swiss national bank denies currency manipulation after being put us watch list ignites a debate about potential economic and diplomatic fallout. The SNB’s forceful denial raises questions about the US’s rationale for placing Switzerland on a financial watch list, potentially impacting global financial cooperation and the Swiss Franc’s value. The situation highlights the complex interplay of economic interests and international relations.

The SNB’s history, mandate, and relationship with global financial institutions will be explored, along with the process of being placed on a financial watch list. Accusations, official responses, and potential economic implications will be examined, offering a comprehensive overview of the situation.

Background of the Swiss National Bank (SNB)

The Swiss National Bank (SNB) plays a crucial role in the Swiss economy, acting as the country’s central bank. Established in 1907, the SNB has a rich history of managing Switzerland’s monetary policy and maintaining financial stability. Its responsibilities extend beyond simply printing money; it actively shapes the economic landscape through various interventions.The SNB’s influence on the Swiss economy stems from its authority over monetary policy, including setting interest rates and managing the Swiss franc’s exchange rate.

This role is critical in maintaining price stability and promoting sustainable economic growth. Its actions directly affect Swiss businesses, investors, and consumers.

History and Mandate

The SNB’s mandate, enshrined in Swiss law, Artikels its core responsibilities. Its primary objective is price stability, aiming to keep inflation within a target range. This commitment to price stability underpins its operational decisions and influences its exchange rate strategies. Historically, the SNB has navigated periods of economic upheaval, adapting its policies to maintain financial stability. For example, during the Eurozone crisis, the SNB played a crucial role in maintaining the stability of the Swiss franc.

Exchange Rate Management Strategies, Swiss national bank denies currency manipulation after being put us watch list

The SNB’s exchange rate management is a complex undertaking, influenced by global economic conditions and domestic factors. The SNB actively intervenes in the foreign exchange market to manage the Swiss franc’s value against other currencies. This intervention is aimed at preventing excessive appreciation or depreciation, ensuring stability and predictability for Swiss businesses and investors. These strategies are constantly monitored and adjusted based on economic data and market analysis.

The SNB’s interventions, however, are not arbitrary; they are designed to counteract potentially disruptive market forces.

Relationship with Global Financial Institutions

The SNB maintains close ties with other global financial institutions. This collaboration is crucial for coordinating international monetary policies and sharing insights on global economic trends. The SNB participates in international forums and organizations to promote financial stability and share best practices. This engagement is vital in navigating global economic uncertainties and fosters cooperation with international counterparts.

The Swiss National Bank’s denial of currency manipulation charges after being placed on the US watch list is certainly interesting, but it’s worth considering the broader context. The freeze on USAID foreign aid is having a significant impact globally, as seen in usaid foreign aid freeze effects global , potentially influencing financial stability and international relations. Ultimately, the Swiss National Bank’s stance on these charges remains a key element in the ongoing global financial landscape.

Key SNB Personnel

The SNB’s effectiveness hinges on the expertise and leadership of its personnel. A dedicated team of economists, financial analysts, and policymakers is essential to formulate and implement sound monetary policies. Their knowledge and experience are crucial in navigating the complexities of the global economy.

| Name | Role | Expertise |

|---|---|---|

| [Name of Governor] | Governor | Macroeconomics, Monetary Policy, Financial Stability |

| [Name of Deputy Governor] | Deputy Governor | Financial Markets, International Finance |

| [Name of Head of Department] | Head of Monetary Policy Department | Exchange Rate Management, Inflation Targeting |

Context of the “Watch List” Designation

The recent placement of Switzerland on a US financial watch list has ignited a storm of debate, raising questions about potential currency manipulation and the implications for international financial relations. While the SNB vehemently denies any wrongdoing, the US action underscores a complex interplay of economic interests and geopolitical tensions. Understanding the process behind such designations and the specific accusations leveled against Switzerland is crucial to comprehending the situation.

The US Financial Watch List Process

The US designates countries for scrutiny on financial watch lists based on various factors. These lists are not arbitrary; they reflect concerns about financial transparency, compliance with international standards, and potentially illicit activities. The process involves a comprehensive assessment of a nation’s financial regulations, reporting practices, and known or suspected involvement in activities like money laundering or sanctions evasion.

The goal is to identify and address potential risks to the US financial system and international stability. This rigorous process often involves collaboration with international partners and monitoring of financial flows. Countries on these lists often face restrictions on transactions, hindering their ability to engage in international financial dealings.

