PMI | The Bureau for Economic Research (BER) | Monthly | This index surveys South African manufacturers to gauge business activity, production, and expectations. |

| Vehicle Sales | National Association of Automobile Manufacturers of South Africa (Naamsa) | Monthly | This data represents the number of vehicles sold in South Africa, providing a measure of consumer demand and economic sentiment in the automotive sector. |

Potential Market Reactions

The South African Rand’s performance against other currencies, particularly before the release of manufacturing PMI and vehicle sales data, often triggers varied reactions across different market participants. Understanding these potential reactions is crucial for assessing the overall impact on the South African economy and related global markets. These anticipated responses are dynamic and can shift based on the specific data points released.

Market Participant Reactions

The South African Rand’s strength or weakness relative to other currencies can have distinct effects on various market sectors. A stronger Rand, for instance, could impact trade flows, investment decisions, and overall investor sentiment. The following table Artikels potential reactions from key market participants:

| Market Participant | Potential Reaction | Reasoning |

|---|---|---|

| Importers | Increased import costs | A stronger Rand makes imports cheaper in terms of the domestic currency. This leads to higher import costs as the value of the Rand increases against other currencies. |

| Exporters | Decreased export revenues (in Rand terms) | A stronger Rand makes South African exports more expensive for foreign buyers. This decreases the revenue earned by exporters when translated back into Rand. |

| Local Businesses (manufacturing and retail) | Mixed impacts, depending on import/export mix | Businesses reliant on imports will face higher costs, while those focusing on exports will see decreased revenue. The overall impact will vary based on the specific business model. |

| Foreign Investors | Potential for increased investment opportunities (if the Rand is strengthening) or decreased investment opportunities (if the Rand is weakening) | A stronger Rand can attract foreign investors, making South African assets more affordable in their home currencies. Conversely, a weaker Rand might deter investors. |

Investor Sentiment

Investor sentiment is likely to be influenced by the Rand’s performance in the lead-up to the release of manufacturing PMI and vehicle sales data. A strong Rand, potentially signaling a robust economy, could boost investor confidence, driving increased investment in the South African market. Conversely, a weakening Rand might indicate economic uncertainty, leading to a decrease in investor confidence.

This sentiment will further influence investment decisions and market dynamics.

Currency Responses

The South African Rand’s movement often influences the performance of other currencies, particularly those of emerging economies. For example, if the Rand strengthens significantly, it might encourage capital outflow from other emerging markets, potentially impacting their respective currencies. Conversely, a weakening Rand could lead to a strengthening of competing currencies. This ripple effect is a crucial aspect of global financial markets and needs to be carefully monitored.

Illustrative Scenarios

The South African Rand’s performance often hinges on a delicate interplay of economic indicators. Understanding how different data points – particularly manufacturing PMI and vehicle sales – can influence its movement is crucial for investors and stakeholders. These scenarios highlight the potential impact of these key metrics on the Rand’s value.

The South African rand is showing some strength ahead of the manufacturing PMI and vehicle sales data releases. Meanwhile, it’s interesting to see that a women’s supplements brand, O Positiv, is reportedly exploring various sale options, as reported by womens supplements brand o positiv explores sale sources say. This could potentially have some ripple effects on the broader market, though it’s still too early to say how this will impact the rand’s future performance.

Overall, the rand’s performance before these key economic indicators remains to be seen.

Positive PMI, Strong Vehicle Sales

A scenario where positive manufacturing Purchasing Managers’ Index (PMI) data coincides with robust vehicle sales figures typically leads to a strengthening of the Rand. A high PMI suggests a healthy manufacturing sector, indicating increased production, investment, and potentially higher exports. This positive economic momentum, combined with strong domestic demand (as reflected in vehicle sales), often translates into increased foreign investment, boosting the currency’s value.

The market perceives this as a sign of a robust and growing economy, driving up demand for the Rand. This scenario often results in a positive appreciation of the Rand, as investors anticipate continued economic growth and increased demand for South African assets.

Positive PMI, Weak Vehicle Sales

While a positive manufacturing PMI suggests a healthy industrial sector, weak vehicle sales figures can temper the overall positive impact on the Rand. A robust manufacturing sector, with high production and export potential, is still a positive indicator. However, weak vehicle sales might signal a downturn in consumer confidence or economic uncertainty in the broader economy. This scenario suggests that the positive effects of the PMI might be partially offset by a lack of growth in another key sector.

This could result in a more limited appreciation of the Rand, as the market weighs the mixed signals from the economy. Investors may be hesitant to fully embrace the currency’s potential given the uncertainty, leading to a muted reaction.

The South African rand is gaining strength ahead of manufacturing PMI and vehicle sales data releases. Meanwhile, the Giants are showing some serious hitting power, rallying past the Rockies for another one-run victory, a fantastic win. This positive momentum in the sports world might just be a sign of things to come for the rand’s performance, suggesting a potential uptrend as the economic data comes out.