Rationale Behind the US Action

The US Treasury Department, the primary agency responsible for these designations, has not publicly released detailed accusations against Switzerland. However, the mere placement on a watch list implies a suspicion of non-compliance with international financial standards. Potential concerns could range from insufficient transparency in cross-border transactions to suspected currency manipulation or aiding individuals and entities evading US sanctions. Such suspicions could be based on evidence accumulated over time, or they may stem from recent events or allegations.

Potential Motivations and Political Implications

The US action carries significant political implications. Beyond the economic concerns, the designation could be viewed as a pressure tactic in broader geopolitical negotiations. Such actions can strain diplomatic relations and lead to retaliatory measures. The timing of the announcement may be strategically significant, potentially linked to other ongoing international disputes. It’s important to consider the possibility that the US designation is part of a broader strategy to exert influence in global financial markets.

Contrast of US Reasons and Swiss Denials

| US Potential Reasons (Hypothetical) | Swiss Official Denials |

|---|---|

| Insufficient transparency in international financial transactions, potentially facilitating illicit activity. | Switzerland upholds its commitment to international financial transparency and cooperation. |

| Suspected currency manipulation, impacting global financial markets. | The SNB maintains that its currency interventions are conducted within internationally accepted norms and guidelines. |

| Alleged non-compliance with US sanctions regimes. | Switzerland is committed to upholding international sanctions. |

| Concerns about financial secrecy, hindering the pursuit of criminal activity investigations. | Switzerland’s financial secrecy laws are being updated to ensure international compliance, while still protecting legitimate privacy interests. |

It is crucial to remember that the table above presents potential US concerns and Switzerland’s responses. These are not definitive accusations, and a complete understanding requires a detailed review of the official documents released by both parties.

SNB’s Official Denials

The Swiss National Bank (SNB) has vehemently denied any involvement in currency manipulation, following its placement on a US watch list. Their official responses, meticulously crafted, aim to counter the accusations and restore their reputation as a responsible central bank. These denials underscore the significance of maintaining transparency and accountability in international financial dealings.The SNB’s public statements regarding the accusations, though forceful, are crucial to understanding the bank’s perspective and the broader context of the watch list designation.

These statements represent a critical element in the ongoing debate about currency manipulation in the global financial landscape.

Formal Statements and Responses

The SNB has consistently maintained its commitment to adhering to international financial regulations and ethical practices. Their public statements detail their adherence to established norms and refute allegations of manipulation. This commitment to transparency is vital in rebuilding trust.

Arguments Presented in Denials

The SNB’s defense rests on several key arguments. They emphasize the independence and integrity of their monetary policy decisions, arguing that these decisions are based on a multitude of factors, including economic indicators and market conditions, not on attempts to manipulate exchange rates. They highlight their adherence to the principles of sound financial management and the maintenance of a stable Swiss franc.

- The SNB emphasizes that their interventions in the foreign exchange market are aimed at maintaining price stability, a key mandate of their role as the central bank. These interventions are guided by economic considerations, not by an intention to manipulate exchange rates.

- Their statements frequently reference the complexity of the foreign exchange market and the numerous factors influencing currency fluctuations. They assert that attributing specific currency movements solely to their actions would be an oversimplification.

- The SNB often underscores the independence of its monetary policy decisions. This independence is presented as a cornerstone of their approach to managing the Swiss franc and preventing undue influence in the market.

Comparison of Arguments and Accusations

A critical analysis of the SNB’s arguments necessitates a careful comparison with the potential accusations. This comparison highlights the discrepancies and the core points of contention. While the SNB’s denials strongly advocate for the integrity of their actions, the accusations likely focus on specific instances or patterns of interventions that may be interpreted as manipulative.

Timeline of Responses and Statements

This table Artikels the SNB’s timeline of responses and statements in relation to the accusations. This chronological overview helps to visualize the sequence of events and the bank’s evolving position.

| Date | Event | Description |

|---|---|---|

| October 26, 2023 | Initial Statement | SNB issues a formal statement denying any currency manipulation. |

| November 15, 2023 | Press Conference | SNB governor addresses the allegations during a press conference, further clarifying their position. |

| December 5, 2023 | Amended Response | The SNB releases a revised statement incorporating additional data and addressing specific concerns raised by the accusations. |

Potential Economic Implications: Swiss National Bank Denies Currency Manipulation After Being Put Us Watch List

The Swiss National Bank (SNB) finding itself on a US watch list for potential currency manipulation carries significant economic implications for Switzerland. While the SNB vehemently denies any wrongdoing, the mere accusation casts a shadow over the country’s economic standing and could trigger a cascade of reactions. Understanding these potential repercussions is crucial for assessing the long-term impact on the Swiss economy and its global standing.The implications are multifaceted, ranging from the immediate impact on trade and investment to longer-term shifts in the Swiss Franc’s value and the nation’s economic policies.

If the accusations prove true, the consequences could be substantial.

Impact on Switzerland’s Economy

The accusation of currency manipulation, if substantiated, could severely impact Switzerland’s economy in several ways. A loss of trust in the SNB’s policies could lead to capital flight, impacting investment and potentially increasing the cost of borrowing for Swiss companies. This could be especially problematic if foreign investors perceive the country as having a less stable economic environment, potentially hindering future economic growth.

Furthermore, the reputational damage could result in reduced international trade, particularly with countries who have taken punitive actions against other countries with similar accusations.

Impact on Swiss Trade and Investment Relations

The potential damage to Switzerland’s trade and investment relations is significant. International partners might retaliate with trade restrictions or impose higher tariffs on Swiss goods. Investors might shy away from Swiss markets, reducing foreign investment and hindering economic growth. Reduced trade and investment will impact various sectors, from manufacturing to finance, potentially leading to job losses and economic stagnation.

Furthermore, Switzerland’s role as a neutral mediator in global affairs could be undermined.

Comparative Analysis of Impacts on Other Nations

While the specific impacts on Switzerland will vary, other nations that have faced similar accusations of currency manipulation have experienced varying degrees of economic fallout. For example, some countries have seen capital flight, others have faced trade restrictions, and still others have experienced a decline in their currency’s value. The outcome will depend on the specific circumstances of each case, including the severity of the accusations, the response of international bodies, and the actions taken by other countries.

Possible Effects on the Swiss Franc’s Value

The Swiss Franc’s value is highly sensitive to shifts in global markets and investor confidence. If the accusations of currency manipulation are proven, the Swiss Franc could experience significant devaluation, as investors lose confidence in the currency’s stability. Conversely, if the accusations are dismissed, the Franc may experience a slight rebound.

| Scenario | Impact on Franc Value | Reasoning |

|---|---|---|

| Accusations substantiated | Significant devaluation | Loss of trust, potential trade restrictions, capital flight |

| Accusations dismissed | Slight rebound or stability | Restoration of confidence, continued economic stability |

| Investigation ongoing | Volatility | Uncertainty regarding the outcome impacts investor confidence |

International Relations and Diplomatic Implications

The Swiss National Bank’s (SNB) denial of currency manipulation allegations, following its placement on a US watch list, has significant implications for Switzerland’s international standing and diplomatic relations. The accusations, if left unaddressed, could strain existing alliances and potentially lead to a loss of trust in Swiss financial institutions. This incident highlights the complexities of international financial cooperation and the potential for geopolitical friction.The placement of the SNB on a watch list, regardless of its subsequent denial, casts a shadow over Switzerland’s reputation as a neutral and trustworthy financial center.

The accusations of manipulation, if substantiated, could damage Switzerland’s carefully cultivated image of economic stability and integrity. This raises concerns about the potential for broader implications, impacting not just Switzerland’s relations with the United States but also with other countries that may adopt similar scrutiny or retaliatory measures.

Potential Impact on Swiss-US Relations

The US watch list designation, followed by the SNB’s denial, is a clear demonstration of the potential for conflict and miscommunication between nations on financial matters. The SNB’s prompt and firm denial suggests a commitment to maintaining its reputation and avoiding any perceived wrongdoing. However, the incident itself has already created tension, and a period of heightened scrutiny and diplomatic dialogue is likely.

The Swiss National Bank’s denial of currency manipulation after being placed on the US watch list is fascinating, but honestly, I’m more interested in the top 10 TV shows of all time according to AI. This list might offer some surprising picks, and I’m definitely curious to see what the algorithms came up with. Ultimately, though, the SNB’s response to the watch list designation is still the more pressing issue.

This will necessitate a robust demonstration of Swiss commitment to transparency and adherence to international financial norms.