Scenario Comparison

| Scenario | Manufacturing PMI | Vehicle Sales | Rand Movement | Impact |

|---|---|---|---|---|

| Positive PMI, Strong Vehicle Sales | High | Strong | Appreciation | Strong positive impact on the Rand due to increased investor confidence in the economy’s growth potential, potentially leading to higher investment in South African assets. |

| Positive PMI, Weak Vehicle Sales | High | Weak | Limited Appreciation | Positive PMI partially offset by weak vehicle sales. Investor confidence is somewhat mitigated by the uncertainty of the broader economic picture. This could lead to a more cautious approach towards the Rand, resulting in a less pronounced appreciation. |

Summary of Scenarios

These illustrative scenarios demonstrate the complex relationship between manufacturing PMI, vehicle sales, and the South African Rand. A positive PMI, while crucial, may not be sufficient to drive significant Rand appreciation if other key economic indicators, like vehicle sales, suggest a less robust overall economy. Understanding these nuanced relationships is essential for accurate market analysis and informed investment decisions.

Visual Representation

Diving deeper into the South African economic landscape, visualizing the interplay between the Rand, manufacturing PMI, and vehicle sales is crucial for understanding potential market reactions. Charts offer a concise and compelling way to identify trends and correlations that might otherwise be missed in raw data. These visualizations can help investors and analysts anticipate potential market movements and make informed decisions.

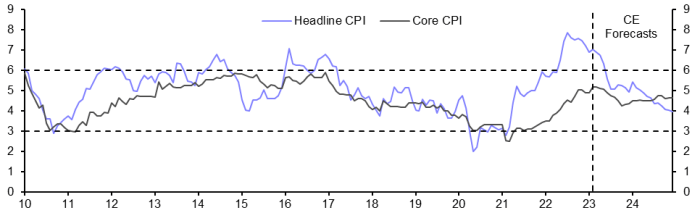

Historical Relationship Between Rand and Manufacturing PMI

This chart displays the historical relationship between the South African Rand’s exchange rate and the manufacturing Purchasing Managers’ Index (PMI). The PMI, a key economic indicator, reflects the prevailing sentiment within the manufacturing sector. A higher PMI generally suggests stronger activity, while a lower PMI indicates weaker activity. The Rand’s performance is plotted against this data, allowing us to observe any potential correlation.

Description: The horizontal axis represents time (e.g., dates from 2018 to 2023). The vertical axis on the left displays the South African Rand exchange rate (e.g., against the US dollar). The vertical axis on the right shows the Manufacturing PMI score. The chart plots the daily closing value of the Rand and the monthly Manufacturing PMI values. Data points are connected by lines to illustrate trends.

The chart allows for the identification of trends and potential correlations between the Rand and PMI.

Correlation: A positive correlation suggests that when the manufacturing PMI increases, the Rand tends to strengthen. Conversely, a negative correlation indicates that when the PMI weakens, the Rand may weaken as well. This relationship, if present, could indicate that the health of the manufacturing sector is a factor in the Rand’s exchange rate.

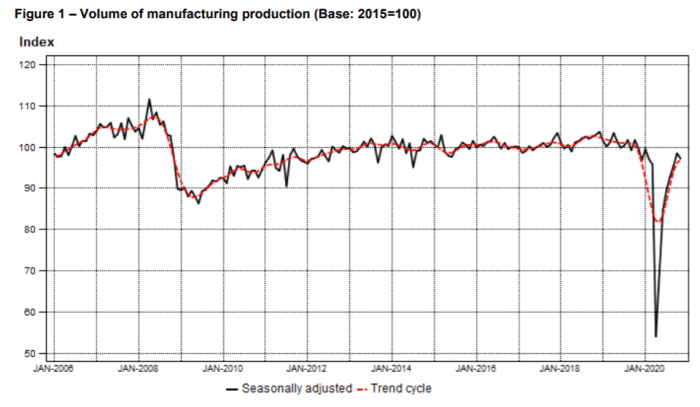

Historical Relationship Between Rand and Vehicle Sales Data

This chart illustrates the correlation between the South African Rand and vehicle sales data over a specified period. Vehicle sales are a significant component of the South African economy, impacting employment and related industries. The Rand’s value and vehicle sales volume are presented to show any potential correlation.

Description: The horizontal axis represents time (e.g., dates from 2018 to 2023). The vertical axis on the left displays the South African Rand exchange rate (e.g., against the US dollar). The vertical axis on the right shows the number of vehicles sold monthly. The chart plots the daily closing value of the Rand and the monthly vehicle sales figures. Data points are connected by lines to illustrate trends.

This visualization helps identify potential correlations between the Rand and vehicle sales figures.

Correlation: A strong negative correlation between the Rand and vehicle sales might imply that a weakening Rand impacts the affordability of imported vehicles, potentially decreasing sales. Conversely, a positive correlation might suggest that a stronger Rand correlates with higher sales. The chart will reveal any noticeable trends or patterns, highlighting the potential interplay between these two factors.

Final Conclusion

In conclusion, the South African rand’s recent gains, occurring before the release of crucial manufacturing PMI and vehicle sales data, highlight the complex interplay of global and domestic factors. This analysis has shown the potential impact of these indicators on the rand’s value and the South African economy. The upcoming data releases are sure to generate significant market interest, and understanding the historical correlations between these factors and the rand is essential for informed decision-making.

The potential market reactions, as well as the illustrative scenarios, provide a glimpse into the possible outcomes. Stay tuned for the upcoming data releases and their implications for the rand and the South African economy.