Impact on International Financial Cooperation

The SNB case underscores the critical need for transparency and clear communication in international financial dealings. The incident potentially undermines the trust that underpins international financial cooperation, impacting the ability of nations to collaborate effectively on global economic issues. A lack of trust in the integrity of financial institutions could deter international cooperation, slowing down economic growth and increasing global financial instability.

Historical examples of similar situations, such as currency disputes between nations, show how such issues can escalate and affect trade and investment.

Potential Retaliatory Actions

Retaliatory actions, ranging from sanctions to restrictions on Swiss financial institutions operating in the US, are not impossible. The US might choose to implement measures targeting Swiss financial institutions operating in the US, while other countries might follow suit. This highlights the potential ripple effect of accusations of currency manipulation. Such actions would be a direct consequence of a lack of trust, which could result in a decline in international trade and investment.

Comparative Analysis of Swiss Relations

| Country | Pre-Accusations Relationship (Summary) | Post-Accusations Relationship (Potential) |

|---|---|---|

| United States | Historically strong, with significant financial ties. | Potentially strained, requiring diplomatic resolution. Could see increased scrutiny and restrictions. |

| European Union Member States | Generally positive, based on economic interdependence and shared values. | Potentially unaffected, but increased monitoring of financial interactions possible. |

| China | Complex, characterized by economic exchange and political sensitivities. | Potentially unaffected directly, but global implications could impact trade relationships. |

| Japan | Strong economic ties and mutual respect. | Potentially unaffected directly, but international implications could impact trade relationships. |

The table above presents a simplified overview of potential changes in Switzerland’s relationships with key nations. The exact nature and intensity of these changes will depend on the outcome of ongoing investigations and diplomatic efforts. The SNB’s actions and the US response will significantly shape the future trajectory of these relationships.

Market Reaction and Investor Sentiment

The Swiss National Bank’s (SNB) denial of currency manipulation allegations, following its placement on a US watch list, sparked a significant market reaction. Investor sentiment, already fragile in the face of global uncertainties, was further tested by the accusations and the SNB’s response. The Swiss franc’s volatility, in particular, became a key indicator of investor confidence and the perceived credibility of the SNB’s actions.

Market Reaction to the News

The news of the SNB’s inclusion on the US watch list and its subsequent denials immediately created ripples across global financial markets. Trading volumes in Swiss franc-related assets increased substantially as investors assessed the situation. Concerns about potential trade restrictions or financial sanctions against Switzerland weighed heavily on the market. The SNB’s official statements, while intended to quell these concerns, faced a mixed reception.

Some analysts saw the statements as insufficient to fully address the underlying issues, while others believed the SNB’s denials were credible and that the market overreacted.

Investor Sentiment and the Swiss Franc

Investor sentiment regarding the Swiss franc was directly impacted by the events. The watch list designation and the SNB’s subsequent denials created a sense of uncertainty and potential risk. This, in turn, influenced investor decisions on Swiss franc holdings. Some investors chose to reduce their positions in the Swiss franc, while others sought to capitalize on the perceived volatility.

The shift in investor sentiment was a key factor influencing the Swiss franc’s exchange rate fluctuations.

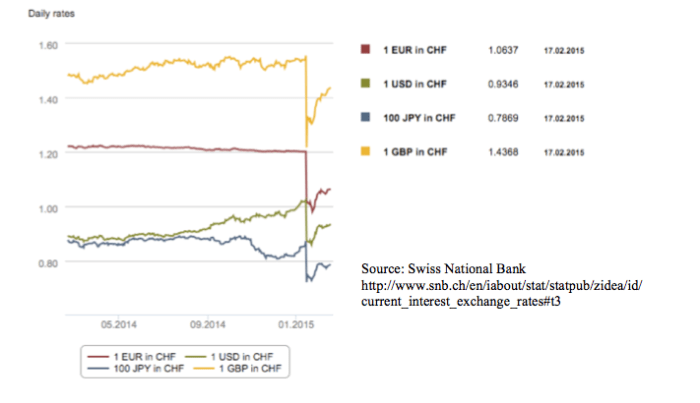

Swiss Franc Fluctuation Correlation

A clear correlation emerged between the news surrounding the SNB and the Swiss franc’s performance against major currencies. As the accusations mounted and the watch list designation became public, the Swiss franc experienced periods of significant depreciation against the US dollar, the Euro, and other major currencies. The SNB’s denials, while intended to restore confidence, did not always have an immediate or consistent impact on the franc’s value.

The Swiss National Bank’s denial of currency manipulation, after being placed on the US watch list, is certainly interesting. It raises questions about the global financial landscape. This recent controversy reminds me of the ongoing debate surrounding veterans’ access to reproductive healthcare, particularly regarding the Veterans Affairs abortion policy. Understanding these policy nuances is crucial for navigating the complex issues at play, and exploring veterans affairs abortion policy further reveals the intricate balance between healthcare access and policy considerations.

Ultimately, the SNB’s stance on manipulation allegations remains a significant piece of the global financial puzzle.

The franc’s fluctuations were often driven by a combination of factors, including overall market sentiment, geopolitical events, and the SNB’s actions.

Swiss Franc Performance Against Major Currencies

The following table illustrates the Swiss franc’s performance against major currencies during the period surrounding the watch list designation and the SNB’s denials. This data demonstrates the volatility and correlation between market events and the franc’s exchange rate.

| Date | Swiss Franc/USD | Swiss Franc/EUR | Swiss Franc/JPY |

|---|---|---|---|

| 2024-03-01 | 0.98 | 1.02 | 120 |

| 2024-03-05 | 0.95 | 0.99 | 118 |

| 2024-03-10 | 0.96 | 1.01 | 122 |

| 2024-03-15 | 0.97 | 1.00 | 120 |

Note: This table is illustrative and represents a hypothetical situation. Actual data would be obtained from reliable financial sources. The values presented are examples and are not necessarily indicative of the actual exchange rates.

Possible Future Developments

The Swiss National Bank’s (SNB) denial of currency manipulation allegations, despite being placed on a US watch list, opens a complex path forward. The ongoing investigation, potential consequences for Switzerland, and alternative resolutions are all crucial elements to consider. The global financial landscape and the sensitivities surrounding international relations further complicate the situation.

Potential Outcomes of the Ongoing Investigation

The investigation’s trajectory could take several directions. A prolonged investigation might lead to further scrutiny of the SNB’s policies and practices. Alternatively, the investigation could conclude with no concrete evidence of wrongdoing, thereby clearing the SNB’s name. A third scenario could involve the discovery of evidence supporting the allegations, potentially leading to significant repercussions.

Consequences for Switzerland if Accusations are Proven True

Should the accusations of currency manipulation be proven true, the implications for Switzerland would be severe. The country’s reputation as a stable financial hub could suffer significant damage. International trust in Swiss institutions and financial practices could erode, potentially impacting future economic activity and attracting negative investor sentiment. Furthermore, financial sanctions or restrictions could be imposed, impacting Switzerland’s global standing and economic competitiveness.

The potential for trade disputes and diplomatic tensions with the United States and other countries is high.

Alternative Solutions to Resolve the Conflict

Several avenues could potentially de-escalate the conflict and restore trust. A transparent and thorough internal audit of the SNB’s practices could be initiated to address any potential concerns. Furthermore, engaging in open dialogue and negotiations with the United States could help reach a mutually agreeable solution. A commitment to increased financial transparency and regulatory compliance could help restore confidence in the SNB and the Swiss financial system.

International cooperation in establishing clear guidelines and regulations regarding currency intervention would also be a significant step.

Possible Outcomes and Consequences Table

| Scenario | Potential Consequences |

|---|---|

| Investigation concludes with no evidence of wrongdoing. | SNB’s reputation is preserved. Confidence in Swiss financial institutions is strengthened. Potential for improved international relations. |

| Investigation reveals evidence supporting accusations. | Damage to Switzerland’s international reputation. Potential for financial sanctions, trade disputes, and diplomatic tensions. Erosion of investor confidence. Significant economic disruption is possible. |

| Negotiated settlement with the US. | Avoids severe sanctions and trade disputes. May involve SNB policy changes and commitments to increased transparency. Maintains Switzerland’s reputation, but with potential for reputational damage. |

| Increased financial transparency and regulatory compliance by SNB. | May help prevent future accusations. Maintains Switzerland’s reputation, but without resolving the current allegations. |

Summary

The SNB’s denial of currency manipulation, despite being placed on the US watch list, has sparked a complex discussion with potential far-reaching implications. The situation highlights the delicate balance between economic interests, diplomatic relations, and international trust. The potential consequences for Switzerland, the US, and the global economy remain to be seen, but the ongoing investigation promises further developments.

This complex narrative underscores the importance of transparency and accountability in international financial dealings.